Mutual funds available to the investor

The denomination currency of the investment in the fund

Investments in stocks must be made in the currency of the invested companies or the country of destination

Bond investments must be made in the investor’s or country of origin’s currency

Vanguard’s study on foreign exchange exposure in equity and bond investments

This article is part of the series on mutual funds, which we consider the “core” investment of investors for its characteristics and advantages.

In the first article in this series we describe what these funds are and their main advantages and benefits.

In the second we presented their main types or categories and showed the importance of investment policy.

Then we saw the profitability and costs of mutual funds.

But there are two other key factors in the choice of funds.

First, the practical issue of access to or availability of the fund to the investor, i.e. the possibility of investing in the fund.

Secondly, the technical issue of the fund’s denomination currency, in so far as, as we shall see, it is important for the choice of the most appropriate funds for the investor.

Mutual funds available to the investor

Each mutual fund is marketed and offered in a particular country or set of countries, with the authorisation of its supervisory authorities.

It is in the factsheet and in the prospectus of the fund that we can find the conditions for the marketing of the funds, including, inter alia, the countries in which they are distributed and marketed.

Accordingly, the investor must first of all know the investment funds that are eligible for his investment.

This is an important restriction. To the investor, it is only worth considering the funds to which he can have access. Funds that are regulated and approved in your country. All the other ones don’t matter because they’re not reachable.

In the following link we have an example of the factsheet of a stock investment fund on the S&P 500 index in which the countries of registration refer:

https://www.ssga.com/library-content/products/factsheets/etfs/emea/factsheet-emea-en_gb-spy5-gy.pdf

The denomination currency of the investment in the mutual funds

The currency of the mutual fund must be taken into account by the investor.

Mutual funds are denominated in each of the major currencies, dollars, pounds, euros, yen, etc.

In addition, in some cases, the investment portfolio that makes up the fund may be covered by foreign exchange risk (or currency hedging).

As we know, the investor is interested in international diversification, as it reduces the risk of the investment portfolio by corsican between the assets concerned.

However, this international diversification also carries with it the risk of foreign exchange exposure.

Accordingly, the question arises as to how the investor should decide and choose the denomination currency of the funds.

There are several studies that analyze how we should face foreign exchange risk in investments.

The conclusion is that investment in stocks should be made in the investment currency while that of bonds must be made in the investor’s currency.

Investments in shares must be made in the currency of the invested companies or the country of destination

For example, if the investment is in a US stock fund the investment should be in dollars, if it is in a Eurozone stock fund the investment must be made in euros, and so on.

What about in the case of investment in equity funds from a set of different geographies?

If the investment is made in a global stock fund the investment should be made in dollars, since the U.S. stock market has a weight of about 60% in the world market.

If investment is made in all emerging markets, investment should also be made in dollars to the extent that it is being the world’s leading currency, most of these countries have their currency associated with the dollar.

Bond investments must be made in the investor’s or country of origin’s currency

Investments in bond funds must be made in investor currency securities or with foreign exchange hedging.

For example, if the investor is us the investment should be in u.S. company bond funds in dollars, if the investor is from the Eurozone the investment should be in eurozone companies in euros, and so on.

It may be interesting to invest in bonds from other countries, giving the portfolio exposure to different economic cycles, with their interest rates and inflation.

When interest rates are rising in one market they may be stable or falling in another. The joint effect can dilute interest rate movements, allowing a more stable returns profile.

In addition, investment in bonds from other countries may also be interesting to have exposure to a lower credit risk than those of the investor’s domestic market.

In these situations, if the investor wishes to diversify investments by other geographies by investing in bonds of companies from other countries or regions, he/she must do so through bond funds that are denominated in his currency or have their foreign exchange coverage.

The reason for this option is that stability is one of the main advantages of bonds for a diversified investment portfolio, and therefore the volatility of exposure to foreign exchange risk of investments should be avoided.

In this way, these investments must be made in the currency and/or with exchange coverage for the investor’s currency.

Vanguard’s study on foreign exchange exposure in equity and bond investments

One of the best studies on this area of the coverage or not of foreign exchange exposure in investments in bonds and shares was conducted by Vanguard in 2019.

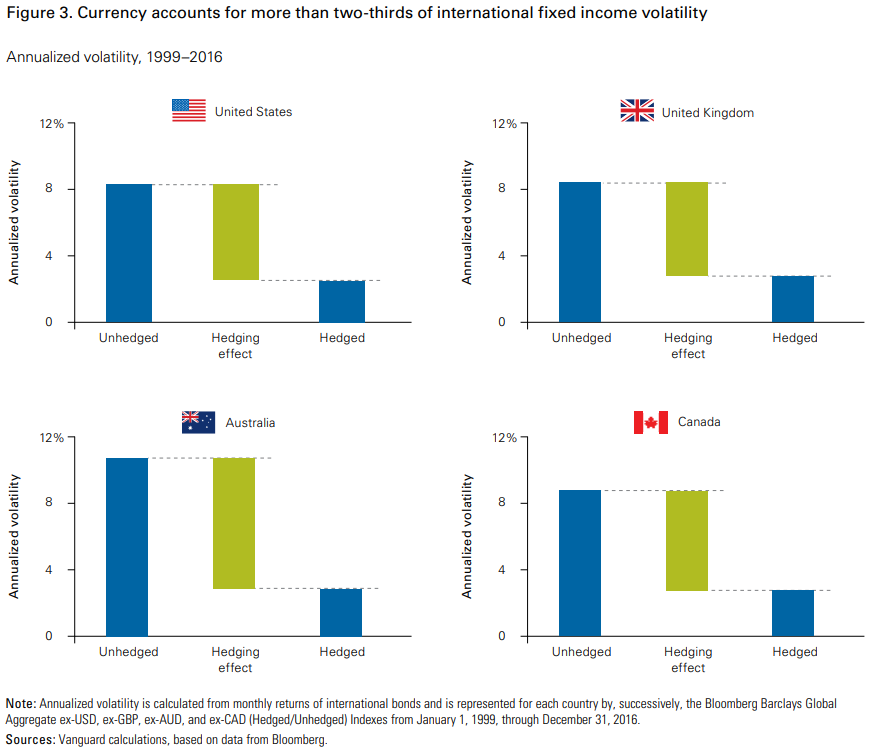

It concluded that the currency represents more than two-thirds of the volatility of bond investments:

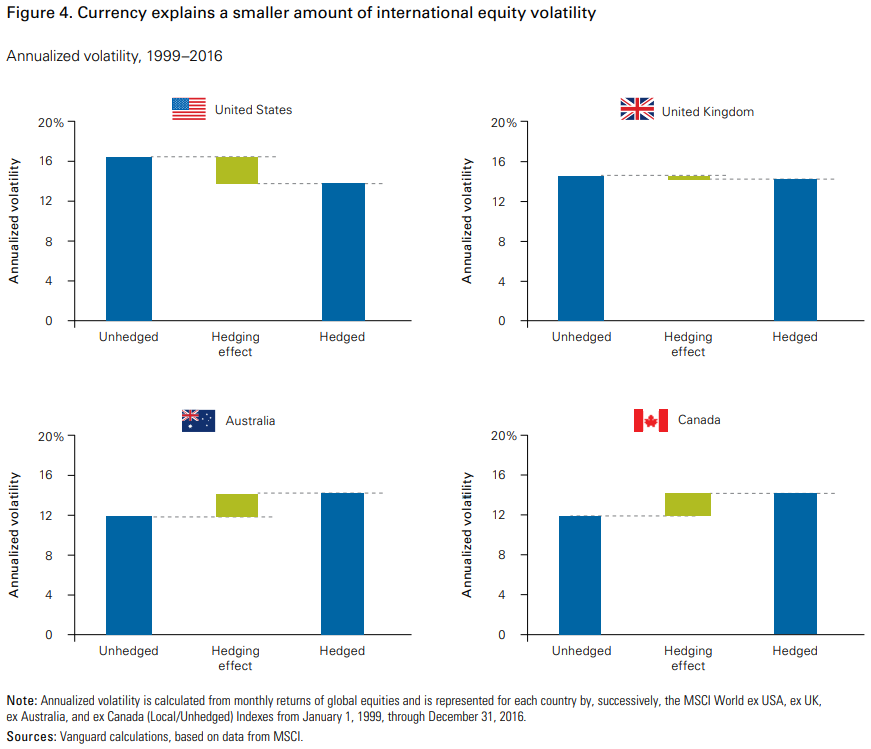

It also concluded that the currency does not have a major impact on the volatility of equity investments:

The Vanguard study can be accessed at the following link: