How many years are we going to live? We must be prepared for a long retirement

It is essential we make the right allocations of income and capital: savings for essential expenditure and investments for the appreciation of capital in the medium and long term

If any unforeseen events, personal or market, affect us we must adjust the base plan

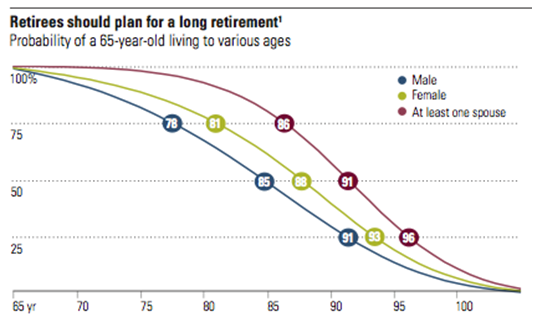

In order to be prepared a very long, good and healthy retirement, and avoid the risk of running out of money we must manage the risks of longevity, inflation, markets and some unforeseen events

We worked hard and sacrificed a lot to get to retirement.

We did it because we want to enjoy good times in this new phase of our lives.

We dreamed of doing many things that we could not do before: travel, helping and caring for the family (children and grandchildren), being more with friends, having more time for ourselves and for our hobbies, etc.

How many years are we going to live? We must be prepared for a long retirement

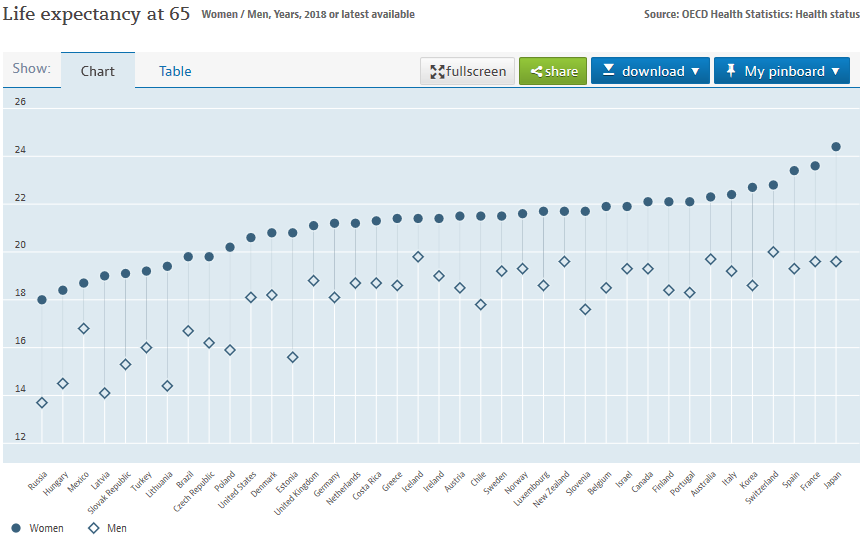

Advances in medicine, the progress of health systems and the improvement of lifestyles have allowed us to live longer and better. Fantastic!

The only but, is that with more years ahead of us, we’re going to need more money than in the past to live them well.

It’s surprising how life changed in a short time: until a few decades ago retirement life barely exceeded 10 or 15 years.

Currently, we can already count on the possibility of living up to 90 years of age or older, either individually or as a couple. This means envisaging about 20 to 30 years of retirement.

What income can we count on? Social pensions, private pensions, other eventual income and personal retirement investments must be able to bear our living expenses

The money we have are public pensions, private pensions, other possible income, inheritances, and the assets or personal retirement complementary fund that we should have accumulated for this specific purpose.

Our expenses are the current essential expenses, plus spending on health care and old-age life care and the overheads we want to do to help others.

We have to know the income, evaluate the expenses and manage and control these accounts because each case is a case, because they depend on many factors, including income sources, assets, debts (especially with the mortgage of the house) and the standard of living of each one.

How much do we spend on retirement? We need to do math and consider the rising cost of living during those years

As a reference, several studies point to essential expenditures being about 85% of expenditures before retirement. In addition, the costs of health care and care in old age are very high and are expected to continue to increase.

Historically average annual inflation has been around 2% to 3%. This means that during the 20 to 30 years of retirement we will need sufficient capital appreciation to cover this aggravation.

With an inflation rate of 2% a year, a current capital of $50,000 is only worth $30,477 in 25 years. Put another way, 25 years from now we’re going to need $82,030 to buy the same goods and services that cost $50,000 today.

What are the total retirement savings that we should have accumulated throughout our lives? As public pensions are generally low, we need to have complementary retirement funds to live on

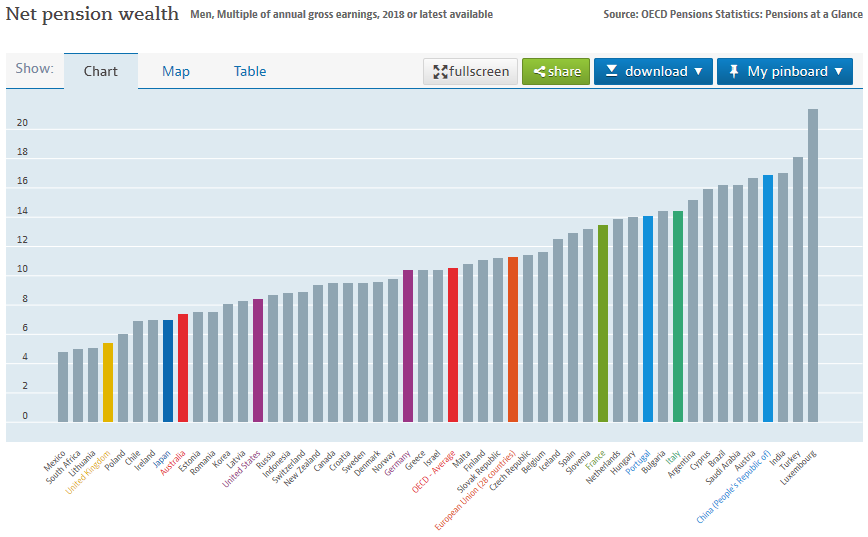

Public pensions vary widely from country to country in terms of systems and schemes, with the average net replacement rate in OECD countries from 40% to 80% depending on the countries.

Once again for each country we are talking about averages and not concrete cases. For example, the average public pension in the U.S. is about $1,400 per month. Each of us must know our own situation.

There are countries where private pensions are mandatory, voluntary and others where they practically do not exist. Even in the former there are great disparities between people who have a good private pension and others who have almost nothing.

As these pensions are generally insufficient to maintain the standard of living, we have to accumulate throughout the working life a capital for retirement that complements those incomes.

https://www.oecd.org/daf/fin/private-pensions/Pension-Markets-in-Focus-2021.pdf

In the years close to retirement, the management of investments in financial assets should be more prudent because although we need appreciation we have less and less time to recover from possible major markets devaluations

Another very important risk is the one of financial markets, especially in the years near retirement age.

- The duration of our retirement portfolio or complementary retirement fund is very dependent on the evolution and performance of these markets at three levels:

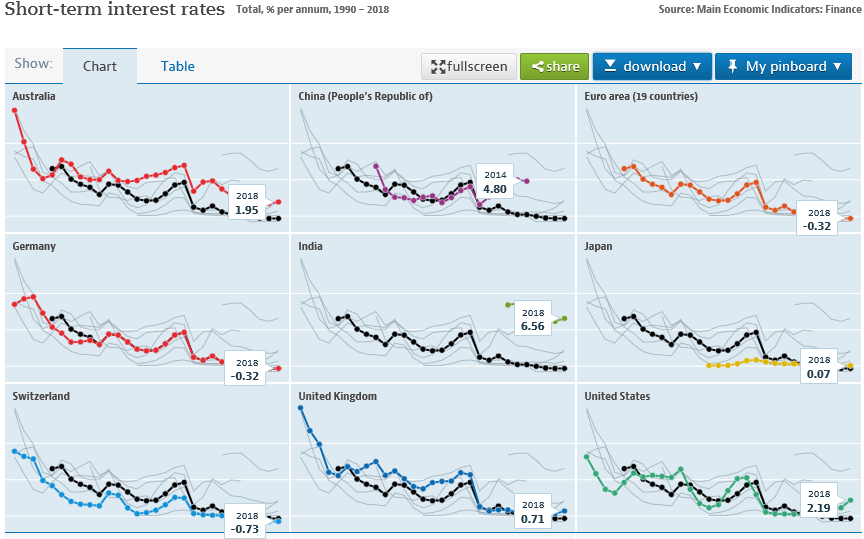

- The level of the risk-free interest rate throughout the retirement, in nominal terms, or even more in real terms.

A capital of $200,000 with an interest rate of 5% generates an income of $10,000 per year (or $833 per month), but if that interest rate is only 1% or even less as it has been in recent years, that capital is only $2,000 per year ($167 per month);

Fonte: OCDE Data

- Allocations of this asset in terms of financial assets and the annual deaccumulation rates taken.

In average terms, the greater the allocation of assets to financial assets, the greater their sustainability. With a 4% annual deaccumulation rate, a net worth of $1,000,000 runs out after 25 years if it is applied in cash or savings, but still has $200,000 at the end of 30 years with 20% allocated to stocks and 80% to bonds and almost $400,000 in the same term with allocations of 40% to stocks and 80% to bonds.

For the same allocation, the higher the deaccumulation rate, the shorter the duration of the portfolio.

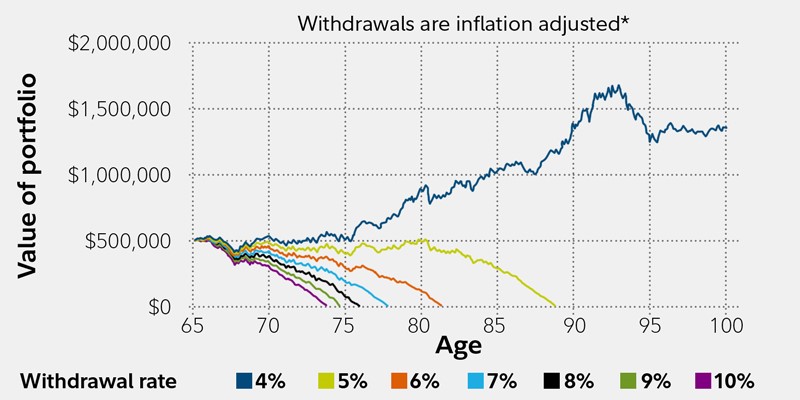

The following chart shows the performance of a $500,000 asset invested in 1972 over the next 35 years with an allocation of 50% in shares, 40% in bonds and 10% in savings for several deaccumulation rates (from 1/12 of the amount in the first month and increased inflation in the following months).

With a 4% deaccumulation rate the portfolio would increase to $1,400,000 by the end of 35 years. Any other deaccumulation fee would exhaust the estate before the age of 90. With a 6% fee, we’d have money by the time we were 82 and no more.

- The annual return of financial markets during the first 5 to 7 years of retirement (as well as, in the last years before retirement).

A good start allows a substantial reinforcement of the wealth, but a very bad start can call into question the ability to survive and keep that wealth.

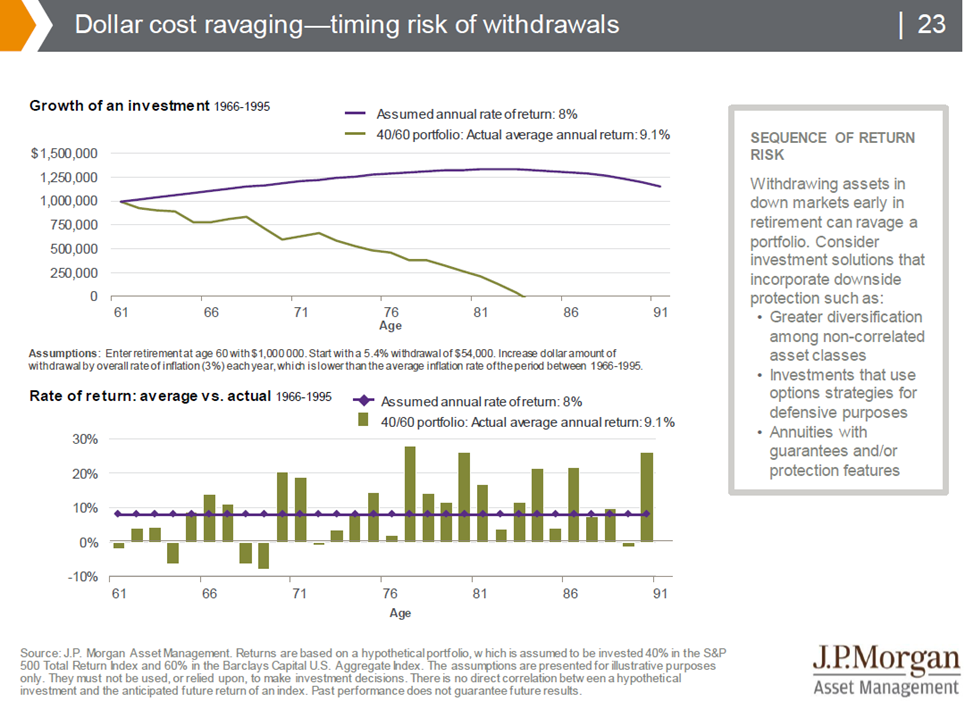

A person who retired at 61 years of age in 1966 with a net worth of $1,000,000 allocated to 40% in stocks and 60% in bonds, and assuming a deaccumulation rate of 5.4% per year, this estate would have been exhausted at 83 years of age due to the first years of bad returns, despite its average annual return being 9.1% (a systematic annual return of 8% would have allowed this $1,000,000 assets to be kept intact until age 91).

The sequence of good and bad years of market performance can also have a great effect on the ability to maintain retirement income by the portfolio.

An invested portfolio that begins with strong performances and has losses only later, will be much better than another that has losses early on and the gains more distant in time, if both revert to the average annual historical return.

This means it is necessary to consider the effects of market fluctuation when deciding on the deaccumulation rate in the first years of retirement, the ability to remain invested in periods of volatility and the allocation between asset classes.

It is essential we make the right allocations of income and capital: savings for essential expenditure and investments for the appreciation of capital in the medium and long term

So, what must we do?

The best strategy seems to be:

- To meet current essential expenditure, rely on public and private pensions, other possible income and to use part of the assets or complementary retirement fund to purchase a financial annuity required for the missing amount.

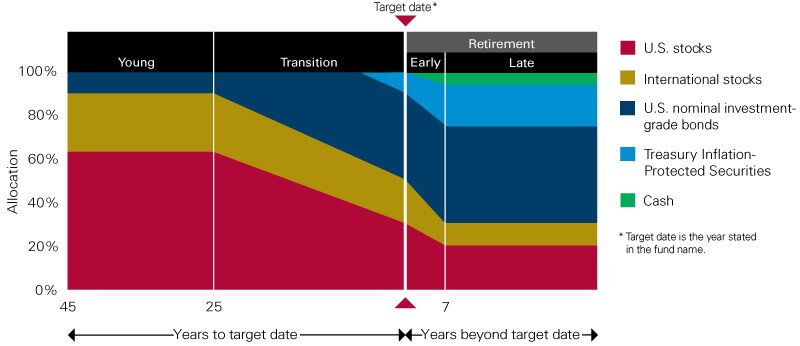

- The remaining wealth or complementary retirement fund must remain invested in financial assets for appreciation, with allocations between 40% and 20% in stocks and 60% to 80% in bonds, similar to what is done by the Target Dated Funds or funds with allocations adjusted for retirement.

Source: Vanguard

If any unforeseen events, personal or market, affect us we must adjust the base plan

One hypothesis is to decrease the rate of deaccumulation when the portfolio is below the target and increase it when it is above. That is, to live worse or better depending on the markets.

Another hypothesis that is adapted to situations in which we have not been able to have the serenity to maintain the discipline of the initial allocation is to change it and to align it with our profile and risk tolerance capacity.