What is the herding bias or herd mentality?

Studies consider that this is the main investors bias

What is the herding bias or herd mentality?

In behavioural finance, the herding bias of the herd mentality refers to investors’ tendency to follow and copy what other investors do. Investors are largely influenced by emotion and instinct, rather than by their own independent analysis.

In other words, an investor who exhibits a herd instinct will gravitate toward the same investments or similar investments based almost exclusively on the fact that many other investors are buying these securities.

Herd instinct is a mentality that is distinguished by the lack of individual decision-making or introspection, causing people to think and behave similarly to those around them.

The fear of losing an idea of profitable investment is often the driving force behind that instinct.

The market bubbles and the selection of funds based on past performance are the main manifestations of the instinct of herding

The formation of market bubbles

The herd instinct has a vast track record of initiating large and unfounded purchases and ups, and sales and declines, of markets, often without any fundamental reason to justify any of the moves. Herd instinct is an important driver of asset bubble formation in financial markets.

The technology bubble (or “dotcom”) of the late 1990s and early 2000s is an example:

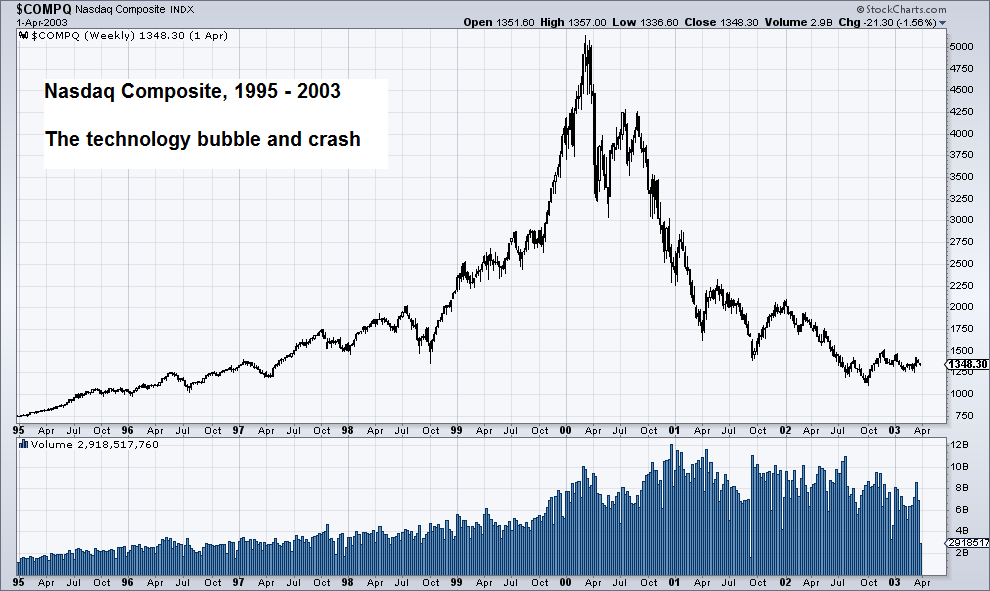

The following chart shows the evolution of the stock price (above) and the traded volume (below) of the Nasdaq technology stock index between 1995 and 2003:

As can be seen, especially from October 1999 we see massive purchases of shares of technology companies – many of them with large losses, with little track record and on the basis of subscriber multiples numbers or growth, or clicks per user, without looking at future development and the ability to generate economic and financial value – which caused Nasdaq to rise from 1,500 points to 5,000 points in a year. Then, one knows what happened, that is, a sharp drop in the prices accompanied by heavy volume sales by individual investors until 2003.

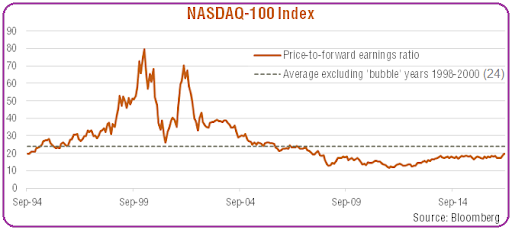

As can be seen in the price earnings ratio valuation indicator chart for the Nasdaq between 94 and 2014 these investments had no financial rationale:

At the height of the bubble that ratio reached a value of 80x compared to an average of 25x.

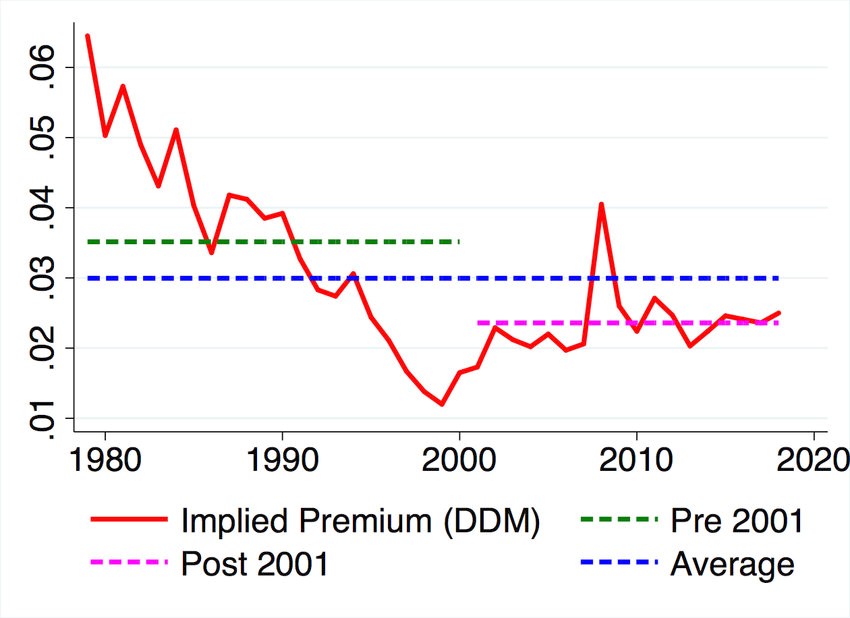

We have another perspective of the lack of rational looking at the S&P 500 Equity Risk Premium chart between 1980 and 2020 compiled by Damodaran:

Equity Risk Premium (ERP) is the risk premium or expected excess return that the market pays to take the risk. In 2000, the ERP reached almost 1%, which means that the investment in shares did not pay almost any risk premium.

It is because of these phenomena that we say that when everyone only talks about stock markets or stocks, from coffee talks to taxi drivers to hairdressers, instead of talking about sports, traffic or the lives of celebrities, it’s time to get out of the market (sell part of the stakes).

The selection of investment funds based exclusively on past performance

Another manifestation of the herd or herd effect occurs in the selection of mutual funds based exclusively on past performance.

What happens with the mutual funds is also happening with other investment products, collective, individual shares, cryptocurrencies, exchanges, etc.

In fact, there are also many studies showing that 40% of investors choose the 10% of mutual funds with the best performance of the previous year, and regardless of the commissions charged.

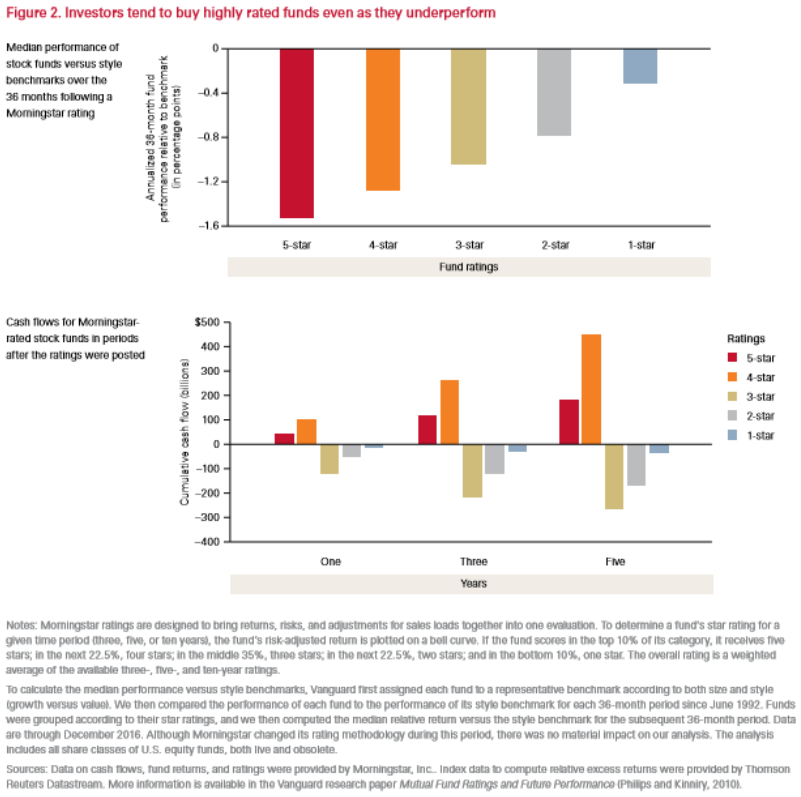

A study by Vanguard looked at this situation:

It concluded that individual investors continue to buy the best rated funds by Morningstar even when they show subsequent performances worse than the rest.

That is, although financial products generally include the disclaimer that “past performance is not indicative of future results,” individual investors still believe they can predict the future by studying the past.

Investors mostly disregard costs when choosing funds, picking instead the funds with the best past performance.

We know that chasing past performance is a poor mutual fund selection strategy, as long-term analyses have confirmed that mutual funds cannot provide better profitability consistently than average performance, with any higher individual performance attributed primarily to luck.

.

As investors tend to disregard costs, they end up paying too much for their investments, with no observable benefits in terms of additional services. In fact, on average, cheaper funds tend to provide better performance in the long term, as they are not burdened by the high recurring costs that can undermine the returns of funds. The rational strategy, therefore, is for investors to choose the fund with the lowest costs within a given asset class.

Studies consider that this is the main investors bias

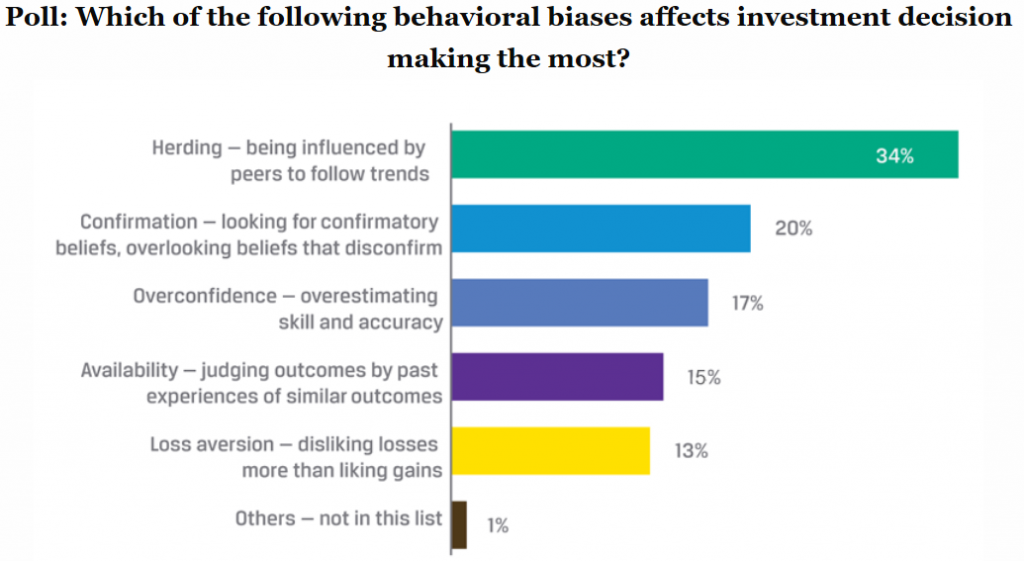

Many studies consider that this is the main bias of investors. One example was the CFA Institute Financial Newsbrief survey in 2015 of 724 investors worldwide:

Herding or herd instinct is highlighted with 34%, followed by confirmation only with 20%, overconfidence with 17% and availability and aversion to loss, with 15% and 13%, respectively.

https://thedecisionlab.com/reference-guide/anthropology/herd-behavior/

https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/herd-behavior/