“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. Through a continuous process of inflation, governments can confiscate, secretly and unobserved, an important part of wealth of its citizens.” – John Maynard Keynes, (1919) “The Economic Consequences of Peace” Chapter VI, pp. 235-236.

Inflation, assets and investments

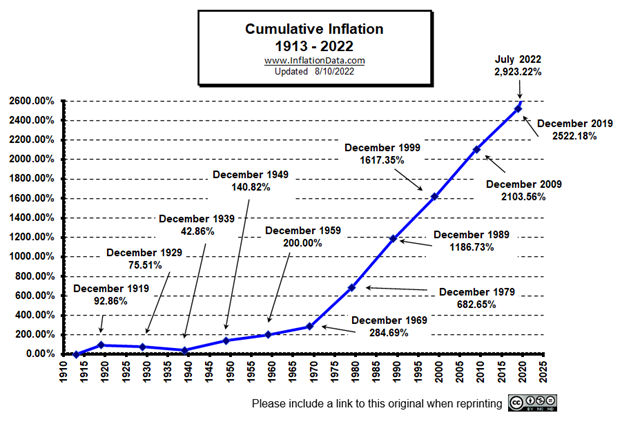

Right inflation evaluation: cumulative inflation in the period analyzed instead of annual inflation

Inflation costs

The biggest cost of inflation is its uncontrol, and the development of an inflationary spiral

The various inflation measures: CPI, PPI and PCE

How we are in terms of inflation

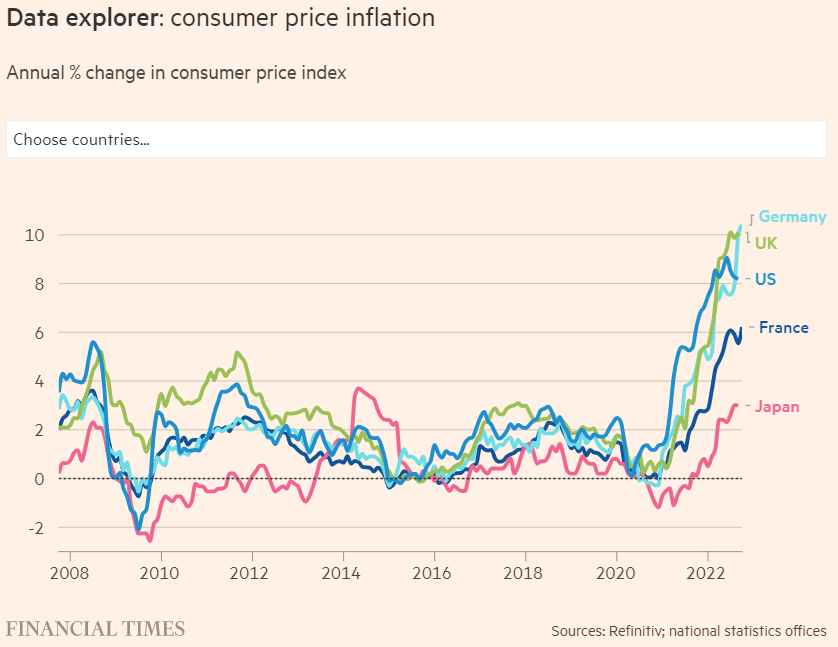

We are living the highest annual inflation rates in the last 40 years, between 8% and 10%, in the US and Europe.

This high inflation is at the heart of the action of rising interest rates and liquidity contraction by central banks and consequently the sharp losses and high volatility of the bond and stock markets this year.

Its restrictive policy aims to reduce aggregate demand, in particular consumption and investment, with the effect of a contraction in economic growth.

Central banks have been increasingly clear that they will only finish their operations when there is evidence that medium-term inflation returns to the target level of 2%.

That is, as long as high inflation persists, volatility and pressure on financial markets will remain, as we have seen in the most recent articles in the quarterly Financial Markets Outlook.

That is why we consider it useful and opportune to have some basic knowledge about inflation.

In previous articles we have seen the expected effects of inflation and rising interest rates on bond and shareholder markets, and how we should act in this context.

Inflation, assets and investments

Realising inflation, rising prices of goods and services is essential for us to manage our whole lives, and in particular our investments.

The main reason is the corrosive effect that inflation has on our wealth, income, pensions, savings, which we described in a previous article.

Inflation diminishes our purchasing power, reaches our quality of life, and to that extent, requires adjustments in the way we view work, reform and spending.

But inflation is also central to our investments.

First, the investments we want to make are those that provide a rate of return that is at least equal to inflation.

This excludes risk-free or low-risk investments such as term deposits or savings accounts, and leads us to investment in stocks and bonds.

Inflation is one of the main motivations for investing in stocks and bonds.

Secondly, inflation is directly linked to economic cycles, and by that way, to market cycles.

As we have seen in other articles, the evolution of inflation, and its interaction with economic growth and monetary policies, has an impact on the attractiveness and profitability of those financial assets.

So it’s worth knowing a little more about inflation.

Let us do this in the current context of markets where we know that the main issue is the level of inflation.

The fight against inflation is the reason for the adoption of restrictive monetary policies that have caused volatility and the devaluation of investments in financial assets, bonds and stocks.

It is very difficult to predict the evolution of inflation.

This does not mean that it is not important to understand some key inflation issues in view of the situation and market developments.

Once again, we will develop in more detail the situation in the USA, given the greater importance of the impact of the evolution of this country’s inflation on the world economy, global financial markets and our investments.

Right inflation accounts: cumulative inflation in the period analyzed instead of annual inflation

Most people focus on annual inflation because it’s the most talked about, but that’s not the one that matters most to doing our math.

Annual inflation is measured by the rate of change in the prices of the goods and services we buy in a given year.

However, what interests us most at each moment are the values of our wealth and income in real terms, that is, what we can buy with these values.

This loss of purchasing power is due to cumulative inflation, or accumulated in a given period, and not by annual inflation, which measured the loss of the last year.

It is this cumulative inflation that should be compared with income or wealth growth in the same period.

And it must be assessed both for inflation in the past and for its future evolution.

Many people forget this, especially in periods with high and prolonged inflation.

There is a lot of talk about annual inflation, because it is on the agenda, and we forget the inflation of previous years.

Governments, in particular, have no interest in recalling this fact.

The later they recognize inflation, the better. The same is true, the greater focus on inflation for a given year.

Tax revenues increase immediately with inflation and salaries of civil servants are updated at rates lower than the actual loss of purchasing power.

Therefore, the settings are delayed.

Cumulative inflation represents the loss of the purchasing power of money over a certain period, usually longer than annual inflation.

For investors, the loss of wealth or financial assets is the sum of the loss of purchasing power with the appreciation of financial assets that occurred in the period.

We already have two years of high inflation, 2021 and 2022.

Stocks and bonds have already depreciated more than 20% since the beginning of the year, but had appreciations last year.

For example, in the US and Europe, stocks rose 20% in 2021.

Inflation in these regions was 5% in 2021 and is estimated at 7% in 2022.

Thus, equity markets gained 15% in real terms in 2021, and are losing 27% in 2022.

And it will be difficult to achieve inflation below 5% in 2023.

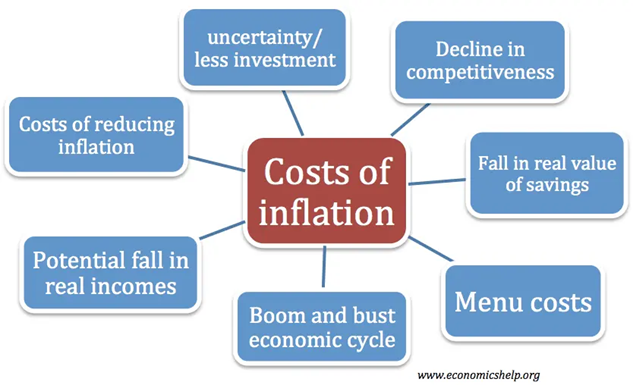

Inflation costs

There are many costs associated with inflation.

Therefore, the main mission of central banks around the world is price stability, or seek to keep inflation at a controlled level and close to an average of 2% per year.

Inflation increases the prices of goods and services, decreasing purchasing power.

This reduction in consumer purchasing power, and the consequent decrease in real income, is the highest cost of inflation.

Inflation also has other costs:

Inflation decreases the values of pensions, savings, bonds and shares.

Inflation causes volatility and uncertainty, which can lead to lower investment levels and lower economic growth in the long run.

Countries with lower and stable inflation rates tend to perform better economically than countries with higher inflation.

As high inflation is considered unacceptable, governments and central banks seek to reduce it by raising higher interest rates to reduce consumption and investment.

This reduces aggregate demand and will result in a decline in economic growth and unemployment.

Very high inflation is unsustainable and is usually followed by a recession (which is one of the current fears).

Inflation usually results in a redistribution of income, worsening the situation of the aphoritators and improving that of debtors.

Inflation causes an increase in our taxes, because the amount we pay increases if the updating of income tax levels does not keep up with inflation.

Inflation reduces international competitiveness.

If a country has a higher inflation rate than its trading partners, its exports will become less competitive. This will lead to a reduction in exports and a deterioration of the trade balance.

The only way to curb inflation is by reducing demand, through economic policies, which mainly reduce consumption.

This reduction will result in a decrease in activity and economic growth.

The most effective policy is monetary policy, through rising interest rates and currency contraction, because fiscal policy usually has to be used to support those most vulnerable to the effects of inflation and economic slowdown.

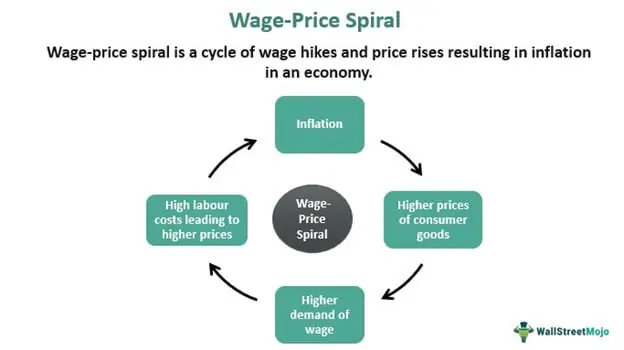

The biggest cost of inflation is its uncontrol, and the development of an inflationary spiral

When inflation arises it must be immediately fought and stopped.

If not, an inflationary spiral is likely to begin to develop that will be more difficult and more costly to contain.

The inflationary spiral arises when economic agents, in a rational attitude, demand compensation for rising prices of goods and services.

Workers demand higher wages to compensate for the loss of purchasing power.

Companies increase the prices of their goods and services to maintain profit margins in the face of rising raw material and wage costs.

And so on: increased prices of goods and services, increased wages, increased prices of goods and services, …:

Inflation costs are multiplying and extending, exacerbating the cost in terms of economic growth.

To curb this, it is essential to contain rising inflation expectations, or inflation expected by economic operators.

The higher the expected inflation, the greater the pressure of these agents to be compensated in their incomes.

If these expectations are contained, households and businesses will not seek large increases in wages or prices of products, avoiding the formation of the spiral.

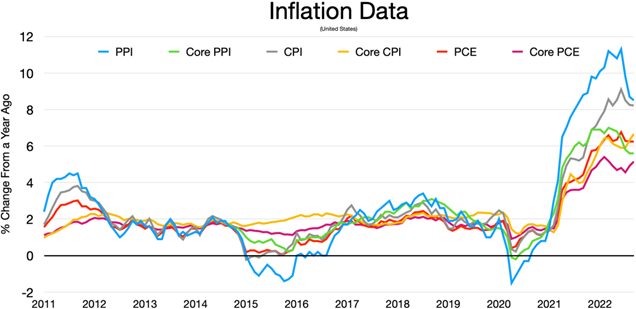

The various inflation measures: CPI, PPI and PCE

There are 3 main inflation rate measures.

The inflation rate of the consumer price index, or cpi, is the most common and disclosed, and measured the price variation of the basket of goods and services type as standard for the country’s households.

Central banks typically exclude from this indicator the components of power and energy because they are volatile for the purposes of the development of monetary policies.

The producer price inflation rate indicates the price variation in the producer. It is an indicator used to anticipate consumer price developments and to assess inflationary pressures on company margins.

The FED prefers to use the implied inflation rate in consumer expenditure excluding food and energy, or the core PCE.

Core PCE excludes the two most volatile price components from the purchasing basket and considers all expenses of all consumers, including expenditure on non-profit institutions and urban and rural households, as opposed to the consumer price index.

How we are in terms of inflation

Inflation in developed countries is still close to highs, showing resistance to the decline:

Inflation is at the highest levels of the last 40 years in developed countries, reaching values between 6% and 10% in Europe and the USA.

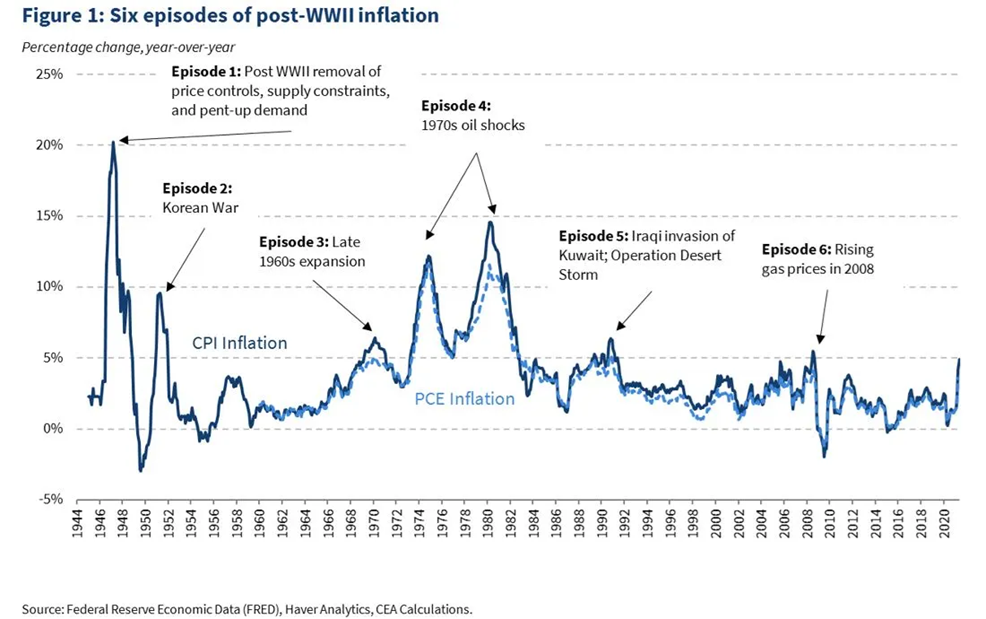

In the U.S., this will be the seventh episode of high inflation since World War II:

The previous six episodes comprised the post-War economic recovery (1945-49), the Korean War (1951-52), the expansion of the late sixties (1968-1972), the two oil shocks (1970 and 1983), the invasion of Iraq and the Kuwait War (1987-1992) and the rise in oil prices in the GCF (2008).

We know that inflation stems from factors that were already coming from before the war in Ukraine, which we can associate with the pandemic, and the war itself.

When the war in Ukraine is over, inflation is expected to decrease greatly.

For example, energy prices will tend to fall, as will some product price speculation resulting solely from the worsening of this geopolitical risk.

However, there are other factors that will remain beyond the Ukraine war, such as the upheavement of supply chains and the reduction of globalization of world trade.

On the other hand, inflation acts with lags. There are contracts that provide for their prices to be updated on the basis of inflation. For example, these are the cases of some wages, pensions, rents and some prices for the supply of goods and services.