What are Savings?

What are Investments?

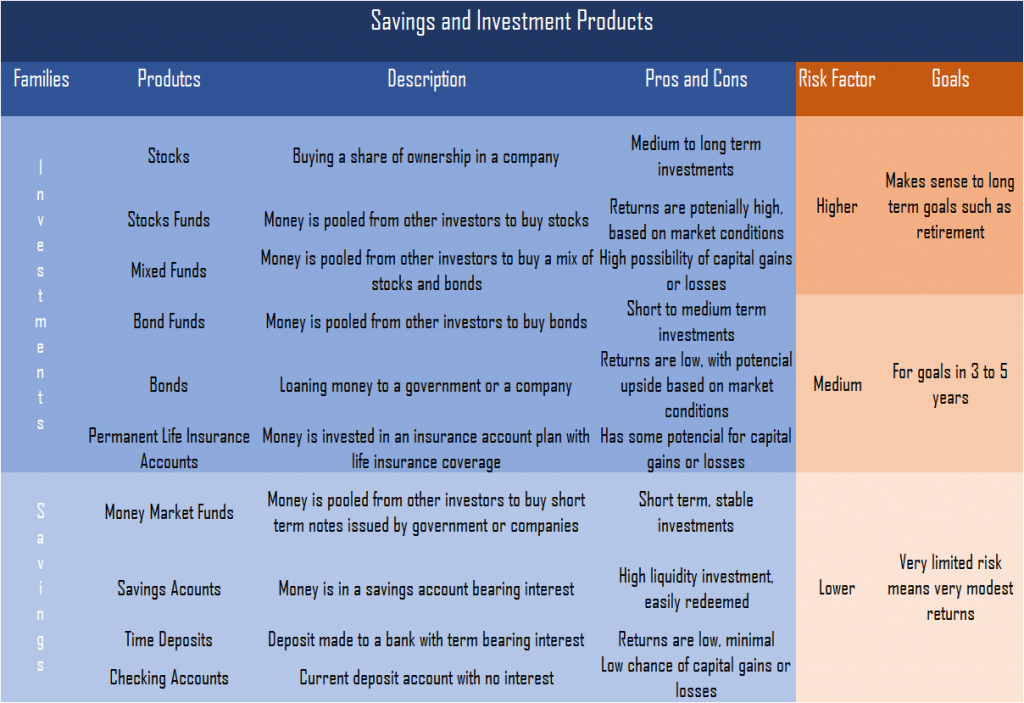

Savings and investment products

How much to Save and how much to Invest?

Why We Need to Invest

There is a lot of confusion between savings and investing. Unless we understand it we don’t know how much we must have of savings and investing money and why we need to invest.

There is a big difference between both. To understand let’s start to clarify an important issue that is at the root of the mess. To save or the act of saving (hoarding or amass cash) is different from money savings. To save is to not spend the money earned. Savings money is to put that money in a savings account. Investing money is to invest money in productive assets.

There are no savings or investments without saving money. To save or saving is the beginning. It is the process by which we have money that can be put to work for us. Savings and money and investing money is what kind of work we do with it.

What are Savings?

Savings are the process of putting cash aside and parking it in extremely safe and liquid accounts or securities (meaning they can be sold or accessed in a very short amount of time, at most a few days).

Above all, cash reserves must be there when you reach for them; available to grab, take hold of, and deploy immediately with minimal delay no matter what is happening around you.

What are Investments?

Investing money is the process of using your money, or capital, to buy an asset that you think has a good probability of generating a safe and acceptable rate of return over time, making you wealthier even if it means suffering volatility, perhaps even for years.

True investments are backed often by assets or owner earnings. The best investments tend to be so-called productive assets such as stocks, bonds, and real estate.

At its core, investing is about laying out money today expecting to get more money back in the future. Most of the time, this is best achieved by acquiring productive assets. Productive assets are investments that internally throw off surplus money from some sort of activity.

Savings and investment products

Savings products include:

a) Checking accounts and savings accounts secured by governmental Deposit Insurance Schemes;

b) Treasury bills;

c) Money market accounts (but not always money market funds as you need to look at the holdings and structure closely).

Investment products are:

- Business Equity or Stocks – When you own equity in a business, you are entitled to a share of the profit or losses generated by that company’s operating activity. Whether you decide to own that equity by acquiring a small business outright or buying shares of a publicly traded business through the purchase of stock, business equity has historically been the most rewarding asset class for investors. So much so that it has been wisely observed that a good business is a gift that keeps on giving.

- Fixed Income Securities or Bonds – When you buy a fixed income security, you are really lending money to the bond issuer in exchange for interest income. You can do it from buying certificates of deposit and money markets to corporate bonds, tax-free municipal bonds to a variety of government bonds.

Real Estate – There are several ways to make money investing in real estate but it typically comes down to either developing a property and selling it for a profit or owning something and letting others use it in exchange for rent or lease payments.

How much to Save and how much to Invest?

Savings should almost always come before making investments. The reason is simple. Unless you inherit a large amount of wealth, it is your savings that will provide you with the capital to feed your investments.

There are two primary types of savings programs you should include in your life. They are:

- As a rule, your savings should be enough to cover all of your personal expenses, including your mortgage, loan payments, insurance costs, utility bills, food, and clothing expenses for at least six months. That way, if you lose your job, you’ll be able to have enough time to adjust your life without the extreme pressure that comes from living paycheck to paycheck.

- Any specific purpose in your life that will require a large amount of cash in one year or less should be savings-driven, not investment-driven.

In general, all financial needs up to two years should be met by savings and not by investments, because markets can be very volatile in the short term.

Only once we have safeguarded these issues, as well as insurance coverage of all risks, or all insurance, including health insurance, can we start investing. The only exception will be to make contributions to corporate retirement plans that match or are linked to our contributions. This is because in addition to the tax advantage we receive for free the funds put by the companies.

Why We Need to Invest

We need to invest because we have financial life goals that can’t be achieved if we don’t invest. These goals are not only interest or wants but some of them are effectively needs, which we can’t afford to fulfil, such as retirement living and old-age health-care expenses.

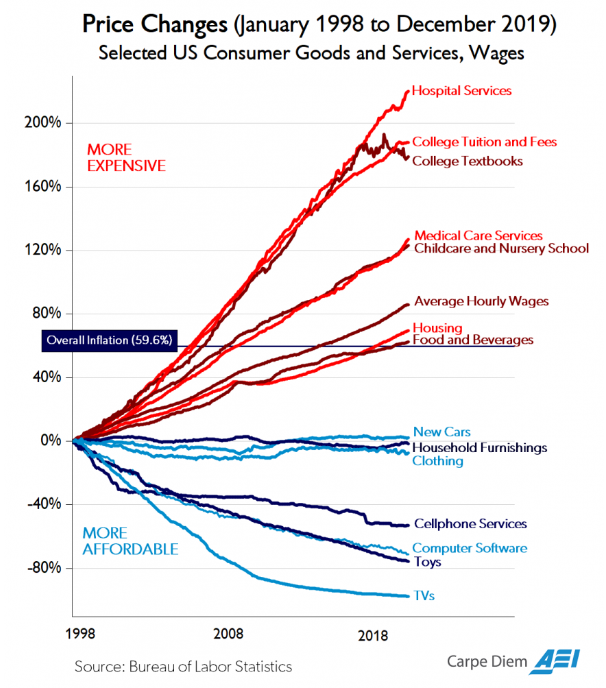

We need to invest because working income and saving money accounts aren’t enough to provide us to the life we want and most of all need. Wages growth barely has beaten inflation in the last 20 years in the US (around 1% per year more). That’s close to nothing.

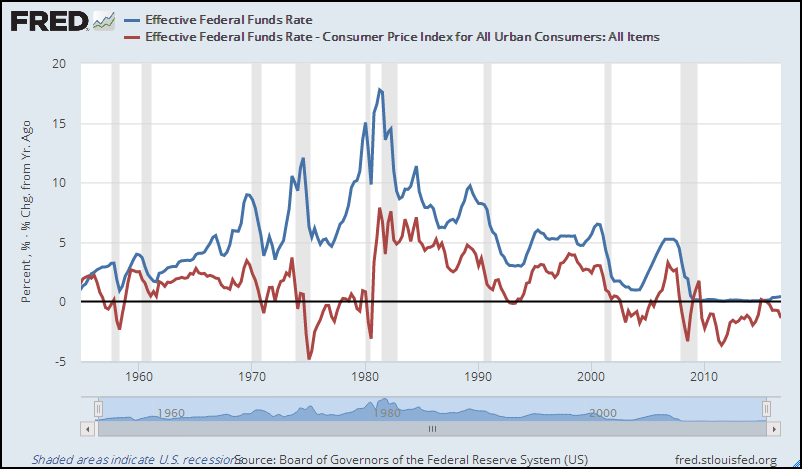

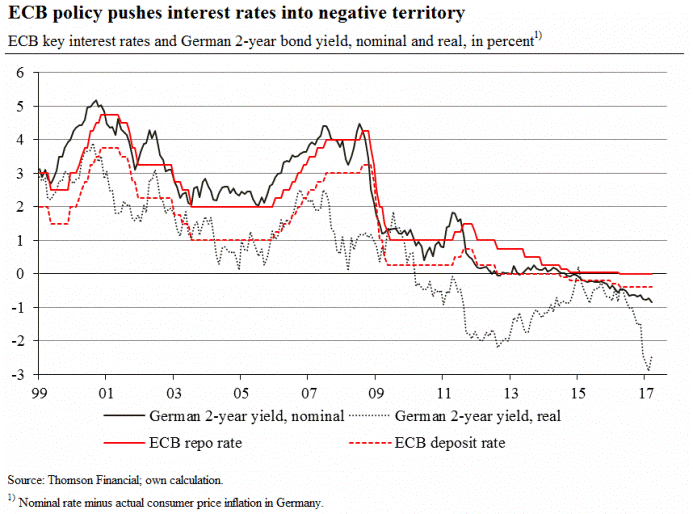

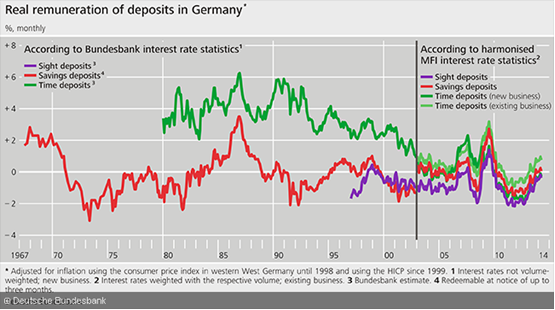

Deposit and savings accounts earn either zero or a minimal rate of interest. The maximum interest rate paid on those accounts would be close to the central banks rate.

The FED Funds rate in the US after inflation (real terms) has averaged slightly above 1% since 1954 and has been negative in the past 10 years. In the Eurozone the situation is similar since its creation in 1999. The real remuneration of deposits in Germany shows an equivalent situation.

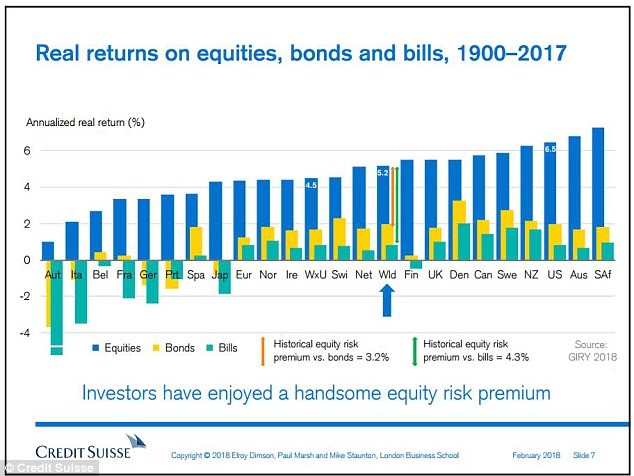

We shall see in another post with detail that the returns of investments around the world and also in real terms (after inflation) are well above, in the range between 2% to 5,2% per annum in world averages terms, respectively for 10-year treasury bonds and listed and quoted shares or stocks.