We argue that the common investor should have an investment portfolio mostly made up of indexed funds, but that it can be complemented by direct investment in shares

The rationale and framing of active investment in secular growth or vintage stocks

The saga of the search of hidden FAANMG (and many others)

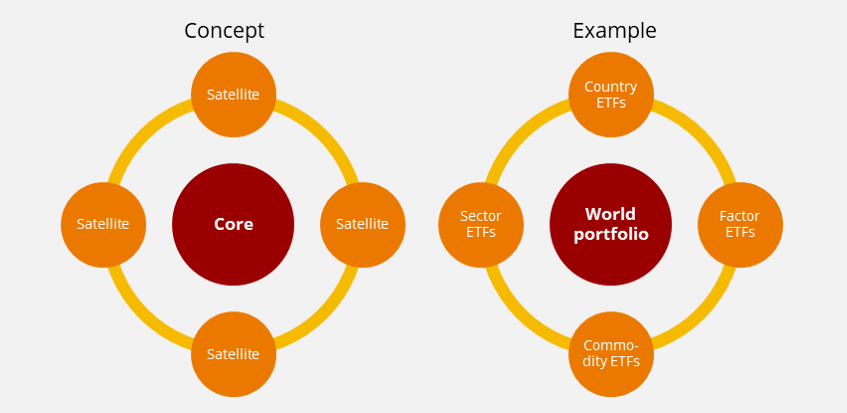

This direct investment strategy in stocks is based on the overall “core” and satellite investment management strategy

The program of this series to invest in secular growth or vintage stocks

This is the first article in a series on direct investment in stocks, with the aim of supporting the investor in the execution and management of this type of investment.

In this series we will present the rational and framework that we advocate for this direct investment in stocks, objectives and the rules of this investment, criteria for selecting stocks, methods and indicators for the evaluation of companies, among others.

In this article we begin by addressing the reasons, motivations and strategy of investing in stocks.

“Given a 10% chance of a 100 times payoff, you should take that bet every time.” — Jeff Bezos

“Buy into a company because you want to own it, not because you want the stock to go up.” – Warren Buffett

Our view is that individual investors should invest most of their assets in investment funds, indexed and low cost.

We consider that the allocation by the main classes of assets, stocks and bonds, should be made according to the term of the investment and the investor profile, knowing that this is the main determinant of performance.

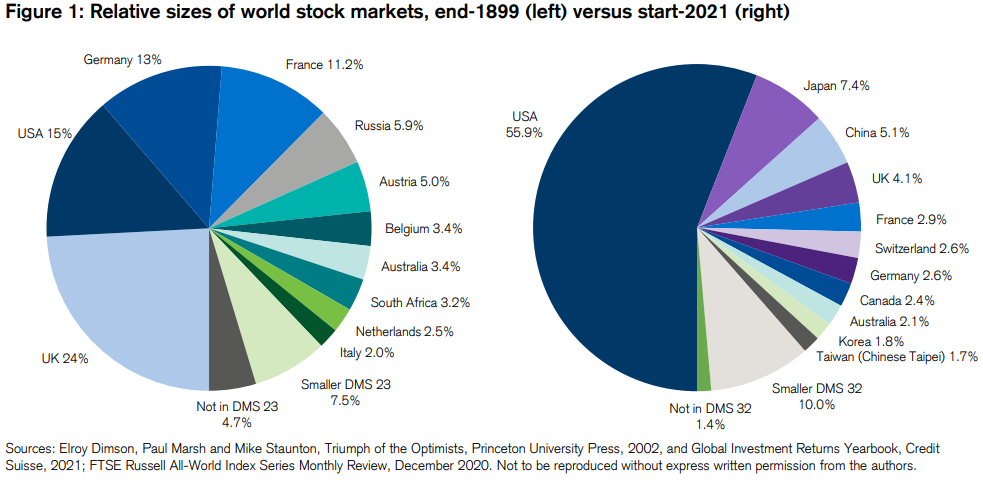

We believe that investors should also pursue a good level of diversification of investments, ensuring distribution by geographies and in terms of their own securities and/or companies.

The composition of the global equity market can be a good reference for geographical distribution. And most of the largest investment funds contain more than 50 securities, which is considered a good degree of diversification by securities.

We believe that investors should prefer the funds indexed to the main market indices, which better replicate the desired allocation and diversification, and have a low cost.

Despite this, we do not mean that investors should not allocate a minority share of their assets to other financial investments, including other types of investment funds, or even individual shares.

In particular and in along those terms, we consider that the individual investor can and should make the investment in some stocks, either directly or through active funds, seeking to obtain higher market returns with acceptable risk levels.

A good example of stocks performing higher in the last two to three decades have been FAANMG, but there is more.

The rationale and framing of active investment in secular or vintage growth actions

In order to achieve high profitability in equity investments, we must follow a planned and structured process in the medium and long term.

We must save to invest as soon as possible and we should invest considering the financial objectives, risk profile and financial situation and capacity.

Given that we can start investing when we are 20 years old (or even less) and that we can live to 90 (or even longer), our equity investments can be 70 years long (or more, in fact, if we leave this wealth in inheritance for future generations).

It means we have a very long time frame to invest.

Even if we do not want to take over the entire 70 years, at least we can look at a period of 30 to 50 years, corresponding to the time of a generation of investment, which is still very long.

With a horizon of 30 to 50 years ahead we can perfectly live with the risks of fluctuations in the stock markets.

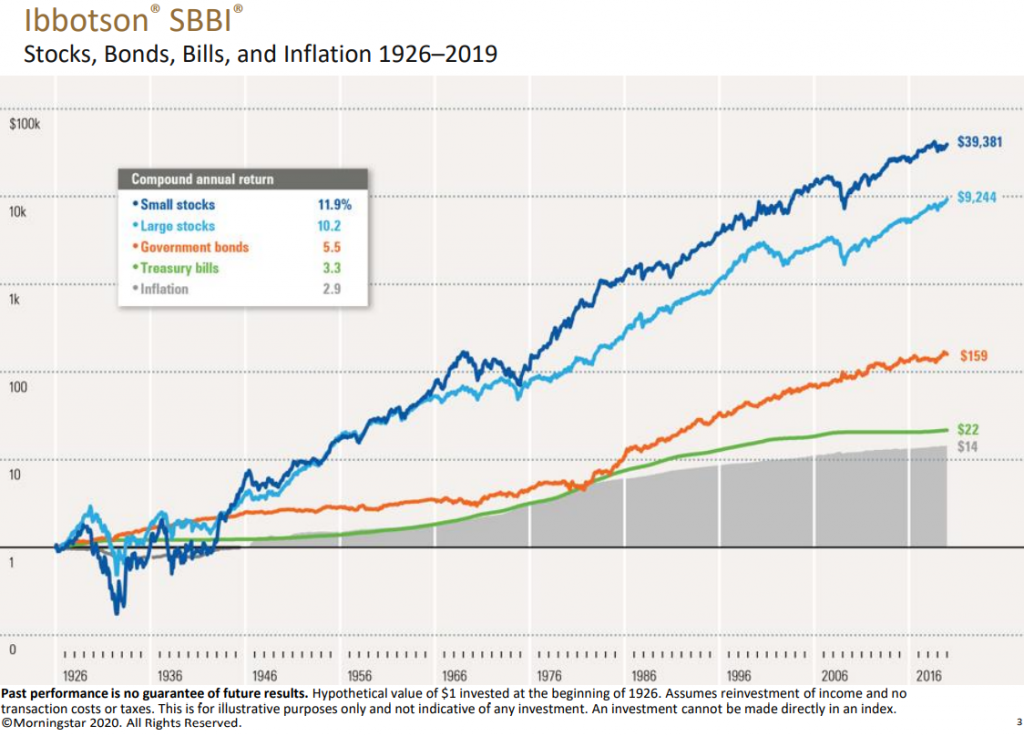

During this period, we will experience many market cycles, some positive and some negative, knowing that, history tells us that in the end our investments will be more valued.

According to financial history, positive cycles last longer and result in higher valuations than negative cycle falls.

On average, from 1926 to today, the returns on stocks of large companies are 10% per year, which in 30 to 50 years results in a 17 to 117 times appreciation of invested capital, respectively.

Investing with returns of 10% per year and very diversified risks is very good, from any perspective.

Moreover, we consider it is very difficult, if not even impossible to do better, in a systematic and consistent way, which is one of the fundamental reasons for recommending investment in index funds from the main markets (the other is low cost).

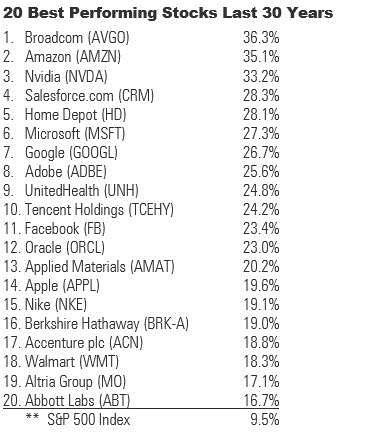

But in the last 30 years, or in periods of several decades, there have also been some companies shares that have done much better than average. We are not talking about small stocks, but medium and large companies.

The saga of the search of hidden FAANMG (and many others)

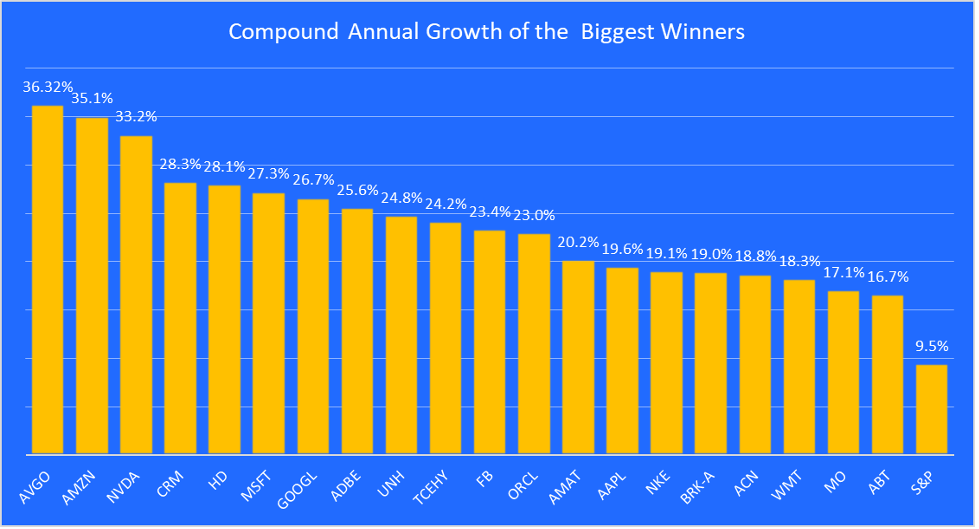

For example, in the following chart we see the 20 stocks in the S&P 500 index that have appreciated the most in the last 30 years and their annualized return:

These 20 stocks had valuations that reached more than double the appreciation of the S&P 500 index, in some cases triple.

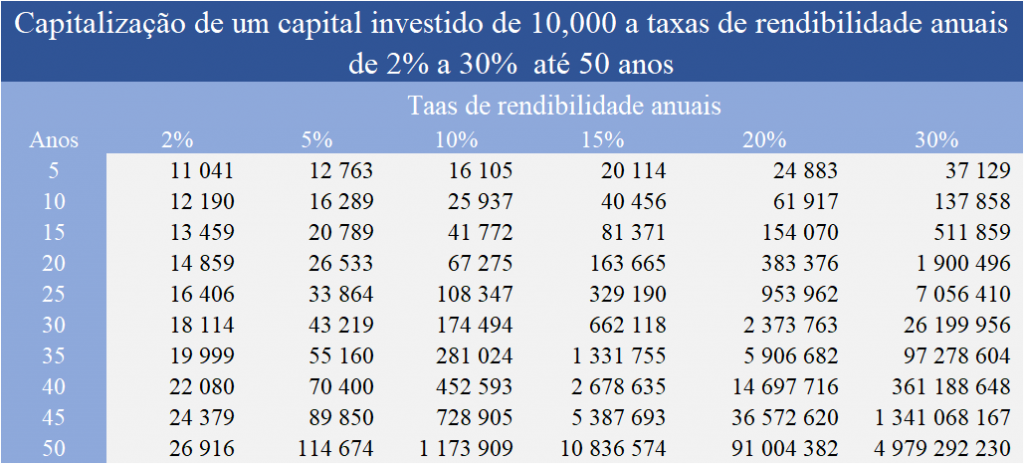

A 30% annual rate of return over 30 years turns 10,000 of invested capital into 2.37 million, 10 times more than the 174,500 we would get if profitability was 10% of the S&P 500 average.

More importantly, in 30 years, a stock with a 20% annual return has a valuation of 13.6 times of a stock with a 10% return, equal to the market average. That is, investing in this stock is equal to investing in more than 13 average stocks.

We can see that for 30% annual returns the capital reached in 30 years would be 26.2 million, as well as that for 20% returns and a longer term of 40 years the capital would be 14.7 million.

But is it worth thinking about going after only the best 20 stocks? It would be a difficult, complicated, if not impossible exercise.

No, and for two reasons. The first is that a difference of only 2% in annual returns that seems small turns out to be a considerable gain increase. This is due to the effect of capitalisation for long periods.

The second reason is that there are hundreds of stocks that have higher profitability than the market.

A recent study by Hendrik Bessembinder showed that between 1926 and 2019 there were more than 1,000 out of the 26,000 in the S&P 500 that did much better than the index.

Therefore, while risk diversification leads us to advise investing most of the shareholder component of our assets in funds on the main indices of the stock market, we should not ignore this reality, so we cannot be against direct investment in some companies.

On the contrary, we believe that we should do so, but with simple rules, well defined and better implemented.

This starting series of articles will address precisely these rules of direct investment in long-term stocks to achieve higher valuations than the market.

In other words, we seek to invest in the winning companies of the next 20 to 30 years. It’s a very difficult exercise, but it’s not impossible. And with some method, the chances of success increase substantially.

What we want is to identify one or more companies that will be on the list of the best in the next 20 to 30 years.

Our future or our descendants will thank you for this exercise!

In the following posts we will see all these rules in more detail.

For now, it is sufficient to point out that it should be for a small and controlled percentage of the assets or total equity investment, between 10% and 20%, from a very long-term perspective, i.e. 20 or up to 30 years, and not trading, sharing the investments by several companies with great potential for appreciation and which already have some market size.

The separation of these active and complementary investments from indexed and core investments is essential so as not to mix, and mark the differences well and manage each of these investments in its own way.

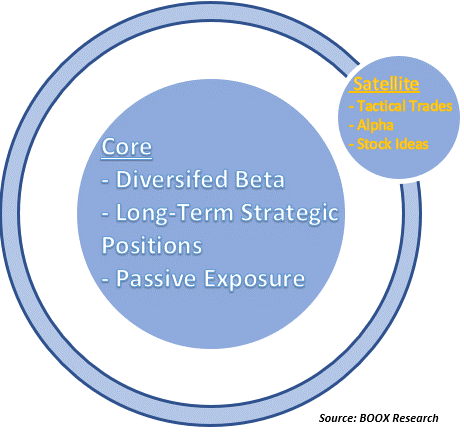

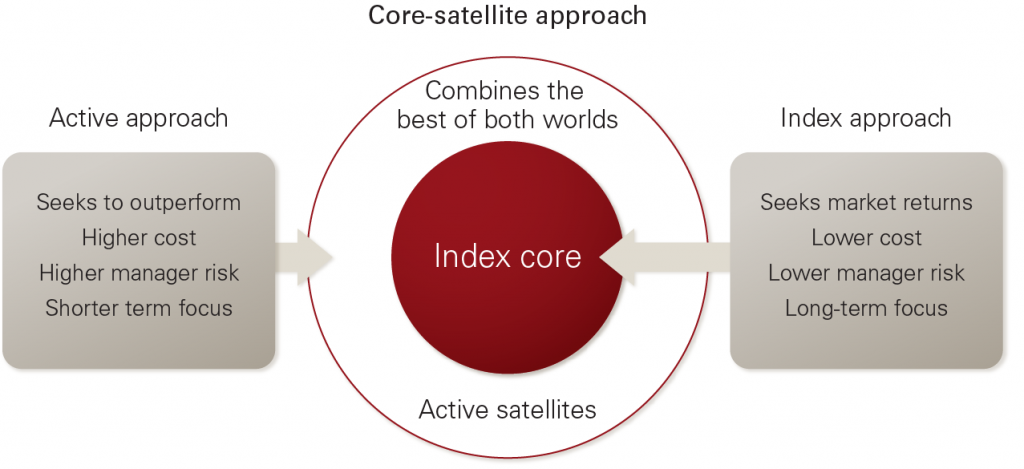

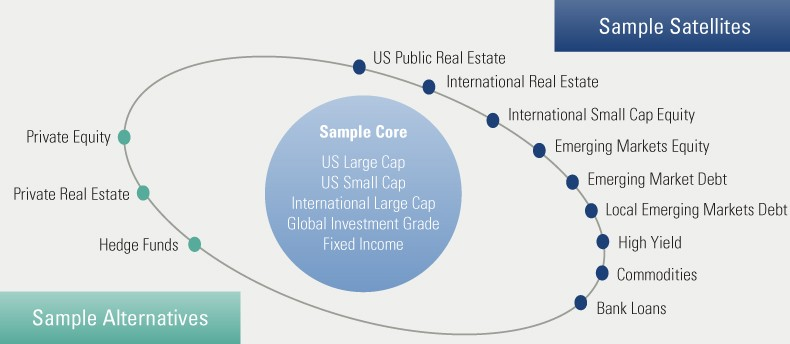

Moreover, this idea of combining two large investment groups, index investment funds, on the one hand, and active investments (whether funds, stocks, etc.), on the other, is at the basis of the investment strategy called core-satellite.

This strategy recognizes the differences and combines the advantages of each type of investments, liabilities and assets.

It uses indexed funds as the core of the portfolio and active investments as the satellite.

On the one hand, indexed or passive and low-cost management investments reflect the profitability and controllable risk of the intended market segment, but do not offer the opportunity for superior performances.

They are the controlled risk and at low cost part, to capture the market yields (beta) in the long term.

They should be used as the core and main position of the portfolio and for investments in efficient markets, for example in companies with large capitalisations in developed markets.

On the other hand, active investments are a way to achieve superior market performance (alpha).

These active investments are used as satellites or the secondary position of the portfolio in relation to investments where the investor considers that there are skills and capabilities to be able to generate higher returns.

In this group we can include active funds, direct investments in securities, etc.

It is very important to separate these two investment groups to be successful, because the way to decide and manage each is different and lies in the distinction and passive/core and active/satellite association.

In conclusion, the core and satellite investment strategy is a portfolio building method designed to minimize costs, taxation and volatility, while providing an opportunity to overcome the broad stock market as a whole.

The core of the portfolio consists of passive investments that accompany major market indices, such as the Standard and Poor’s 500 Index (S&P 500). Additional positions, known as satellites, are added to the portfolio in the form of actively managed investments.

This core and satellite strategy that aims to reconcile the best of 2 worlds can be followed for combinations of passive and active investments of various types, and not only for direct investment in stocks as illustrated here.

One hypothesis is to core the funds of major assets and world markets and as active satellites and secondary markets, or even alternative investments:

Another possibility, based on ETF combinations, is to use the ETF on the world market portfolio as core and the ETFs of countries, sectors, factors and raw materials as satellites: