Relying only on Social Security and other mandatory pensions (public and private) is increasingly not enough and we are the ones who must take care of ourselves

We have many years to live in retirement (and more important: years of healthy living)

Do we have any more pensions besides mandatory public and private pensions?

What are the average pension expenditures per beneficiary?

Population ageing and the strong foreseen increase in the old-age dependency ratio will worsen the situation of those pensions (besides lower wage increases)

Retirement age will increase, and future pensions will be lower than today

If people in higher income brackets think they will have an important contribution from Social Security and other mandatory pension schemes (public and private), it is a mistake or a very risky assumption

We have many years to live in retirement (and more important: years of healthy living)

We live longer and we hopefully we will live more years in retirement.

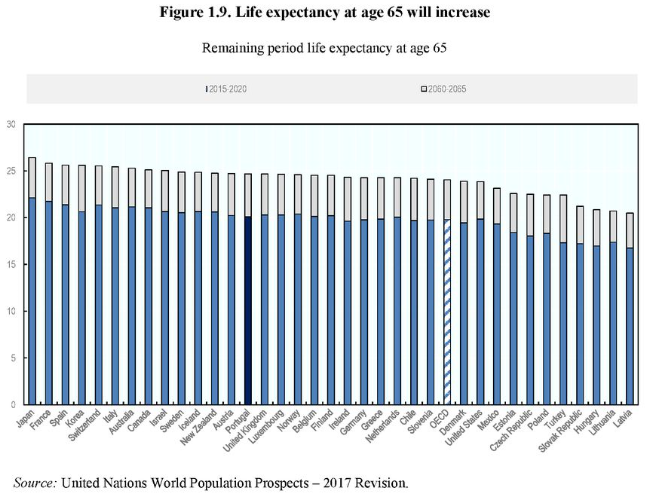

It is estimated the following increase in average life expectancy at age 65 in OECD countries between 2015-20 and 2060-65:

In Portugal, the current life expectancy at age 65 is about 20 years and will increase to 25 years. These figures are slightly higher than the average of OECD countries. Japan, France and Spain lead with the current 22 years and the predicted 26 years and in the other opposite we have some Eastern European countries.

This is the first useful indicator to prepare our retirement income needs because it gives us a reference to the years of spending that we must anticipate to live a peaceful retirement.

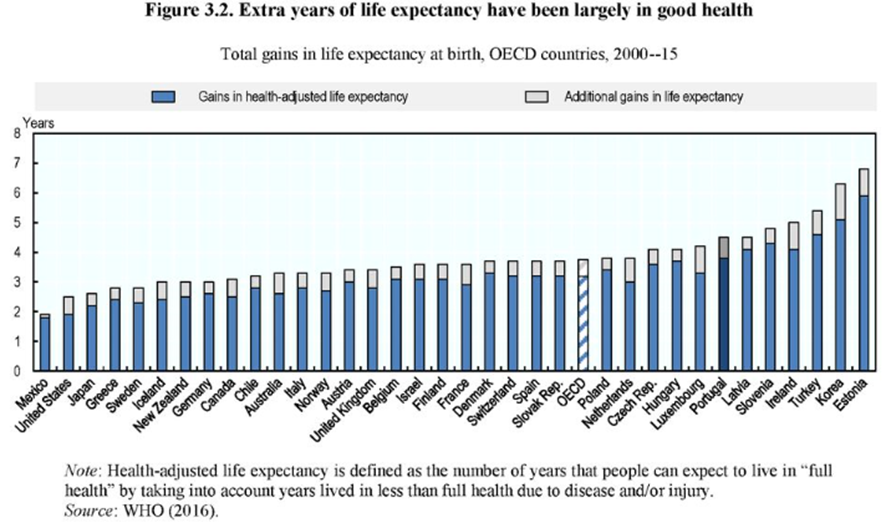

This increase in average life expectancy has been significant over the past 15 years and is accompanied by a growth in years in good health:

In Portugal, the average life expectancy at birth increased 4.5 years between 2000 and 2015, and this increase is mainly in good health (3.8 years). Portugal is one of the OECD countries which recorded a bigger increase.

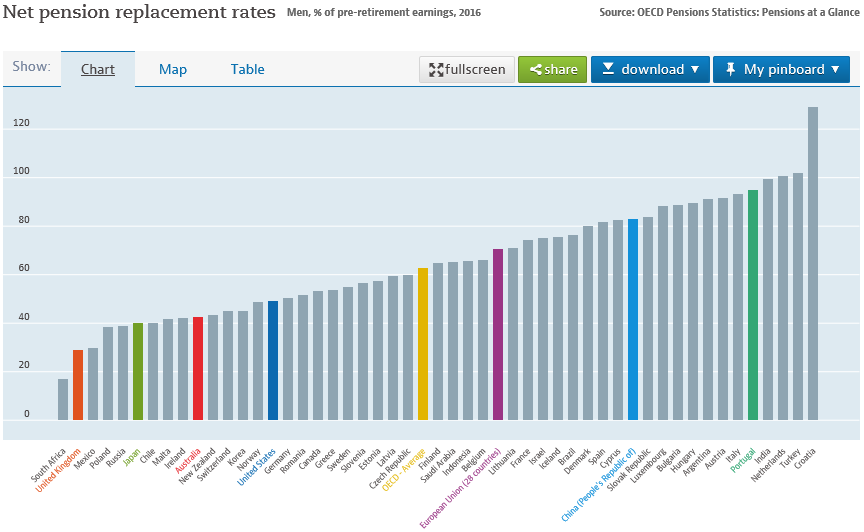

How much do Social Security and other mandatory pension schemes pay us to live in retirement as a percentage of our last wage (net pension replacement rate)?

To assess with what we can count on Social security to live in retirement the most useful indicator is the net pension replacement rate, given by the value of the pension of Social security and other mandatory public and private equivalent schemes as a percentage of the last salary.

The study of the latest OECD, published in 2017, concludes the following:

The net pension replacement rate, including pensions from Social security and/or other mandatory public and private schemes, is 62% on the average of OECD countries and 73% in the 28 European Union countries. This rate is close to 100% in Portugal, Netherlands and Italy and surprisingly low in countries such as the United Kingdom (29%), Japan (40%), Australia and Switzerland (40%-43%).

Do we have any more pensions besides mandatory public and private pensions?

In many of these advanced countries with low pension replacement rates of Social security pensions and other mandatory public and schemes, people complement those values by adopting individual voluntary contributions schemes from occupational pensions or personal plans.

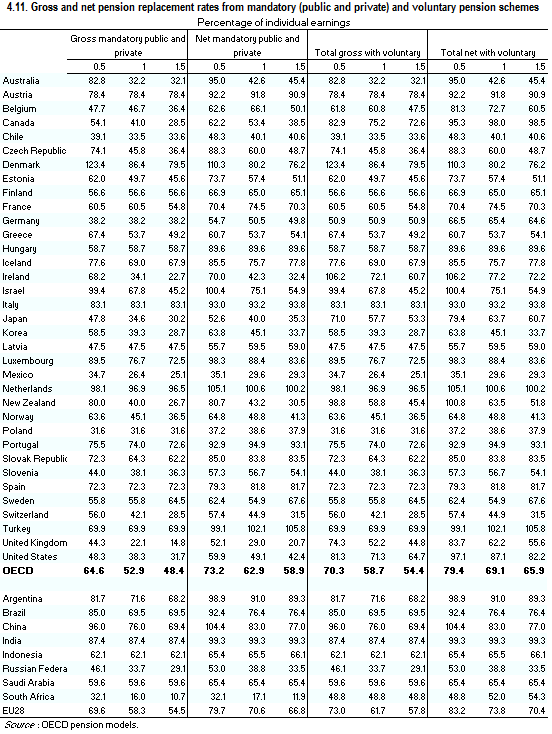

The following table shows the theoretical (i.e. full contributively career) values of total (public and private) pensions for old age as a percentage of the last income, for beneficiaries with 3 income levels in the OECD countries, in 2017, also known as gross or net substitution rate depending on whether we are speaking of before or after taxes values:

In the rightmost columns group we have the total net pension replacement rate (most useful indicator), from the 3 pension schemes – public, mandatory private and voluntary – relative to the 3 types of beneficiaries. For a pensioner with average income that rate is 69,1% in the OECD countries average. In the Netherlands, Denmark and Italy this rate is higher than 80%, in Portugal it is 94%, and reaches the lowest and lower values of 40% in less developed countries, such as Mexico and Poland.

Thus, many countries with mandatory, public and private, low net pension replacement rates usually have good and strong voluntary pension schemes (occupational or personal), such as the United Kingdom, the US and Canada, where total replacement rates are 62.2%, 87.1% and 98% for the average beneficiary, respectively. However, there are advanced countries where the total net pension replacement rate, including voluntary schemes, remain low, with Australia (42.6%), Switzerland (44.9%), Norway (48.8%) and Sweden (54.9%).

https://www.oecd.org/daf/fin/private-pensions/Pension-Markets-in-Focus-2021.pdf

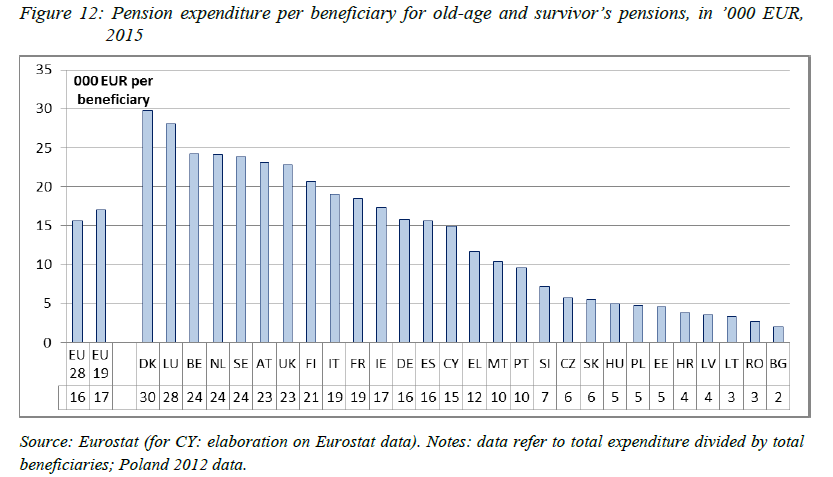

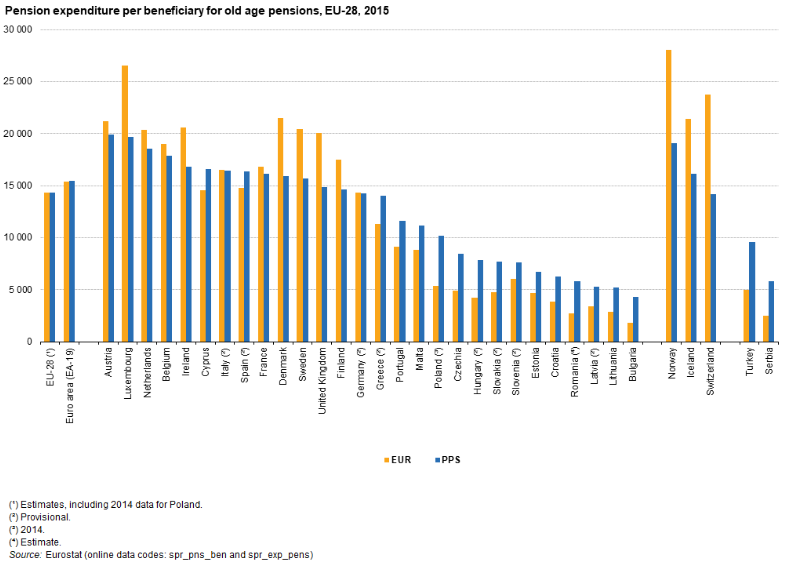

What are the average pension expenditures per beneficiary?

On average, the pension expenditure values per beneficiary in the various countries of the European Union are as follows:

The average expenditure per beneficiary with old-age and survival pensions in Portugal is around €10.000 per year, placing it at the bottom of the European Union countries. The average of the EU28 is higher than €15.000, with the richest countries clearly above €20.000 a year.

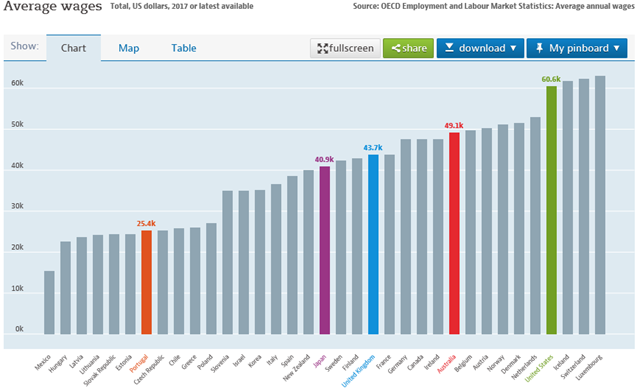

To put these values into perspective it is worth knowing the situation of average wages relative to OECD countries:

The highest average wages are recorded in Luxembourg, Switzerland, Iceland and the USA exceeding $60,000. Portugal has one of the lowest average wages, in the amount of €25,400. The remaining European developed countries have average wages between $40,000 and $50,000.

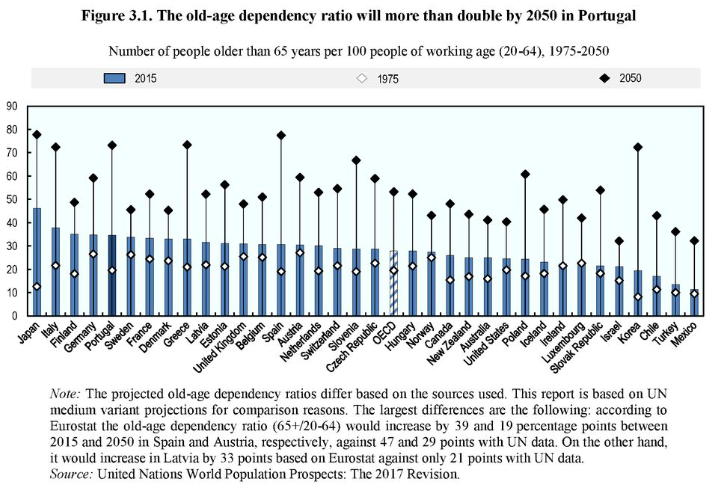

Population ageing and the strong foreseen increase in the old-age dependency ratio will worsen this situation

All advanced countries in the world are ageing and this situation will significantly increase their old-age dependency ratio:

Due to the combined effect of low birth rates and the increase in average life expectancy, the dependency ratio of the elderly will be worsening in all OECD countries. Portugal, Spain, Italy and Japan are the countries that will record the greatest deterioration of the dependency ratio of the elderly, from 30%-40% in 2015 to more than 73% in 2050 (practically double!). In the other OECD countries, the evolution will be at a slightly more moderate pace. Portugal will be the fourth most aged country in the OECD, behind Japan, Spain and Greece.

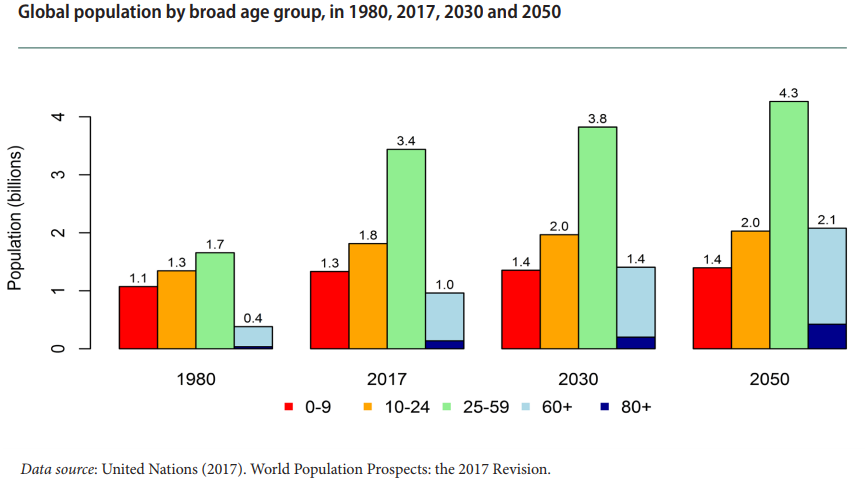

The following chart shows the age demographic evolution predicted worldwide:

The number of people over 60 years will increase significantly in a few decades, more than doubling between 2017 and 2050, going from 1.0 to 2.1 billion. On the other hand, the age group between 10 and 24 years old will increase only 200 million and the group of 25-59 years of age increases 900 million. In particular, it is anticipated that the number of people over 85 years grows more than 3 times, from 137 to 425 million, in this period.

This results in a strong increase in financial pressure on social pension systems around the world.

Retirement age will increase, and future pensions will be lower than today

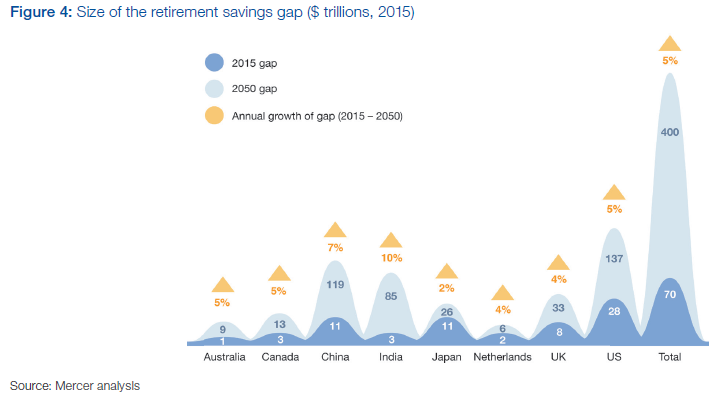

In a 2017 study, Mercer estimated the evolution of the retirement savings deficit in the major countries of the world if the current low savings rates for retirement are kept:

The 2015 deficit of $70 trillion, will increase to about $400 trillion in 2050. This value is calculated by the difference between the costs necessary for the retirement and the three sources of income, the Government pension corresponding to the minimum pension (pillar 1), the public and private contributive pension (pillar 2), and personal savings (pillar 3). Of the current $70 trillion more than 75% relate to government and public pensions deficits.

The solution of this situation will necessarily go through:

1) An increase in retirement age increasingly linked to increased longevity;

2) A decrease in public, governmental and contributive pensions, and in countries where possible, an increase in contributive rates.

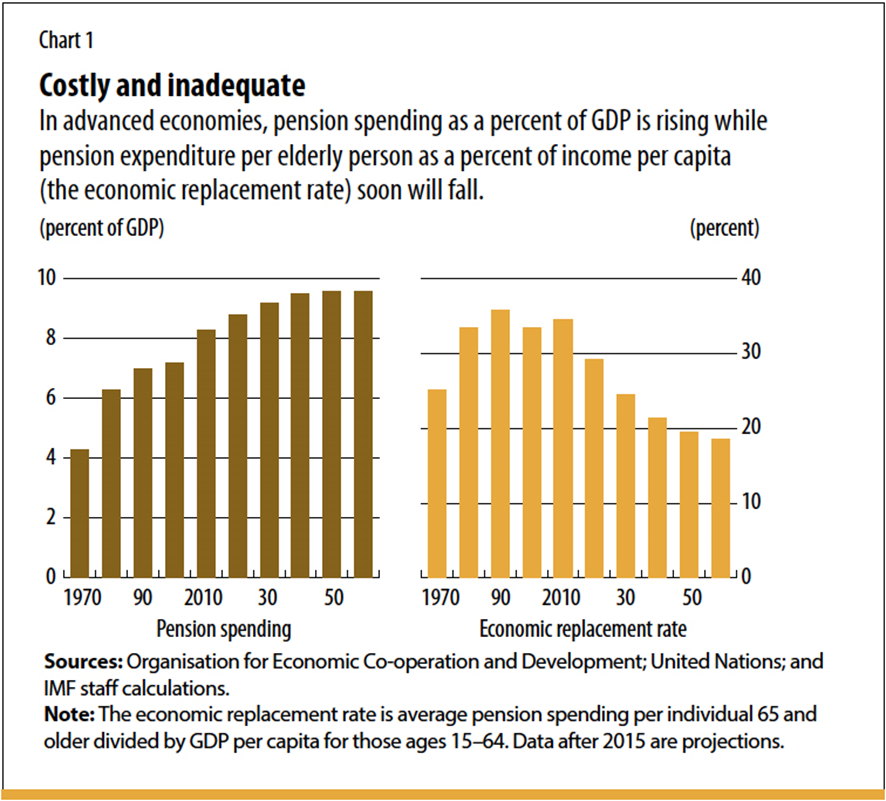

A recent study on the current situation and prospects of the Social security pension system in advanced OECD countries has shown that pension spending has reached a ceiling and the replacement rates of economic pensions will decline from here:

The pension spending costs about 9% of the gross domestic product on average, which is considered very close to the maximum sustainable limit. Because of the changes caused by population ageing, the average replacement economic rate that had a maximum value of 35% in 2010 will decrease to less than 20% in 2050.

In any case, we will pay more and have less, reducing our quality of life.

If people in higher income brackets think they will have an important contribution from Social Security and other mandatory pension schemes (public and private), it is a mistake or a very risky assumption

The expected pensions sustainability worsening caused by the ageing population, coupled with the redistributive regime of public pensions (regressive) – which results in higher incomes households having lower substitution rates, and with the limits of mandatory private pensions schemes, the risk is higher in higher income tiers.

People will increasingly contribute and receive less, damaging their expectations of a longer retirement life in line with the increase in average life expectancy.

For these reasons, the values of pensions foreseen in the future, especially for households framed in higher gross income tiers and for self-employed persons, will increasingly distance themselves from the values of the last income and the standard of living they are accustomed to. It is very risky, and it is a mistake, to think that these higher-income households can find a substantial part of their income in the future pension to live in retirement.

The solution to maintain our standard of life in retirement can only come from the increase in retirement savings rate and voluntary private pension funds or personal self-financed retirement plans

In order to ensure the incomes that allow us to maintain the standard of life in the retirement, the sole solution for higher income households can only come from the increase in the retirement savings rate and the from voluntary private pension funds either with the employer or personal retirement plans.

Public pensions are clearly insufficient. Mandatory private pensions or occupational transfers are, as we have seen in some countries, a good complement to these situations. But we know that there are very few companies that provide their employees with private pension funds, usually only the multinationals and the largest domestic companies.

Thus, it is very advisable for us to take care of ourselves by making voluntary contributions for private plans or for personal retirement plans. It is the model of personal or individual welfare. This is already the reality in countries where compulsory pensions do not arrive.