There are 4 large classes of financial assets relevant to investment: cash, stocks, bonds and alternatives (reminder)

The main subclasses of Alternatives investments are the traditional ones – real estate, commodities and gold – plus the new ones – hedge funds and private equity

Alternatives extend diversification beyond regulated financial markets for high net worth investors

There are 4 large classes of financial assets relevant to investment: cash, stocks, bonds and alternatives (reminder)

The three most important investment classes are the stocks, bonds and cash. Alternatives are the fourth class.

Stocks have 2 main subclasses arising from the degree of economic or financial market development (developed and emerging) plus 3 arising from the companies’ size (large, medium and small).

Bonds have 3 main subclasses arising from the combination of geography with degree of economic development (domestic, international and emerging), plus 2 of nature or type of the debtor (government or company) and another 2 from the level or the quality of the credit risk (investment or speculative).

Cash includes current and time deposits, savings accounts and currency.

Alternatives include the subclasses of real estate, commodities, gold, and more recently, hedge funds and private equity.

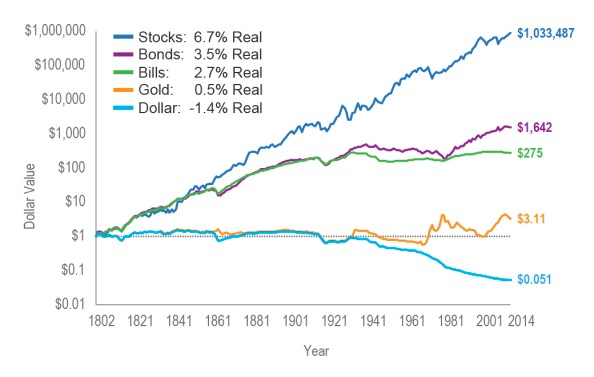

The real rate of return (deduced from inflation) of investment in shares of large companies and Treasury 10-year bonds in the US, for the period between 1802 and 2014, was as follows:

Source: The Future for Investors, Jeremy Siegel (2005) with updates to 2014

The main subclasses of Alternatives are the traditional ones – real estate, commodities and gold – plus the new ones – hedge funds and private equity

The alternatives financial asset class contains all other assets besides stocks, bonds and cash, traditionally:

- Real estate;

- Commodities such as oil, metals, cereals, etc.;

- Gold and other precious metals.

The alternatives class also comprises hedge funds, private equity, art works, collectible goods, agricultural and forestry land, etc.

Real Estate

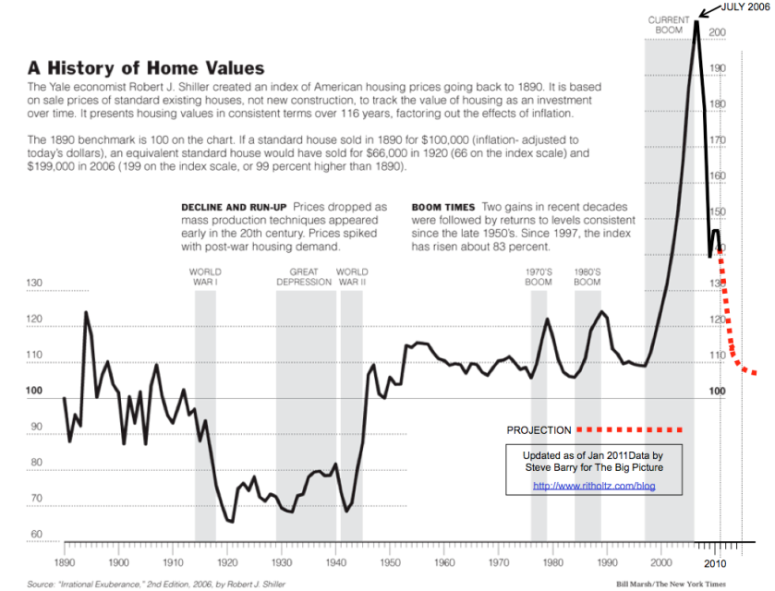

Not all real estate is investment. Our own housing is not investment, but a good. Real estate is only investment when it is not for personal use. Real estate can be residential or commercial.

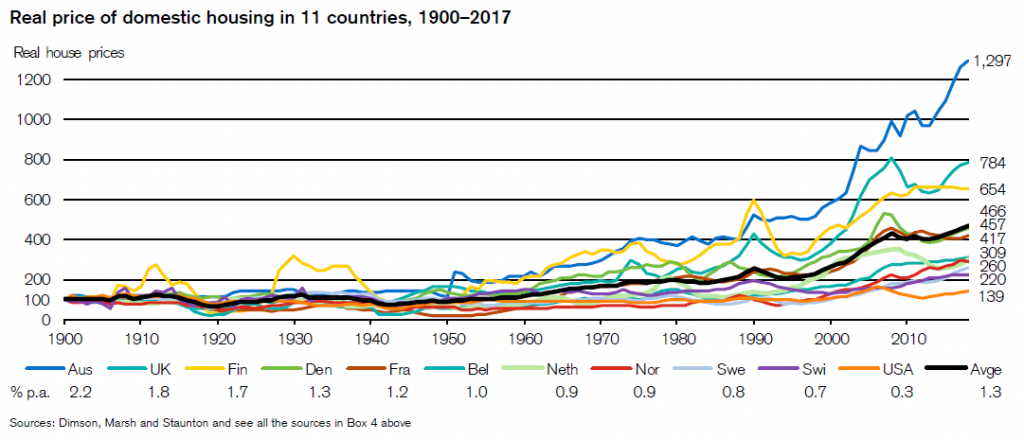

Real estate has been one of the best performing classes in recent years. In addition, the evolution of real estate prices is uncorrelated with that of other financial assets, being useful in diversification.

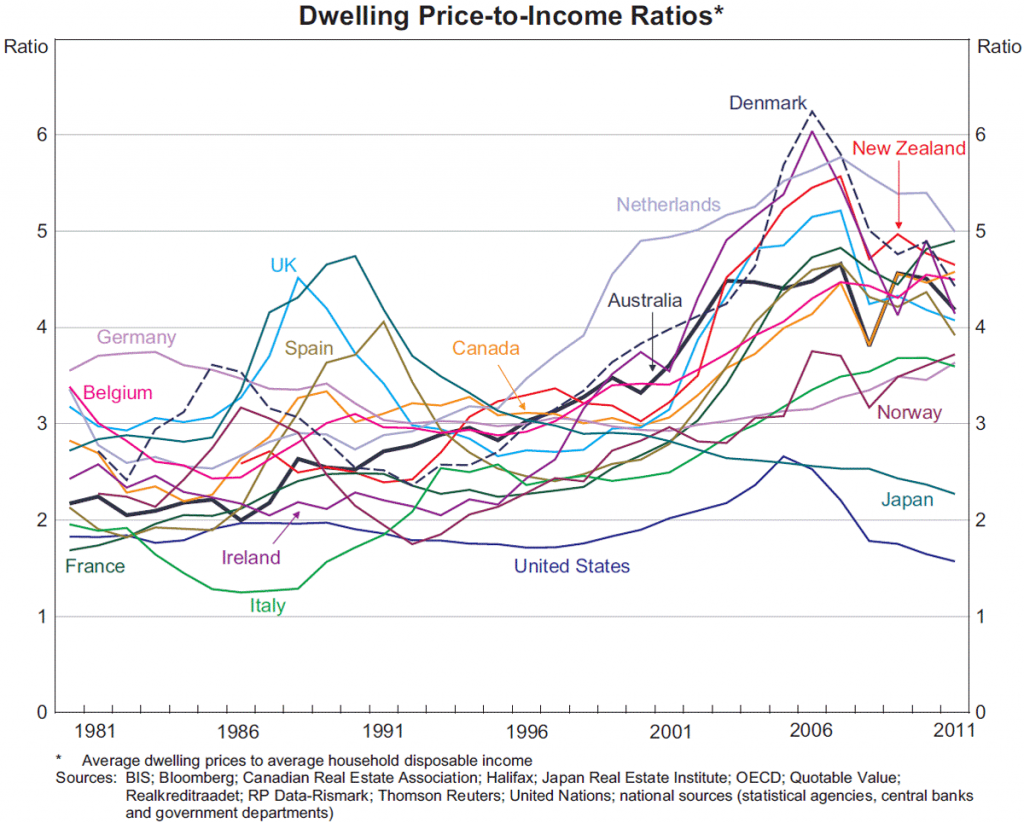

Real estate prices depend on supply and demand. The demand for residential real estate is directly related to property prices and financial affordability – income and interest rate – to buy.

Commodities

Commodities are, in many cases, raw materials used in the production of goods. To this extent, there are many who do not consider them a subclass of assets because raw materials are represented in the companies that exploit or manufacture them.

They comprise precious metals, oil, natural gas, and some unperishable agricultural goods such as wheat, soybeans, cocoa, coffee, etc.

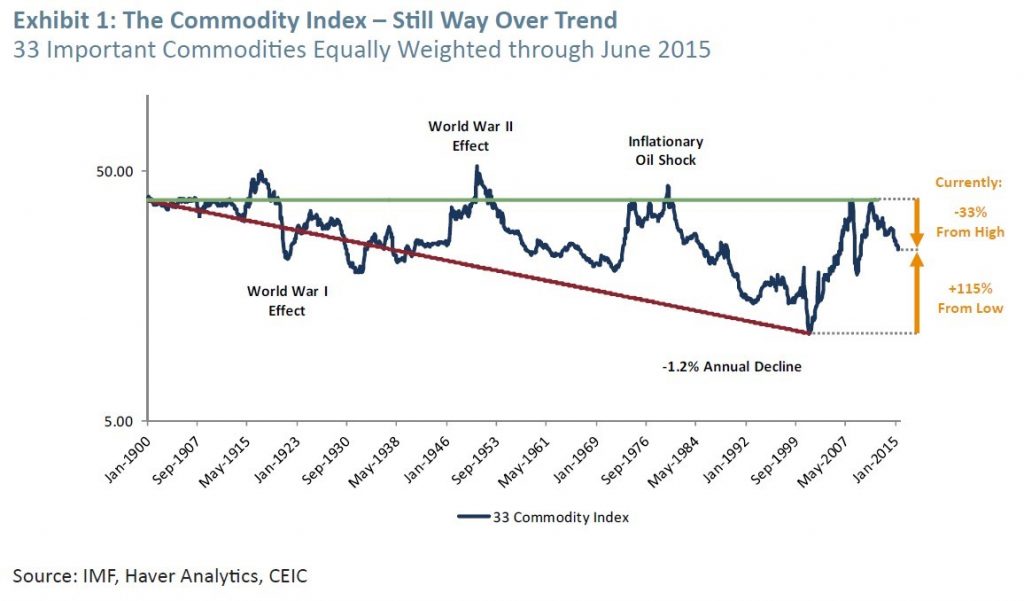

In the last 100 years its overall performance has not been positive, and even showed an annual devaluation of 1.2%.

Gold

Gold usually emerges as a subclass of alternatives apart, due to the fact that it is viewed as the safest asset or considered of greater refuge.

For many years the issuance of currency was subordinated to gold held by central banks, the so-called gold standard regime. Despite the abandonment, with the end of the gold standard in the late 1960s, the gold reserves of central banks are still measured to assess their strength and financial capacity.

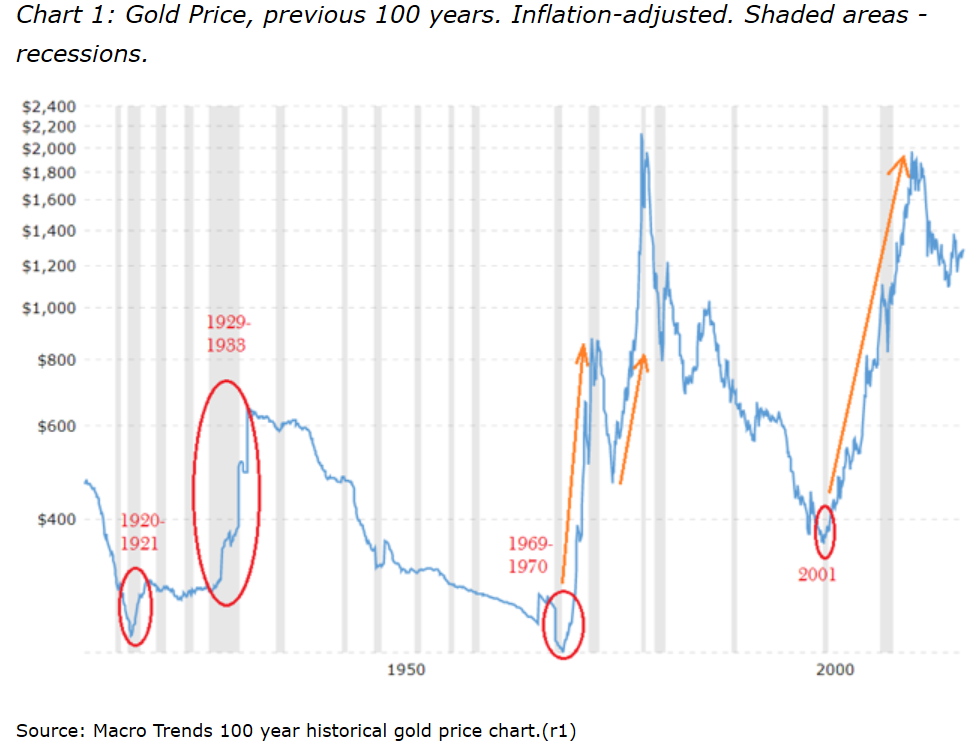

Gold is a very useful refuge in periods of high inflation, financial crises and high “stress” of the financial system.

Hedge Funds

A hedge fund is an investment fund that pools capital from accredited investors or institutional investors and invests in a variety of assets, often with complicated portfolio-construction and risk management techniques.

Hedge funds are generally distinct from mutual funds and regarded as alternative investments, as their use of leverage is not capped by regulators, and distinct from private equity funds, as the majority of hedge funds invest in relatively liquid assets.

Many hedge fund investment strategies aim to achieve a positive return on investment regardless of whether markets are rising or falling (“absolute return”).

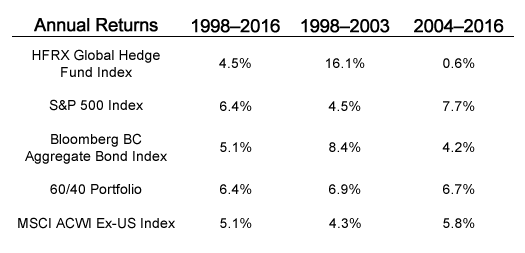

Its returns have been lower than those of the stock markets or even the bond markets, except in a short period of the technological bubble between 1998 and 2003.

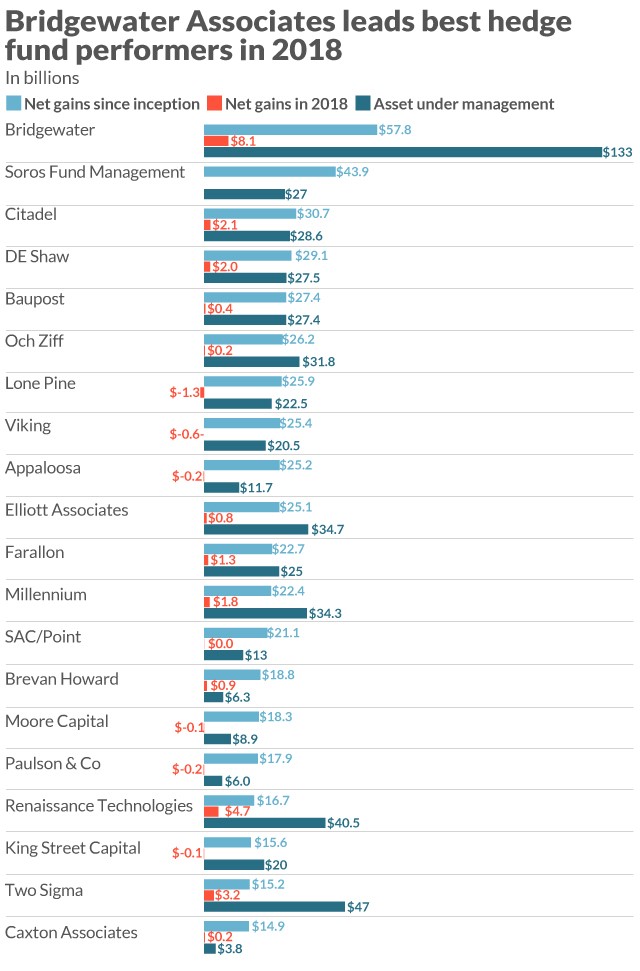

The world’s largest hedge fund management companies are the following:

Private equity

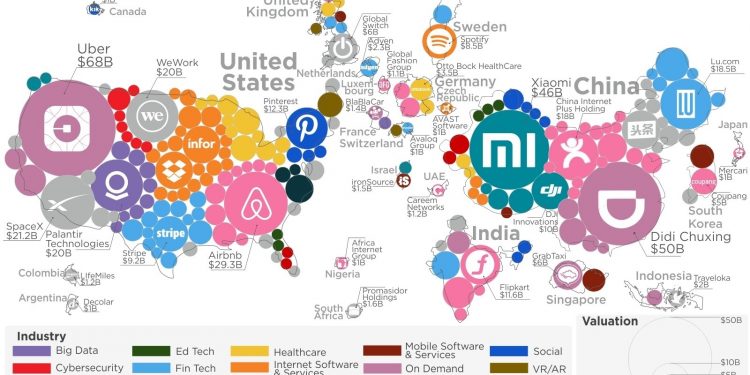

Private equity typically refers to investment funds, generally organized as limited partnerships that buy and restructure companies that are not publicly traded.

Common investment strategies in private equity include leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital.

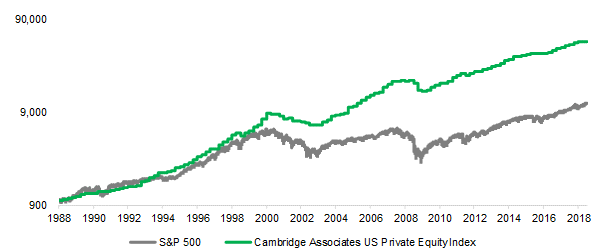

Its long-term annual rate of return is higher than that of the stock markets, which is justified by the fact that the liquidity of its assets is much lower. This is one of the features that explain why their performance normally amplifies the stock markets returns, both in positive and in negative economic and market cycles.

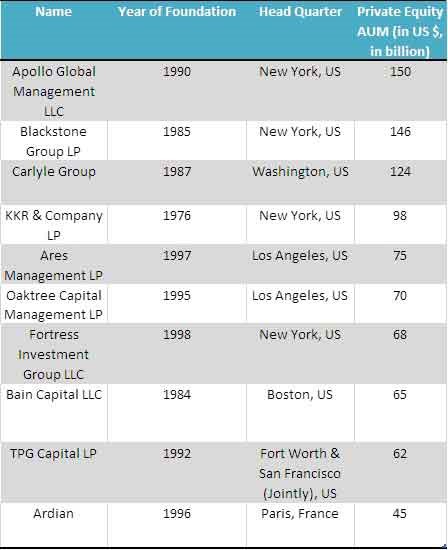

The world’s top 10 private capital companies are the following:

Guide to Alternatives | J.P. Morgan Asset Management (jpmorgan.com)

Alternatives extend diversification beyond regulated financial markets for high net worth investors

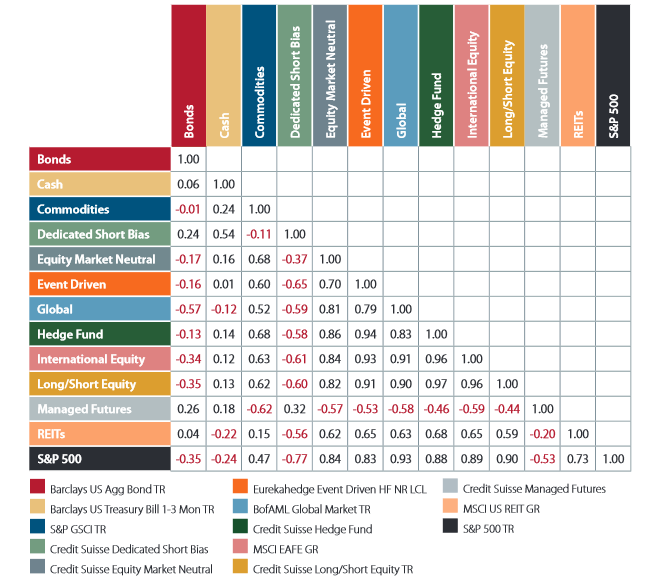

Alternatives provide a more complete diversification due to the low correlation with the conventional assets, and therefore have a diversification value.

They can be suitable for big fortunes investors (UHNWI and HNWI) with wealth allocations up to 5% to 10% in total.

In addition to the diversification effect they provide, it is important to compare the returns and risks of each of these subclasses of alternatives with those of the two main assets, stocks and bonds, in the medium and long term, to assess their interest in the composition of an investment portfolio.