We need to invest in equities to build wealth in a diversified investment portfolio

The wisest thing is to invest in the global market portfolio equities, which reflects the importance of all stocks at any given time and serves as guidance to the largest professional managers

Diversify not only in geographies, but also in the currency of the destination country

Investing in products indexed to the targeted stock markets and at a lower cost

We need to invest in equities to build wealth assets in a diversified investment portfolio

We need to invest in equities to:

- Diversify an investment portfolio and associate the growth of stocks with the income stability provided by bonds.

- If we want to have a share of our assets to build more wealth in the long run, through higher returns but with more volatility in the short term.

We have seen that stocks provide high annual average returns but with a higher level of risk.

In the US, between 1926 and 2018, the real return on investment in stocks of the largest capitalizations (after inflation and taxes) was 5.1% per year, which implied that over 90 years, the capital obtained was 30 times the amount initially invested, in real terms.

Its main attraction is to provide growth to the capital invested. Not investing in stocks means giving up these higher returns.

Many of us do not make any stock investments because we think it is too complex or too risky. In other posts we have seen that we need to invest in financial assets, and particularly in stocks, to live better.

Of the 3 major financial assets, equities provide greater annual returns and a higher wealth growth in the medium and long term. And we have financial goals that we want to achieve in the medium and long term. If we do not invest in stocks, we cannot. We do not get there with our working income or from the investments returns of other financial assets.

On the other hand, investing in stocks is not as complicated and risky as it looks. It is possible to simplify and reduce the risk of this investment.

This post aims to answer the question of how we should properly invest in actions according to a model of reasoning and structured thinking.

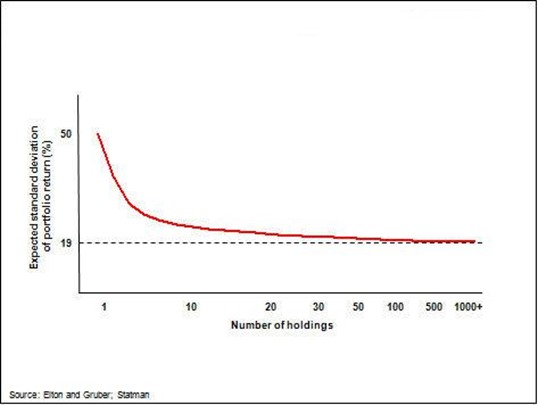

A diversified equities portfolio must contain at least 30 stocks to manage the risk of investing in individual shares

To do this we have to start by knowing what type or class of stocks we want to invest in.

There are people who invest in a small number of individual stocks because they believe that they are the ones which give better returns, either because they think they know them better or because they have heard the opinion of someone they consider as an expert. In most situations the results are not good, which is confirmed by various studies which show the poor performance of the individual investor and even the professional manager in average terms.

The first question is how many stocks we should invest in. For the average investor, the answer is simple. In order to have adequate risk diversification, which allow us to maximise returns for a given level of risk, or achieve a given level of expected return with risk reduction, we need to invest in a pool of at least 30 stocks. Studies show that this is the minimum number of actions that minimizes the risk of the investment portfolio.

Some investors prefer to invest in fewer stocks because they think they can get better results by choosing these stocks. The answer is always the same: if you get better results, do not change. But do the math well, and account for all the exceptions. We, like many other investors, are not capable. If they exist, the winners count by the fingers of the hand, if not they would be very rich and would be publicly known. It would have been great to invest in Microsoft and Apple and other similar companies that have had superb returns in recent years. However, we do not know if we would have avoided investing in Lehman, Enron, Worldcom and many others that while not failing had disastrous performances.

The next question is what kind of instruments. Directly in stocks or in mutual funds, and if this is the case in what types of funds.

We should prefer investment products indexed to the main indices of the stock markets and low cost, because not even professional managers exceed the markets performance and the more expensive they are, the worse

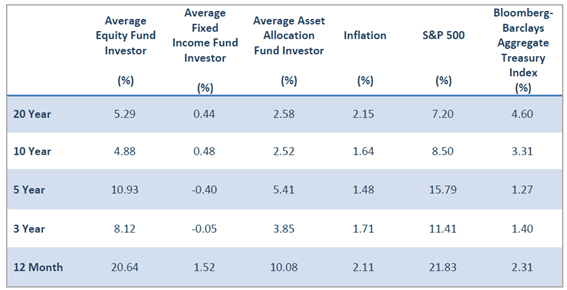

Studies show that investing in a set of securities has given bad results to the average individual investor:

Investments in equities made by individual investors have had much lower returns than the market as a whole (measured by the performance of the main US index, the S&P500) in the medium and long term, with a difference of about 3% to 5% per year in terms of 3 years and up to 20 years. The compounding effect makes these differences large amounts.

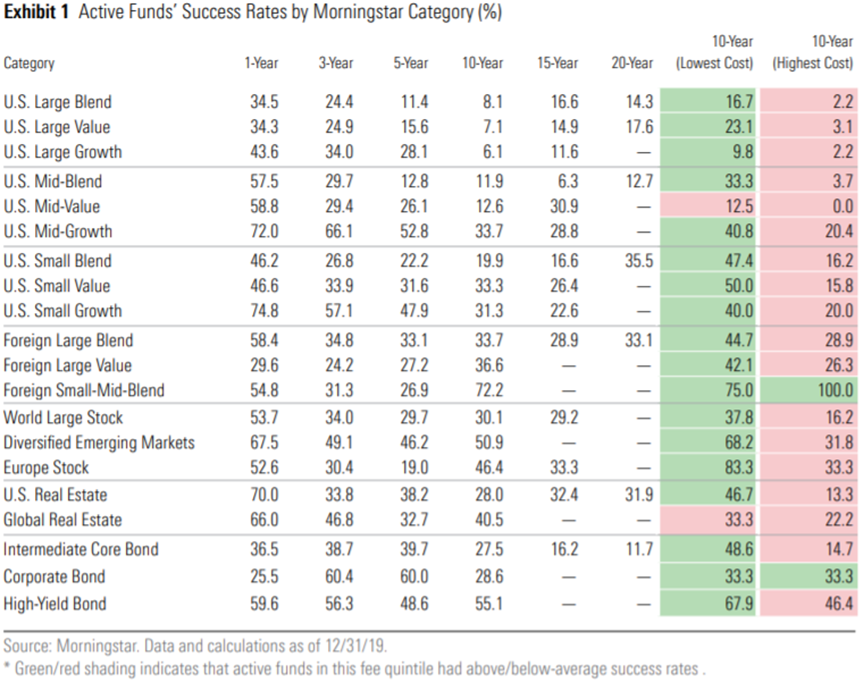

The active fund manager has not had much better results also:

Only between 6.1% and 17.6% of them beat the market in investments in large capitalisation companies for 10 to 20 years periods. The numbers improve slightly for small and medium-sized capitalisation companies (more risk), but even so most do not beat the market, being only between 11.9% to 35.5% that can do so in the same periods. And because they are professionals, they charge commissions. The surprising thing is that the more they charge, the worse the results.

Neither individual investors nor even professional managers can achieve better returns than the market in general.

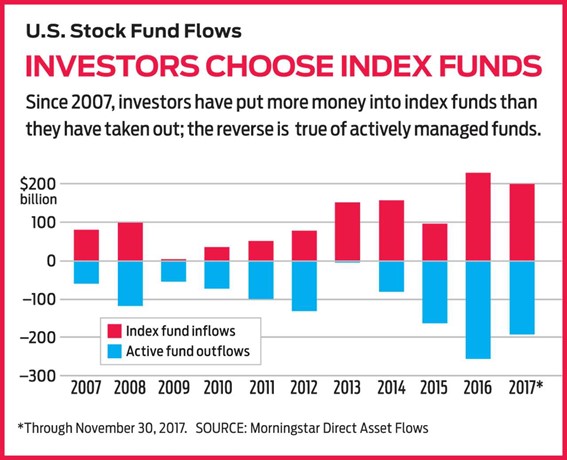

The solution is then to invest in investment products that replicate market indices and are low cost. So-called index funds that are or are not traded on exchanges (Exchange traded funds or ETF).

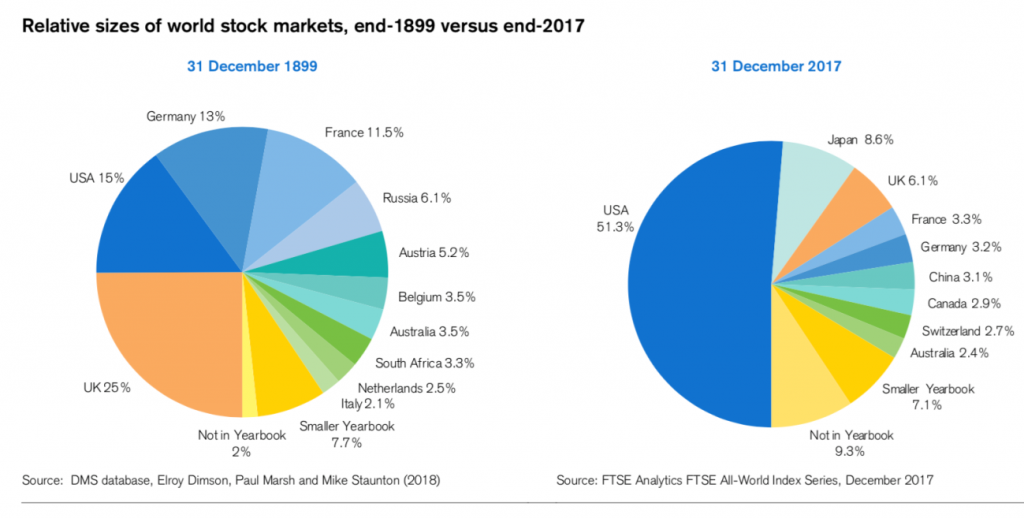

The wisest thing is to invest in the global market portfolio equities, which reflects the importance of all stocks at any given time and serves as guidance to the largest professional managers

We saw that stocks have as main characteristics:

(a) Geography.

(b) Size, from large to medium and small market capitalisation companies.

(c) Nature of companies, stable and paying a good dividend classified as value companies, or more volatile and in strong expected expansion, classified as growth.

(d) Currency of denomination.

There are several clues regarding the investments we should select:

- Do it as the main institutional investors, including the Norges Fund (more than 1 trillion euros of assets under management), which follow the global market portfolio of equities markets.

- See which index funds are most sought after, with the highest volume of assets under management and lower management costs.

The answer is to replicate the global market portfolio of the stock markets by choosing the largest and lowest cost funds.

In these terms we would have allocations to the US at about 50%, Japan at 9%, UK at 6%, Eurozone at 15% and 20% of Emerging markets.

Diversify not only in geographies, but also in the currency of the destination country

Diversification once again leads us to disperse our investments geographically.

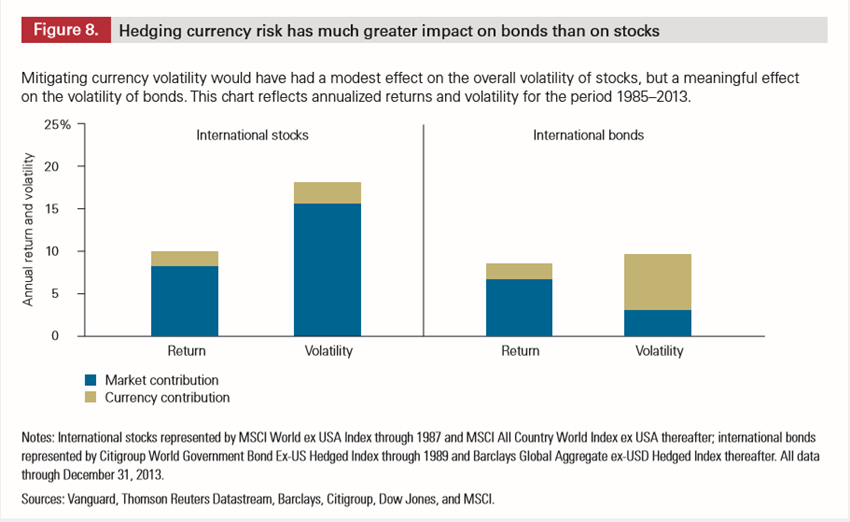

The following chart shows the currency volatility or foreign exchange risk in stocks and bonds investments:

It is concluded that it is not worth covering the currency volatility or the foreign exchange risk in stocks, being preferable to invest in the currency of the destination country, on top of the fact that the supply of these investment products is much higher.

Regarding investment in equities we must invest in the currencies of destination markets, i.e. US dollars for US stocks, Japanese yens for Japan, British pounds for the UK, euros for the Eurozone and so on.

In stocks we must invest in the currency of the destination country or without exchange conversion to our own currency, which contrasts with what we should do in our bond investments.

Investing in products indexed to the targeted stock markets and at a lower cost

Again, we should invest in the most diversified and lower cost investment products, which leads us to mutual funds and equivalent products, whether index funds or products with a similar investment policy, in any case aligned with the desired asset classes. Commissions can represent a huge cost in terms of accumulated capital at the end, reaching, in some cases, more than 50% of the capital appreciation.

In fact, indexed investment products are a growing trend of investment management evolution.

Among the various hypotheses we have the funds of Blackrock, Vanguard, State Street, Fidelity, etc:

In another post we develop in more detail these investment products.

Morningstar is a company specialized in the evaluation and comparison of investment funds, assigning ratings to each fund according to performance, profitability, risk, among other factors. Its rating covers most indexed investment funds. In this sense, it is a useful source of information for their selection:

https://www.morningstar.pt/pt/fundquickrankLegacy/default.aspx

https://screen.morningstar.com/fundselectoraol.html

In another post, we will deepen the information contained therein.

https://www.amazon.com/Little-Book-Common-Sense-Investing-ebook/dp/B075Z6HSCJ

https://www.amazon.com/Warren-Buffett-Way-Robert-Hagstrom/dp/1118503252