What are cash and cash equivalents and what are their rate of return and risk?

There are 4 major classes of financial assets relevant to investment: cash, stocks, bonds and alternatives

The three most important asset classes are stocks, bonds and cash. The alternatives class makes it 4 in total.

Stocks have 2 main subclasses that arising from the degree of economic or financial markets development (developed and emerging) and 3 others associated with the companies size (large, medium and small).

Bonds have 3 main subclasses arising from the combination of geography with the degree of economic development (domestic, international and emerging), plus 2 from the nature or type of the debtor (government or company) and another 2 from the level or the quality of the credit risk (investment or speculative).

Cash has as main subclasses current and time deposits, savings accounts and currency.

The alternatives asset class comprises the subclasses of real estate, commodities, gold, hedge funds and private equity.

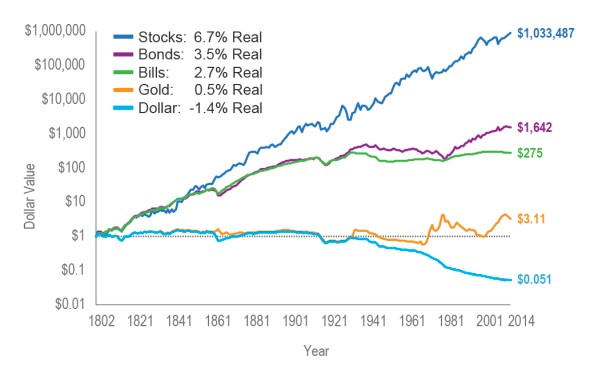

The annual real (inflation deducted) rates of return of investments in stocks of large companies and 10-year government bonds in the US, for the period between 1802 and 2014, was as depicted:

Source: The Future for Investors, Jeremy Siegel (2005) with updates to 2014

What are cash and cash equivalents and what are their rate of return and risk?

The cash and cash equivalents are money that we have under the mattress, in a piggy bank or deposited in banks, in current, time deposits and savings accounts.

Taken as a whole, all these money forms are called savings. Their income is null or very low, but has an immediate or almost immediate availability (hence the designation of monetary or quasi-currency availabilities). Their risk is also very low. Savings protect our net worth with respect to monetary (or nominal) capital losses but not to purchasing power.

The interest rate paid by deposits and savings accounts is usually low and sometimes even below the inflation rate, which makes the real rate of return zero or negative. This situation has worsened especially in recent years.

Since deposits are a bilateral contract between a bank and its clients, there is virtually no statistical data on the rate of interest paid.

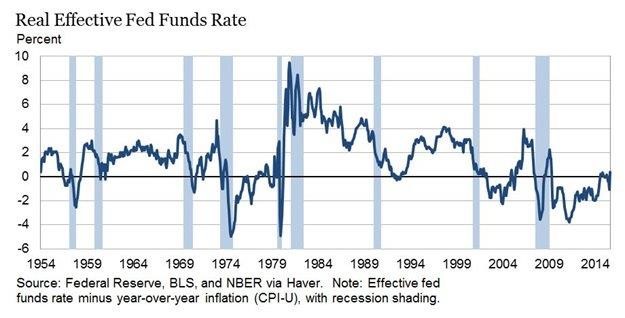

However, banks establish the deposits rate with reference to the funds rate of the central banks. This is because banks can borrow money from customers, other banks or from central bank, in this case usually with limits.

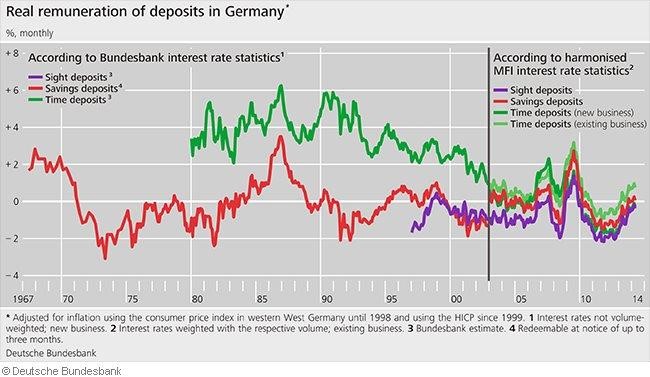

For Germany, there are statistics on the real interest rate paid on demand deposits, time deposits and savings accounts for the period between 1967 and 2014:

As expected, the interest rate paid is greater in time deposits which are not available ahead of schedule, intermediate in savings accounts and lower in sight deposits.

From the year 2000, the rate practiced was virtually nil for any type of bank account. Even in previous years, the actual interest rate in savings accounts was negative most of the time. Only in the 80s and 90s was the real interest rate positive, between 2% and 4%, for the time deposits.

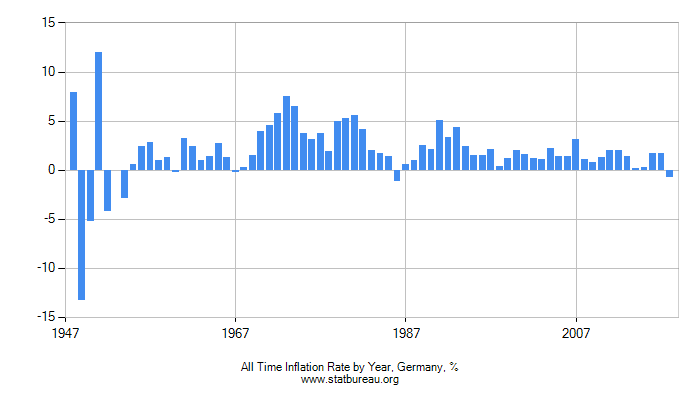

These decades coincide with periods in which the inflation rate was between 3% and 5%:

In most advanced countries, like the US and western Europe, the certificates of deposits are the are the best-paid savings or cash product because they normally have require high investment minimums and are monies invested by large companies or HNWI.

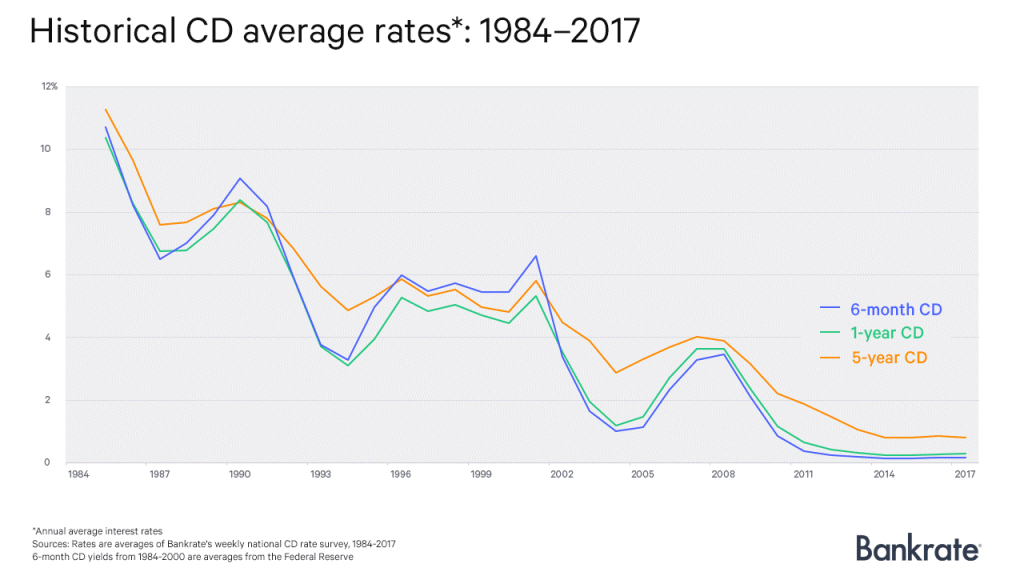

In the following chart, we can see the interest rates practiced in certificates of deposit in the United States between 1984 and 2017:

In recent years, interest rates have been set close to zero.

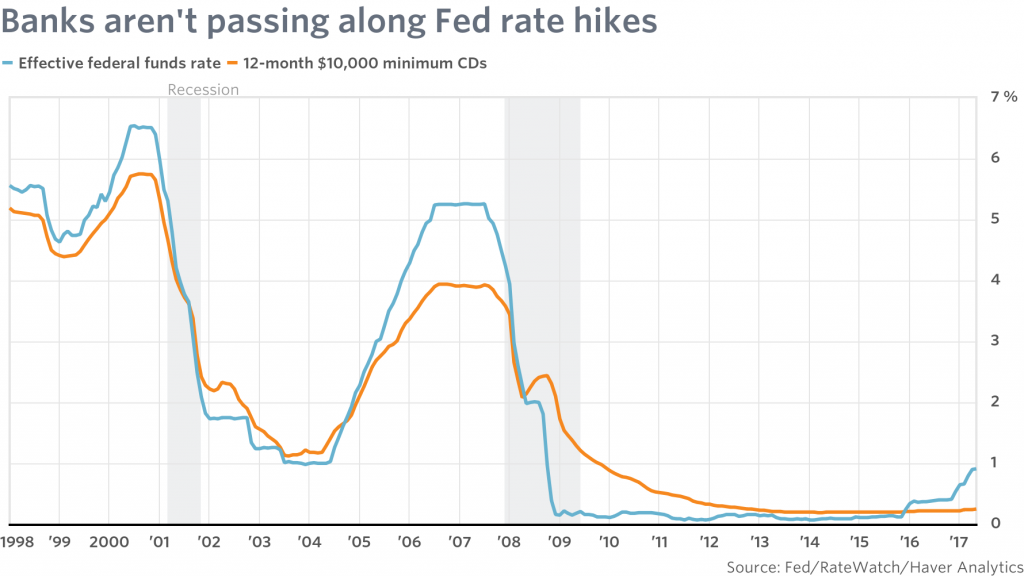

The following graph shows the evolution of the interest rates on certificates of deposit and the central bank reference rates, the FED, in the US:

It proves, what we said, namely that the interest rates of the certificates of deposit certificates basically reflect the central bank’s reference rate.

https://data.oecd.org/interest/short-term-interest-rates.htm

Cash and cash equivalents are financial investments or more adequately savings, used to cover for planned expenses up to 2 years and as a very short-term safe haven

Cash is in the form of banknotes and coins, at home or deposited in the bank, produces a low income and generally short of inflation, but has little risk. So, cash or deposits are more savings than investments, to the extent where the latter assume generally a productive asset that generates return and wealth.

Thus, the usefulness of cash comes mainly from its convenience as a means of payment for the expenses that we do on a daily basis or to which we can resort with immediate availability and without loss of value

It should normally be used to cope with the expenses that may occur within 2 years. For all financial objectives or needs that we have at time horizons equal to or greater than 2 years we must channel our funds for investments in financial assets.

As Warren Buffet said cash is a bad investment given its poor return, quoted: “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.”