The S&P is the inescapable benchmark of the global stock market and should be part of any investment portfolio

The S&P 500 Index

Long and recent year historical performance of the S&P 500 index

The S&P is the inescapable benchmark of the global stock market and should be part of any investment portfolio

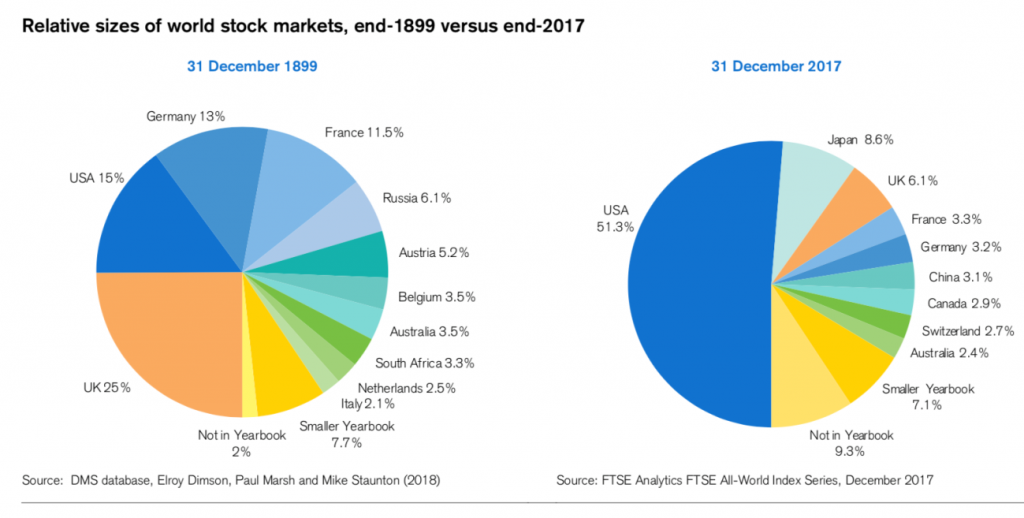

The US accounts for more than 50% of the world’s stock markets:

The S&P 500 (created in 1957) growing importance replaced the original DJIA 30 (Dow Jones Industrial Average) (created in 1896) as the leading US market index.

The S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks, and is weighted by market value whereas the Dow Jones is price weighted.

To this extent it is the indispensable reference of the world’s stock markets and must integrate any and all investor investment portfolios, whether institutional or private.

It is the most used, followed and analysed index of the capital markets. Its movement is studied and followed to the smallest detail by all investors, private and institutional, of various natures, because its evolution determines the behaviour of other indices worldwide.

That is why we use this index in many of our articles.

The S&P 500 Index

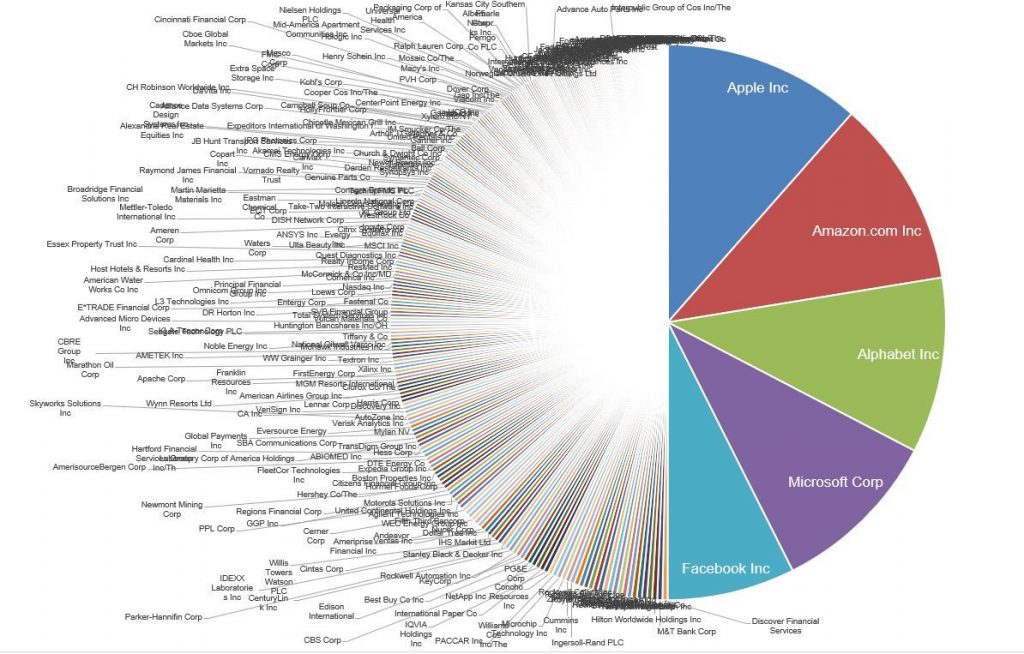

As of March 2020, it consists of 506 shares of the 500 largest US companies (includes 6 preferred shares), covering a stock capitalization of more than $25 billion, corresponding to 80% of the US global stock market’s stock market capitalization..

Apple’s largest capitalization is $1.2 trillion, the average and median capitalization is $43 billion and $17 billion, respectively; the lowest capitalization is $760 million.

To integrate the index, companies must be domiciled in the US, have enough liquidity-capable stocks for buying and selling and be profitable in the previous year (meaning that companies that have had losses are not included in the index even if they have a high value and exceed many of the profitable 500 that integrate it).

The index is an index weighted by capitalization, that is, movements in stock prices with higher market capitalizations (the stock price times the number of shares in circulation) have a greater impact on the value of the index than companies with lower market capitalization.

The S&P 500 is widely regarded as the best single indicator of US large-cap stocks.

There are more than USD 9.9 trillion indexed or compared to the index, with indexed assets comprising approximately $3.4 trillion of that total.

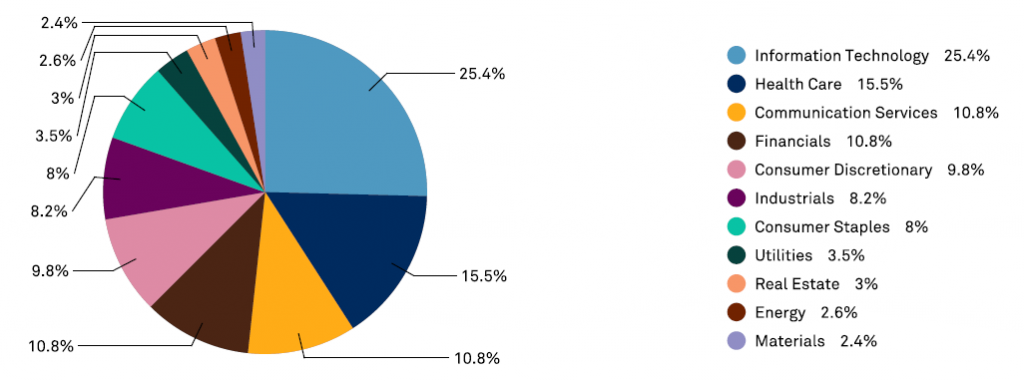

Its sectoral composition is as follows:

The largest sector is information technology with 25%, followed by health care with 16%, communication services and financial with 11% each, consumer discretionary, industrials and consumer staples with 8%-9% each, and subsequently utilities, real estate, energy and materials.

The following chart shows the logos of some of the companies that make up the S&P 500, in which we can recognize many of the world’s largest companies and whose goods we consume and are consumed worldwide.

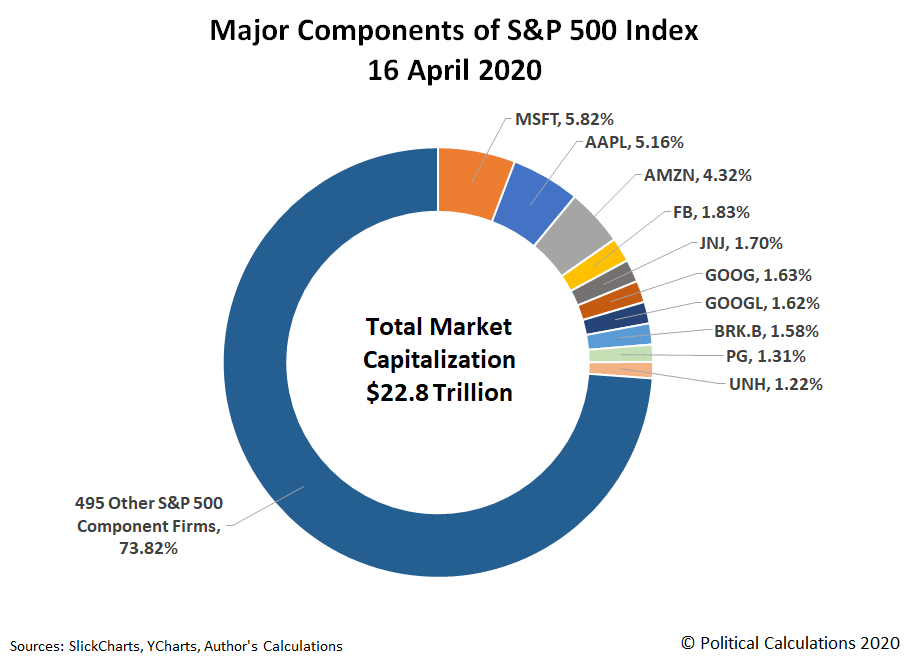

Its top 10 companies with a 25% combined weight are the following:

The following graph compares and shows that the 5 largest technology companies, the FAAMG, have a weight equivalent to the nearly 300 companies with the lowest capitalization of the index:

The mutual funds that track the index were recommended as investments by Warren Buffett, John C. Bogle and Tony Robbins for investors with long-term horizons.

In the following link we have a brief feature of this index:

https://ca.spindices.com/indices/equity/sp-500

Long and recent year historical performance of the S&P 500 index

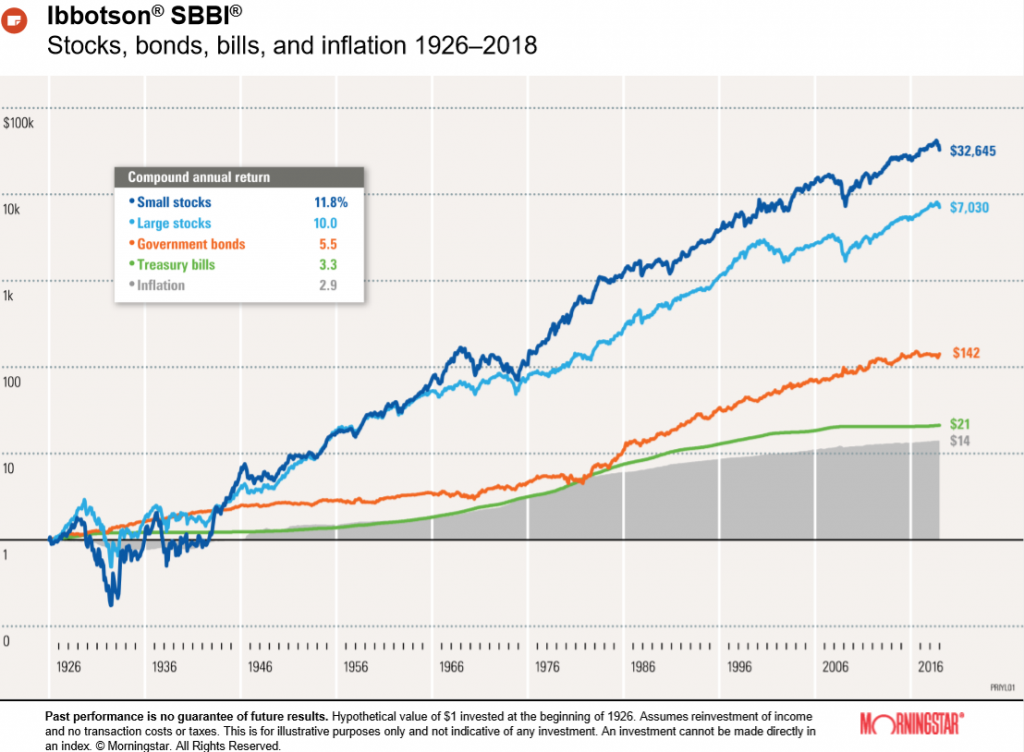

The following graph shows the return on investment in various assets between 1926 and 2018, including the stocks of large companies, which are represented by the evolution of the S&P 500 index:

The S&P 500 posted an average annual nominal return of 10%, well above the 5.5% per year provided by 10-year treasury bonds and the 3.3% annual yield on 3-month treasury bills, and only surpassed by small companies stocks of 11.8% per year. The index recorded valuations in 74% of the years.

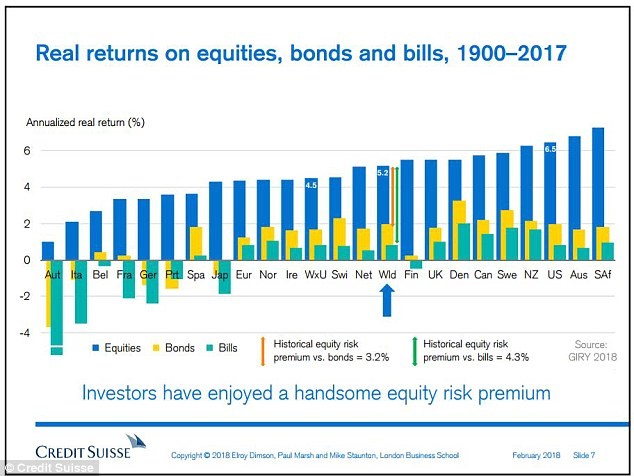

The following graph shows the annual real returns provided by the S&P 500, which represents the market compared to indices in other countries between 1900 and 2017:

The S&P 500’s real annual rate of return (deducted from inflation) was 6.5% compared to 4.5% for the world excluding the US.

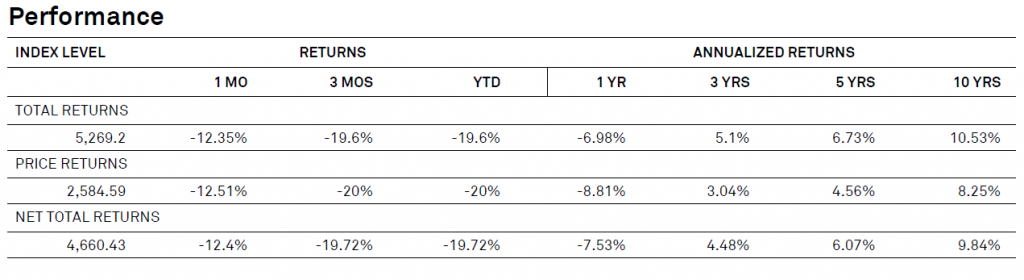

The evolution of the S&P 500 index in recent years through March 2020 was as follows:

The following table shows the annualized returns over the last 10 years:

The annualized return of the S&P 500 was -7%, +5.1%, 6.7% and 10.5% in investments made in the 1, 3, 5 and 10 years more recent.

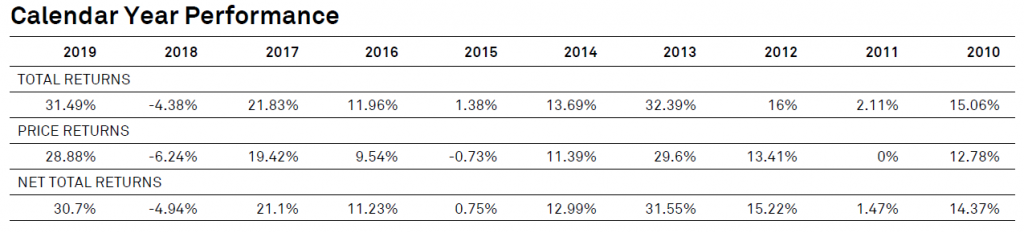

The following table shows the performance observed in each year of the last 10 years: