They want to make dreams come true, devote themselves to pure leisure with family and friends, and prepare for managed care in old age

Current retirees receive a pension of 65% or 60% of the last net salary in the countries of the European Union and the OECD, respectively

The main sources of pensioner’s income are social pensions followed by occupational pensions

Current retirees have incomes close to the national average

Retirement brings a loss of standards of living in many countries, especially for Europeans

There are many retirees living in the heels of running out of money to live and pensions are the biggest concern over 10 years of people in the OECD

The vast majority of people have low individual savings for retirement

There are major fears that future generations do not have the same pensions and that reform will be increasingly

There are great fears that future generations do not have the same pensions levels and that live in retirement will become increasingly worse

They want to make dreams come true, devote themselves to pure leisure with family and friends, and prepare for managed care in old age

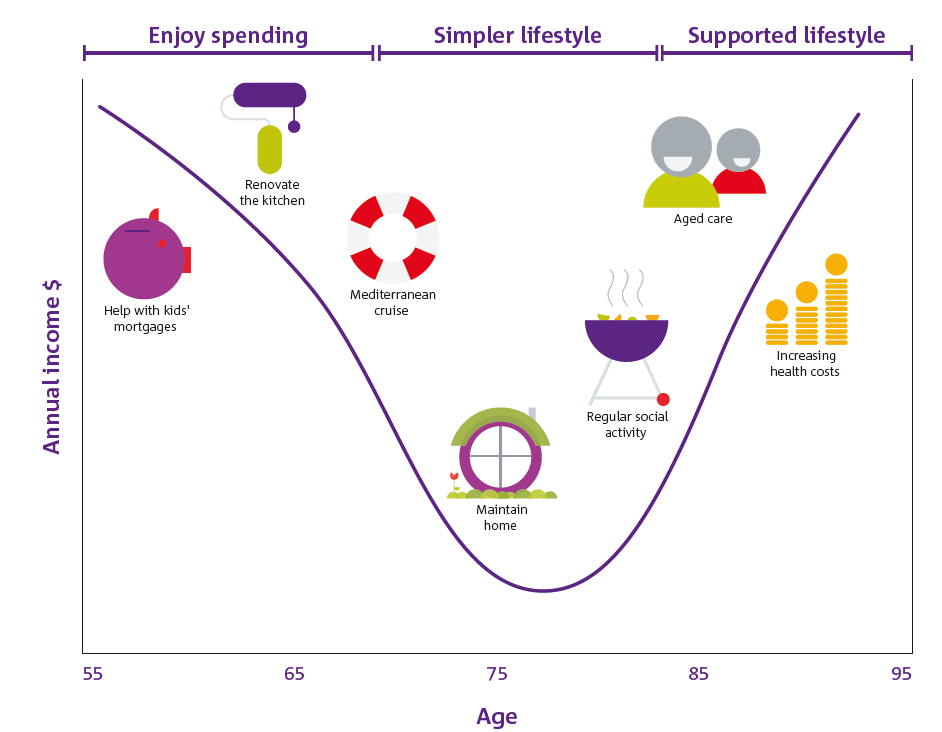

Normally, we go through 3 stages in our retirement, each corresponding to different and specific spending needs.

In a first phase, we spend more, because we want to enjoy the retirement freedom, making the trips we always dream of, renovating the house to feel better and helping our children in raising their families.

In a second phase, we spend less, because we wish to enjoy our renovated home and be close to family and friends, having a regular social activity, and supporting small maintenance expenses.

In a third and final phase, spending rises substantially as we enter old age, especially with the expense and health costs and managed care we need.

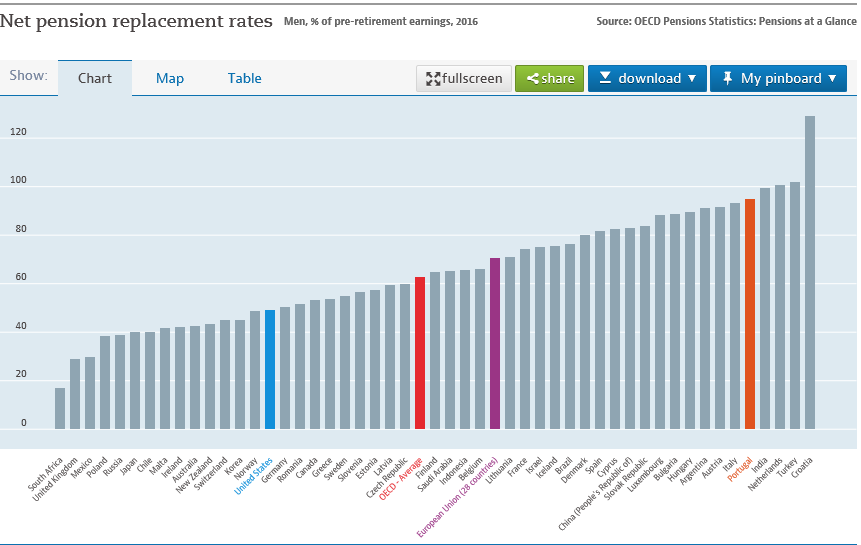

Current retirees receive a pension of 65% or 60% of the last net salary in the countries of the European Union and the OECD, respectively

The problem that may arise is that we don’t have the money to enjoy the retirement for what we’ve worked a lifetime.

There are countries where social protection system is strong and the average rate of replacement of salaries for pensions in net terms of taxes is high (quotient between pension and last salary, both in net terms), standing above 80%, among which includes Portugal.

However, this rate is 65% for the average of European Union countries at 28, from just over 60% for the OECD countries average and less than 50% for the US.

These are average rates, i.e. average pensions and average wages, which is quite different when we analyse specific situations; normally, as these systems have a redistributive component, the replacement rate for higher wages is lower than average.

In some of these countries, the situation is mitigated by private (or non-public) pension systems, which may have a more or less mandatory scheme, such as the US and the UK.

However, we know that these private regimes are generally applied or have greater penetration from households with higher income levels than in the lower ones. Whether it is characteristic or nature of its own and diverse of employability, either by decision and will of the worker who when given the option prefers not to discount or discount very little for such systems.

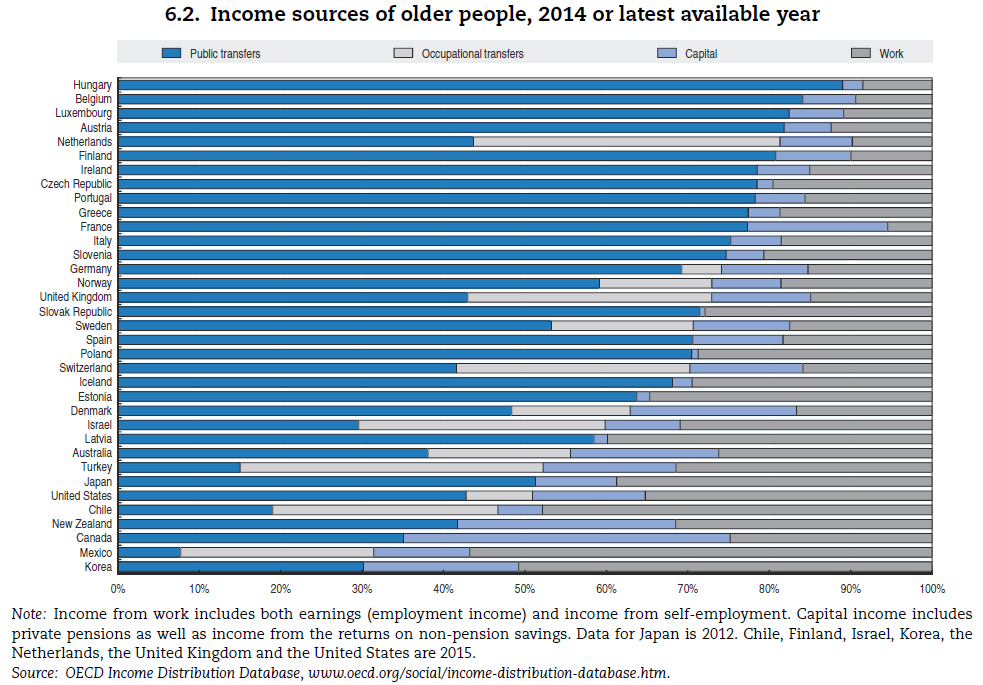

The main sources of pensioner’s income are social pensions followed by occupational pensions

The main sources of income for retired people are social pensions, followed by private pensions.

In the US, Canada, UK, Central Europe, Nordic countries and Australia, incomes from capital are very relevant. In many countries, from the richest to the poorest, there is a percentage of the population still working after the age of 65.

Social pensions account for more than 50% of income in most countries, and even more than 75% in some European countries, such as Hungary, Luxembourg, Austria, Finland, Ireland, the Czech Republic and Portugal.

Occupational pensions are very relevant in countries such as the Netherlands, UK and Switzerland.

Capital income is important in France, Denmark, New Zealand and Canada.

Finally, there are countries where work by the elderly still has a great expression, especially the U.S., Japan, Chile, Mexico and South Korea.

Current pensioners have incomes close to the national average

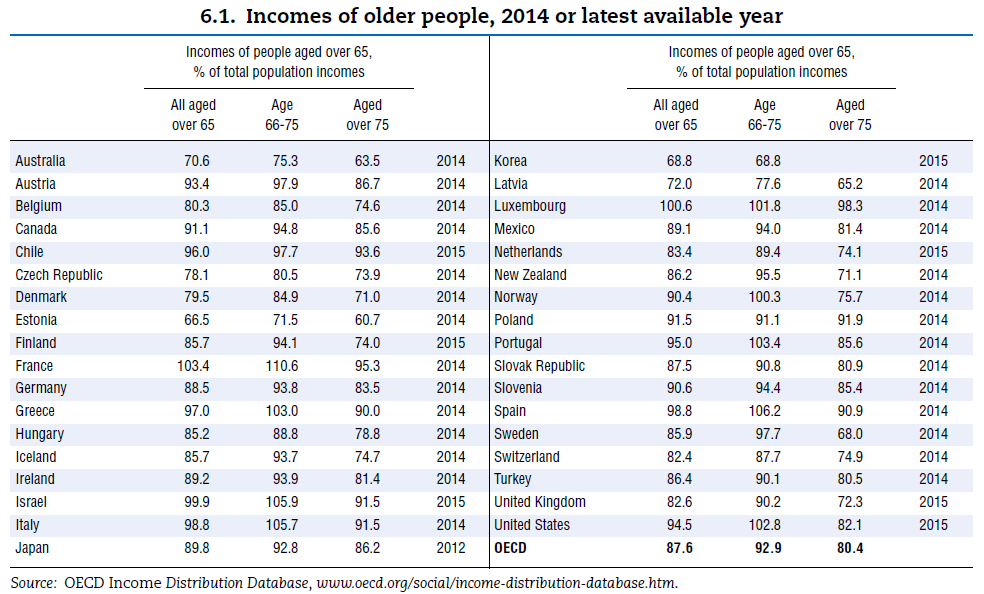

The average incomes of retired people are in line with those of the working population in the majority of OECD countries:

Global-Insurance-Market-Trends-Cover.indd (oecd.org)

Retirement brings a loss of standards of living in many countries, especially for Europeans

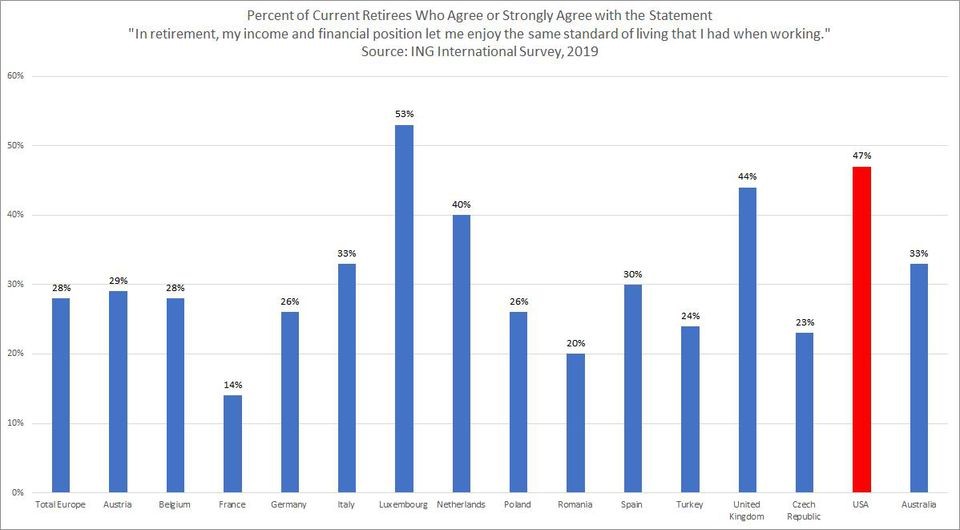

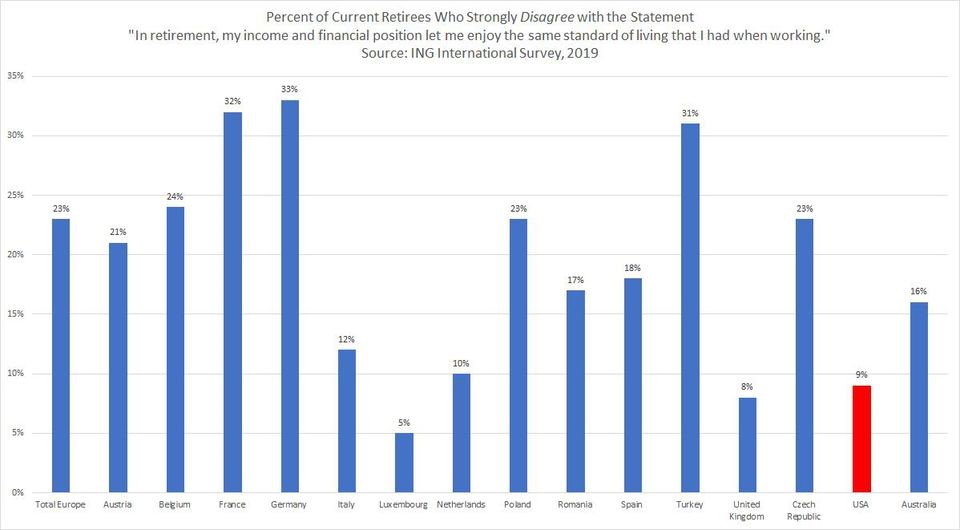

Dutch bank ING recently conducted an inquiry into the quality of life of retirees in the various geographies in which it operates in Europe, the US and Australia:

Only in Luxembourg, the Netherlands, the UK and the US, did a significant proportion of retirees say that their income was enough to maintain the same standard of living they had when they worked.

Instead, a significant proportion of retirees say they have lost their living standards in countries such as Germany, France, Belgium and Austria, i.e. in many of most developed European countries.

There are many retirees living in the heels of running out of money to live and pensions are the biggest concern over 10 years of people in the OECD

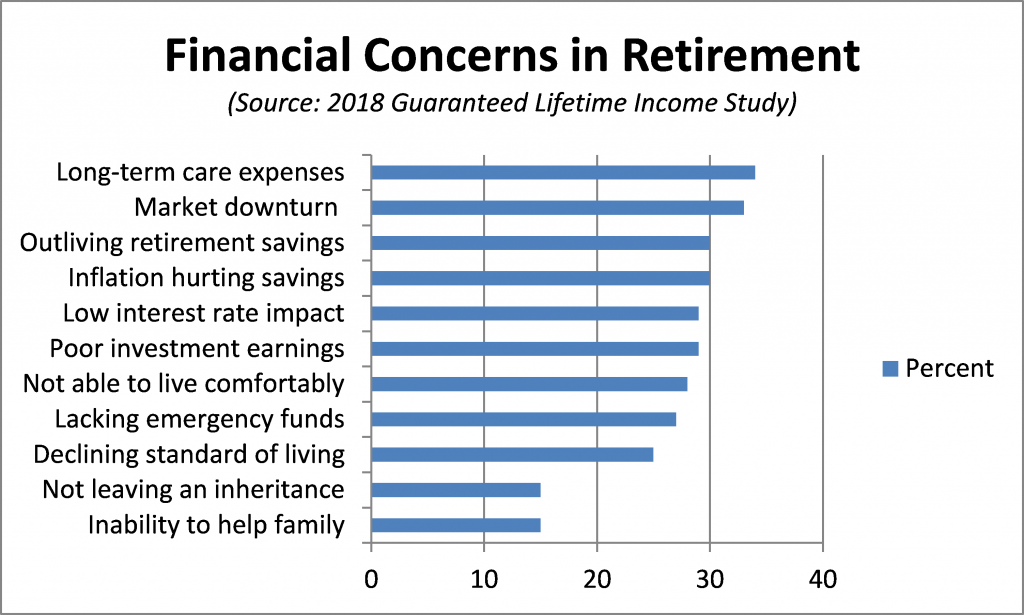

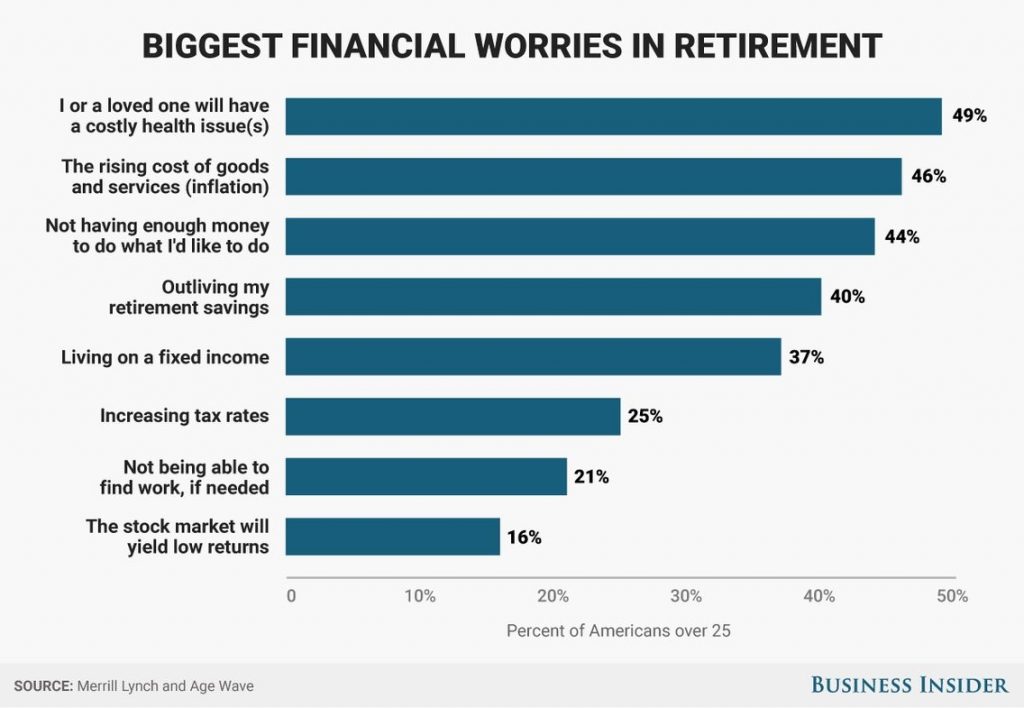

Surveys in the US show that retiree’s greatest fear is running out of money, whether to support health care, to address adverse market conditions or simply to sustain the predictable increases in its longevity.

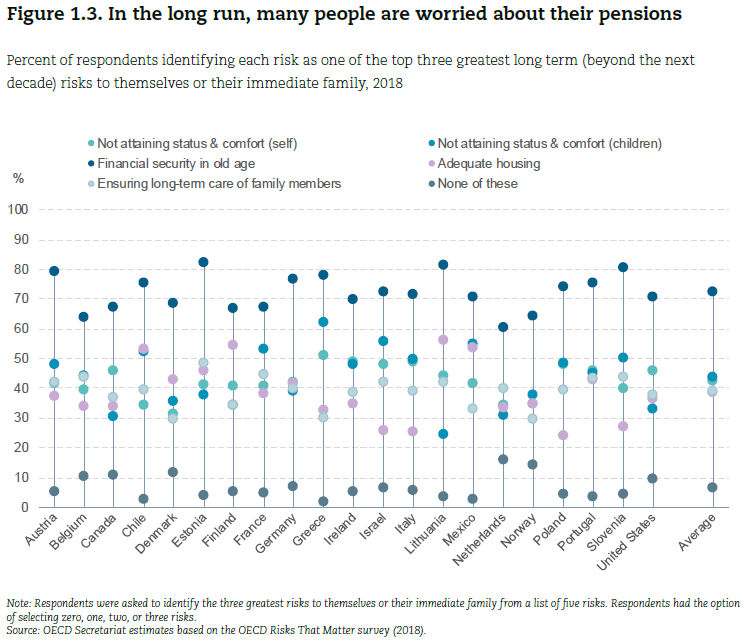

A recent OECD study revealed that the biggest long-term concern of people (next 10 years) is with their lives in retirement and old age:

Financial security in old age was selected as the main concern in the various OECD countries for between 60% and 80% of respondents.

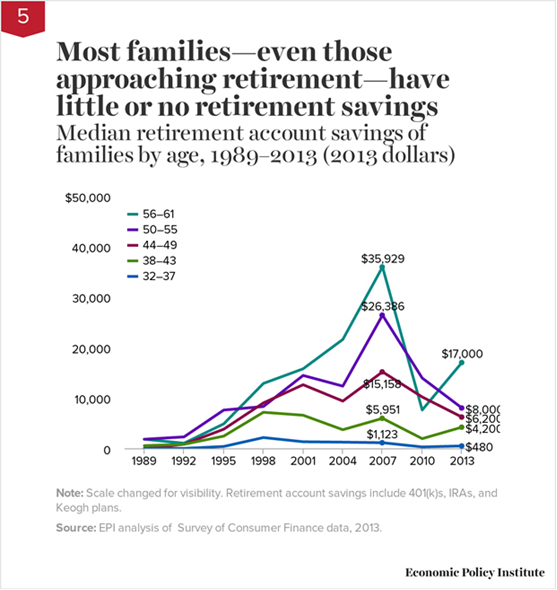

The vast majority of people have low individual savings for retirement

In the US, even people close to retirement age have very low accumulated savings, with median retirement accounts savings of $17,000.

Nos EUA, mesmo as pessoas próximas da idade da reforma têm poupanças acumuladas muito baixas, tendo metade das pessoas saldos médios de $17,000 em contas reforma.

There are major fears that future generations do not have the same pensions and that retirement life will be increasingly worse

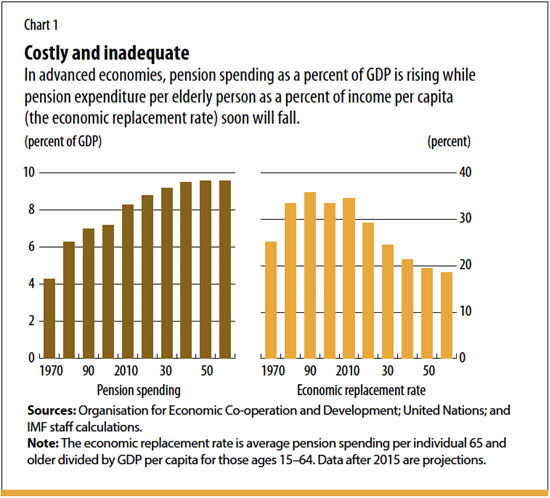

In the OECD countries, despite the increase of money spent on Social Security, social security benefits in relation to the per capita income of the active population per beneficiary have been decreasing.

It is expected that this reduction will be accentuated in the near future due to the combination of the effects of demographics with those of social security sustainability

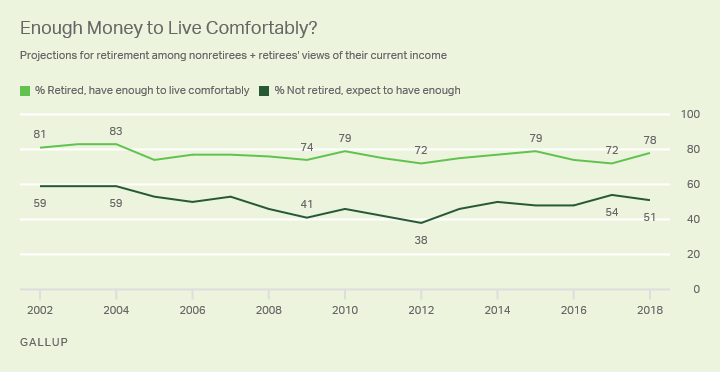

So, it’s not surprising that fears about living a comfortable retirement is greater for non-retired than retired people, as this recent study in the US showed: