Diversification of investments is distributing them and combine useful and properly the 3 major assets assets: investing in stocks and bonds, and cash savings (and their main subclasses of each). Do not put all your eggs in one basket but spread them wisely

It is impossible to predict the performance of asset classes even in the short term

In terms of wealth we want growth that comes with stocks but also need preservation related to bonds; and there is a “ruler” to measure and decide on the right asset allocation

Tough growth is fundamental to build wealth, preservation is useful specially in times of financial market stress (or when we can´t risk much)

We must diversify in line with our individual objectives, investment timeframe and personal risk tolerance

Diversification of investments is distributing them and combine useful and properly the 3 major classes of assets: investing in stocks and bonds, and cash savings (and their main subclasses of each). Do not put all your eggs in one basket but spread them wisely

This is the most important rule in wealth and asset management and making either personal or institutional investments.

Diversification is a highly logical and rational attitude:

- Don’t put all your eggs in one basket

- Different asset classes have different benefits: cash (low return, immediate liquidity), bonds (medium return, preservation) and stocks (high return, growth)

- The most appropriate asset classes will depend on the term of the investment, and our financial goals have varied time horizons: safety or emergency fund, retirement, buy a home, pay for tuition of children, dream vacation, inheritance, health care, etc.

- It is impossible to predict the performance of investments in the very short term (otherwise we’d be rich)

- We want growth but also preservation, especially in times of markets stress

- The allocation or distribution of investments by asset classes improves the relationship between return/investment risk and determines the performance of investments in more than 90%

That´s why Harry Markowitz, Nobel Prize of Economics and father of the modern financial theory on investments and asset management said that diversification is the only free lunch in Finance.

The 3 major asset classes

Cash (including deposit and savings accounts) is for the very short term, have immediate liquidity, with null or even negative return in real terms, and low-risk. As they are secure, should be used to meet all the financial needs up to 2 years.

Investments in stocks and bonds provide higher average returns although subject to possible losses arising from the short-term financial markets fluctuations. They must be made for goals with timeframes over 2 years to dilute the short-term market fluctuations and benefit from their greater profitability.

The main stocks subclasses are the geography (region or country) and the size of businesses (small, medium and large).

The main bonds subclasses are also the geography (region or country), the nature or type and quality or the issuer’s credit rating.

As poupanças ou “cash” são aplicações de curtíssimo prazo e liquidez imediata, com rendibilidade nula ou mesmo negativa, em termos reais, e de baixo risco. Tendo em conta a sua segurança, devem ser usadas para suprir todas as necessidades financeiras até 2 anos.

It is impossible to predict the performance of asset classes even in the short term

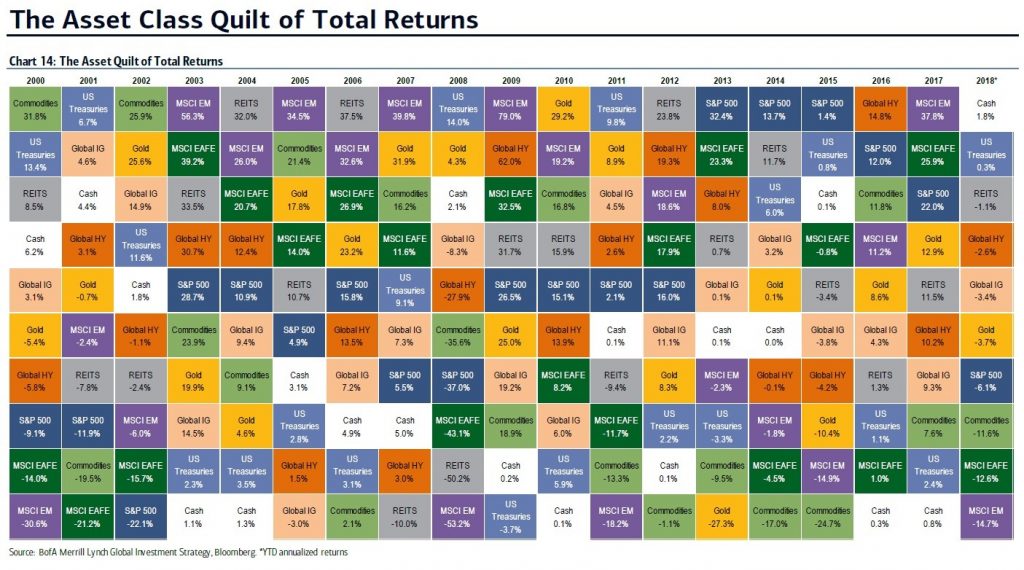

The graph below shows the annual performance of 10 classes and subclasses of assets over a period of 18 years from 2000 until 2018, including: 4 of stocks, MSCI World (developed world), MSCI EAFE (developed countries ex-US), MSCI EM (emerging markets), and 500 S&P (US main index); 2 of bonds, US Treasuries (US government debt) and US Fixed Income (private debt of the US with good credit quality); 1 Cash; and 3 of other classes, REITS (real estate listed on US stock market), Commodities, and Gold.

Source: Asset Class Quilt of Total Returns, Bank of America Merrill Lynch

Source: Asset Class Quilt of Total Returns, Bank of America Merrill Lynch

Assets with a good performance in one year or for a few years can end up having bad performances in the following years: this is the effect of market cycles (“boom” and “bust”); e.g. real estate (REITS), commodities, emerging markets, etc.

Cash (3-months Treasury Bills), as well as commodities, are typically in the lower half of the table. The main stock market indexes, such as the MSCI World MSCI EAFE or S&P 500, are usually in the upper half.

There is no asset class consistently better in a period of 18 years.

Thus, it is difficult to predict the behavior of asset classes even in the short term.

However we can find some patterns. Note some important observations: a) the MSCI World MSCI EAFE, S&P 500, US Treasuries and US Fixed Income are usually in the middle of the table, which means that stocks and bonds are two very interesting classes (even in a period of two crises, the technology bubble and the “subprime”); b) confirms that stocks are more higher returns and more risk (wealth growth) and bonds have average returns and less risk (wealth preservation); c) cash, which is given by the performance of investment in US 3-months Treasury Bills is typically in the lower half of the table because it has very low returns.

In terms of wealth we want growth but also need preservation. There is a “ruler” to measure and decide on the right asset allocation

If we could live with average returns the choice would be easy but the truth is that we live with observed and real returns.

Higher returns necessarily imply higher risks at the level of each of the asset classes. Risk is the variance of returns that can produce a loss of capital in the short term. This means that there is no asset superior to the others (there’s no free lunch).

However, if we mix two or more asset classes, we can improve the return or the risk of the combined investment. This is one of the few free lunches in finance (along with the capitalization of income).

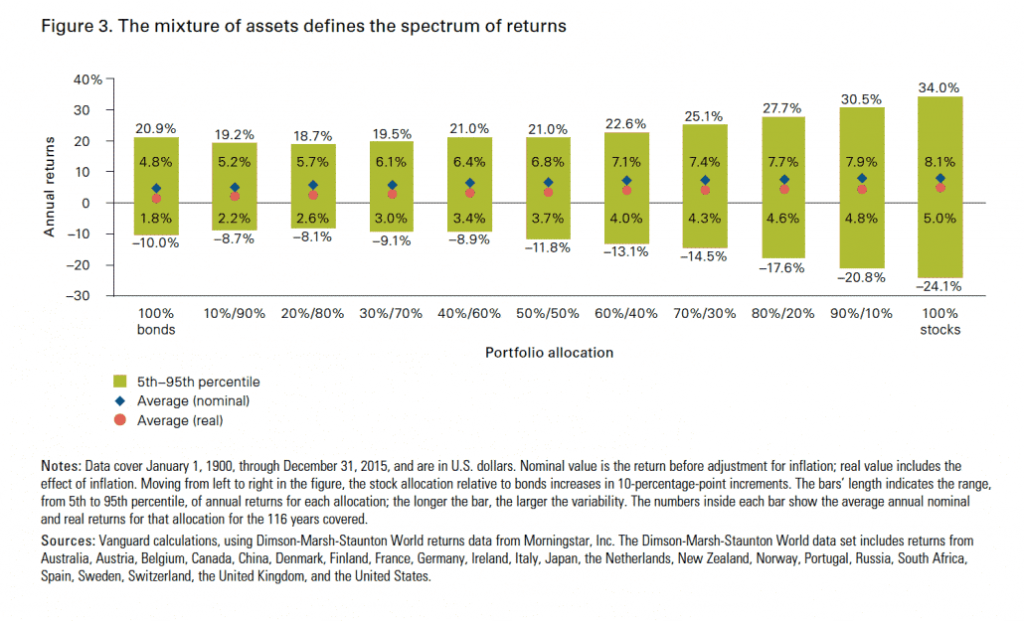

The following graph shows the spectrum of the returns of several asset combinations for the period between 1926 and 2015 in the US. This financial assets return-risk ruler should be used as a guidance to evaluate and measure our allocation decision (rational and emotional) between stocks and bonds.

Source: Vanguard

To trade-off wealth growth for preservation means to exchange average annual return of 8.1% by 4.8% per year in nominal terms, or 5% 1.8% a year in real terms, and swap best and worst annual yearly fluctuations ranges of 58.1% by 30.9% in the medium and long term, respectively.

Preservation is useful, especially in times of financial market stress (or when we can´t risk much)

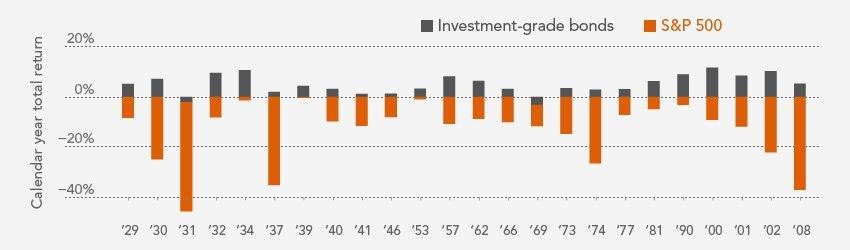

The next graph shows the (24) annual periods in which stocks had negative returns in the last 90 years, between 1926 and 2016.

Source: Fidelity Capital Markets, Investment Themes 2017

In the years that stocks had losses, bonds had a positive performance. So, bonds are a good refuge and serve as a cushion in times of stress in the markets.

Only owning stocks is very risky specially when we need capital, we cannot emotionally handle devaluations of assets, and are forced to liquidate investments.

The relationship between the performance of stocks and bonds – called asset correlation – is at the technical base for asset diversification. The lower the asset correlation, that is the greater the divergence between the asset movements, the higher the diversification effect.

We must diversify in accordance with our individual objectives, investment timeframe and risk tolerance

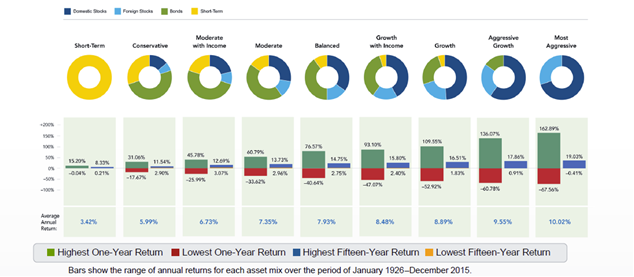

The following graph shows the average, highest and lowest annual, and also the 15- year highest and lowest annual returns of a series of combinations of asset classes, or different degrees of risk, for the period between 1926 and 2015.

Source: Diversify your portfolio, Fidelity, 2016

The annual average return ranges from 3.42%, and 10.02%. But we should also take into account the maximum and minimum annual returns and returns of 15 years.

We must choose the combinations depending on the term of investment and personal risk tolerance to fluctuations of financial markets in the short term. Generally to be very conservative is to be short-sighted and being too aggressive is to be highly adventurous. We must have risk in our investment to avoid risking our lives.

The goals and our emotional reactions are determining factors in this choice. The asset allocation decision is regarded as the most important and decisive in the performance of investments, accounting for more than 90% of the final outcome.