It is neither chocolate nor teas. It could be wonderful landscapes, great lakes and spectacular mountains.

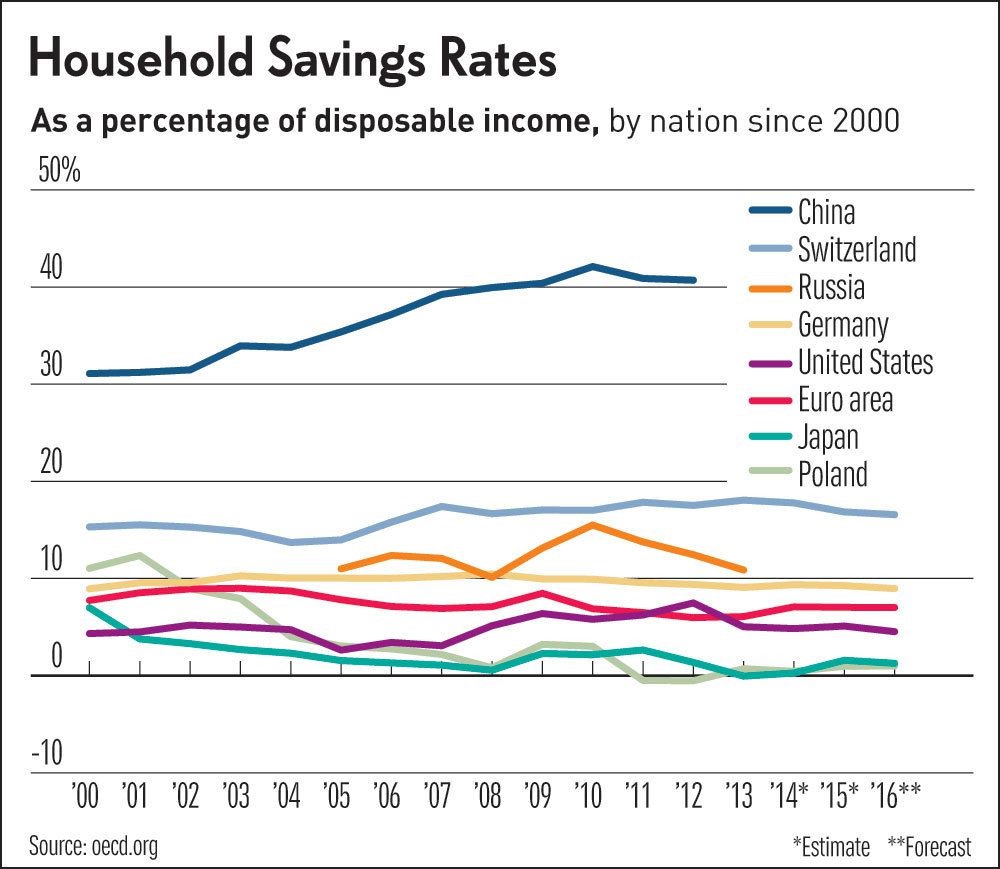

In personal finance, what the Chinese and the Swiss have common are high rates of savings!

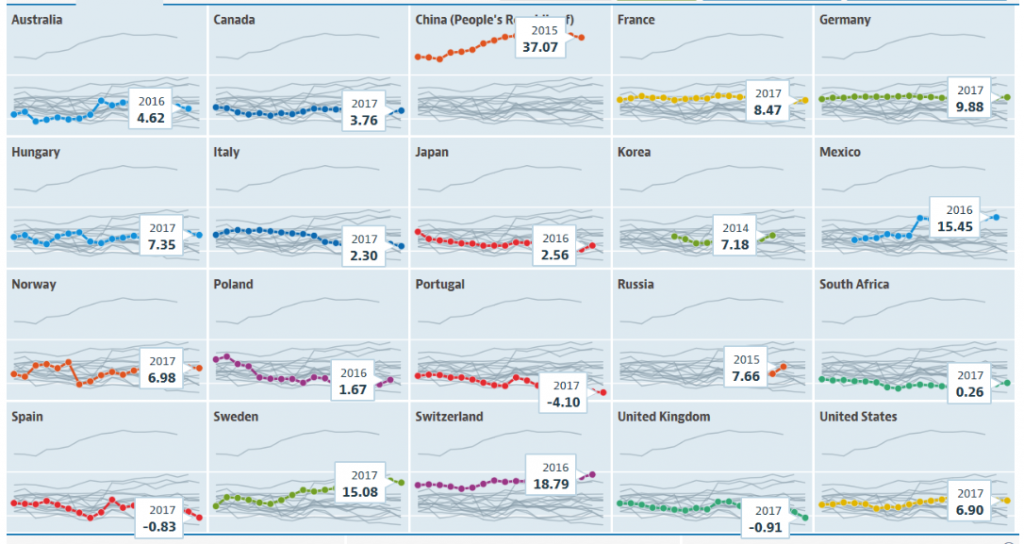

On average, the Chinese save 40% and the Swiss nearly 20% of their disposable income, being of the highest savings rates in the world. The Chinese are saving because they need money in the future, given that the social protection systems in China are still incipient. The Swiss save because they like to have more money in the future, to live better retirement or build capital to pass to the new generations.

https://data.oecd.org/hha/household-savings.htm

https://howmuch.net/articles/saving-rates-around-the-world

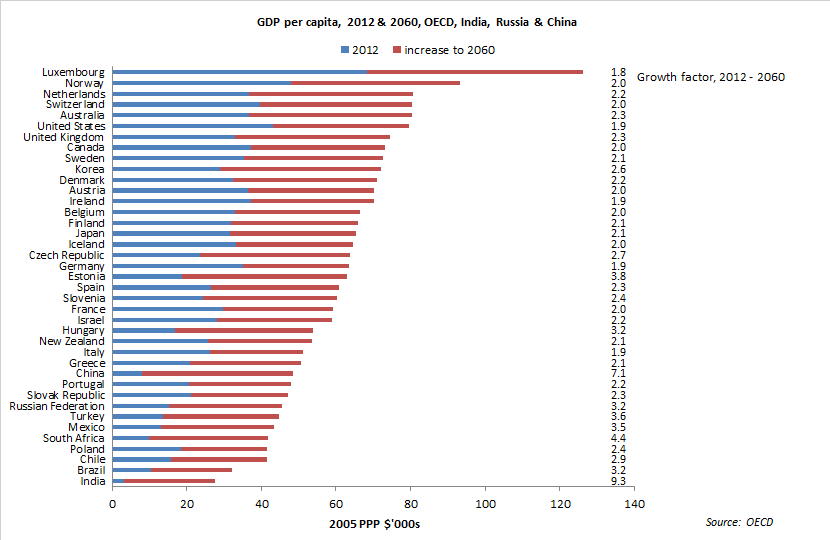

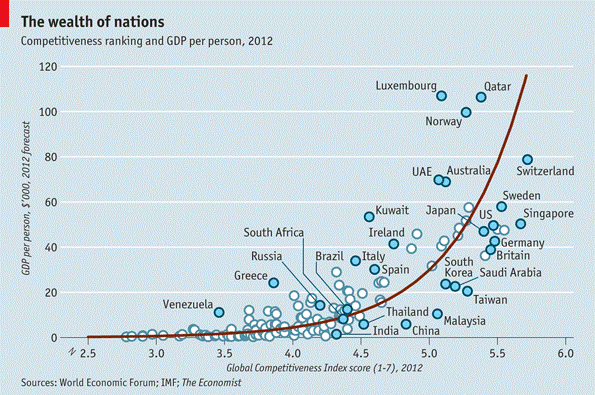

The per capita income adjusted by purchasing power (or adjusted to the cost of living) of the Chinese is very low in global terms, and the one of the Swiss is the highest in the world.

This and other examples show that hih savings rates are not only for the rich.

The savers are people who want and not just who has a higher wealth or income. Normally, we think that the only people that can save are the ones who have a better financial situation. People who earn a lot of money, or people with high incomes that can spare a portion to savings. As we see, it’s not like that. The Chinese have enviable saving rates anywhere in the world.

Another prejudice is that those who least need money in the future also don’t skimp. Spend money to enjoy life in the present. The Swiss show that do the opposite. Although they have a good system of social protection, they save a lot. And, the Swiss are not alone.

There are some who save out of necessity, others for pleasure. Some because they need, others because they know it does them well.

What do other countries tell us? We have a variety of situations. Other countries that spare more, with savings rates over 10% of disposable income, are rich and with good social protection systems, such as Sweden, Germany, France and Luxembourg, and other less wealthy countries, like México, Hungary and Rússia. On the other hand, we have very rich countries such as Japan, Australia, and Canada with very low savings rates. We have developing countries, such as Poland and the Baltic countries, with savings rates close to zero. The United States and the Netherlands have moderate savings rates of around 7%. Portugal, Spain and United Kingdom have negative savings rates.

In international terms, wealth can influence the savings capacity, but it is not decisive. Thus, the factors that appear to be most important are cultural. Within these factors it stands out the issue of housing property and consumerism in general. This is the only way to explain that the Nordic countries, China and Hungary are the countries that save most.

In summary, savings is a way of being and living; a habit and a practice; a culture that one acquires; regardless of income and wealth.

Source: OECD, Economic Outlook, 2000-2017, November 2018