What is asset allocation and why is it important for investments?

Top 4 Asset Allocation Strategies

#1 Strategic asset allocation

#2 Dynamic asset allocation

#3 Tactical asset allocation

#4 Core-satellite asset allocation

It comprises from the conception and design phases of the allocation process to the 4 main strategies used by investors.

In other articles we had already elaborated on some aspects related to asset allocation.

In fact, we presented the development of the financial planning process itself, the definition of objectives, the consideration of constraints, including the financial situation and capabilities, and the investor’s risk profile.

We have also focused on the importance of portfolio diversification, directly linked to expected returns, as well as the expected risks of the main assets.

We have also seen the importance of the correct allocation of assets in the construction of the investment portfolio, as it largely determines the expected profitability and risk profile.

What is asset allocation and why is it important for investments?

Asset allocation is the implementation of an investment strategy that adjusts the percentage of each financial asset in an investment portfolio according to the investor’s risk tolerance, objectives, and investment timeframe, in order to balance risk versus expected return.

The focus is on the characteristics of the overall portfolio.

This strategy contrasts with an approach that focuses on individual assets.

Asset allocation is an important factor in determining the returns of an investment portfolio.

The main justification for asset allocation is the notion that different asset classes offer returns that are not perfectly correlated.

To that extent, diversification reduces overall risk in terms of the variability of returns for a given level of expected return.

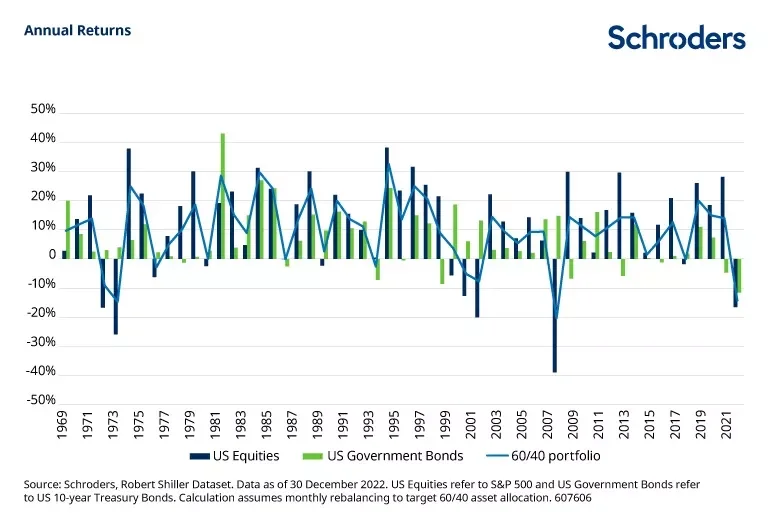

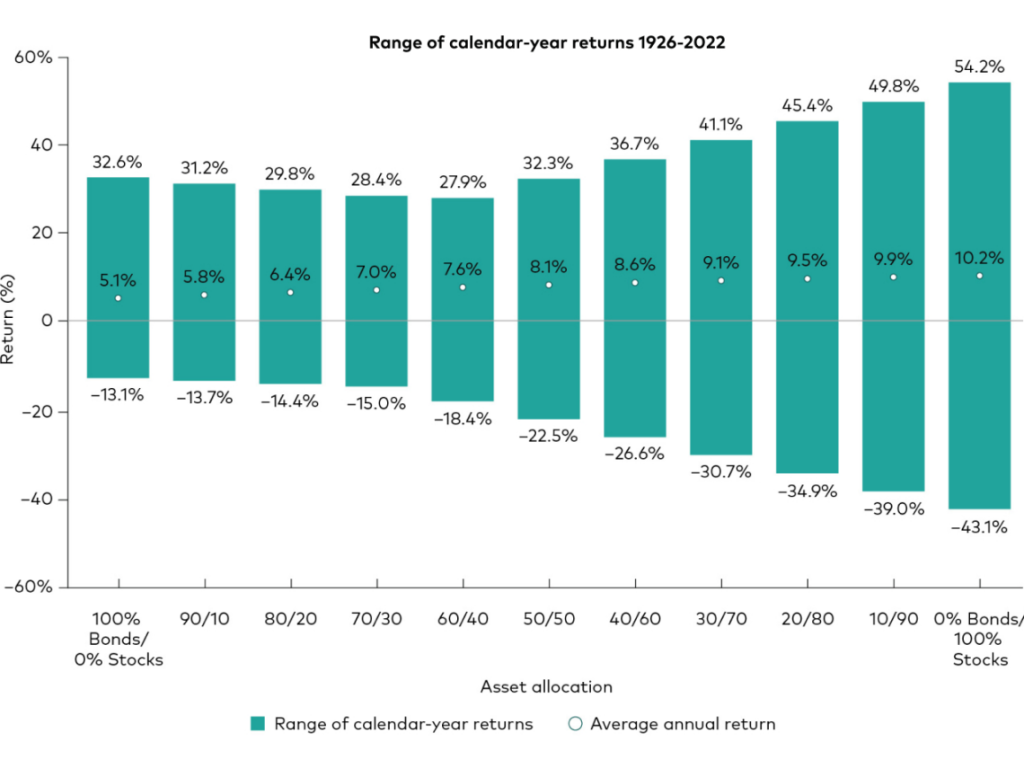

The various combinations of allocations to the 2 main assets, stocks and bonds, produce a spectrum of historical returns verified over a very long period, which can be taken as a reference for the expected returns of each combination:

The average returns observed between 1926 and 2022 for the various combinations result in a range of values between 5.1% and 10.2%, respectively, for portfolios of 100% bonds and 100% shares.

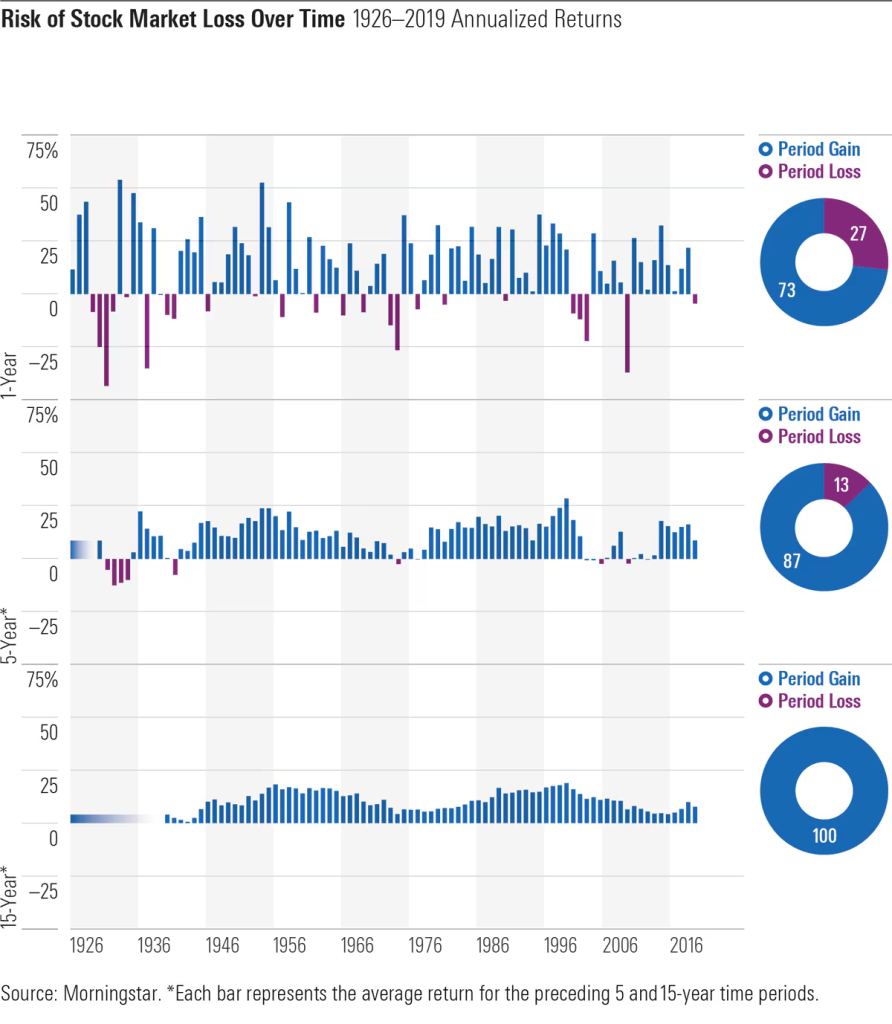

Another relevant dimension is the percentage of years of positive and negative returns, as well as a metric to assess the recovery time of negative events:

Since 1926, for periods of 15 years, stocks have always provided positive returns. At 5 years, only 13% of the periods were negative (most in the Great Depression and the values are small), while at 1 year they were 27% of the cases.

Top 4 Asset Allocation Strategies

There are various models or types of asset allocation strategies based on investment objectives, risk tolerance, timeframes, and diversification.

The 4 most common types of asset allocation are: strategic, dynamic, tactical, and core-satellite.

#1 Strategic asset allocation

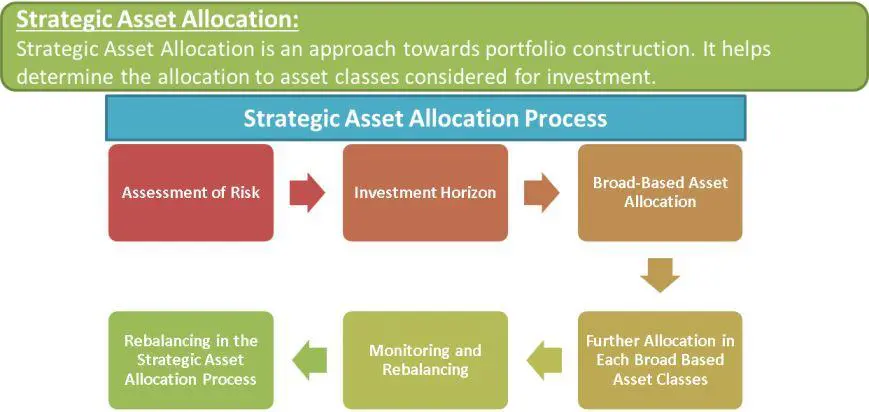

The primary goal of strategic asset allocation is to create a mix of assets that provides the optimal balance between expected risk and return for a long-term investment horizon.

Generally speaking, strategic asset allocation strategies are independent of economic environments, i.e. they do not change their allocation ways in relation to market changes or economic conditions.

#2 Dynamic asset allocation

Dynamic asset allocation is similar to strategic asset allocation in that portfolios are built by combining assets that seeks to provide the optimal balance between risk and expected return for a long-term investment horizon.

Like strategic allocation strategies, dynamic strategies largely maintain exposure to their initial asset classes.

However, unlike strategic allocation strategies, dynamic asset allocation portfolios adjust and adapt their allocation ways over time in relation to changes in the economic environment.

#3 Tactical asset allocation

Asset allocation is a strategy in which an investor takes a more active approach and tries to position a portfolio in the assets, sectors, or individual stocks that show the greatest potential for expected gains.

While the initial asset mix is formulated in a very similar way to strategic and dynamic portfolio allocation, tactical strategies are often traded more actively and are free to move in and out of their core asset classes entirely.

#4 Core-satellite asset allocation

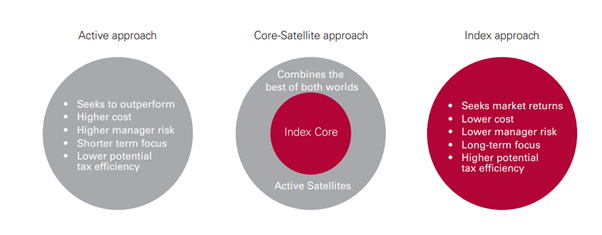

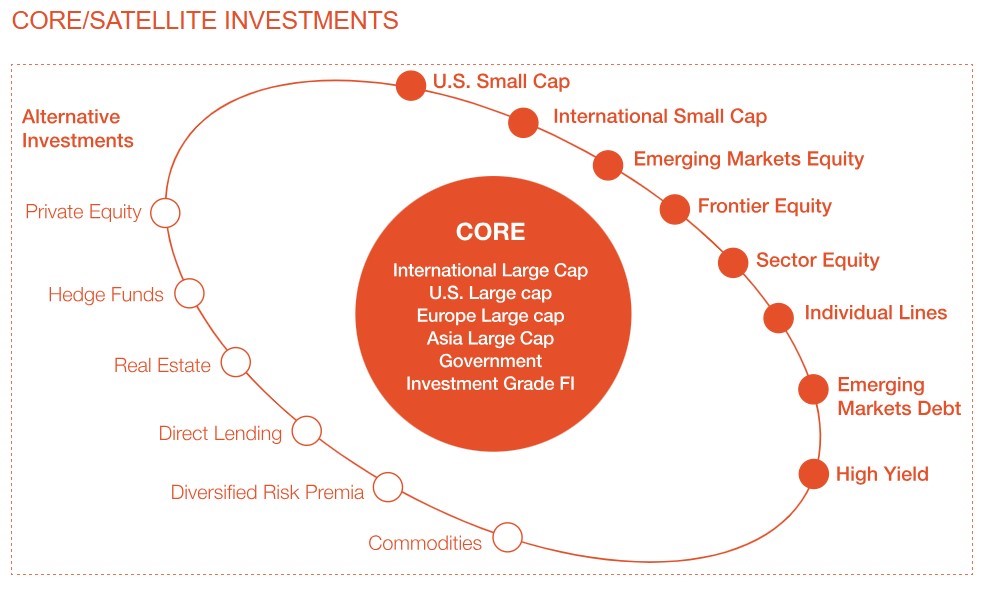

Core and satellite strategies usually contain a “core” strategic element, which constitutes the most significant part of the portfolio, while applying a dynamic or tactical “satellite” strategy, which constitutes a smaller part of the portfolio.

In this way, core and satellite allocation strategies are a hybrid of the strategic and dynamic allocation strategies and tactics mentioned above.

The core or primary allocation includes generalist and broader investments, such as large-cap stocks in the US and worldwide, as well as government bonds and investment quality ratings.

Satellite or secondary allocation can integrate market segments such as global small- and mid-cap equities, emerging market equities, sector-specific equities, as well as speculative or high-yield developed market bonds, and emerging market bonds.

In addition, satellite allocation includes alternative investments, such as private equity, hedge funds, real estate, raw materials, and other more peripheral and less liquid segments.

In the context of the discussion of the choice between passive and active investments, the core-satellite strategy combines the best of both worlds, positioning indexed investments as the “core” component and active investments as satellite: