The excessive intensity of monetary and fiscal stimulus, aggravated by the war in Ukraine, generated high inflation, which erodes the economy and finances

The irreversibility of “Tightening” (the effect of “boomerang”)

The end of the long bull market of bonds has given way to an unprecedented bear market

How can we navigate this bear market?

Many investors and managers have never experienced this reality

The rotation of assets with risk-free interest rates of 4%

The path of inflation return to 2%

Future implications for asset yields and the 60/40 portfolio

In previous articles we have been addressing the extraordinarily positive performance that bond investment had between 1980 and 2020, a long period of 40 years.

This performance was so remarkable that it became known for the long bull market of bonds.

In a first article we investigated what was at the root of this cycle, and concluded that it was an expansionary monetary policy that caused a continued fall in interest rates.

In the second article, we saw that this expansion has been accentuated in the last 10 years, between 2009 and 2021, with the three quantitative easing programs for the exit of the Great Financial Crisis and the superprogram to combat the pandemic.

These impulses were so strong that they pushed interest rates to near zero levels and in some countries to negative ground.

We have also seen that it was this policy that was behind the high yields of bonds and shares in this period.

In the third article, we saw that the majority of investors did not take advantage of this ride, since the yields on their investments fell far short of market yields, both in bonds and in stocks. And we also looked at the effects of this long bull market of bonds on the traditional 60/40 portfolio and on the correlation of assets

In this article, we will analyze how this long bull market of bonds, its reasons, results and consequences ended.

The excessive intensity of monetary and fiscal stimulus, aggravated by the war in Ukraine, generated high inflation, which erodes the economy and finances

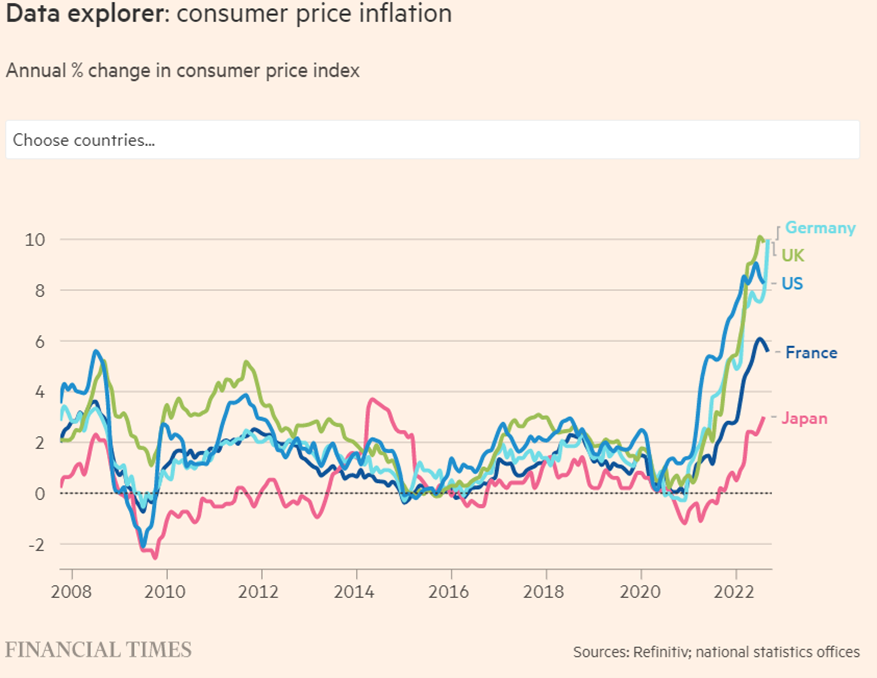

Strong monetary and fiscal policy stimulus over time, but especially in response to the pandemic, generated inflationary pressures from the beginning of 2021.

These pressures were seen as transitory and associated with the problems that the pandemic created in the breakdown of supply chains, which delayed the response of central banks.

The war in Ukraine has exacerbated pressures on energy, agricultural products and some raw materials prices.

It was not until September 2021, when inflation was already above 6% and on wages, that the FED acknowledged that inflation was persistent and initiated a restrictive monetary policy.

In the first few months, the action consisted of very moderate official rate hikes and term announcements and reversal of the asset program.

As inflation worsens to more than 8%, the high levels of the last 40 years, the FED has increased interest rates and the sale of assets in the balance sheet.

The Bank of England’s response was similar, but the ECB’s has been further delayed.

In two previous articles we have seen the importance of monetary policy for asset yields and the consequences for them of the adoption of a contractionary monetary policy.

In another article we looked at the implications of inflation and rising interest rates for financial markets, and we said how individual investors should act in this context.

In another article we saw how investors can position themselves in the various stages of economic cycles.

The irreversibility of “Tightening” (the effect of “boomerang”)

Very high inflation has a number of serious negative effects, in terms and economic growth, income, consumption and investment, as well as the destruction of wealth and the increase of inequalities.

Central banks have no choice but to take this objective as a first priority.

Central banks in the US, UK and Switzerland are significantly raising official interest rates, while the ECB does so more moderately.

These banks are also selling the assets they have on balance sheet, at also differentiated paces.

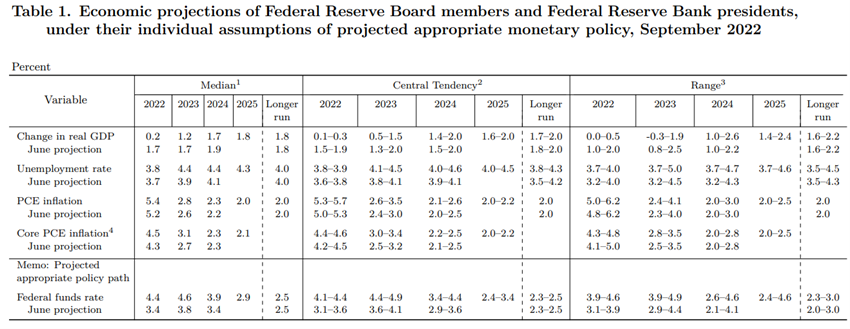

At the last FED meeting on September 22, there was another increase of 0.75%, bringing these rates to 3.00% – 3.25%:

The FED has shown to increase these rates to 4.4% by the end of this year, and forecast 4.6% at the end of 2023, 3.9% in 2024 and 2.9% in 2030.

The preferred inflation measure by the FED is the “core PCE” in the table.

This is the inflation rate of consumer spending excluding energy and food components (as they are considered more volatile components)

The end of the long bull market of bonds has given way to one of the unpublished bear market

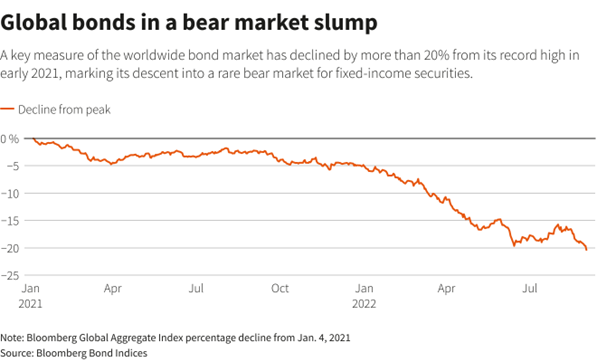

Bond markets have fallen sharply with this restrictive economic policy.

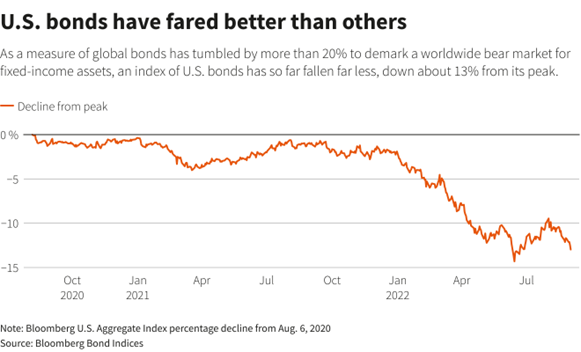

U.S. bond rates between 2 and 10 years have risen between 3% and 2% in the last 12 months, currently above 4%.

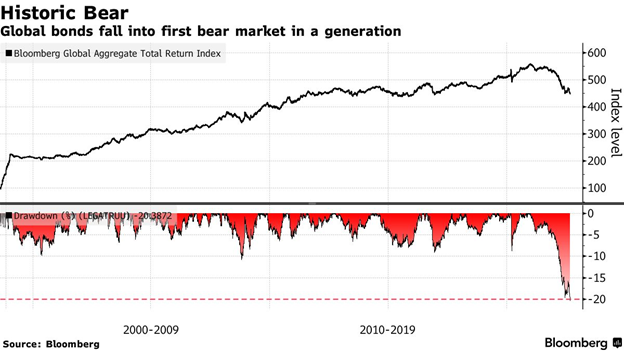

Global investment quality bond markets went into bear market in September, with a correction of more than 20%:

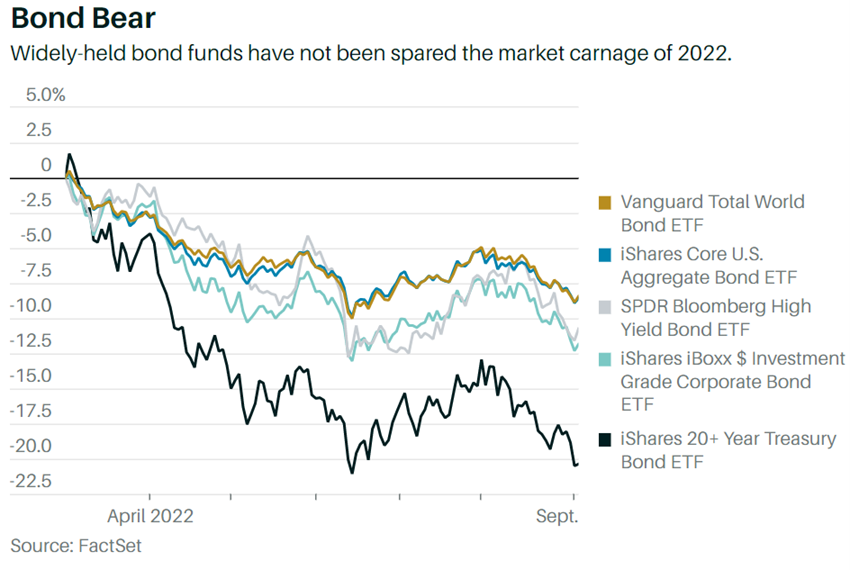

U.S. treasury bonds for investment quality did not depreciate as much, about 15%:

This is the biggest correction since World War II, and more than twice the largest correction since 1970.

It is recalled that between 1990 and the peak of January 2021, the cumulative appreciation of this index was 470%.

In the various segments of the U.S. bond market, the falls were between 10% and 22%:

This is the first time the global bond market has entered the bear market in the last 20 years:

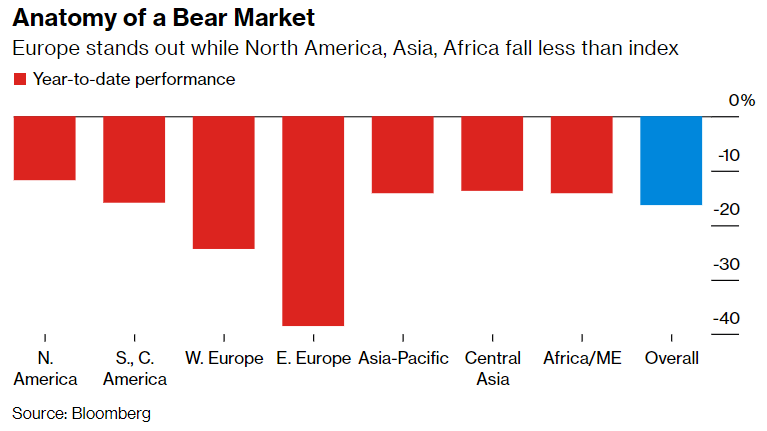

The bear market of global bonds has been widespread to almost all countries:

Bonds fell less in the U.S., Asia and Africa, and much in eastern and western Europe, most affected by the Ukraine war.

How can we navigate this bear market?

The stock went into bear market in June, with corrections of the three major U.S. indexes higher than 20%.

These corrections in stocks and bonds validate the saying that it is not worth fighting against central banks (“don ́t fight the FED”).

It’s the reverse of the coin.

There is a bonanza that came with the strong expansion of monetary policy followed by the storm of its contraction.

The only asset that has served as a refuge is liquidity or cash.

However, as we know, cash is the worst of medium and long-term applications.

Moreover, we must not forget that with inflation rates of 8%, the loss of purchasing power of cash is very large.

In two previous articles we have listed the corrections of the stock markets and said how investors should act in these situations.

Many investors and managers have never experienced this reality

Most investors and managers have never experienced this new reality.

This is one of the reasons why many do not know what to do in these circumstances, obviously beyond the uncertainties of the markets.

The rotation of assets with risk-free interest rates of 4%

In the current situation, investment in treasury bonds up to two years in the U.S., with yields of 4% per year, is quite interesting.

Investing in 10-year treasury bonds to maturity, with implied yields of 4%, is also interesting, especially for dollar currency investors who have no foreign exchange risk for such a long period.

Even if long interest rates rise higher in the short term, projections point to a stabilisation below 4% from 2025.

Therefore, for a 10-year investment horizon, slightly higher rates in the early years will be more than offset by the lower rates in most of the following.

We first noted this in the most recent quarterly article on the performance and prospects of financial markets.

This level of risk-free rates sets the bar for the opportunity cost of risky investments at a high level by putting pressure on the valuations of other assets.

This is the adjustment that the financial markets are making.

The rise in interest rates lowers the stock multiples, reduces their attractiveness to bonds, increases demand for bonds, to the point where capital markets find their new balance.

On the other hand, the fall in stock prices, especially those of defensive, quality, dividend, leading, stable and with good levels of cash-flow generation, so-called value companies, is beginning to make them interesting from a medium and long-term perspective.

The path of inflation return to 2%

For many, the question of a million dollars is when the falls stop and markets begin to rise.

No one can be sure.

Some believe that we will have a major recession, both in Europe and in the US, causing one of the biggest crises in the stock market, and that the S&P 500 could fall another 20% to 40% (e.g. Nouriel Roubini).

But there are also those who understand that even if there is a recession in the U.S., it will be smooth, without such a profound impact on the markets, with stocks that, in this scenario, quote at interesting prices.

What we all know is that the edf’s priority is to bring inflation from the current 8% to levels close to 2% per year.

This route can be a walk of at least 2 to 3 years, since inflation is very sticky.