In a previous post we saw the main benchmarks of bonds in global or geographical terms.

However, there are several segments or subclasses of investment in bonds that are generally associated with different levels of investment risk, the most relevant being the degree of classification, type or nature of the issuer and currency.

For investors, the biggest risks of bond investment are credit risk and interest rates risk.

As bonds are debts, if the issuer does not pay his debt, the capital is not repaid and there is default. As a result, the riskier the issuer, the higher the interest rate required by the bond investor (and the higher the cost to the debtor).

Moreover, since the value of bonds varies inversely with interest rates if rates rise the value of bond fall.

Background on credit ratings

Bond indices by rating grade: investment or speculative

Bond indices by issuer type or nature: sovereign debt (public or treasury) and other issuers

Bond indexes historical performance

Background on credit ratings

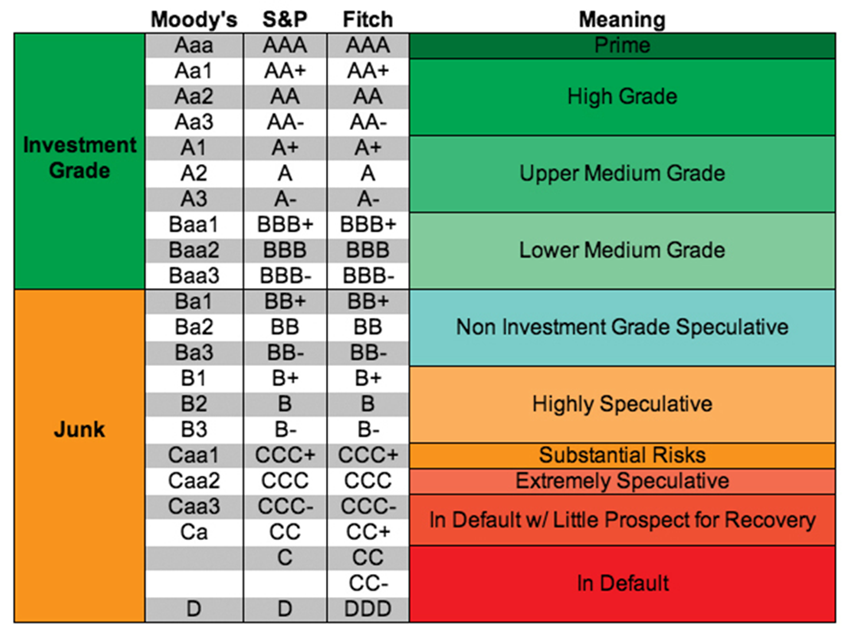

Bond issues are assessed by popular credit rating agencies such as Standard and Poor’s, and Moody’s. Each agency has slightly different rating scales, but the highest rating is AAA and the lowest being C or D, depending on the agency. The top four ratings are considered safe or investment grade, while any rating below the BBB for S&P and Baa3 for Moody’s is considered a speculative grade or a junk bond.

Although large financial institutions are often allowed to buy only investment grade bonds, speculative grade or high yield bonds take place in the portfolio of a more sophisticated or professionally oriented investor.

There are many types of bonds, including those of governments, companies, municipal entities, and mortgage loans.

Government bonds, also called sovereign, public or treasury debt, are generally the safest, as these issuers have the possibility to raise taxes to increase their financial capacity and repay issued bonds. Generally, sovereign bonds have higher credit ratings than companies, so government debts are less risky and have lower interest rates.

The main rating and issuer indices are those of the Bloomberg Barclays and Iboxx families. In a previous post on global and geographic indices we saw the first family; now let us see the second.

These indices exist in dollars and euros. In general, individual investors should invest in bonds in the same currency as their treasury.

For example, US investors should invest in dollar bonds and euro zone Europeans in euro bonds, limiting exposure to foreign exchange risk (other countries should invest in bonds whose currency is more tied to theirs, whether dollars or euros).

Bond indices by rating grade: investment or speculative

The main rating indices are the Markit Iboxx Corporate Investment Grade and the Markit Iboxx High Yield. They only include issues from developed countries.

Bonds domiciled in countries classified as developed markets based on Markit’s overall economic development classification are eligible for any of these indices.

The issuer or, in the case of a financial subsidiary, the issuer’s guarantor must be domiciled and the country of risk must be in Andorra, Australia, Austria, Belgium, Bermuda, Canada, Cayman Islands, Cyprus, Denmark, Faroe Islands, Finland, France, Germany, Gibraltar, Greece, Hong Kong, Iceland, Ireland, Italy, Japan, Jersey, Liechtenstein, Luxembourg, Malta, Monaco, Netherlands, New Zealand, Norway, Portugal, San Marino, Singapore, Spain – Sweden , Switzerland, United States or United Kingdom.

Any of these indices only contain corporate debt issuers. Public debt, almost sovereign debt and debt guaranteed or supported by governments are not eligible.

Also, for any of these indices the minimum period up to maturity is 3.5 years for the new bonds, and 3 years for the already constituent or existing bonds of the index.

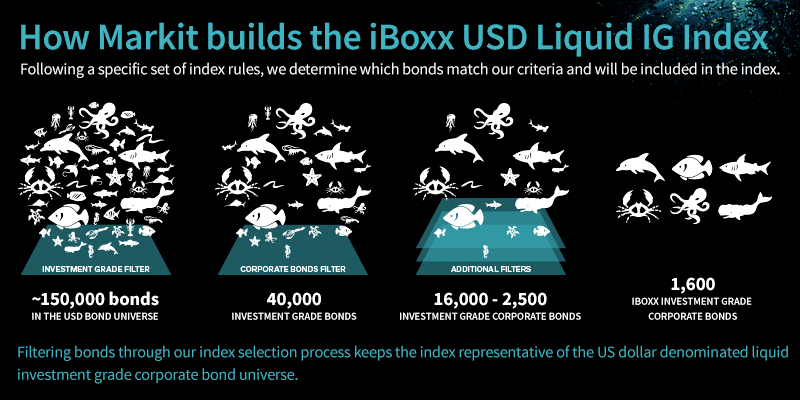

The Markit iBoxx USD Liquid Investment Grade index is designed to provide a balanced representation of the USD investment grade corporate debt market and to meet investor demand for a highly liquid and representative USD-denominated investment grade corporate bond index.

The index is a tradable reflection of the corporate bond market.

All bonds need to have an average investment grade rating.

The bond selection process undergoes a multi-criteria assessment of the following filters to the total universe of 150,000 bonds (e.g., in dollars): investment grade, corporate debt, size, liquidity and maturity.

The Markit iBoxx USD Liquid High Yield index consists of net high yield bonds in dollars, selected to provide a balanced representation of the broad universe of dollar-denominated high yield corporate bonds.

The index is a tradable reflection of the corporate high yield bond market.

All bonds need to have an average high yield or sub-investment grade rating.

Each of these indices exists for issues denominated in dollars and euros (and some in pounds sterling).

The following links contain a synthetic description of these indexes:

https://cdn.ihsmarkit.com/www/pdf/iBoxx-Indices-Overview-Hires.pdf

https://cdn.ihsmarkit.com/www/pdf/MKT-iBoxx-USD-Liquid-Investment-Grade-Index-factsheet.pdf

https://cdn.ihsmarkit.com/www/pdf/MKT-iBoxx-USD-Liquid-High-Yield-Index-factsheet.pdf

As we explained earlier, private investors should invest primarily in investment rating bonds, avoiding or at the limit making residual investments in speculative rating bonds.

Bond indices by issuer type or nature: sovereign debt (public or treasury) and other issuers

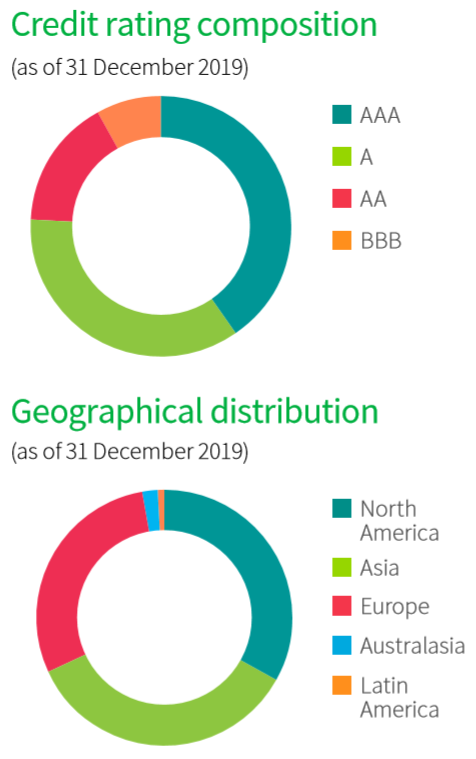

The IHS Markit iBoxx® Global Government Index is designed to reflect the performance of a broad global universe of investment grade government bonds while maintaining minimum investment and liquidity standards.

The index includes locally denominated sovereign bonds representing various currencies and several developed and emerging countries: Canada, Australia, Philippines, Colombia, China, Singapore Mexico, Indonesia, South Korea, Japan, Thailand, Malaysia, Austria, Netherlands, Belgium, Czech Republic, Poland, Portugal, Finland, Russian Federation, France, Spain, Sweden, Ireland, Switzerland United Kingdom, and Italy.

The inclusion of the country is determined by a proprietary methodology, reviewed annually and the index is weighted by market value, and is rebalanced monthly.

The following charts show the geographic composition and rating of the index in 2019:

The following link contains a synthetic description of the index:

https://cdn.ihsmarkit.com/www/pdf/0220/GlobalGovernmentBondIndex_IHS-Markit-2020.pdf

As we have seen before, the indexes by rating level are exclusively of corporate or corporate bond issues.

Bond indexes historical performance

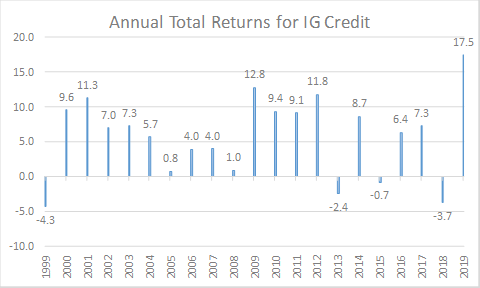

The following chart shows the annual returns of the Iboxx Investment Grade dollar index between 1999 and 2019:

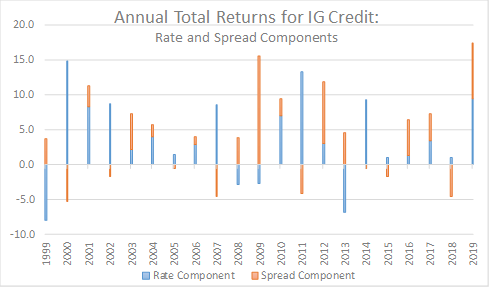

The following chart shows how this annual return was split between the benchmark interest rate and spread, showing substantial rate and spread gains over most years:

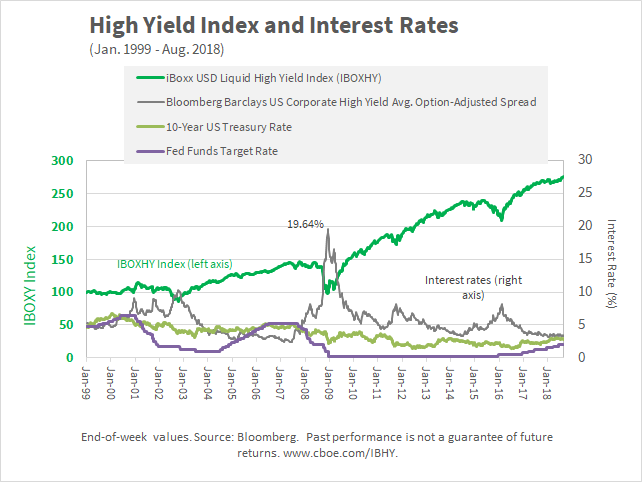

The following graph shows the cumulative appreciation of the Iboxx High Yield index between 1999 and 2018, alongside the benchmark interest rates (the short-term EDF and 10-year treasury bonds) and the spread of high yield bonds, showing that interest rates are at historic lows:

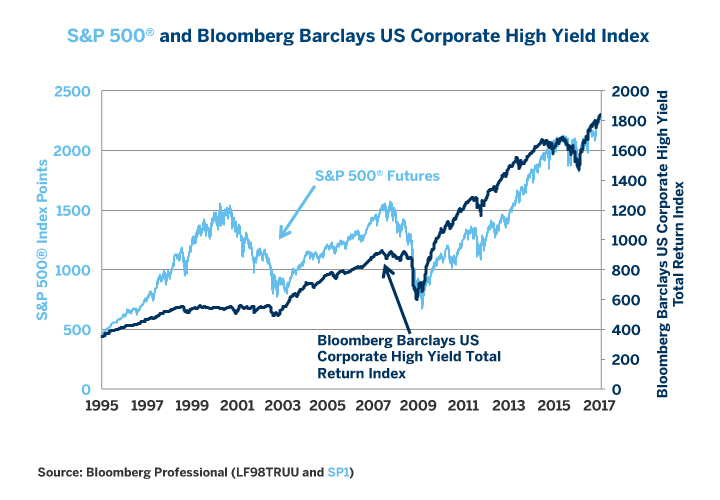

The following chart shows the appreciation of investment in high yield index products compared to that of equity investment in the S&P 500 index between 1995 and 2017, showing that they were virtually equal (period of the long bull market of bonds):

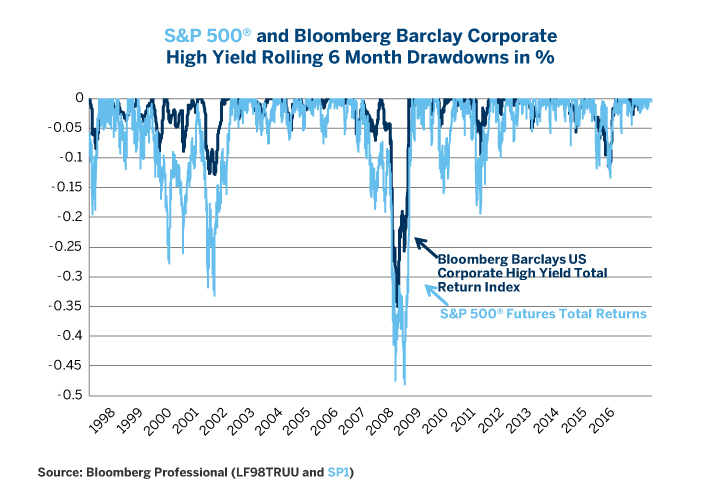

Although risk or volatility and drawdowns were lower in high yield investment than in S&P 500 in that period:

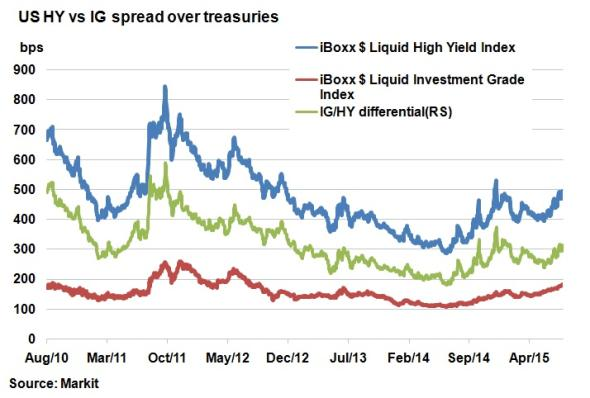

The following chart shows the evolution of credit spreads against the reference interest rate (10-year treasury bonds) of investment grade and high yield bonds from 2010 to 2015:

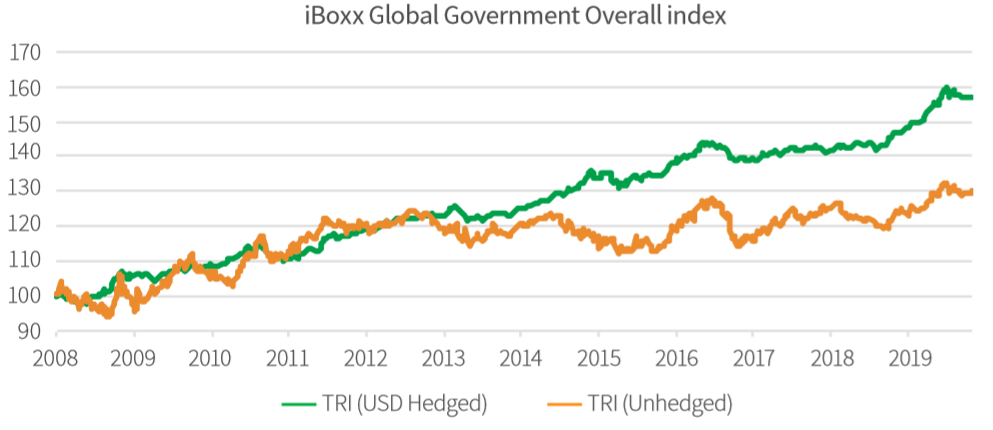

The chart below shows the accumulated appreciation of the Iboxx Global Government index between 2008 and 2019, direct and with foreign exchange hedging for dollars: