How many years do our pensions last? The total present value of pensions due measured in the number of last annual salaries in the OECD

The calculations we can make

The central questions of many of us are these:

Do pensions last long enough to live well all our lives?

We’ve contributed a lifetime for over 40 years. With these contributions we make a piggy bank to last how many years?

Can we live with this alone or are we going to run out of money?

How many years do our pensions last? The total present value of pensions due measured in the number of last annual salaries in the OECD

OECD analyses every year the situation of pensions in each country belonging to the organisation using the respective average pensions as a reference.

One of the useful information is the calculation of the number of years our pensions last.

This is obtained from the assessment of the wealth or assets of the pensioner’s rights and their comparison with the annual wage.

This is calculated as the amount or capital financially equivalent at the present time to the sum of payments with pensions made throughout life to the pensioner for the compulsory pension system of each country.

It takes into account people’s retirement age and life expectancy, as well as pension indexation rules.

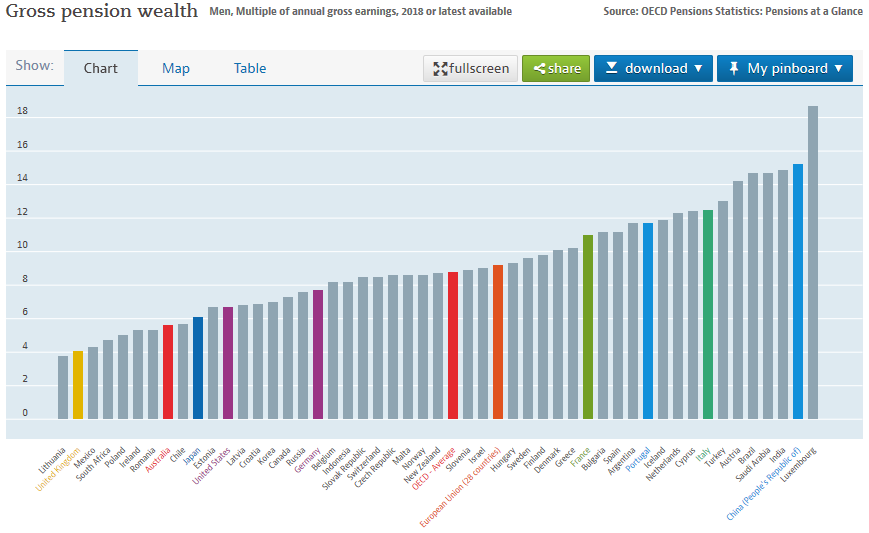

For OECD countries, the latest available data show that these figures also known as gross pension wealth were as follows:

The average pension paid in Portugal is equivalent to about 12 years of gross wages, above what is the case in the average of the countries of the European Union and the OECD, where the figures are about 10 years of wages.

Luxembourg is the country where this pensioner’s assets are the largest, valued at more than 18 years.

There are some very well-placed emerging countries such as Brazil, China and India, which pay over 14 years of wages.

In the US, Japan and the UK, pensions as a percentage of wage are lower and equate to less than 7 years of gross wages for the first two countries and just over 4 years of wages for the latter.

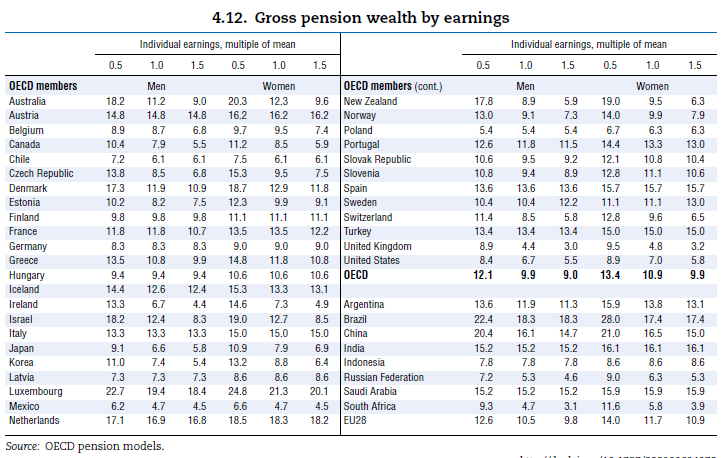

The OECD also determines the gross wealth of pensions for households with different income levels and by gender:

We see that the lower the income the higher the gross wealth of pensions and vice versa.

We also see that women have a higher gross wealth, which is directly associated with their greater longevity.

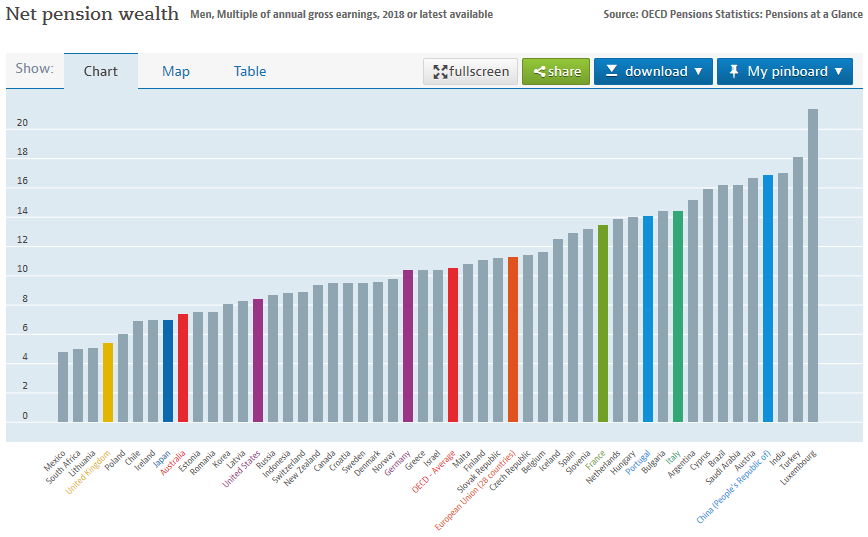

Similarly, the OECD publishes pension wealth in net terms:

In Portugal the net present value of pensions is equivalent to 15 years of net wages, which compares with 11 to 12 years in the OECD and European Union, 7 years in the USA and 6 years in the UK.

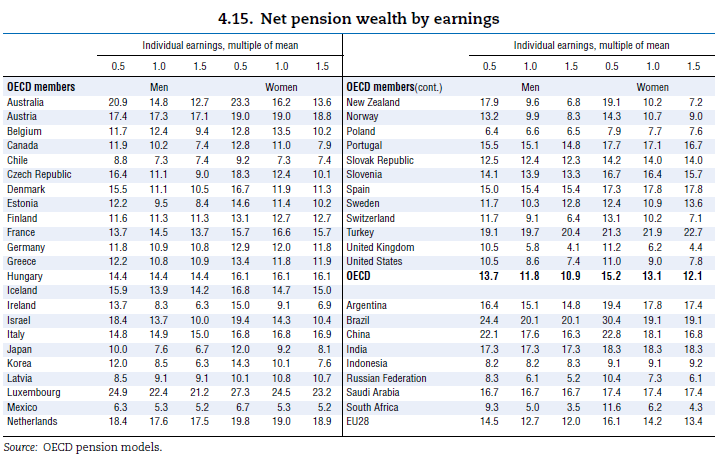

The net wealth of pensions by various levels of income and gender is as follows:

In Portugal pensions amount to about 15 years of net wages.

The positions of the other countries mentioned above remain more or less the same, improving the number of years for almost all economies due to the fact that the tax regime is more favourable for pensioners than for workers.

https://www.oecd.org/daf/fin/private-pensions/Pension-Markets-in-Focus-2021.pdf

The calculations we can make

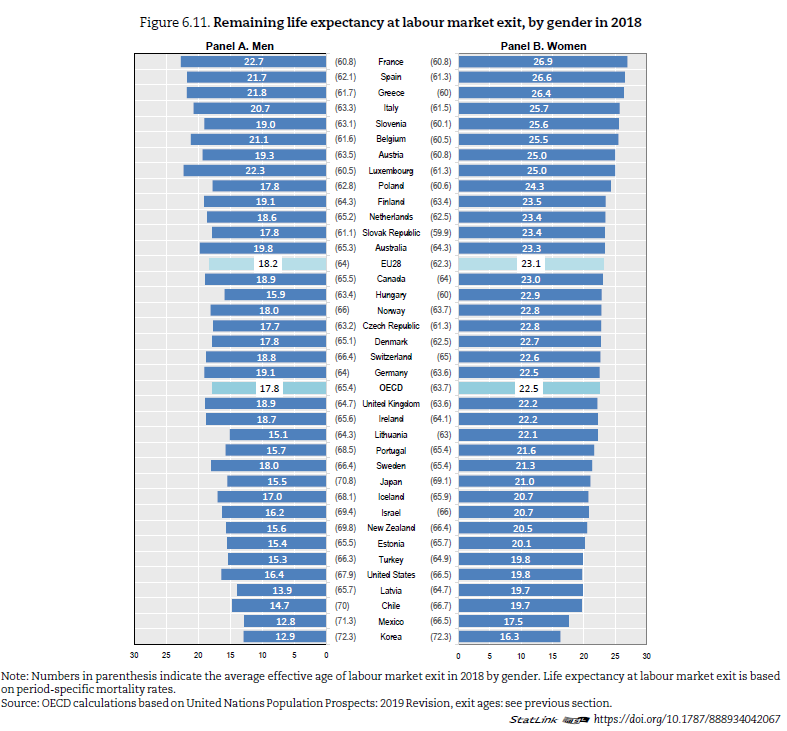

The issue that matters most to pensioners is to compare these realities with longevity or average life expectancy in these countries, or better yet with the number of average years in retirement, which was as follows:

The average length of life in retirement is 17.8 years for men and 22.5 years for women in OECD countries, and 18.2 years for men and 23.1 years for women in the European Union.

In most developed countries life in retirement is more than 20 years for women and 18 years for men, with France in the lead, followed by Spain, Greece and Italy, with South Korea, Mexico, Latvia and the USA at the bottom.

Thus, in general, the life of current pensioners is longer than the number of years of wages paid to pensioners. The same is to say that if the pensioner makes a life in which he spends the same as a salary, the money is not enough for life.

In some countries this difference is very significant, reaching more than 8 to 10 years in the USA, Japan and the UK, 8 years for the average of the countries of the European Union and the OECD and 3 to 5 years for Portugal.

Só há duas formas de resolver esta situação. Gastar menos do que o salário, que normalmente é o que se passa uma vez que há vários estudos que apontam para que o reformado necessite apenas de 85% do último salário, em média, para manter o nível de vida.

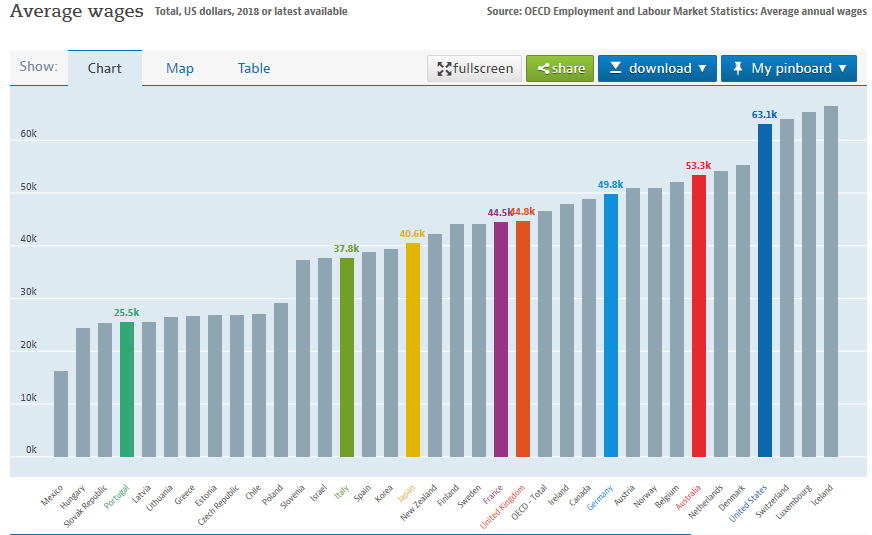

To have a more complete view of the situation of pensions in the world it is important to know the values of average wages practiced in these geographies, corrected by purchasing power

The average annual gross wage adjusted for purchasing power is about $25,400 in Portugal, which compares with nearly $40,000 in Spain, slightly more in Japan and the UK, and $60,600 in the US.