Stock and bond markets close 2022 in bear market territory, with few exceptions. Outlook for 2023 shows a year with two phases, for negative cycle inversion. Long-term treasury bond interest rates stable in the US, and rising in the Eurozone.

The issues that currently impact investments are inflation and restrictive monetary policy – rising interest rates and quantitative tightening – and secondarily, the war in Ukraine and the energy crisis, as we said a quarter ago.

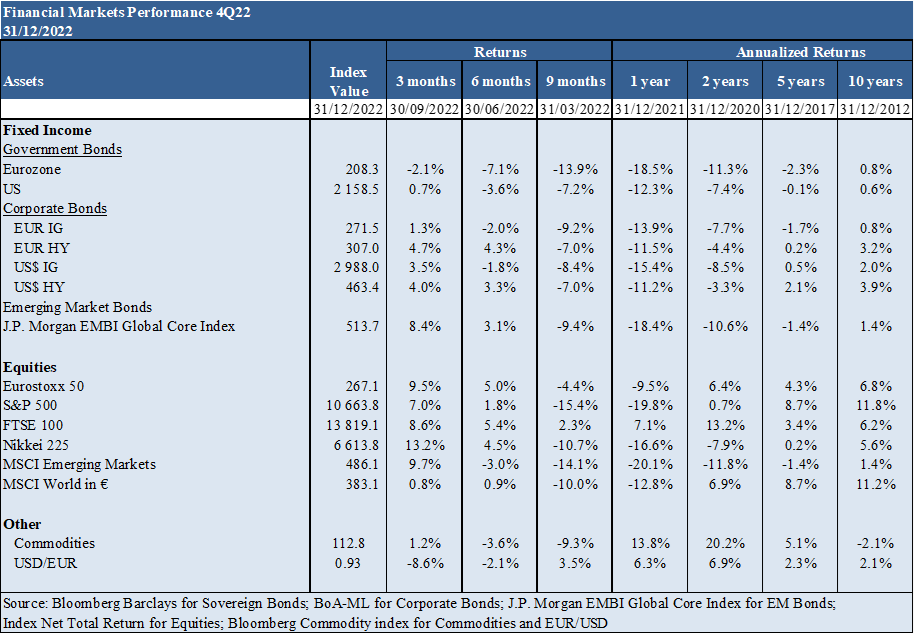

Performance Markets 4Q22: Stock markets in bear territory with corrections in excess of 20%, excluding Dow Jones, FT100 and some peripherals. Bond markets entered an unprecedent bear market , as well as the traditional and very popular 60/40 portfolio

Macro Context: Continued sharp slowdown in economic growth around the world due to restrictive monetary policies to fight inflation, and the extension of the war in Ukraine and the slowdown in China. Forecast of recession in a third of the world by the IMF, including the majority of European countries. Inflation begins to fall in the U.S. and Europe, but gradually

Micro Context: Key leading economic indicators in decline and at contraction levels in Europe

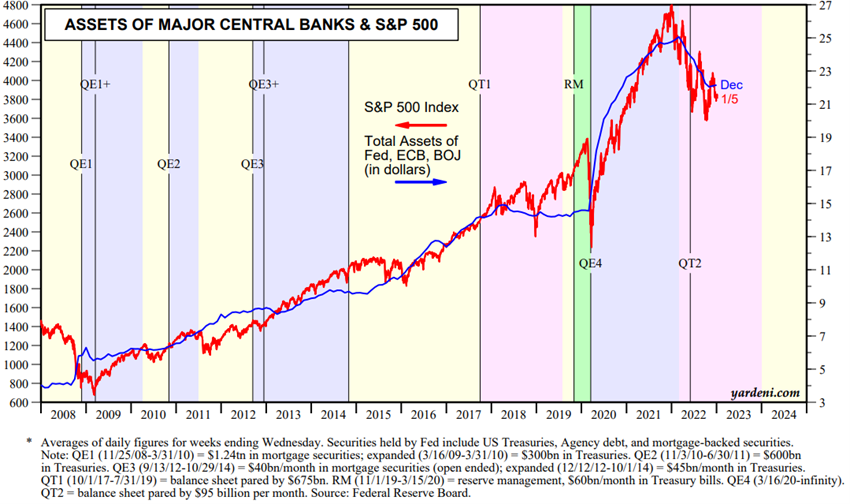

Economic policies: Central banks in developed countries pursue restrictive policies, with official interest rate hikes and asset sales, which could be tougher than expected in the face of the disconnect between economies and markets

Stock markets: Most stock markets in bear territory, even after last quarter’s recovery, but valuations are still above the level appropriate to the current context of economic slowdown, and high inflation and interest rates

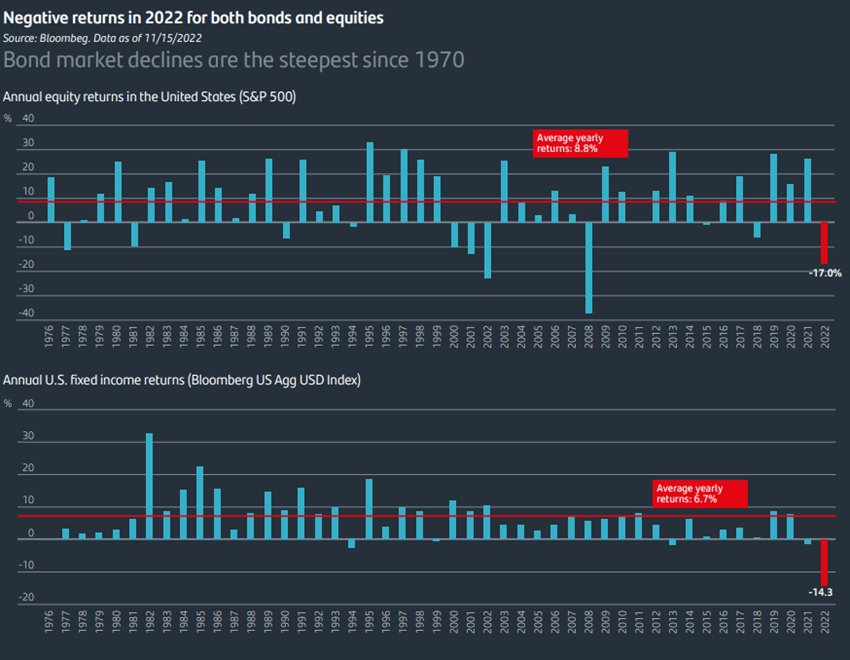

Bond markets: Unprecedent bear market in bonds increased losses in the 60/40 portfolio. Stabilisation of long-term risk-free interest rates in the US and rising in Europe, with widening spreads and risks in lower liquidity market segments.

Key opportunities: Key opportunities: Less uncertainty, lower commodity prices and end of Covid-zero lockdowns in China, with the negotiated end of Ukraine’s war in the short term as main “tailwind”, possible, but unlikely,

Key risks:Recession in Europe almost certain, and very likely in the US, but shallow, tightening monetary policy stronger than anticipated, and increased vulnerability to low-probability but heavy-impact risks

This phase of economic cycle and monetary policy change, favors the protection of financial assets and defensive investments, in value stocks or dividends, and for U.S. investors, in medium and long-term treasury bonds. Exposure to low-quality rating debt should be avoided.

Performance of financial markets 4Q22

Bear market stock markets with corrections in excess of 20%, excluding Dow Jones, FT100 and some peripherals. Bond markets entered an unprecedented bear market, as well as the traditional and very popular 60/40 portfolio

Stock markets remain in “bear market”, or fall above 20%, in developed countries, and higher in emerging markets, despite some recovery in the last quarter.

However, there are exceptions, such as the Dow Jones index, the FT100 and some peripheral markets, that must be recorded as they result from the paradigm and cycle change.

Bond markets entered a bear market, which had not succeeded since records began in 1972 in the US.

Strong drop in cryptocurrencies due to bankruptcies of large operators and domino effect on the ecosystem, and greater regulation, with Bitcoin losing more than 65% in 2022.

Macroeconomic context

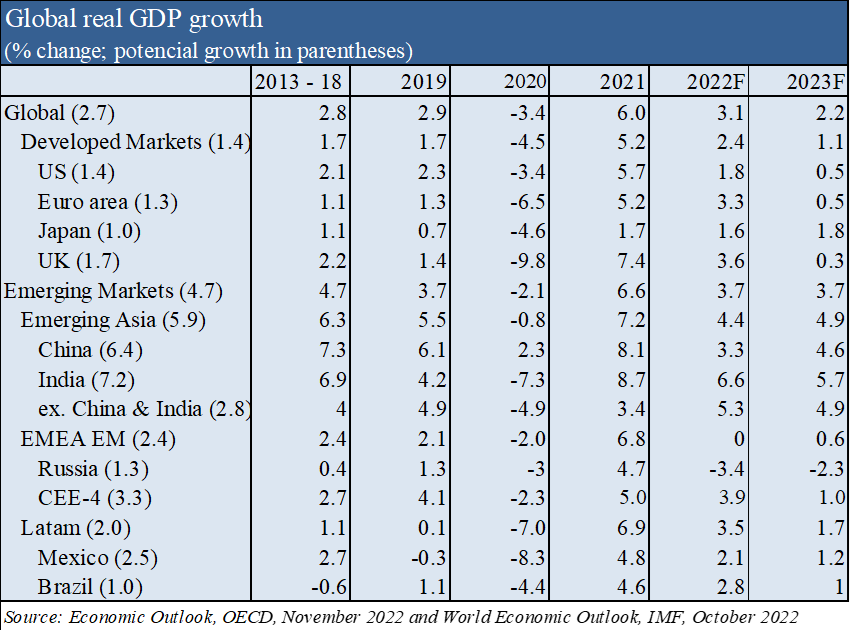

Review of global economic growth forecasts in a slight decline to 3.1% in 2022 and 2.0% in 2023, and with 1.8% and 0.5% in the US, 3.3% and 0.5% in the Eurozone, and 3.3% and 4.6% in China in 2022 and 2023 respectively, due to the persistence of high inflation, rising interest rates, and war in Ukraine (OECD November and IMF, October).

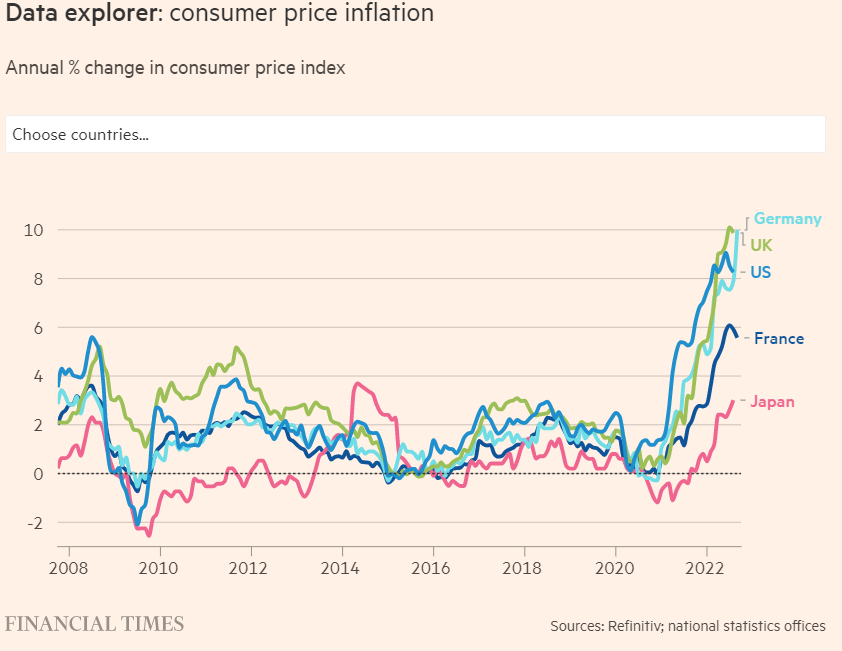

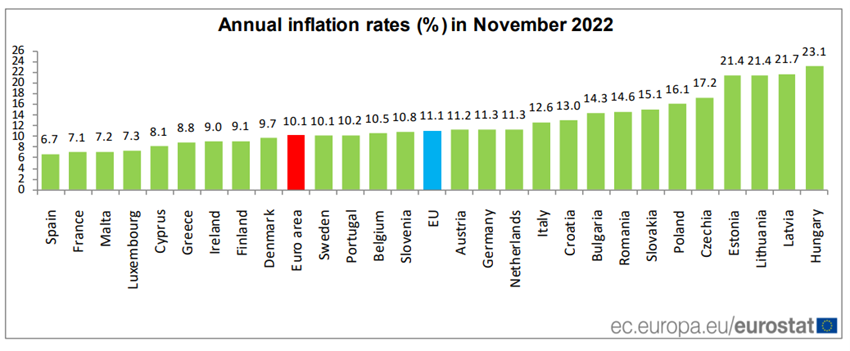

Inflation is gradually falling in developed countries by lowering the price of energy and other goods, with an estimated 6.2% in the US, 8.3% in the Eurozone, and 8.9% in the UK for 2022.

According to the OECD, inflation of 3.5% in the US, 6.8% in the Euro zone and 6.6% in the UK is expected in 2023

According to the IMF, China could grow below the world average for the first time in the last 40 years. and the three major economies – the US, Europe and China – slow down significantly and simultaneously in 2023, assuming that a third of the world will go into recession by 2023, including most European countries.

The possibility of recession in the US remains, but if it exists, it will be mild, given the good financial conditions of households and corporations.

The degrees of effectiveness of monetary policies in reducing inflation via aggregate demand, transmission of inflation to wages and anchoring capacity of inflationary expectations will be determinant for the transition of the economic cycle and market performance.

Micro-economic context

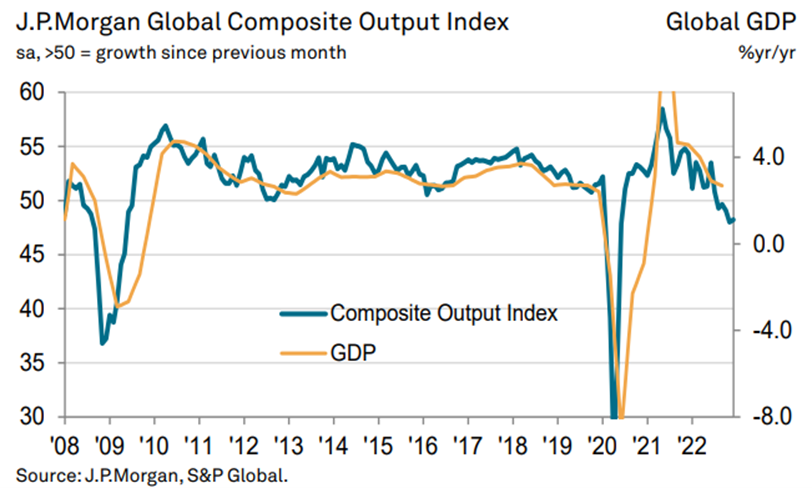

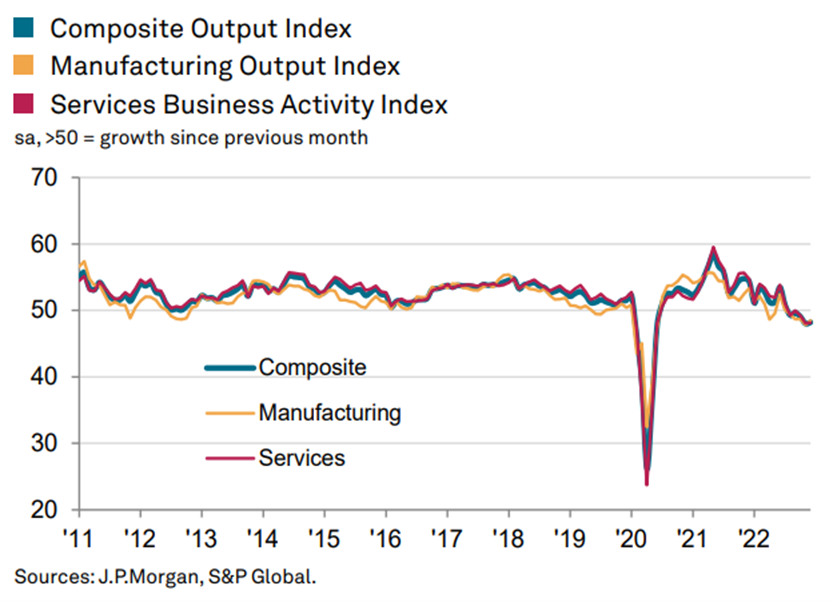

Global economic contraction, with slowdown in the US, Eurozone and UK

The J.P.Morgan Global Composite Output Index recorded 48.2 in December, close to 48.0 November, being one of the weakest records in the last 15 years.

India and Ireland were the only countries to record economic activity growth in December. Japan has stabilised in production, while the US, China, the Euro zone, the UK, Brazil, Russia and Australia all contracted.

The unemployment rate in the U.S. is at 3.7%, levels very close to the lows.

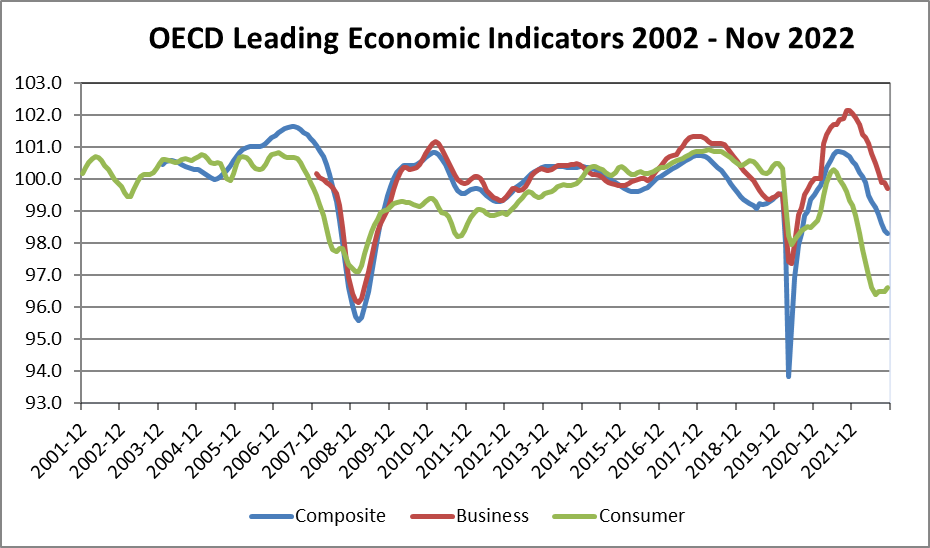

Business and consumer confidence in OECD countries continues to decline sharply.

Economic policies

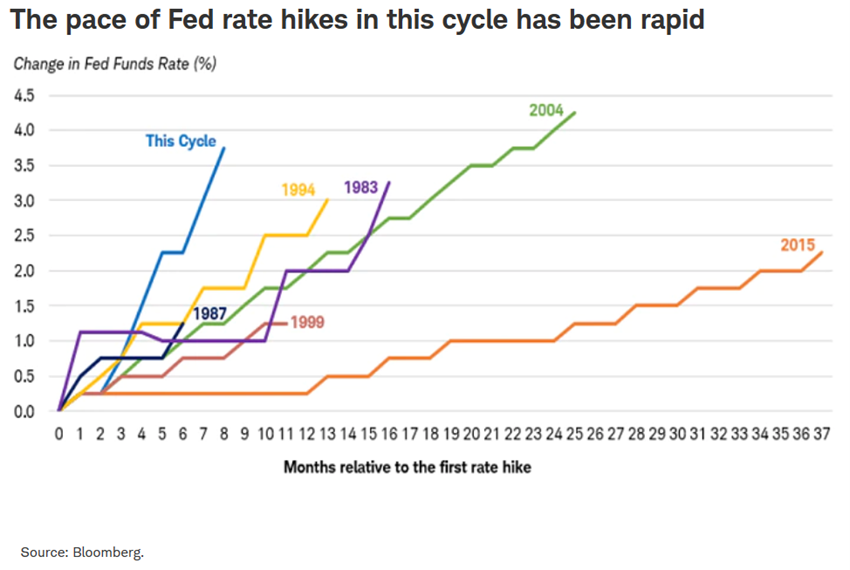

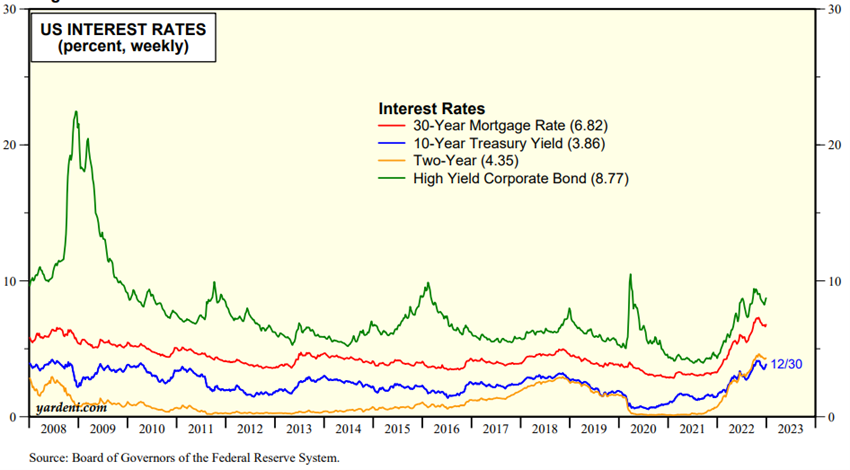

The FED is determined to fight inflation, having risen the official interest rate by 0.75% in December, setting it at %-5,50%, the seventh of the year, in the fastest increase in memory.

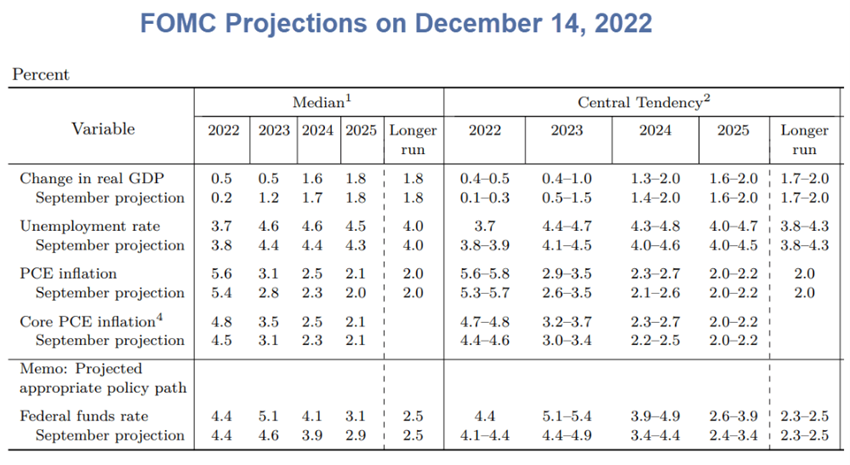

Its projections point to the increase of this rate to 5.1% at the end of 2023, 4.1% in 2024, 3.1% in 2025, and 2.5% in the longer term.

It admits that unemployment could reach 4.4%.

The Bank of England raised the official interest rate to 3.5%.

The ECB has raised the official rate to %-2,5% and expects to start selling assets in the first quarter of 2023.

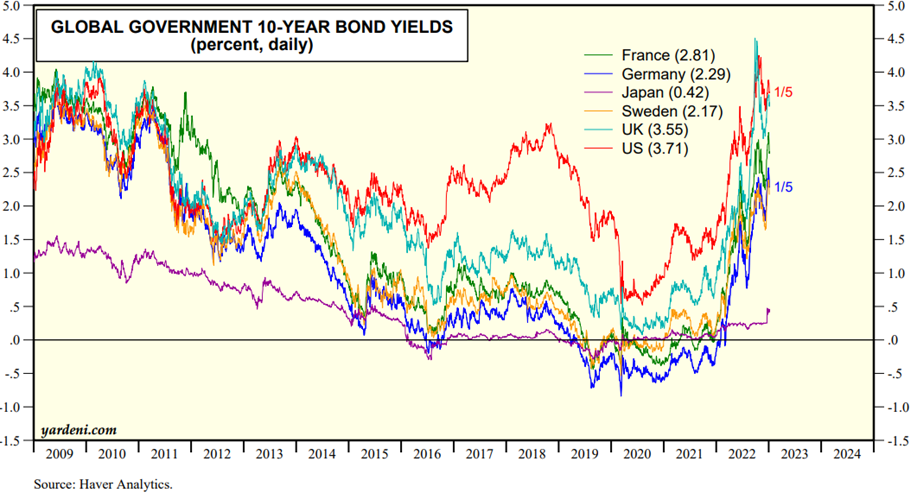

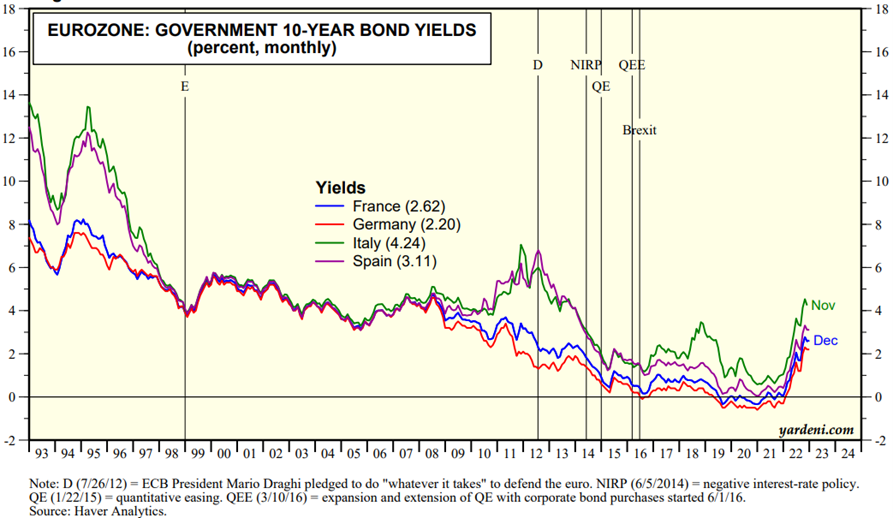

10-year treasury bonds have fallen in the US and are stable in the Eurozone and the UK.

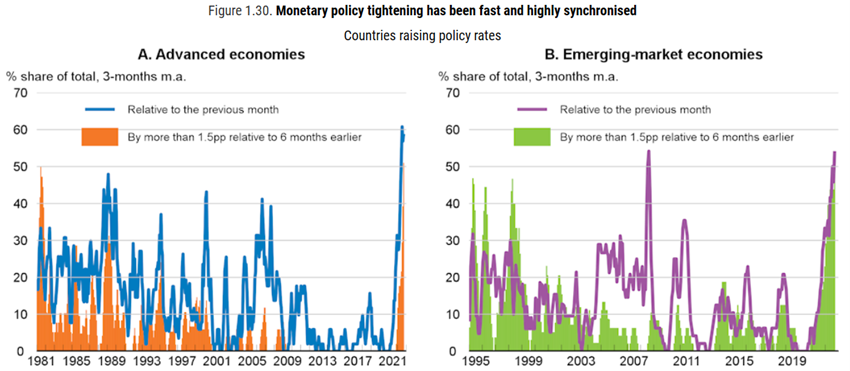

Most advanced and emerging economies are rapidly raising interest rates.

Reducing inflation to target levels may become more arduous than expected in the US and Europe due to the new disconnect between the realities of economies and markets.

This disconnect, accentuated by monetary policy in the response to the now-reversing pandemic, has increased the resistance and barriers to the necessary adjustment by increasing the wealth and capital available for investment in the markets and the narrowing of labour market supply.

Source: OECD Economic Outlook, November 2022

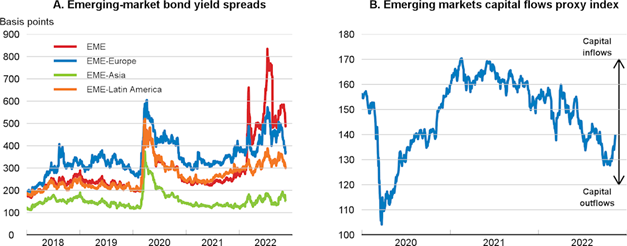

Financial conditions continue to worsen in developed countries and especially in emerging economies

The rapid pace of monetary policy contraction in major economies and the growing risk aversion have led to worsening global financial conditions.

Volatility has increased, particularly in treasury bond markets and in the foreign exchange markets of advanced and emerging market economies.

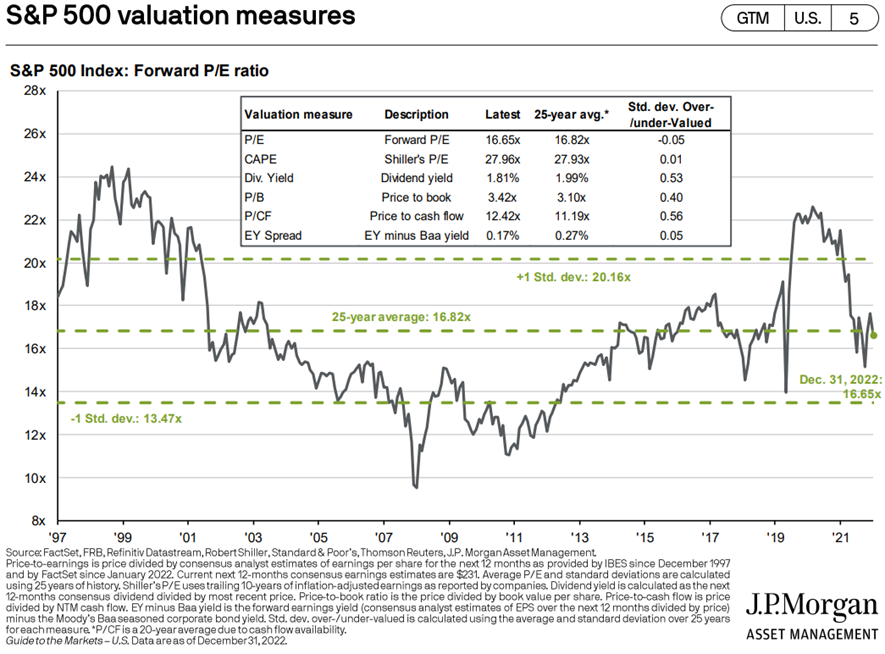

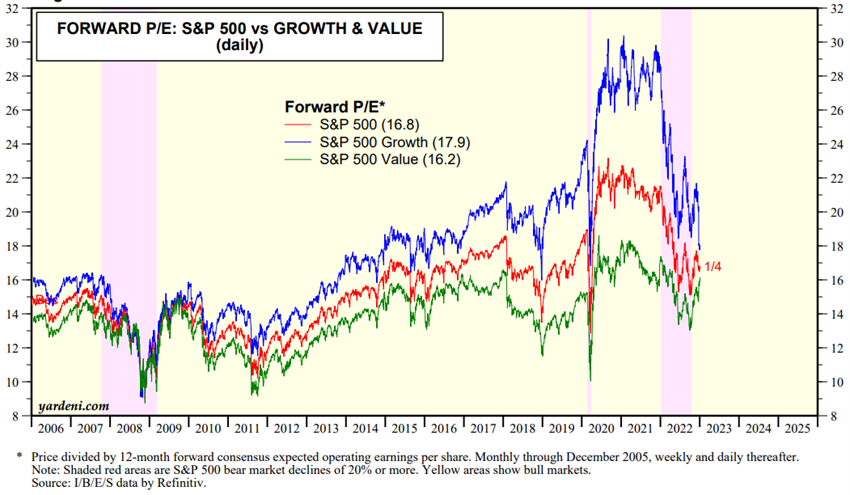

Equity markets valuation

Slowing growth and rising interest rates have caused stock markets to fall in most advanced economies.

Price declines have been relatively large in many Central and Eastern European countries, reflecting the weakening of growth prospects.

Stock markets are in bear market, even after last quarter’s recovery, with some exceptions such as the Dow Jones, ft100 and some peripheral countries.

Emerging stock markets have fallen more sharply.

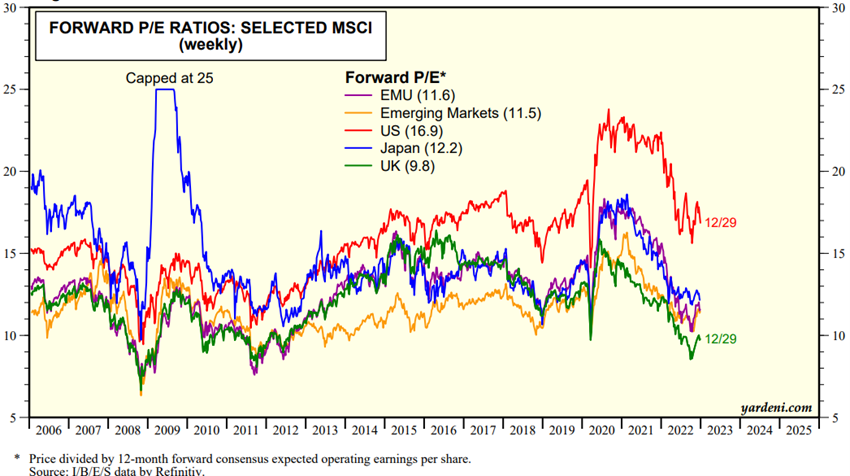

The valuation of the global stock market and the various regions has fallen and is near its long-term average.

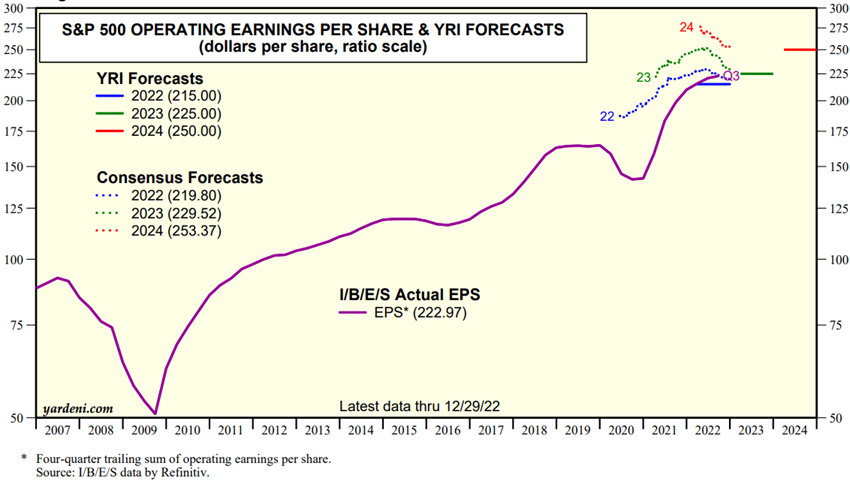

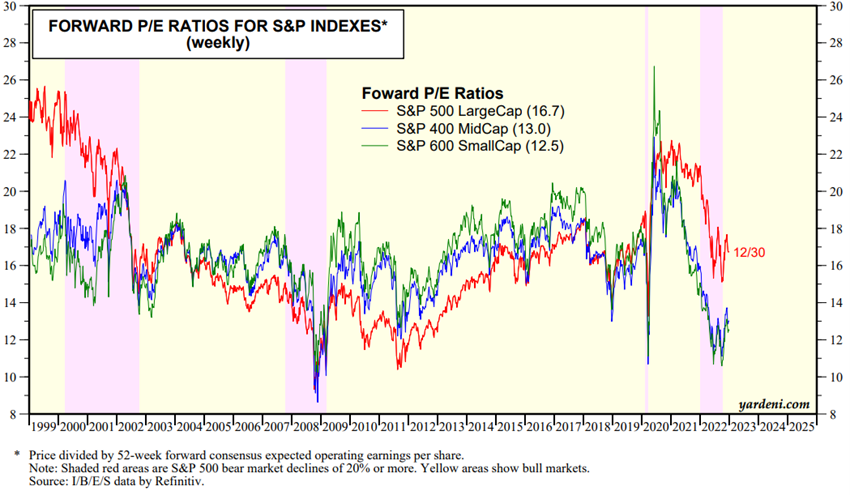

The 16.2x PER forward to the US is slightly above the long-term average.

The PE ratio of the remaining regions fell to 10.3x in the Eurozone, 11.9x in Japan, 8.5x in the UK and 10.5x in emerging markets, below the historical average.

Companies and analysts continue to revise its forecasts for low results.

The PE ratio of small and medium-cap U.S. stocks is about 11x to 12x, below the long-term average, while the mega-caps at 24x are well above the same.

The gap between 10- and 2-year U.S. treasury bond rates remains negative, which has been a predictor of a 6-9-month recession.

The market outlook of the largest investment banks and global asset managers published late last year points to a year of valuations close to zero, but with two halves, reflecting the final phase of cycle change.

At the initial stage, the market is expected to fall, continuing the adjustment of valuations, and a subsequent recovery to levels close to current ones.

The duration will be determined by the resistance to break the disconnect between economy and markets by the current inversion of monetary policy.

These adjustments will be stronger in the more cyclical, growth and valuation multiples sectors compared to their long-term average compared to the more stable, value and lower multiples.

Therefore, at this stage, sectors and companies of value, or quality, or dividends, with good cash-flow generation capacity continue to be favored in the face of growth and with low or negative results.

The health, current and financial sectors stand out, due to the positive, to the detriment of technology.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, January, 4, 2023

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, January, 3, 2023

Source: Major Central Bank Total Assets, Yardeni Research, January, 5, 2023

Source: Style Guide: LargeCaps vs SMidCaps, Yardeni Research, January, 4, 2023

Source: Style Guide: Style Guide: S&P 500 Growth vs Value, Yardeni Research, January, 6, 2023

Bond markets valuation

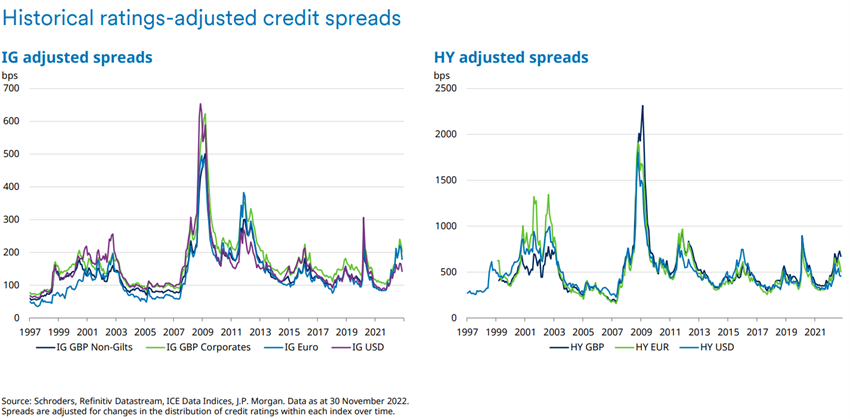

“Bear market” unheard of in bonds increased losses in the portfolio to 60/40. Stabilisation of long-term risk-free interest rates in the US and rising in Europe, with widening spreads and risks in lower liquidity market segments.

Long-term interest rates have risen in the United States, the United Kingdom and the euro zone, reflecting a rapid transfer of official interest rates to long-term bonds.

Global treasury bonds corrected more than 20% and entered an unprecedented bear market last September.

The U.S. treasury bond market continues to trade at interesting levels despite the decline in the last quarter.

The increase in credit spreads increased, especially europe’s sovereign debts, which were not only higher due to the interventions of the authorities, and speculative rating-grade debts.

The less liquid segments of the credit market showed instability.

Source: Market Briefing:Global Interest Rates, Yardeni Research, January, 5, 2023

Source: Market Briefing: US Bond Yields, Yardeni Research, January, 5, 2023

Source: Schroders Credit Lens, December 2022

Main opportunities

The eventuality of a term negotiated in the Ukraine war, with low probability, would obviously be a very positive surprise factor for the markets.

Main risks

Europe may have a deeper recession than expected.

The risks in advanced economies are increased indebtedness charges and lower bond market liquidity.

Public debt has increased and the cost of new debt is rising.

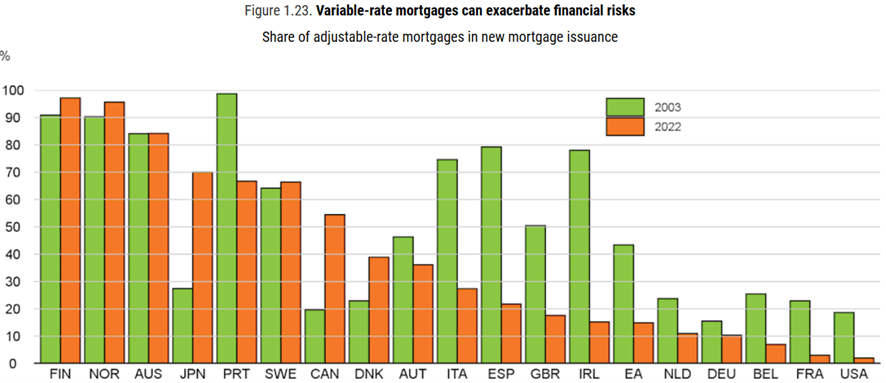

Debt service responsibilities have increased greatly for households and non-financial companies.

And variable rate mortgages can exacerbate financial risks.

The impact of lower energy imports from Russia to Europe could prove to be more severe than expected.

The contraction of monetary policy highlights pre-existing financial vulnerabilities in emerging economies, including high indebtedness.

Capital outflows from these economies have increased, the appreciation of the dollar worsens the situation and sovereign risk credit spreads are higher and volatile.

Adjustment of market excesses in a context of vulnerabilities and instability, it causes the appearance of extreme negative events, as was the case with the spikes in interest rates in British debt, European sovereign debt, strong falls in stock quotes and corporate bonds, even some large and considered stable, in cryptocurrency prices, meme stocks, etc., last year.

Source: OECD Economic Outlook, November 2022

Source: Market Briefing: European Interest Rates, Yardeni Researh, January, 5, 2023