Characteristics of the capitalization classes of the companies’ stocks

Advantages of investing in the various capitalization classes

In the previous article we saw that, contrary to what many people think, small and mid-cap stocks have provided the highest returns in the very long term.

In this second article on the subclasses or investment strategies of capitalizations, we will address the characteristics of each one, and analyze the respective investment advantages and disadvantages.

In the Tools folder, we have developed in detail some of the main indices of the world stock markets of the stocks with the largest market capitalizations, namely the MSCI ACWI for the world market, the Dow Jones IA 30, S&P 500 and Nasdaq in the US, and in Europe, the Eurostoxx 50 and FTSE 100).

We also include the Russell 2000 index of U.S. small and mid-caps.

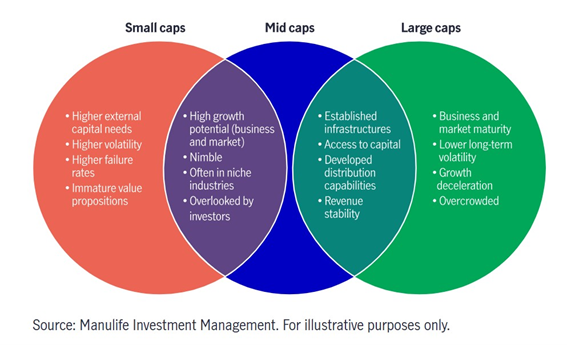

Characteristics of the capitalization classes of the companies’ shares

The characteristics often associated with large-cap stocks are transparency, dividend payouts, and market stability and impact.

Transparency of Information and Liquidity

There is a decisive advantage for large caps in terms of liquidity and analysis coverage.

Large-cap companies have a strong number of analysts, and there is an abundance of company financial information, independent analysis, and market data available for investors to analyze.

In addition, large-caps tend to operate more efficiently in the market – trading at prices that reflect the underlying value of the company – and also trade in higher volumes than smaller companies.

Large-cap companies have a lot of public information, which makes it easier for investors to scrutinize.

Stability and impact on the market

Market capitalization gives a general idea of a company’s position in the business development process. Market capitalization also provides a rough indicator of a company’s stability.

Large-cap stocks are typically higher-quality companies with well-developed phases of the business cycle, generating stable revenues and profits.

This is partly because these larger companies typically have larger financial reserves and can therefore often absorb losses more easily and recover more quickly from a bad year.

They tend to move with the economy because of their size.

They are also market leaders.

They produce innovative solutions, often with global market operations, and market news about these companies is often impactful to the market at large.

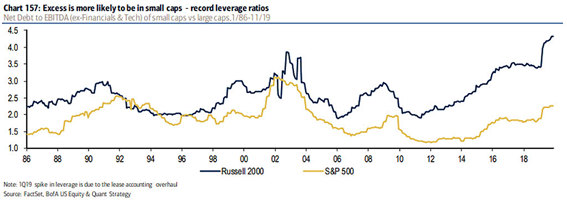

Small-cap stocks tend to be more volatile and riskier investments.

Small-cap companies generally have less access to capital and generally do not have as many financial resources.

This makes it difficult for smaller companies to obtain the financing needed to close cash flow shortfalls, finance new market growth activities, or make large capital expenditures.

This problem can become more severe for small-cap companies during the lower periods of the economic cycle.

However, smaller companies may have a greater potential for rapid growth in periods of economic expansion than larger companies.

Dividend payment

Large-cap, stable, and established companies are often the companies that typically pay good dividends.

These companies can set and commit to high dividend payout ratios because they operate in mature markets.

That’s why some dividend analysts and managers use market capitalization as a filter when searching for companies that pay consistent dividends.

Advantages of investing in the various capitalization classes

Market capitalization can still be a useful indicator, especially when it comes to diversifying portfolio and investing.

When we diversify, we aim to manage your risk by spreading out investments.

To diversify is to invest in different asset classes, for example, in stocks and bonds, as well as within asset classes.

Investing in small-cap and large-cap stocks is an example of diversification within the asset class of stocks.

Large-cap companies tend to be less vulnerable to market fluctuations than mid-cap companies.

And mid-cap companies are generally less susceptible to volatility than small-cap companies.

Despite the added risk of small-cap stocks, there are good arguments for investing in these companies.

One advantage is that it’s easier for small businesses to generate proportionately large growth rates because it’s easier to double the capitalization of a smaller company than a large one.

In addition, since those who run smaller companies are a small, cohesive team of managers, they can adapt more quickly to changing market conditions because they are more agile.

In addition, the fact that these companies are less followed by analysts and investors in general can make it possible to detect investment opportunities resulting from market failures or inefficiencies.

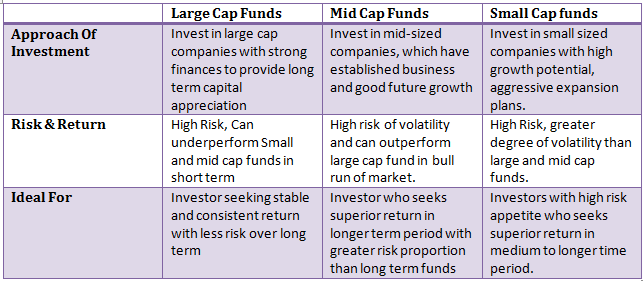

In summary, investing in the different capitalizations has different objectives, and also requires different knowledge and experience:

The vast majority of investors should invest in large-cap companies, either through funds or a very diversified set of these stocks.

Investors who have more knowledge, experience and time can invest in the mid-cap and small-cap segments, either directly or via funds.

The work spent on analysis and selection is greater, but it can pay off by obtaining higher returns and accepting greater risks.

Generally speaking, investors in small and mid-caps are people with a higher risk profile.