The main personal financial and investment goals

Everything we do in life has a purpose, an objective or a goal: in personal savings and investments the goals are objectives financial goals, whether needs or interests

Everything we do in life has a goal, explicit or implicit. Since we were born and throughout our lives. Childhood, adolescence and adult life. So, why don’t we follow the same in wealth management and investments execution?

The traditional wealth management sets investing the whole of our wealth. Modern wealth management consists of investing with and by objectives, splitting our wealth and income by targeted oriented goals.

We know that we want our wealth to fulfil multiple purposes or goals. These are objectives, in some cases unavoidable needs or important situations, and in other cases interests, or conditions to which we aspire.

Given that we save and invest to achieve future goals, that these goals are of greater or lesser timeframes and that the different assets have different returns and risks that vary greatly with the investment term, we should make the diversification of our wealth and the selection of investments according to our objectives.

This is the rationale of setting up and managing investments focusing on each goals, instead of following the traditional approach. What are the main investment goals we have?

The main personal financial and investment goals

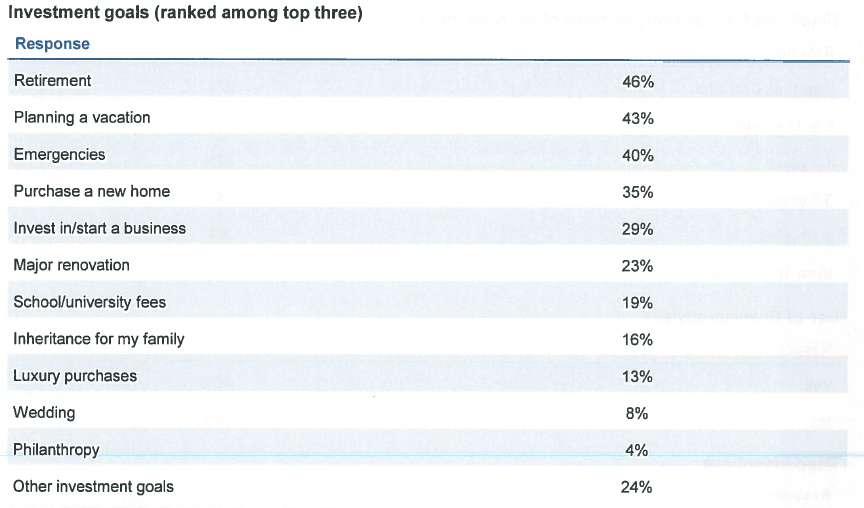

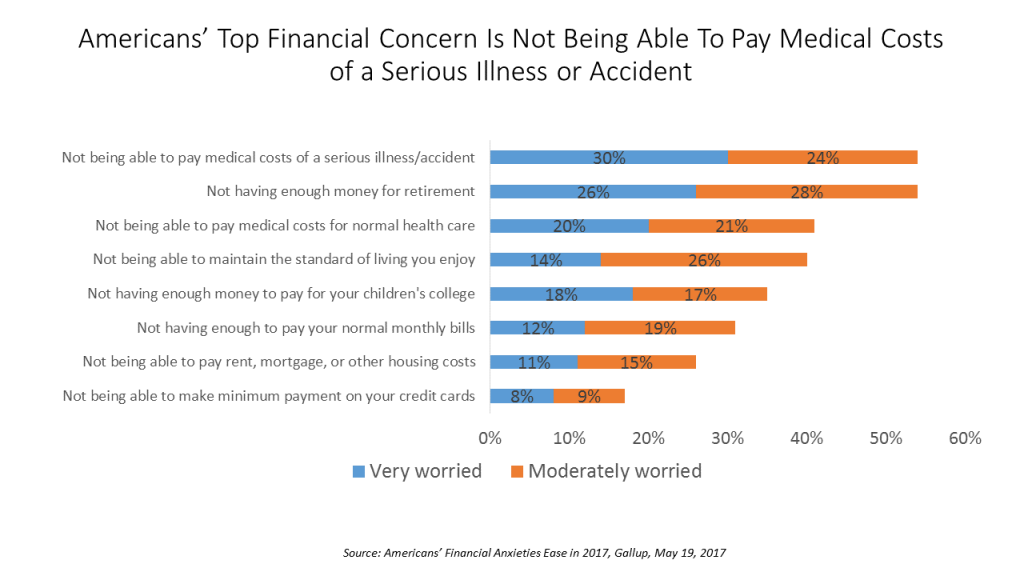

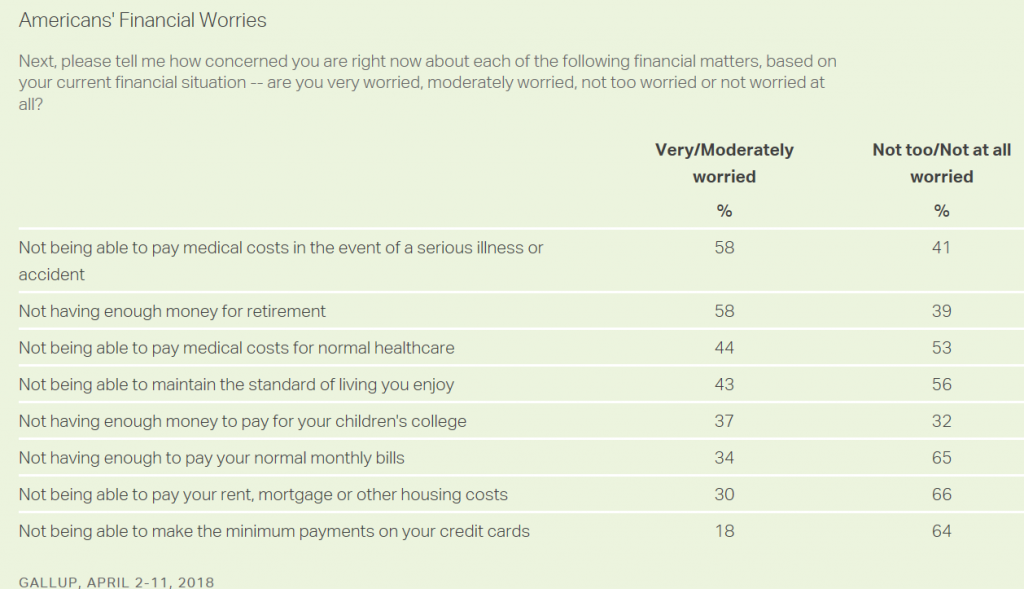

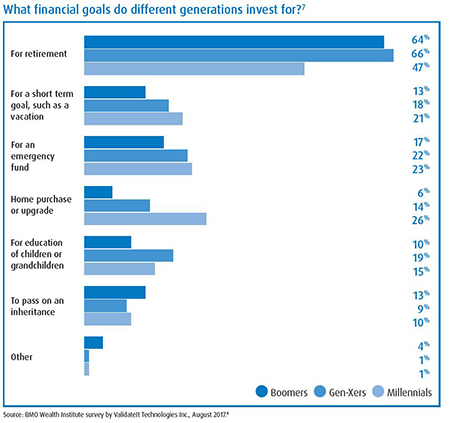

According to the surveys carried out, the main investment objectives and the most common are:

- Emergency fund or safety net;

- Retirement;

- Health care and senior living managed care;

- Pay-off debts;

- Large planned expenses (college tuition, home buying, capital to start a business, vacations etc.);

- Inheritance or bequest;

- General or global purpose wealth growth and transfer.

Fonte: Franklin Templeton

These are also the major financial concerns in the surveys carried out.

These main objectives are common to the various generations: the Baby Boomers (born between 1946 and 64), passing through Generation X (born from mid-1960 to the beginning of eighties), to the Millennials (born between 1980 and the start of the nineties).

https://news.gallup.com/poll/349241/americans-confidence-finances-mostly-recovered.aspx

https://www.thetimes.co.uk/money-mentor/article/top-financial-goals/

However, not all these objectives have the same importance for each of us. Some depend on the lifestyle, others on the life stage, etc.

In this case, but also because we have to bear in mind the conditions to achieve those objectives, we must take into account the financial life cycle, with its two phases of well-defined wealth evolution, and determined by the ability to generate income, the cost of life and accumulation of assets throughout our lives.

The financial lifecycle

We have a financial life cycle associated with our personal life. There is a pattern of evolution of personal finances common to all people throughout life.

This cycle comprises 2 stages of situation or well-defined states of finance:

- The accumulation of wealth that begins when we start working and earning money and ends when we go to retirement, i.e. between 20 and 65 years of age;

- The phase of preservation or deaccumulation of wealth, which begins at the age of retirement and goes to the end of our lives, normally from 65 years of age.

These two phases have different capacities of generating different incomes, generating savings, cost of living and wealth building or growth.

Fonte: Wealth Planning: UBS Wealth Management

This cycle attends for financial needs, interests and aspirations, that come up at different stages in our life. And it determines what our priority financial goals are at every moment.

The personal financial plan should be set-up based on the objectives, the situation and the specific conditions of everyone. It is up to each person to make their own financial plan. This is personal and untransmissible.

In a next article we will see how this plan can be elaborated.