Real rates of return of financial investments are much higher than savings in all countries of the world

Examples of wealth creation of investments versus savings in Germany and the United Kingdom

Real rates of return of financial investments are much higher than savings in all countries of the world

With the little we save we don’t go far just with deposits or savings accounts. It´s like going against a wall.

We saw in another post that the actual annual savings interest rates, including deposits and savings accounts, are close to zero or even negative.

On the contrary, real annual financial investments rates of return, both in the stock markets and in bond markets, are markedly positive.

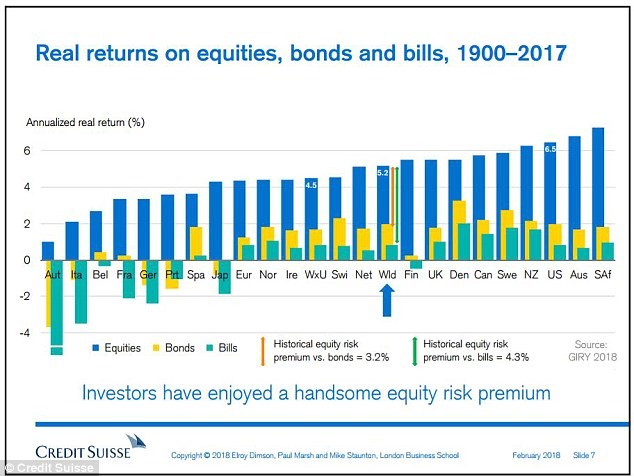

The following chart shows these average annual real profitability rates for investments in the main world stock markets and bond markets in the period between 1900 and 2017:

The average annual share real rate of return was 5.2% for global stocks and 3% for global bonds.

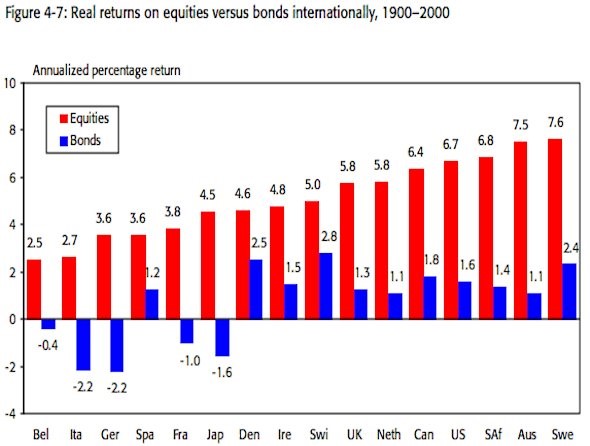

The following graph presents the same information for the previous century and evidencing the values of these rates of return of investments in several countries:

The main stock markets recorded average annual real rates of return between 2.5% and 7.6%. The largest markets recorded rates of return of 6.7% for the US, 5.8% for the UK, 4.5% for Japan and 3.6% for Italy.

The main bond markets recorded average annual real rates of return between -2.2% and +2.8%. The largest markets recorded rates of return of 1.6% for the US, 1.3% for the UK, -1.6% for Japan and -2.2% for Italy.

Countries that escaped the great world wars performed much higher than those directly involved in them. The wars caused the deaths of millions of human lives and destroyed enormous economic, financial, social and cultural wealth.

https://www.credit-suisse.com/about-us/en/reports-research/studies-publications.html

Examples of wealth creation of investments versus savings in Germany and the United Kingdom

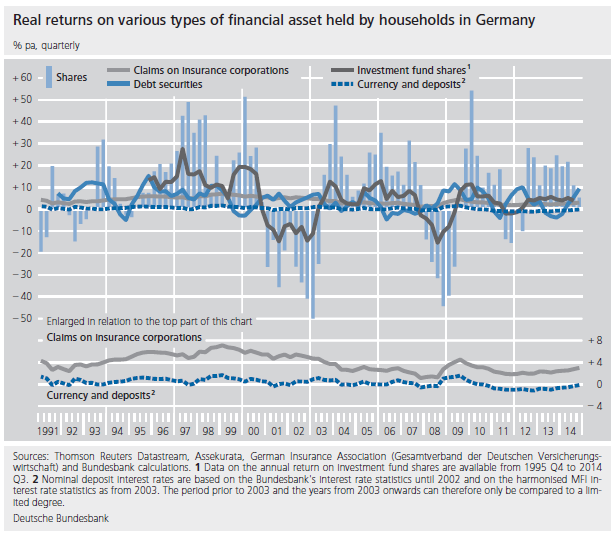

The following graphs exemplify the effect of wealth creation of investments in financial markets compared to deposits and savings accounts, for German and British cases, in recent years.

In real terms, the annual returns of the shares (in light blue) oscillated greatly with a positive average of around 8%. Bond returns had lower variations and an average of around 2%. The returns of claims on insurance corporations were 4% on average. Savings and deposit returns were about 0%.

The effect of those annual real rates of return on the composition of the various financial assets held by German households resulted in very high contributions but with some volatility in the of shares investments, moderate and more stable on claims on insurance, low returns in debt scurities and zero onsavings currency and deposits.

The average annual rates of return on household wealth will have been of around 4% in real terms.

In the case of the United Kingdom, an investment of £1,000 in 1994 would have resulted in a real capital (adjusted for inflation) in 2015 of £2,602 in the stock markets, of £859 in savings accounts and €616 if held cash and without bearing interest.