The allocation of investments should be guided by the time horizon of the financial objective and by the investor profile, and this profile is determined by his financial capacity and risk tolerance

The format of the investor profile questionnaire

The investor profiles types or categories

How to understand and conduct an investor profile questionnaire: the Vanguard questionnaire example

Other useful risk profile questionnaires

What is the best way to view the questionnaire?

The correct allocation of investments should be guided by the time horizon of the financial objective and by the investor profile, and this profile is determined by his financial capacity and risk tolerance

We have seen that:

- Living on deposits and savings accounts aren’t enough due to their low returns so we need to make financial investments.

- To higher returns corresponds more risk, and investments in stock markets provide greater capital appreciation and those in bond markets more stability.

- The risk of any of the investments decreases over time.

- We must diversify investments to improve the level of expected returns to the same level of risk or reduce the risk to a given level of returns.

- The allocation of assets, that is, the distribution of capital between stocks and bonda investments determines performance by more than 90%.

- Our personal allocation of investments depends on the objectives and the investment time horizon, as well as on our investor profile.

- If we do not live well with financial market risk, we will have poor results in our investments.

- The investor profile involves two dimensions: our financial capacity and risk tolerance.

These issues raise the question of what the allocation of investments will be most appropriate to our case, which is equivalent to how to determine our targeted returns or establish our maximum level of risk.

In other words, how to measure and evaluate our investor profile in general or in the face of a given financial investment? That is what the investor or investment profile questionnaires are for.

The format of the investor profile questionnaire

The exercise of knowing or assessing the investor financial identity is called risk profiling or investor profile.

It is usually carried out by financial advisors based on a questionnaire designed for this purpose, and this assessment is mandatory for the provision of advice on investment products and services.

The questionnaire contains a set of multiple-choice questions, typically between 6 and up to 40 questions, which seek to measure those dimensions.

Depending on our answers, we are classified in groups or classes of investor profile types, usually in 5 categories, staggered as follows by increasing order of risk: conservative or prudent, moderate, balanced, dynamic or aggressive.

The odd number has implicit that the average investor is placed in the middle group or core class of balanced profile (as the name implies).

This questionnaire lies at the heart of behavioural economics applied to the practice of investments that had a very recent development with Kahneman, Tversky and Thaler.

The conclusions of the studies on this subject point to the view that these questionnaires have had a great evolution in recent times, although there are still no models that can be considered excellent or of indisputable superior quality.

Thus, we consider that a good principle will be for the investor himself to do this exercise, that is, a self-diagnosis or self-assessment.

How can the investor do it?

We advise that to make the best of it, that is, to be more robust, follow the various stages of the investment process:

- Having prior knowledge of the historical returns and risks of the various financial assets, through their historical performance (because history is repeated) in several periods.

- Having prior knowledge of the results and implications of diversification of investments and the correct way to do so, in terms of alignment with objectives and in particular of the respective investment term (or need for invested capital).

- Being aware that the results of investments and the appreciation of assets are essentially determined by the allocation by financial assets and the behavioural biases to which we are subject.

- Having a reflexive response to the risk profile questionnaire(s), pondering reason and emotion (and possible reviews or simulations in case of identification with more than one response).

The investor profiles types or categories

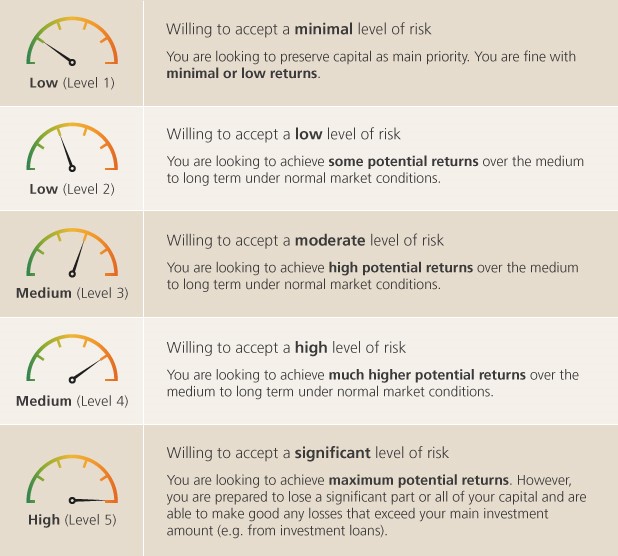

The following table illustrates the meaning of 5 different investor risk tolerance profiles:

The investor profile in general or in the face of a given investment can be classified into 5 major categories:

- Level 1, minimum risk, more conservative: only provided to a minimum level of risk and return, with the objective priority of preserving the capital.

- Level 2, low risk, prudent: willing to incur a low level of risk to achieve slightly better returns over the medium and long term.

- Level 3, moderate, balanced risk: willing to accept a moderate level of risk to achieve higher medium and long-term returns.

- Level 4, high risk, dynamic: willing to take more risk to achieve much higher potential returns over the medium and long term.

- Level 5, significant, aggressive risk: seeks to maximize potential returns, being prepared to lose a significant part of capital.

How to understand and conduct an investor profile questionnaire: the Vanguard questionnaire example

Let us see one of the most widely used models in the world, the Vanguard questionnaire, the world’s largest asset manager.

The simulation is done on the following link:

https://personal.vanguard.com/us/FundsInvQuestionnaire

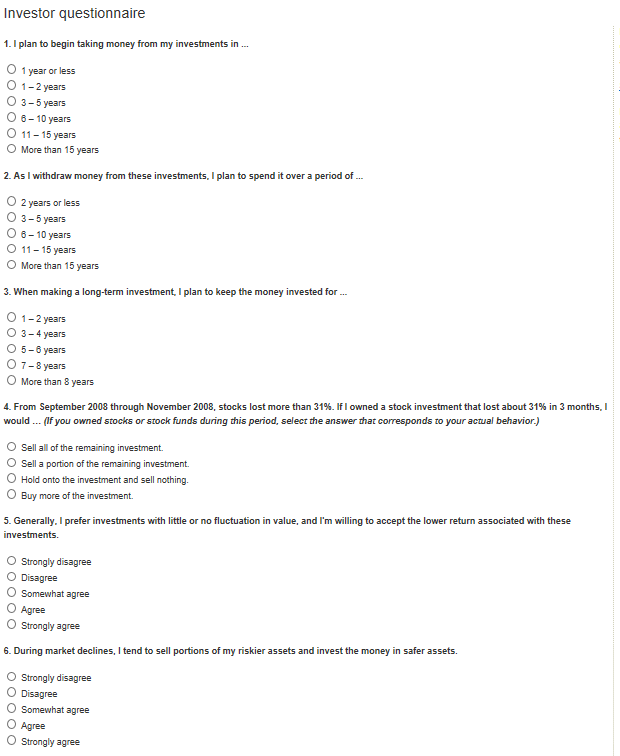

The questionnaire consists of a total of 10 questions that are distributed across 3 large groups:

- Questions 1 through 3 seek to determine the investment term. The first measures the investment period until we begin to need the money, the second focuses on what time period of usage of funds (between the initial and final moment of the capital withdrawal), and the latter seeking to infer the perception of the meaning of what is the long term for investors in terms of the number of years of investment.

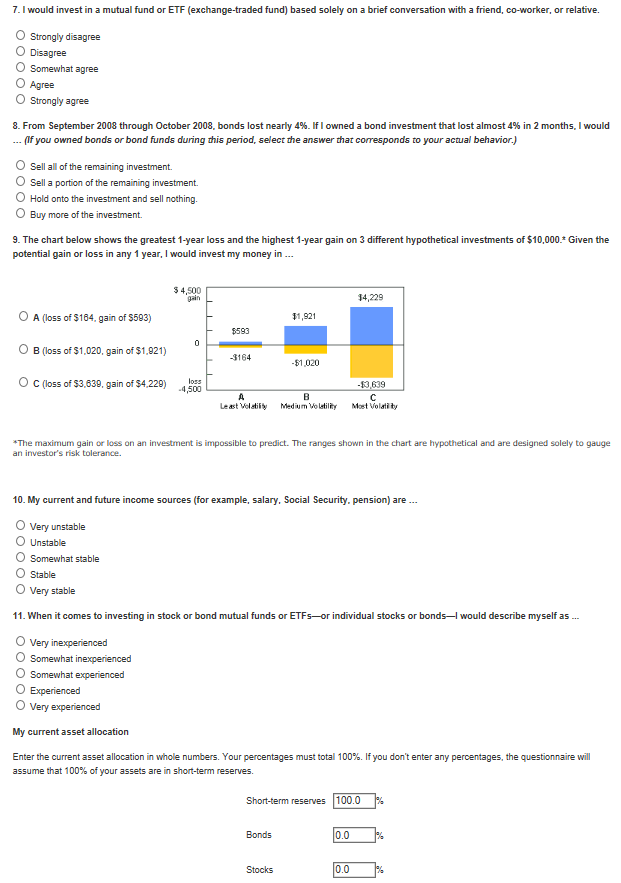

- Questions 4 through 9 try to assess the investor risk tolerance. The fourth is heading to measure the reaction of investing to a sharp drop in stock markets, from its response to a situation in which stocks lost 31% in 3 months. The fifth is positioned in terms of the risk profile declared by itself, or how it manages the trade-offs or conflict of interests between more returns and more risk, in response to a scale of agreements between preferences at low risk and low returns high risk vis-à-vis and high profitability. The sixth questions whether the investor in the face of a decline in risk assets would sell them for safer assets or not. The seventh meets the degree of motivation, security and investor confidence to invest autonomously in mutual funds and without the use of an expert or financial advisor. The eighth corresponds to the fourth for bond investments, asking which investor’s reaction to a decrease in bond value of 4% in two months, as occurred between September and October 2008. The ninth focuses on investing in choices of scenarios or substitution between returns and risk in a year using 3 examples-type investments.

- Questions 10 to 12 focus on the financial capacity, knowledge and experience of investor in investments. Question 10 seeks to know how the income stability is. Question 11 refers to the level of knowledge of investing in investment in stocks or equity funds. The 12 and last asks the investor to say its current allocation of investments among the 3 main asset classes: savings or deposits, bonds and stocks.

Other useful risk profile questionnaires

There are some other frequently used risk profile questionnaires:

https://www.schwab.com/public/file/P-778947/InvestorProfileQuestionnaire.pdf

https://hr.unl.edu/Fidelity%20-%20Investment%20Mix.pdf

https://njaes.rutgers.edu/money/assessment-tools/investment-risk-tolerance-quiz.pdf

https://www.ubs.com/ch/en/swissbank/wealth-management/investing/financial-personality.html

What is the best way to view the questionnaire?

The answers should be reflective. One should seek to live the moment of gain and especially the loss of markets and try to understand what they would feel and what they would do. Try to imagine the adverse situation, see yourself in the mirror and understand the sensations and reactions. Only one answer is right: that it leaves people satisfied and involved in the decision. There is no healthy process with people eager for less risk or for more gains.

It is always useful to carry out the investor profile questionnaire in banks where we have our investments and savings because the information, recommendations and advice received will be guided by these results.