China is traditionally and culturally a country of high savings rates, both nationally and householdly, and there is no prospect of change

The weight of private consumption in China is far from that of more developed countries

The effects of the construction sector crisis on wealth, income and employment have further constrained consumption in recent years

The fall in house prices in medium and small cities (level 2 and 3), which account for more than 60% of the total, has also normalized savings rates to high levels

This article is part of a series dedicated to investing in Chinese stocks.

In the second article, aspects of China’s strong economic growth over the past 4 decades were developed.

The third article was divided into two parts, the first addressing the performance of the Chinese stock market in the last 4 decades, while the second provided a framework for the prospects of foreign investors’ understanding of the economic reality and the markets.

In the fourth article, also divided into two parts, we began to develop the main challenges of the Chinese economy.

In this article we analysed how it all started, the problem of the construction sector, explaining its direct and also indirect effects.

It was thought that this would be the central problem, combined with the draconian Covid response policy.

But appearances are often deceiving.

In the previous article we showed that China’s problem is deeper and more structural, and focuses on the lack of change in the economic development model, from an economy based on public investment to an economy driven by private consumption.

Chinese government authorities intend to stimulate and boost consumption to grow the economy, but have been unable to achieve this goal.

In this article, we begin an explanation for this fact, starting with the prudent reaction of households to the current insecurity of growth, wealth, income and employment caused by the real estate and financial crisis.

In previous articles we have already developed the size and weight of the Chinese economy in global terms, its enrichment in recent years, as well as its convergence with the most developed countries.

Also in previous articles we have addressed the growth of investment in emerging equity markets, as well as their attractiveness, with emphasis on the Chinese market.

In another article, we also delved into the specifics of the structure, functioning and activity of the Chinese stock market.

China is traditionally and culturally a country of high savings rates, both nationally and householdly, and there is no prospect of change

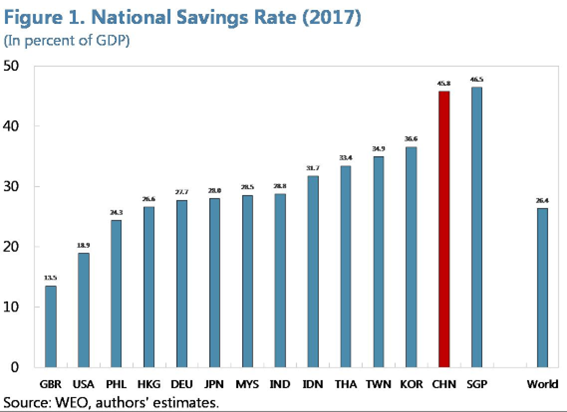

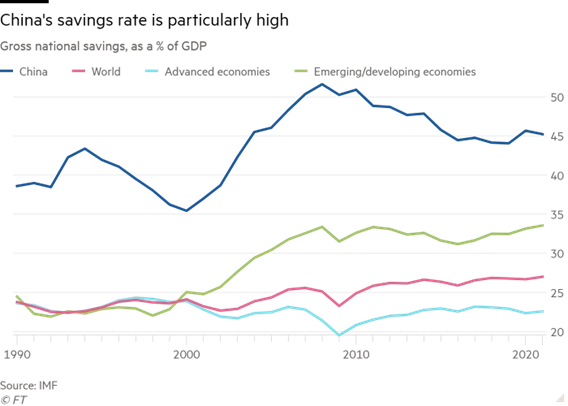

China has one of the highest savings rates in the world.

After the country’s entry into the World Trade Organization (WTO) in 2001, its national savings as a share of GDP increased steadily until a peak of 52% of GDP in 2008, before gradually declining to 46% in 2017.

Despite this moderation, China still stands out compared to the global average of 20% (15% for emerging market economies):

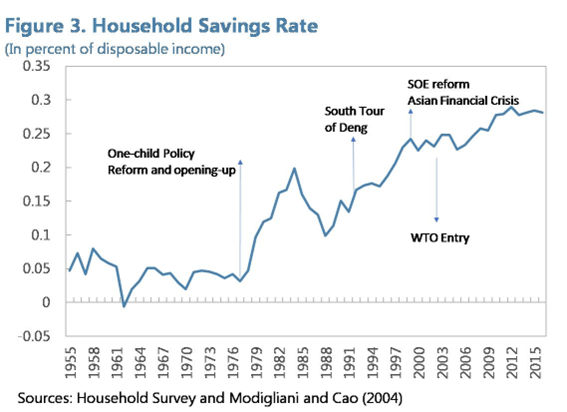

In terms of composition, the household sector has become the main driver of the increase in savings in China.

In 2013, household savings accounted for 23% of GDP, compared to the global average of 8%.

The most recent studies show that the increase in household savings was largely due to changes in the demographic structure and gender imbalances resulting from the one-child policy.

They have also played an important role in increasing savings, increasing income inequality, transforming the social safety net and job security during China’s transition from a centrally planned to a market economy, and developing market prices and housing ownership rates.

The weight of private consumption in China is far from that of more developed countries

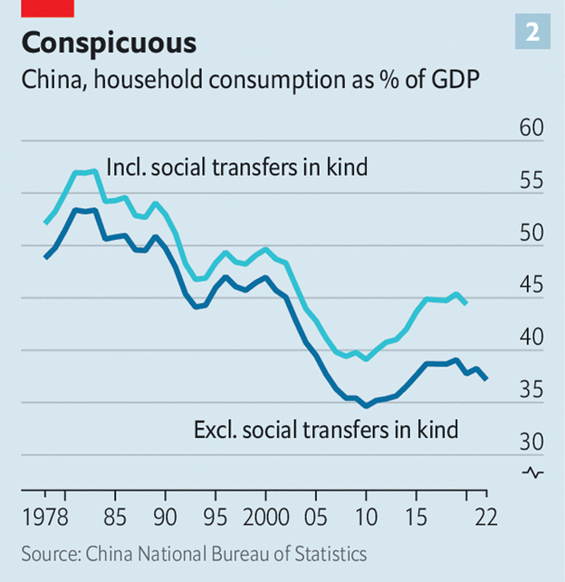

Private consumption in China has a very small weight in GDP:

Private consumption in China accounts for 37% of GDP before government transfers, and 45% counting transfers, still far from the 2/3 of developed countries.

Private consumption has accounted for less than 40% of GDP in recent years.

This represents a sharp decline from levels during the first two decades of economic reform in the 1980s and 1990s and well below the level of 60% or more in most Organisation for Economic Co-operation and Development (OECD) economies.

In the decade before COVID, China achieved some success in reorienting its economy toward higher consumption-led growth.

Between 2010 and 2019, private consumption as a percentage of GDP increased from 34% to 39%, although household disposable income as a percentage of GDP changed little over the same period.

Household savings as a percentage of disposable income also declined from 42% in 2010 to less than 35% in 2019.

Part of this success was driven by a strengthened social safety net, i.e., government spending on items such as health care, pensions, and unemployment benefits, encouraging citizens to consume rather than save for the future or for a medical emergency.

For example, according to the World Health Organization, the share of household health spending in China has fallen from more than 60% in the early 2000s to 35% in recent years, suggesting that medical insurance coverage has expanded in China.

The effects of the construction sector crisis on wealth, income and employment have further constrained consumption in recent years

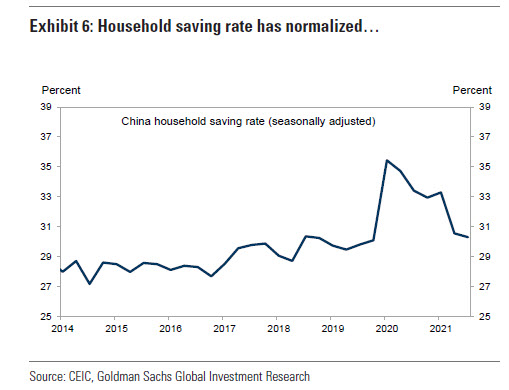

The Covid pandemic has wreaked havoc on this consumption progress.

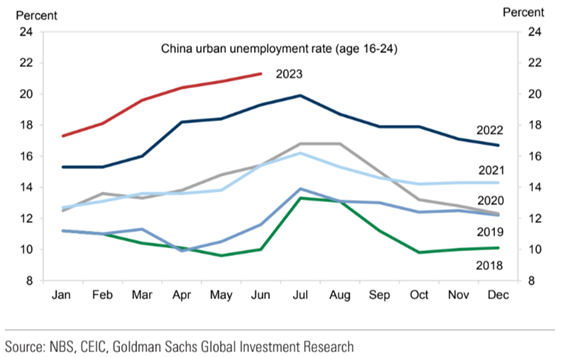

Unemployment rates, especially among young people, have increased, while consumer confidence and household income expectations have weakened, causing savings to rebound to 38% of disposable income in 2020.

The crisis of construction, real estate and its effects on wealth, employment, and income, restrain consumption in a society with low social security.

The economic slowdown and the construction crisis have increased youth unemployment to more than 20%:

Unemployment rates among workers aged 16-24 reached almost 20% at the beginning of this year and remain high at 17%.

Chinese households are now sitting atop a mountain of savings deposits roughly equivalent to China’s GDP.

The fall in house prices in medium and small cities (level 2 and 3), which account for more than 60% of the total, has also normalized savings rates to high levels

Households are putting money into savings at record levels, in particular in term deposits with maturities of 3 to 5 years that are expensive to redeem in the short term.

The global slowdown is likely to affect employment in China’s export-oriented manufacturing sector.

The slowdown in China’s real estate sector will continue to hurt the job outlook in construction and related sectors, affecting employment and incomes.

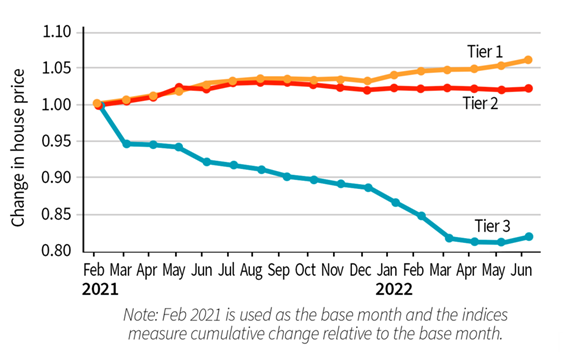

The government is trying to stabilise expectations about property values, but housing prices in the less regulated secondary market are already falling in tier 2 (medium) cities, and especially in tier 3 (smaller) ones:

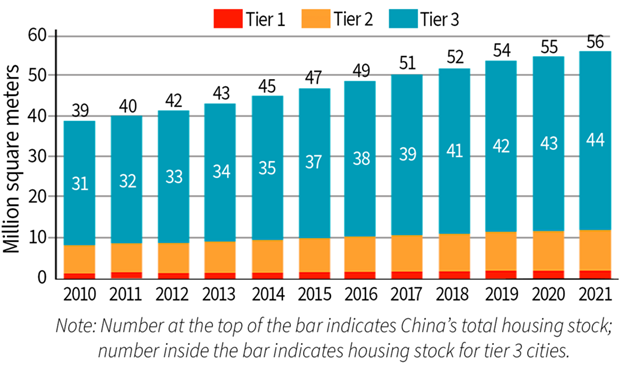

A significant share of total housing construction (78% in 2021) is concentrated in hundreds of tier 3 cities, whose prices have fallen by 20% and where the population is expected to continue to shrink, increasing the imbalance between supply and demand.

Demand for new housing in tier-3, smaller, low-income cities is expected to decline by about 30% from current levels by 2035.

As tier 3 cities account for 60% of China’s national GDP, this real estate slowdown poses a significant and often overlooked risk to the overall economy.

Falling home values typically weigh on the propensity to consume, because a substantial portion of household wealth is tied up in real estate.

In addition, household savings rates have returned to very high levels, for reasons of prudence and in view of the increased economic and financial insecurity:

In the following articles, we will continue to delve into each of these aspects and the consequences regarding the interest of the Chinese stock market for foreign investors.

This central question of the attractiveness of the Chinese market is very pertinent because, as we know, investing well means diversifying risks, doing so, above all, in the world’s largest economies and companies, and privileging those that are world leaders and consumer goods, in order to put the economy to work for us.