Morningstar covers 4,000 mutual funds, including 1,150 funds and 300 ETFs in the US, and 91% of funds traded in Europe.

This rating of mutual funds is of great use because we consider that funds are the investment vehicle par excellence of individual investors.

Therefore, we have dedicated a series of articles on this blog to the theme of the selection of mutual funds, ranging from their description and characteristics, the types and investment policies, to profitability, and costs.

We have also published several articles on the choice between active and passive (or indexed) investment funds, including their differences and their advantages and drawbacks.

In the Tools folder we have been presenting some of the largest equity and bond mutual funds, actives and passives, traded in the USA and Europe.

To select the investment fund in which we want to invest it is important to know the basic information of the fund, namely the asset class, category, profitability and risk history, rating, value of assets under management, managing entity, and costs.

What is Morningstar’s investment fund rating?

The Morningstar Rating, commonly known as the star rating, is a purely quantitative and retrospective measure of the past performance of an investment fund.

This rating is available free of charge.

Morningstar has several types or models of fund rating, being the stars the most known and used by professionals in the asset management industry.

Morningstar Rating helps investors assess an investment fund’s history against its peers.

It is intended to be used as the first step in the fund evaluation process.

The funds are rated from one to five stars, with the best funds receiving five stars and the worst receiving a single star.

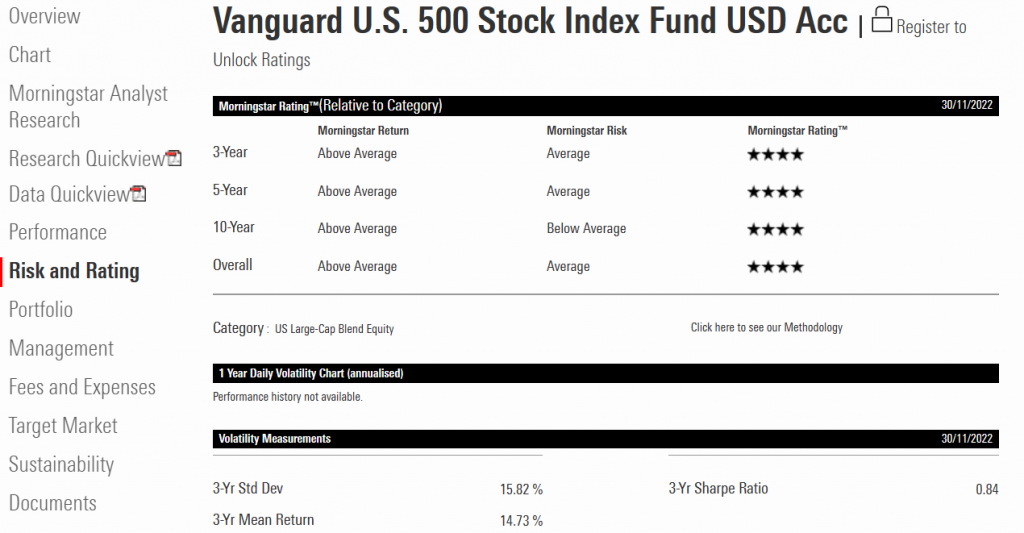

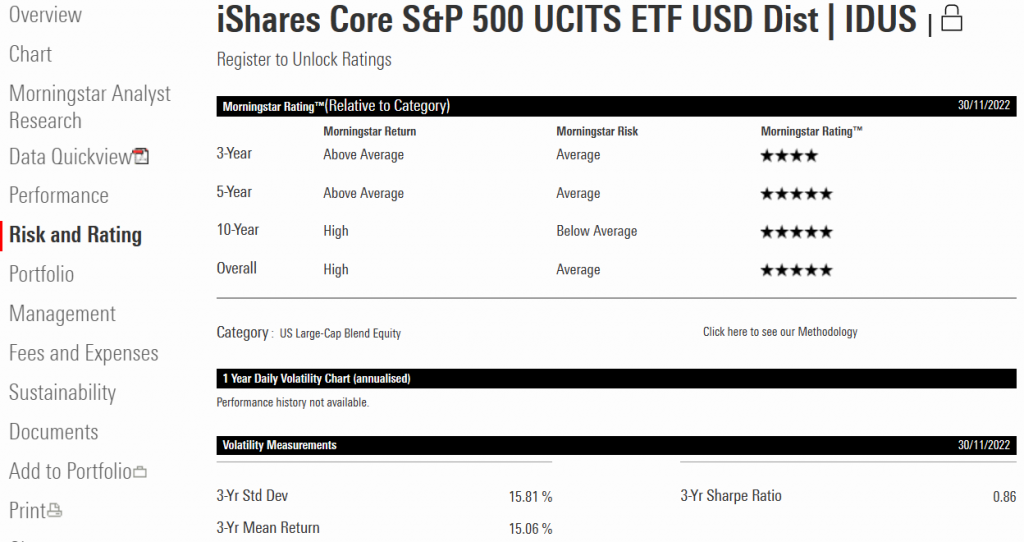

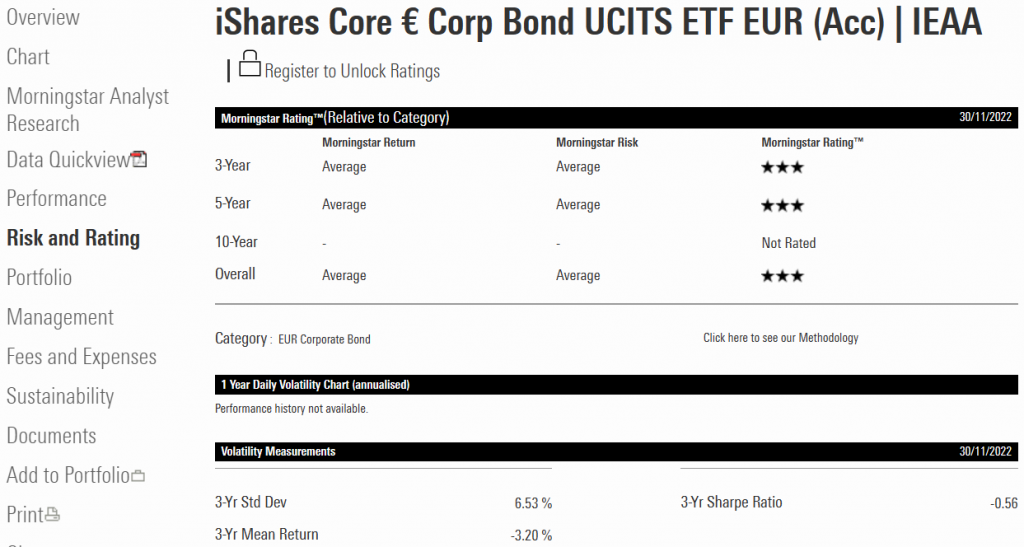

Examples of Morningstar fund ratings

The Morningstar Rating methodology classifies funds within the same Morningstar category based on a Morningstar risk-adjusted return measure.

Each fund receives separate assessments for periods of three, five and 10 years, which are then combined into a global classification.

Star ratings are ranked on a distribution curve: the top 10% receive five stars, the next 22.5% receive four stars, the average 35% receive three stars, the next 22.5% receive two stars, and the bottom 10% receive one star.

To receive a Morningstar Rating, a fund must have a registration of more than three years.

A Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia and Asia. The company offers an extensive line of products and services to individual investors, financial advisors, asset managers and suppliers and sponsors of retirement plans.

Access here: