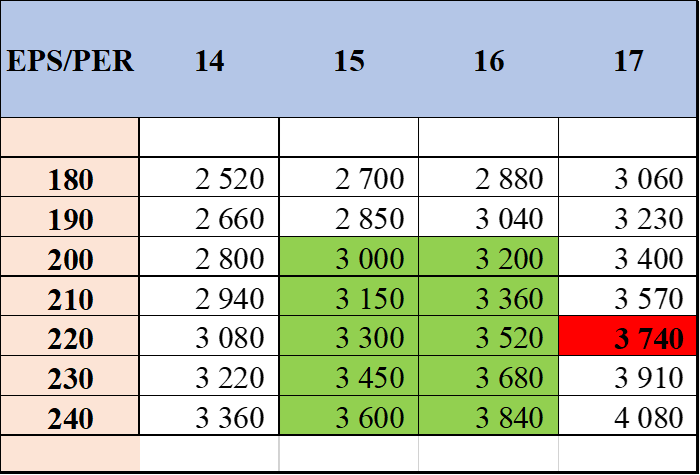

In the previous article we saw how the PER and EPS evolved and concluded with a simulation of market value estimates:

The red is evidenced by the current value of the market.

The green-marked scenarios are the most likely for the next 3 to 6 months, which put the S&P 500 between 3,000 and 3,840 points.

These scenarios assume the continuation of the war in Ukraine, and if there is, a mild recession in the USA, with unemployment rates below 5%.

A negotiated and rapid outcome would result in a significant increase in the PER multiple.

A deep recession, with unemployment rising above 5%, would result in a multiple of PER and lower EPS levels.

This evaluation exercise was initially published in the last quarterly article on the performance and prospects of financial markets.

In this article we will measure the sensitivity of the stock market to interest rate changes.

In other articles, we have seen that monetary policy has a very important effect on the financial markets and that a very significant change in that policy (or even its reversal) is underway.

In a first impact, the change brought about the end of the long bull market of bonds, and gave rise to an unprecedented bear market of bonds, which accompanied that of the shares.

Investors are experiencing major devaluations in their investments, making the issue of market valuation even more relevant.

S&P 500 PE valuation multiple and 10-year treasury bond interest rates

Interest rates influence the value of the market, especially through the PER.

We know that there is an inverse relationship between interest rates and the multiple of the price-results or PER ratio.

Understanding this relationship can help investors assess the relative value of PER levels, and whether the stock market is cheap or expensive.

The value of the stocks is the current value of their discounted future cash-flows, that is, the sum of the annual cash-flows generated by the companies divided by the required return on capital in each year.

The discount rate used is the weighted average of the costs of capital invested in the companies by the two financiers, shareholders and bondholders.

A higher interest rate increases the discount rate required by either funder, thereby reducing the current value of future cash-flows.

This relationship is also felt differently by the competition of the returns of the capital invested from the two sources of financing.

Investors have investments in stocks and bonds.

When implied yields on bonds fall, stocks may look more attractive, attracting investors who are willing to pay more.

As a result, the S&P 500 tends to have a higher PER when interest rates are lower.

If interest rates rise, the per of the shares should go down.

In other words, one only speaks of an PER of the stocks, but there is also the PER of the bond.

For an implied return on 10% bond yields, the PER is 10. If this return is 5%, the PER is 20. And if it’s 3%, the PER is 33.

The lower the interest rates, the lower the bond yields and the higher their PER.

Under these conditions, investors will be more willing to invest in stocks, which have more risk but allow for greater potential returns.

The rotation of the assets causes the stock prices and the PER to rise.

Thus, there is a balance between the PER of bonds and that of the stocks, whose differential is the different degree of risk tolerance of the two investments.

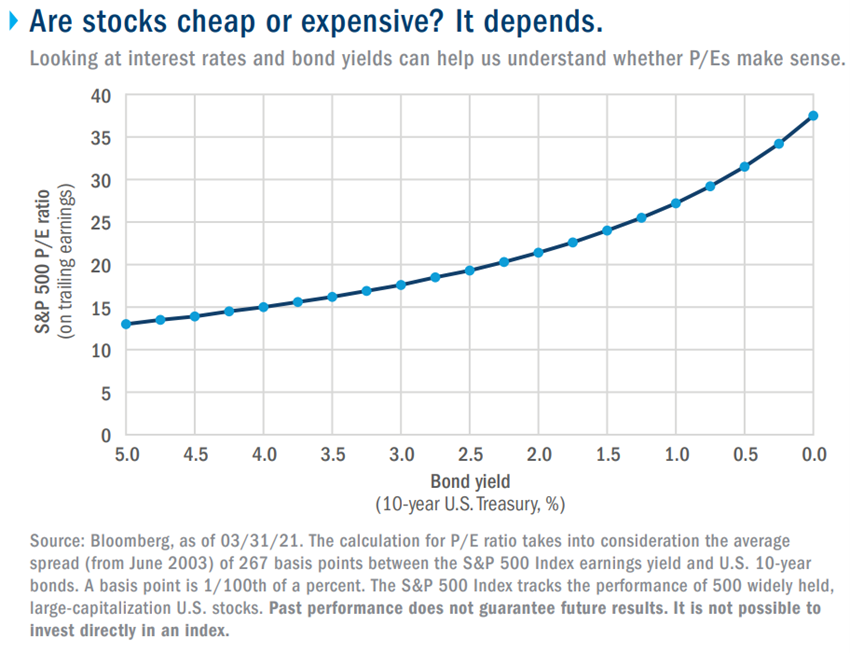

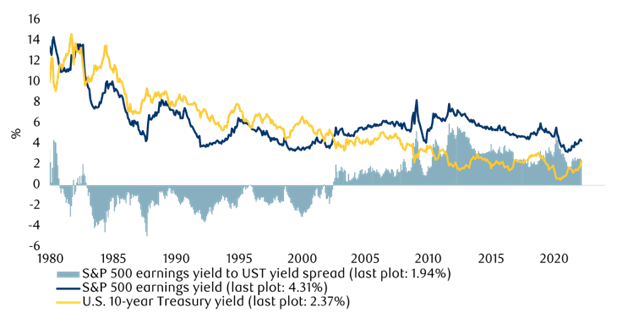

The following graph seeks to estimate the PER for different interest rate levels, taking the average differential of 267 basis points between the earnings yields of the S&P 500 and 10-year treasury bonds between June 2003 and March 2021:

According to these calculations, if the differential is more or less the same, the PER can range from 28 for implied yields of 1% treasury bonds to 15 for implied yields of 4%.

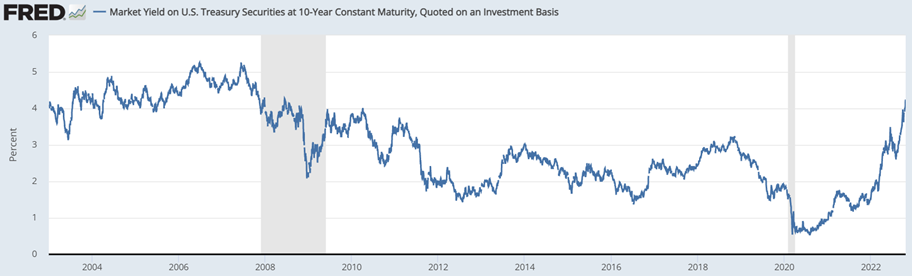

The implied yield of 10-year treasury bonds is currently at 4.2% and has evolved as follows in the last 20 years:

It is clear that these calculations are an over simplification.

The yield between the S&P 500 and 10-year treasury bonds varies and does not remain constant over time, and even if other factors influence the PER, such as market sentiment, were maintained:

In fact, in that period, this differential varied in an interval between 1% and 5%.

And this relationship between PER and earnings differential is not exact.

But these calculations give a good indication of what is at stake.

And they also provide good guidance.

The market EPS

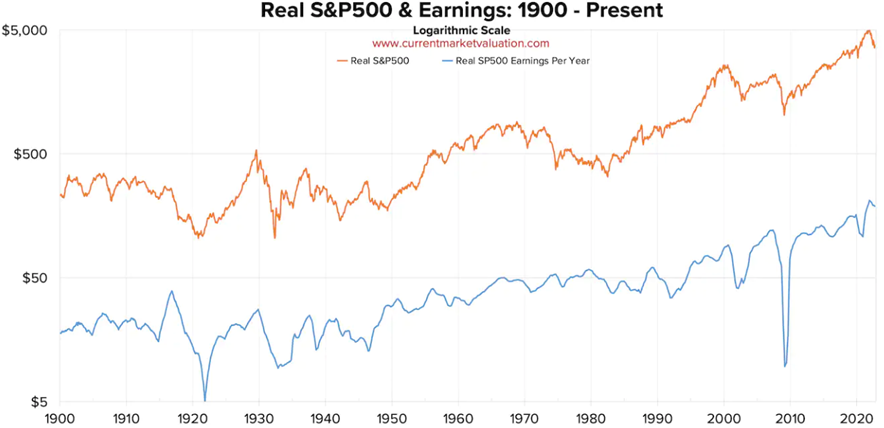

The following graph shows the evolution of the value of the S&P 500 index and the company results of this index since 1900:

There is a direct relationship between the two variables, as you would expect, being more evident in moments of change.

After all, the value of shareholders lies in the value of the earnings distributed by the companies.

The EPS market value is also difficult to estimate.

The best we can do is to use the consensus estimates of market analysts, although we know that they are very variable and subject to revisions, more significant in periods of great uncertainty like the current one.

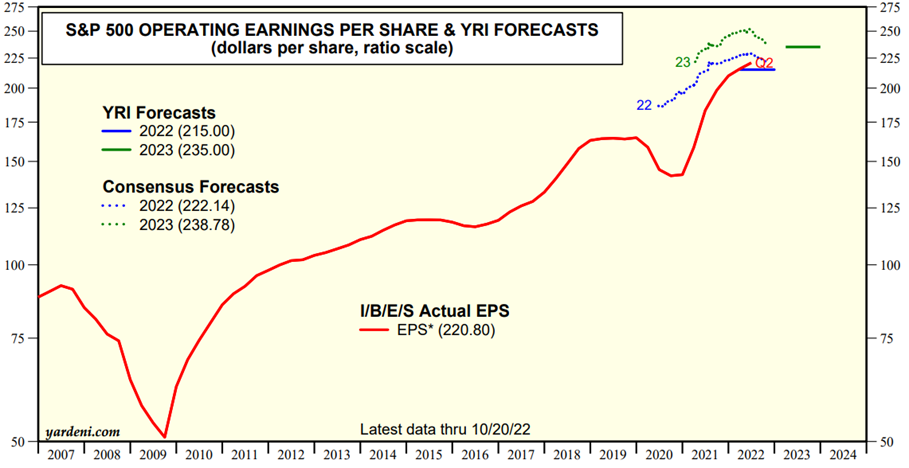

The following chart shows the evolution of S&P EPS and analyst consensus estimates:

In 2021, the S&P 500 EPS was $208.5, with the current analyst consensus of $225 for 2022 and $250 for 2023.

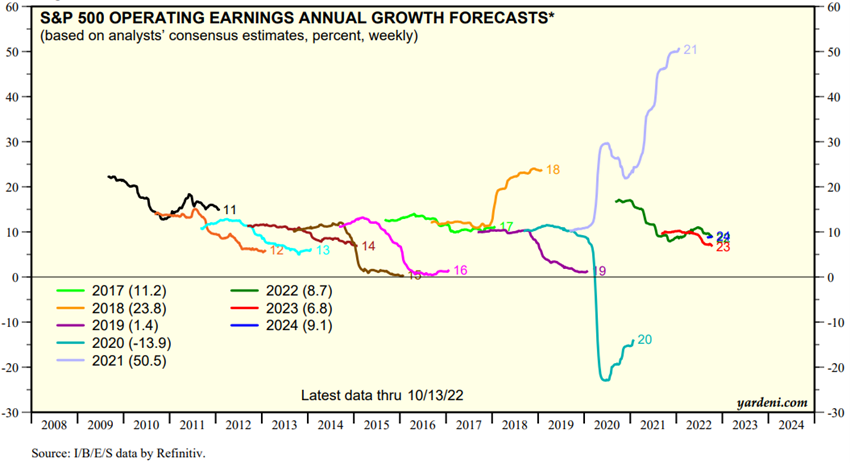

Analysts regularly review their forecasts for business results growth in the light of changing economic and financial conditions, as can be seen in this chart:

The S&P 500 EPS growth estimate of the analysts’ consensus for 2021 was rising from the end of 2019 to the year-end close.

In 2020, this estimate dropped sharply as the pandemic erted, and began to rise in the second half of the year by the effect of economic policies.

Current EPS growth forecasts are stable, at about 8%.

The time of quarterly results by companies is a good time for analysts to update their estimates, with current information relevant.

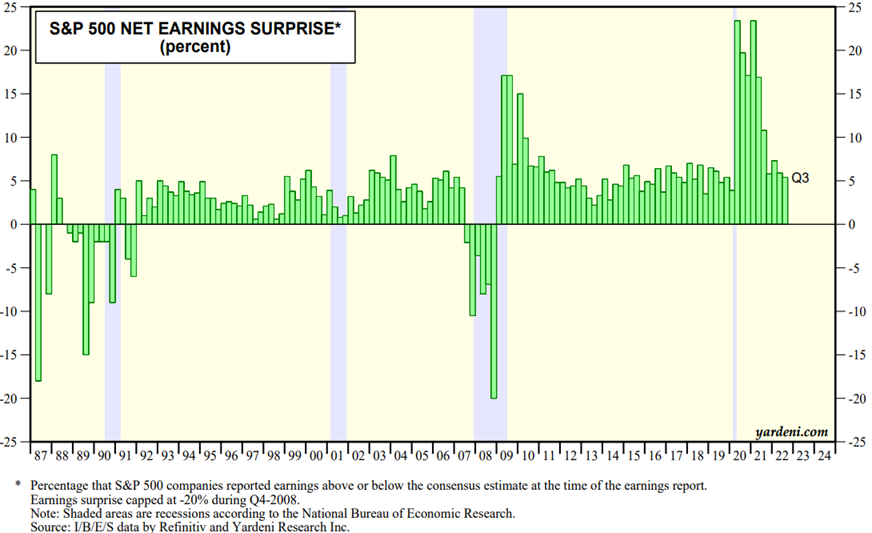

Thus, it is not surprising that an indicator very followed by market professionals when the presentations of the quarterly results of the companies is that of surprises.

This indicator assifies the value of the differences between results and estimates and gives indications about trends for the future:

Since the end of the GFC in 2008, EPS surprises have been positive, with the most recent figure exceeding 5%.

In the following links we can follow the real-time evolution of the indicators mentioned:

https://www.currentmarketvaluation.com/models/price-earnings.php

https://www.longtermtrends.net/sp500-price-earnings-shiller-pe-ratio/

https://www.yardeni.com/pub/stockmktperatio.pdf

https://www.yardeni.com/pub/yriearningsforecast.pdf

People with greater financial knowledge who want to simulate their estimate for the S&P 500 can do so in this spreadsheet provided by Aswath Damodaran: