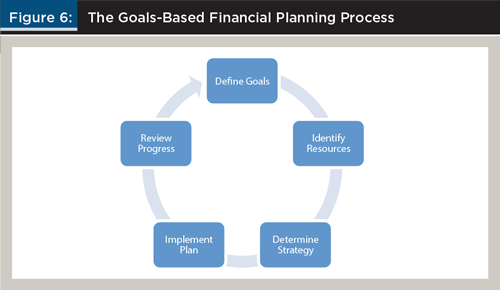

The goal-based investing planning process comprises 5 phases:

#1 Define possible financial objectives

#2 Identify current and future available resources

#4 Implement the plan now, don’t leave it for tomorrow

#5 Reassess progress every six months, or at least annually, aligning it with personal circumstances

In another post we explained the rationale and benefits of making wealth and investments management guided by financial objectives. In this post we will see how this is done in practice.

The goal-based investing planning process comprises 5 phases

The personal financial plan should be an interactive exercise of adjustment between what we want and what we can achieve, and should comprise 5 phases:

- Define the financial objectives;

- Identify the available financial resources, i.e. assess the current financial situation and project predictable financial capacity;

- Determine the strategy by choosing the allocation of assets that will guide the selection of investments;

- Implement the plan by selecting and making concrete investments;

- Assess progress, or monitor evolution, and review the exercise.

Source: CFA Institute

As we know, the capital we have throughout our lives – accumulated savings and future income – is scarce, and personal objectives are multiple and compete with each other.

Therefore, for the individual financial plan to be realistic, we must start by defining each of the objectives, considering the present and future financial capacity, the so-called resources available. It is based on reconciling objectives and resources that we can determine investment strategies.

#1 Define possible financial objectives

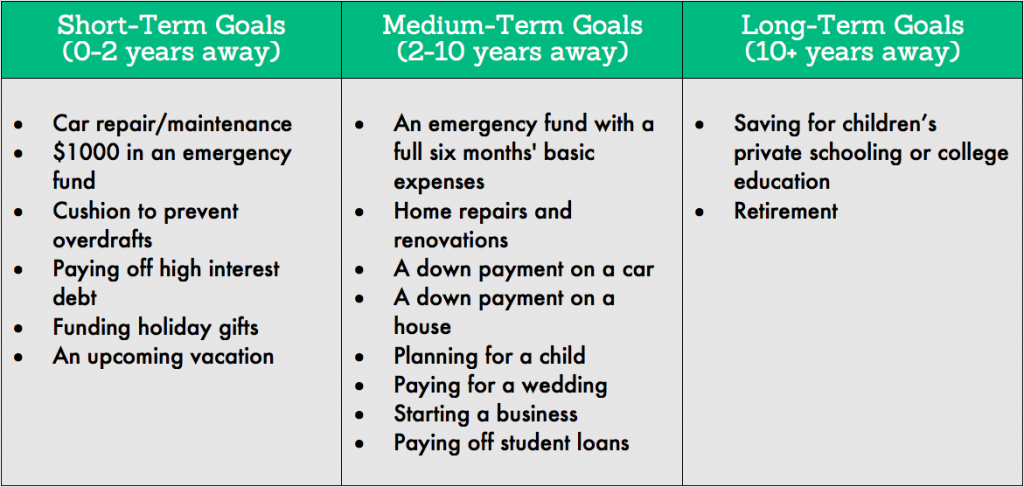

Financial objectives should be realistic, prioritized and scheduled in target dated goals.

In terms of priorities, in all objectives we have needs, interests and aspirations according to their level of criticism.

In terms of the time horizon, we have short-term (up to 2 years), medium-term (2 to 10 years) and long-term (more than 10 years) objectives. For example, in short-term objectives, we have high-cost debts or unforeseen expenses such as medical, home repair or car expenses. In the medium-term objectives we find, for example, the establishment of a reserve or emergencies fund to deal with unexpected and unforeseen expenses and situations or to give the upfront amount for purchase of a house. In the long-term objectives we have, among others, the retirement and the children tuition fees.

Source:FINRA – Financial Industry Regulatory Autority

#2 Identify current and future available resources

In order to assess the available resources, we need to build on our situation and financial capacity, including:

- Current net financial assets (balance between financial assets and liabilities);

- Future contributions foreseeable. They depend on expected income and expenditure, and the capacity for savings, and a financial budget is therefore needed.

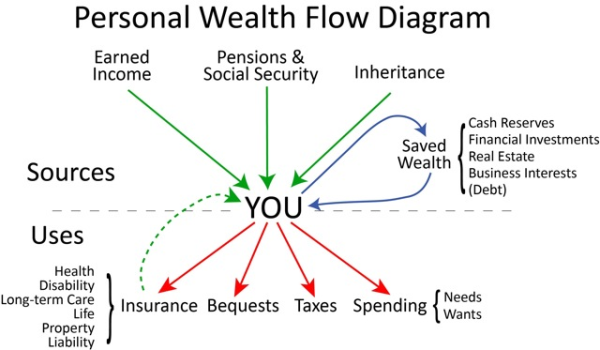

The diagram of personal wealth flows, which contains the sources and uses of incomes, applies to all of us. We have the sources of wealth or wealth generation, which comprise the income obtained, social and private pensions and the inheritances received. And we also have the uses or expenses of wealth, which include expenses, insurance, taxes and inheritances given.

The difference between income stemming from and the expenses made are savings, which can be placed in deposits or savings accounts, or invested in financial assets. There is also negative savings, which are all our debts.

Source: hoganfinancial.com

We must collect, analyse and evaluate the information of our situation, condition and overall financial capacity, present and future.

There are a set of simulators available on the internet as well as apps for money management smartphones, which allow us to balance or budget our finances, as well as evaluate and control our financial budget, even allowing us to see where we can save more.

#3 Determine the appropriate strategy for the distribution of capital between savings and investments, in accordance with their characteristics and personal conditions, and aimed at achieving objectives

Determining the strategy includes the following steps:

- Distribute resources by objectives;

- Distribute money or capital between savings (deposits and savings accounts) and investments;

- Make the distribution of investments by asset and financial classes and subclasses.

The allocation of resources to the objectives is to distribute scarce capital by multiple objectives, thus focusing on priorities.

The distribution of resources between savings and investments is determined by the investment period because, as we have seen earlier, for the short term (term less than 2 years), the most appropriate option are savings, while for the medium and long term, the correct choice are investments.

The allocation of investments by asset classes and subclasses, including between stocks and bonds, and their segments, stems from their expected profitability and risk, the time limit for meeting the objectives, and our risk profile in terms of preservation or appreciation of capital (which comprises both the ability to take risk and our risk tolerance).

This work allows to project the expected rates of return for the investment portfolios of each objective, and by this way, to determine the ability to achieve the accumulated capital objective within the defined period and which capital we should carry out in every moment of time.

#4 Implement the plan now, don’t leave it for tomorrow

Having decided to distribute the capital available between savings and investments, and in these by subclasses of assets, the next step is to realise investments.

When? Right away because there are no better moments.

How? In savings is making placements where we feel safer. As for investments, their selection involves efficient diversification between asset subclasses and the choice of the most representative products of this class and lower cost.

If we do all these steps well, the conditions for successful investments are met.

#5 Reassess progress every six months, or at least annually, aligning it with personal circumstances

When? Ideally, every six months or at least annually.

How? The main idea is to stay on course and avoid acting depending on the market noise. The exception is if there is a change in personal circumstances justifying or even requiring the review and reformulation of some of the objectives.

These 5 themes will be developed in articles to be published below.