What are the main themes and aspects of ESG?

We have seen in previous posts in this series that although sustainable financial investment is a very recent reality, it has been growing at a strong pace, especially in recent years.

Despite the guidelines and standards emanating from supranational and national entities, the frameworks, models, and evaluation methods by agencies specialized in this theme, there is also a lack of standardization of evaluation criteria and metrics that impair their adoption by investors.

To this extent, policy makers have a role to play in developing standards, fostering disclosure and transparency, and promoting the integration of sustainability considerations into investments and business decisions.

In any case, it is important to know the current framework for the application of sustainable investment strategies used in the stock and bond markets, which will be the subject of this post.

What are the main themes and aspects of ESG?

The scope of sustainability factors, comprising its three main pillars, the environment, social and governance (ESG), is very vast and complex.

ESG investment is not a given asset class, but a multidimensional valuation system that can be applied to any asset class.

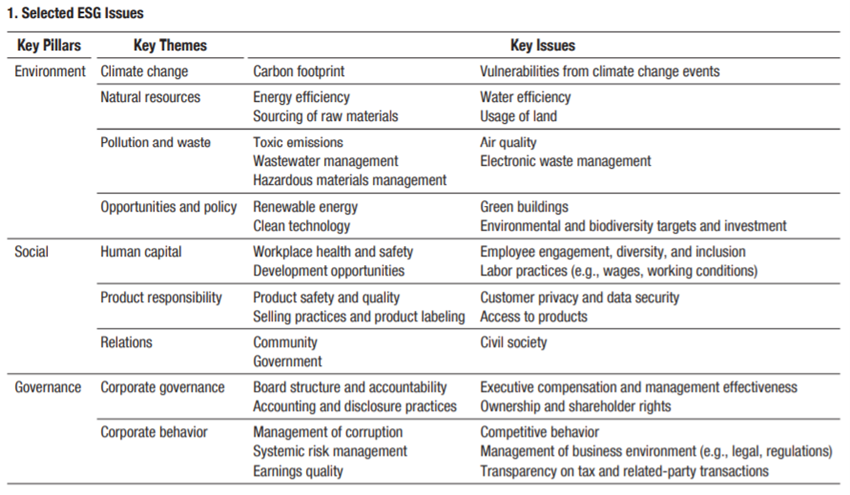

The following graph shows how the 3 pillars of the ESG unfold into key themes, which in turn correspond to critical questions or aspects:

The pillar of the Environment has as key themes and action responses:

- Climate change or the ecological footprint.

- Natural resources, encompassing energy efficiency and the extraction of raw materials.

- Pollution and waste, comprising toxic emissions, water waste management and mismanagement of materials.

- Opportunities and policies, encompassing the development of renewable energies and clean technologies.

Each of these Environment key aspects matches key issues:

- The vulnerabilities associated with the events caused by these changes.

- Water efficiency and land use.

- Air quality and electronic waste management.

- Green buildings and objectives and investments in the environment and biodiversity.

The Social pillar has as key themes:

- Human capital, including health and safety conditions at work and development opportunities.

- Product responsibilities, covering product safety and quality requirements.

- Relations at the community and government level.

The key Social issues are:

- The inclusion, diversity and involvement of workers and working conditions such as wages and working conditions.

- Customer privacy and data protection, as well as access to products.

- The participation and involvement of civil society.

The third pillar, Corporate Governance, has as key aspects:

- Corporate governance in the strict sense, covering the structure and responsibility of management bodies, and accounting and reporting practices.

- Corporate behaviour or action in terms of corruption management, systemic risk management and quality of results.

Key Corporate Governance issues are:

- The remuneration of executive members and the effectiveness of management, and the ownership and rights of shareholders.

- Competitive behaviour, business context management (legal, regulatory), and tax transparency and related parties.

How does it apply or what strategies are adopted by investors in sustainable investment or environment, social and governance (ESG) in the various asset classes?

Investors are increasingly focused on environmental, social, and corporate governance or ESG considerations.

ESG information is increasingly explicitly and systematically integrated into all investment analyses and investment decisions.

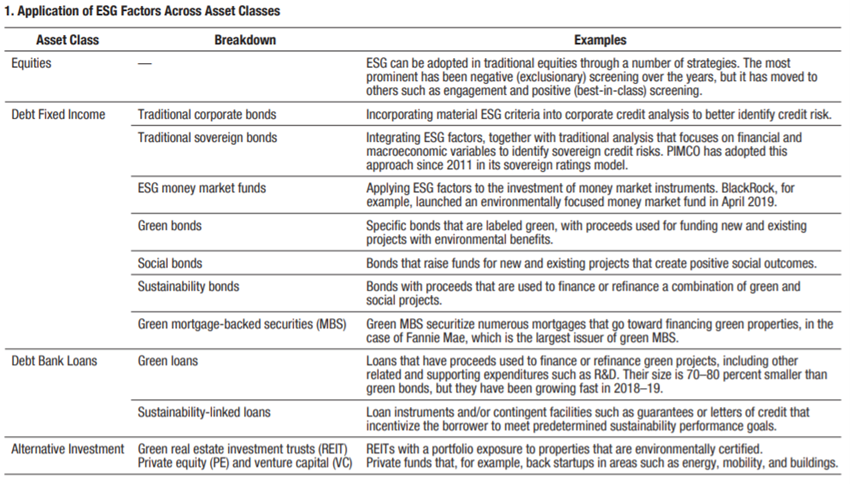

Its application in the various investment classes has different forms and developments:

The adoption of sustainable investment has begun in stocks, but further recognition of the importance of ESG standards and official sponsorship of the financial sector is driving sustainable investment in bonds.

ESG’s integration grew earlier in stocks due to risk and returns considerations, time horizon and engagement rights.

This practice began in equity investments by investors seeking long-term value creation information or trying to avoid specific risks, such as tobacco and weapons, that could cause reputational damage.

The ESG factors were then used to bonds with self-identification and labelling by issuers (as in the case of green bonds). Labelled bonds generally have a certification process for their use of funds with periodic validation, but investors generally rely on voluntary disclosures.

The further incorporation of ESG factors occurs through ratings, where credit rating agencies and others attempt to support their credit risk assessment with non-financial material information arising from sustainability considerations and, in general, apply these considerations to a wider set of issuers (not necessarily labelled on bond issuers).

The application of the ESG to private markets is based on a longer time horizon and greater room for manoeuvre for investor activism.

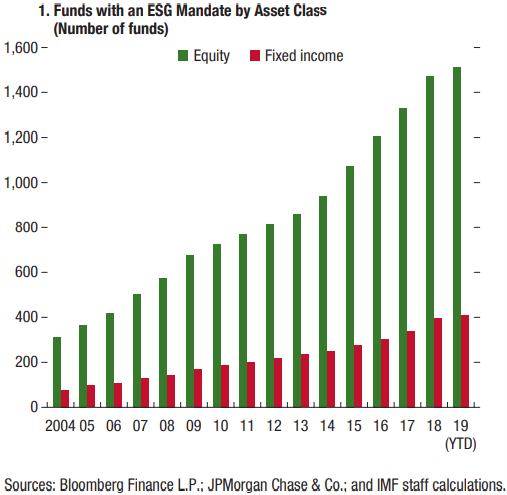

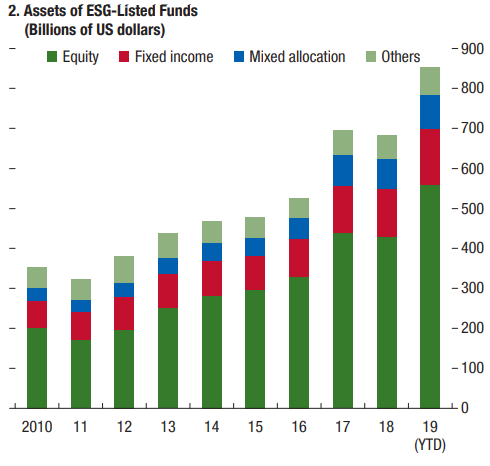

The following two charts show the development of the adoption of ESG funds at the level of the two main asset classes, stocks, and bonds, in recent years:

ESG funds are still few compared to traditional investment funds, controlling about $850 billion in assets (less than 2% of the total universe of the investment fund), but are increasing rapidly.

Equity funds traditionally had a much faster adoption rate of ESG factors than bonds. ESG equity funds reached US$560 billion in 2019.

The main ESG strategies applied to equity investments are exclusion, value integration, corporate involvement, and shareholder activism.

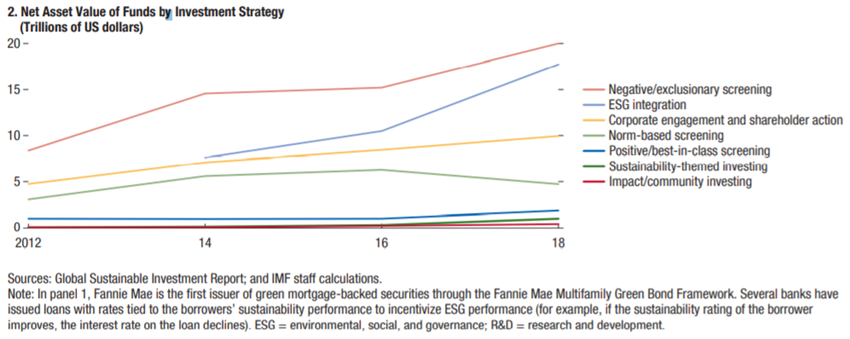

The following graph shows the evolution of key sustainable investment strategies:

Concerns about impact and underperformance have led to the evolution of ESG strategies, from exclusions to more selective inclusion and investor activism.

Initially, sustainable investment had mainly to do with negative screening strategies that exclude companies or entire sectors of investment portfolios.

Over time, risk management concerns, poor profitability performance and the need to demonstrate material final impact have given rise to positive screening-based strategies for companies performing well in ESG (best in class, or in improvement), companies that meet certain minimum standards or standards (standards-based screening), or sectors considered sustainable (sustainability-themed investments).

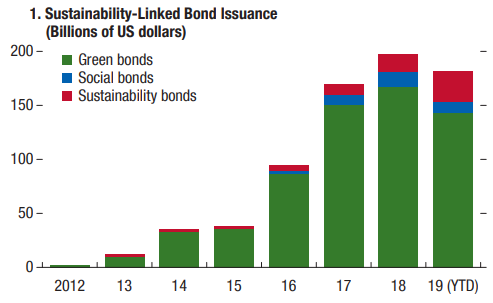

The main ESG strategies applied to investments in Bonds are the labelled bonds, especially the green, and the social ones.

Sustainable bond investment has benefited from the growing recognition that ESG emissions pose material credit risk.

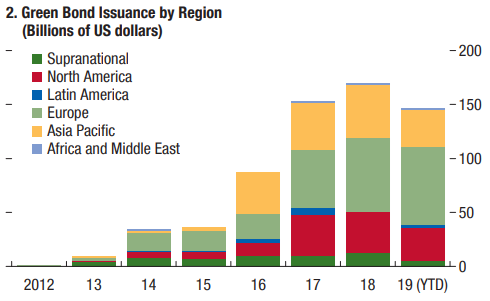

The development of bonds was helped by the issuance by multilaterals (International Bank for Reconstruction and Development, European Investment Bank); developing standards by China, the European Commission, the United Nations, and the United Kingdom, among others; and greater incorporation of ESG factors in credit rating.

The labelled bonds – at the moment, especially green bonds – are a fast and important growth segment. Strong investor demand has boosted strong issuance by European issuers and, more recently, Chinese issuers, increasing the value in circulation to about $590 billion in August 2019, compared with $78 billion in 2015.

However, there is still little evidence that issuers get lower costs through green bonds than conventional bonds, probably reflecting the same credit risk profile.

Secondary market liquidity appears to be slightly worse for green bonds than for comparable conventional bonds, reflecting a greater attitude of investors to buying and holding up to maturity, or not selling.