We are witnessing a change of regime or structural paradigm, to a situation that is new and that many have never lived.

In the initial article we made the introduction and presentation of the approach to the theme.

In the second article we showed what happened in 2022, from a more global perspective of the development and performance of economic cycles and financial markets.

In the third article we analyzed the year 2022 in more detail, to identify the factors and consequences of this paradigm shift, at the conjuncture and structural level.

The goal is to understand what works in this cycle change, so that we can better design the future.

In recent years we have lived in a context of financial conditions – interest rates and monetary liquidity – very different from what has developed since mid-2021

Interest rates have declined sharply since the 1980s and provided a sustained appreciation of bond investment.

This long bull market of bonds was related to the successive policies of quantitative easing, which developed with greater or lesser intensity in this period.

These programmes were stronger in the period between 2008 and 2016 for the recovery of the Great Financial Crisis, and especially in the period of economic and financial combat against the pandemic.

These policies have helped to create the inflationary pressures that began to emerge in mid-2021, alongside the bottlenecks in supply chains and which worsened with the war in Ukraine.

Given the perverse effects of high inflation on the economy of households and businesses, monetary authorities had to reverse the policy of previous years to fight this inflation.

And they started a program to raise interest rates and sell balance sheet assets to contract excess liquidity, known as quantitative tightening.

Quantitative tightening has the effect of raising the cost of money for households, businesses and governments, and thereby reducing private consumption, public spending and investment, i.e. aggregate demand.

This change in context and economic cycle has led to the adjustment of bond and stock prices, and the consequent devaluations of their investments

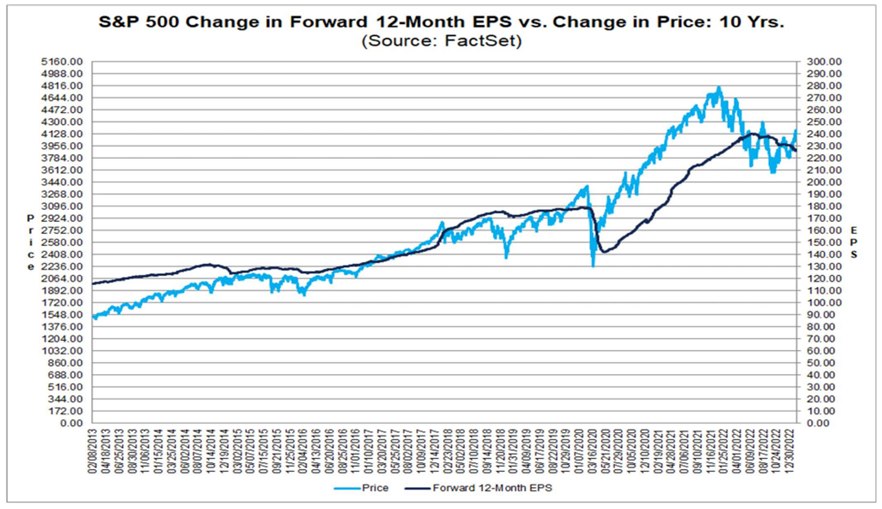

For stocks , this interest rate increase occurs through two effects.

The increase in the cost of financing for companies, both debt and capital, leads to a decrease in their earnings.

The economic slowdown resulting from declining demand, the expectation of lower business results, and competition from bond investment bring down the market valuation multiples.

The adjustment of the bond market is faster, because almost all investors are professionals, and depend only on expectations of interest rate developments, and consequently on inflation.

The adjustment of the stock market is slower because the effects on companies and investors (especially private investors) take longer to make themselves felt.

To this extent it is useful to assess where we are in this process.

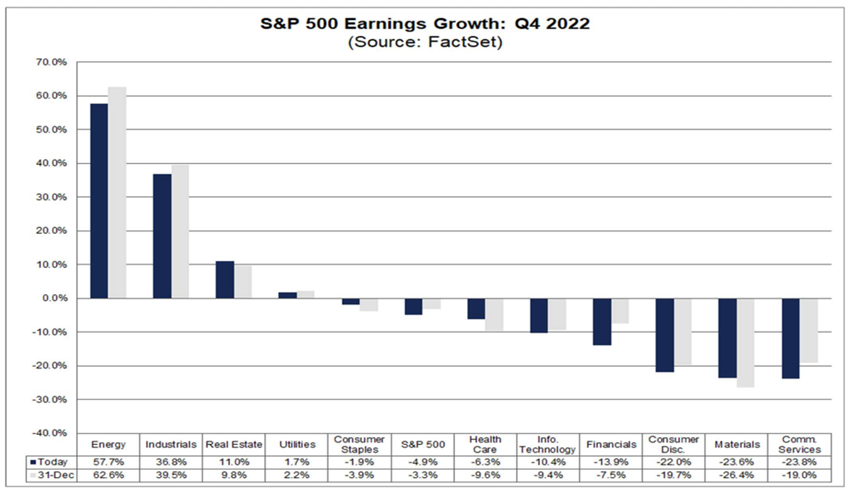

The decline in company earnings (EPS) is also differentiated depending on the activity and business

In mid-February, 70% of U.S. companies that make up the S&P 500 index have already presented earnings for the last quarter of 2022:

These companies showed a 4.9% decline in earnings growth in this quarter, the first since Q3 2020, and higher than the 3.3% estimated in December 2021.

The earnings guidance for the first quarter, was mostly negative (58 negative companies versus 13 positive companies).

Analysts have lowered the S&P 500’s earnings estimates for the end of the year gradually, currently at $225.

Many institutional investors predict that this figure could fall to $210-215 if the high level of interest rates (and inflation) extends longer than expected, and could fall below $200 if there is a recession.

In sectoral terms, earnings have evolved as follows:

The sectors most affected have been communications, materials, consumption durables, financials, technology and healthcare, and the most favored are energy, industry and real estate.

There is no recent data publicly available for the earnings estimates of non-US companies, particularly European ones.

However, expectations are also low for the earnings season that began in the first week of February for the end of 2022, as well as for 2023 guidance.

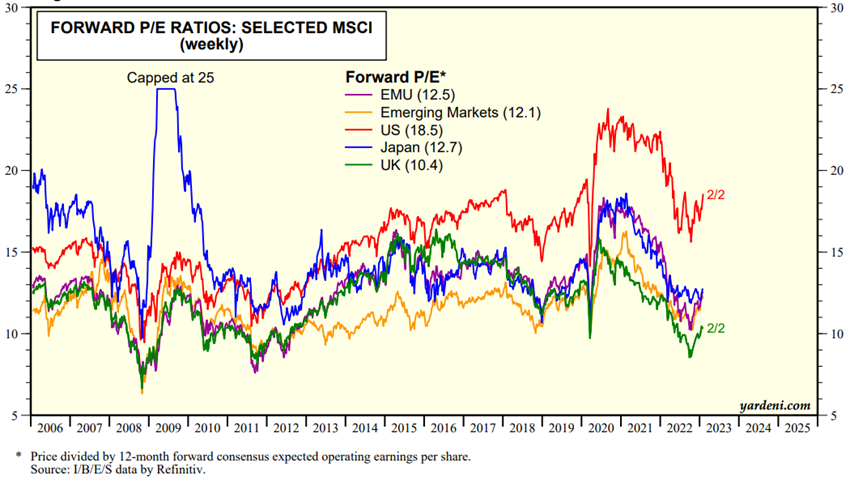

The decline of valuation multiples is not the same for all segments of the equity market

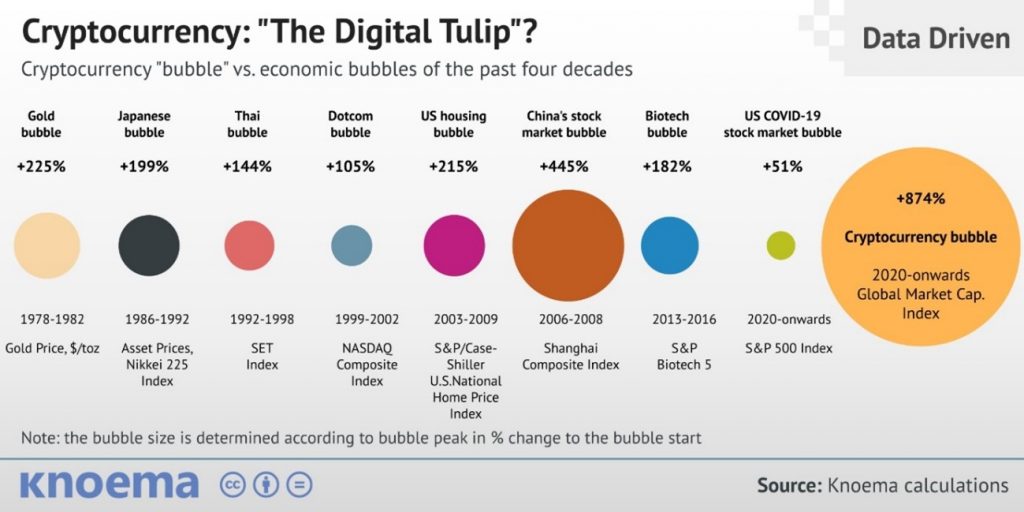

As we have seen before, market excesses have manifested themselves in valuation excesses of the various assets, particularly in cryptocurrencies, but also in equities.

These excessive equity market valuations have been corrected and, in general, we will already be close to long-term mid-term levels if a recession is avoided and a smooth cycle transition is achieved.

If the recession is a little deeper or the economic slowdown is a longer one – that is, if inflation is tighter and interest rates are at a higher level for longer than expected – the consequence will be a further contraction in business earnings and lower multiples.

It is important to note that the correction of evaluations has been very profound.

In the following charts we have the evolution of the valuations of a set of assets, given by the PER multiples (ratio between companies stock price and earnings), over the last few years, and it is worth focusing on the 2022 correction.

Let’s start with the main indices of the equity markets of various countries or geographies:

The drop in 2022 was more than 20% in all geographies, and the first month of 2023 showed a recovery.

The US market has a PER of 18x, well above the long-term average, while the PER of 12.5x in the Eurozone, 12.7x in Japan, and 12x in emerging markets are slightly below average (the PER of 10.4x in the UK is much lower than average).

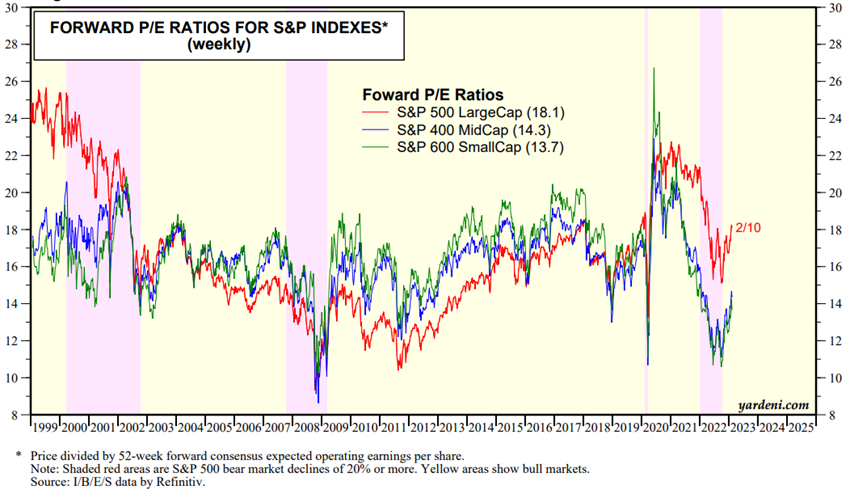

Next, let’s move on to the company size indexes or market capitalization in the U.S. market:

In 2022, the PER drop was very marked for all capitalisations, with falls from more than 22x to less than 16x, mainly for small and medium capitalisations.

The 18x PER of large capitalisations is above the long-term average, while the 14.3x of the averages and 13.7x of the small ones is below the respective average.

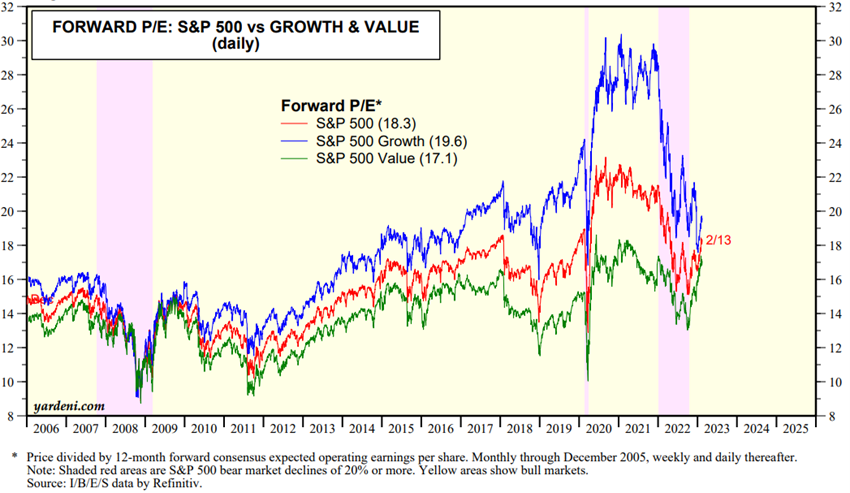

Finally, we cover the indices of value and growth styles:

In 2022, there was a drop in PER in both styles, but much stronger in growth than in value.

Currently, both the PER of 19.6x growth and 17.1x of value are above their long-term average.

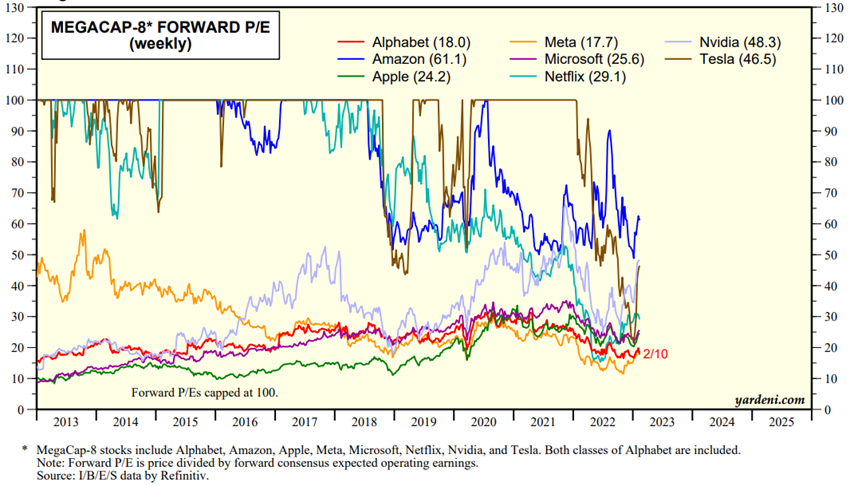

In terms of the stocks of the American mega-companies widely held by investors, developments have been as follows:

The PER’s of these companies fell a lot in 2022.

Almost all of these companies currently quote below the long-term multiples, except Apple and Microsoft that have had less pronounced declines.

This adjustment process of the stock markets, through the companies earnings and valuation multiples, has come a long way, but is still ongoing.

In the next article we will see what we can expect in the next future.