To invest is like to run a long marathon, starting early, with effort and preparation, without shortcuts and with clear a direction and strong determination, to grab the returns at the finish line

When to invest? There is no right time to invest, or rather, all times are good

Investors pay dearly for mismanagement of investing timing

Successful investors invest in the long term

Even in a short term as only a year it is exceedingly difficult to do market timing

Even in a shortest term, such as a daily basis, it is difficult and expensive to make market timing

The best time to invest is as early as possible and for as long as possible

We must also do the annual rebalancing so that we do not deviate from the objective and risk profile

When to invest? There is no right time to invest, or rather, all times are good

We know that to invest well we must diversify. We know that to diversify well we must choose the allocation of assets in terms of the most appropriate categories of financial investments.

We know that this allocation depends on the term of the investment objective and our investor profile. What we need to know is when to invest and what instruments to invest in. This article answers the first question: when to invest?

In other words, we know why, how and in what or where to invest. It remains to be seen when, at what time and for how long to invest.

This question arises mainly in relation to the asset of greater risk or fluctuation of value in the market that are the stocks.

The fear that exists is to buy at a very high price or more serious face one of the strong market corrections in which the stocks can lose 30% or even 50% of the value, as happened in the Great Depression of 1930 or in the technological bubble of 2000-2003 or in the Great Financial Crisis of 2007-2008.

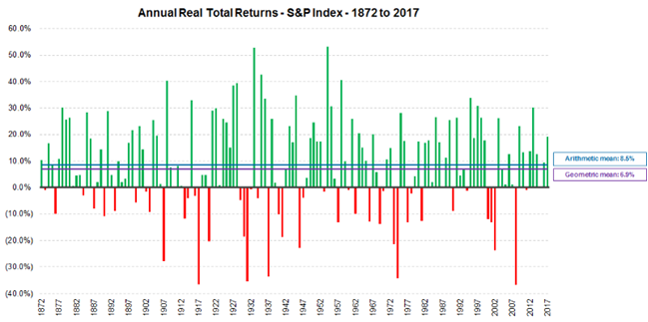

Put another way, can we do something to be invested most of the time, but trying to avoid at least some of the sharpest negative annual real profitability of the S&P 500 in the period from 1872 to 2017 marked red?

Some people go a little further and have the idea that they can choose the “right times”, when markets provide the best valuations, whether in terms of years, months or even days.

One of the best ways to know what we should do is to learn from the results obtained by individual investors, their successes, and their mistakes.

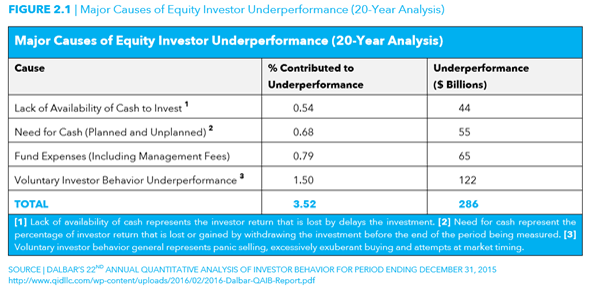

Investors pay dearly for mismanagement of investing timing

The average private investor has poor performances for being undisciplined and impatient.

The main causes for this weak performance of investors in general are behavioural and intentional attitude that represents almost 50%, followed by the costs of funds that we have already talked about in another article. Behavioural errors consist of selling under panic, buying in euphoria, and seeking to do an impossible market timing.

Today we know that we are subject to making mistakes derived from behavioural biases and that they are difficult to combat. We only succeed with understanding, rationalization, rules, and discipline.

We must learn and know how to think slowly and avoid thinking and acting impulsively as Kahneman and Tversky defend, or Thaler, the great thinkers of behavioural economics.

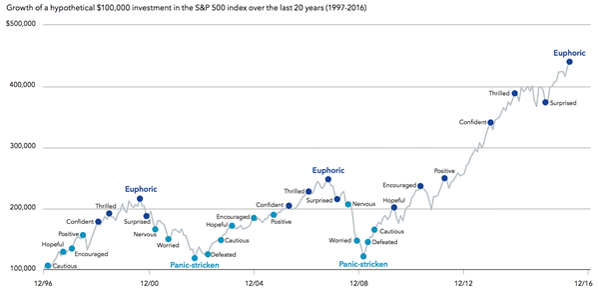

We often buy investments in euphoria and sell them in panic or despair. When the topic of investments is the subject of talk of taxi drivers instead of football (or Uber, Lyft drivers, etc.) or coffee among women replacing what goes with fashions and royalty it is time to leave the market. On the other hand, when no one speaks or after large market losses it is time to maintain and if possible, even strengthen investments.

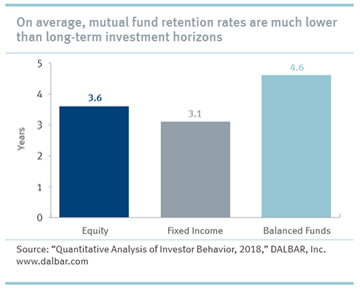

These biases are manifested in the inability to retain the investment for long periods. On average we invest only for 3.6 years in equity funds, 2.1 in bond funds and 4.6 years in mixed funds. These periods are far from medium and long-term. What are we going to do? We sell the investments ahead of time to exchange them for others or to try to make the choice of time.

Successful investors invest in the long term

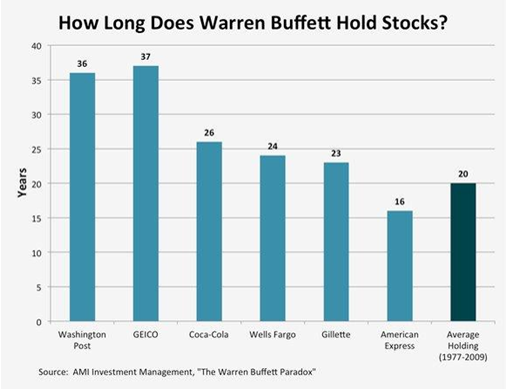

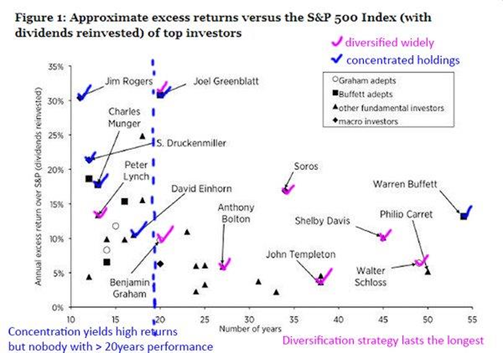

Exceptions are some of the major world class investors that have managed to achieve higher returns and are characterized precisely by having very long investment holding times.

After all, if someone was able to anticipate the evolution of the market would act solely on their own and not share it with others, would become immensely rich and well known, their strategy would be disseminated to everyone and the markets would adjust.

There are no consistently winning active strategies in efficient markets.

They are a mirage that many pursue. They are the last cry of fashion that many advertise, or the invention of the century or of the millennium.

Even in a short term as a year it is difficult to do market timing

We may think that predicting for the medium and long term is difficult, but that in the short term it is much easier. However, the way in which stock markets evolve makes it exceedingly difficult to get it right even in the short term.

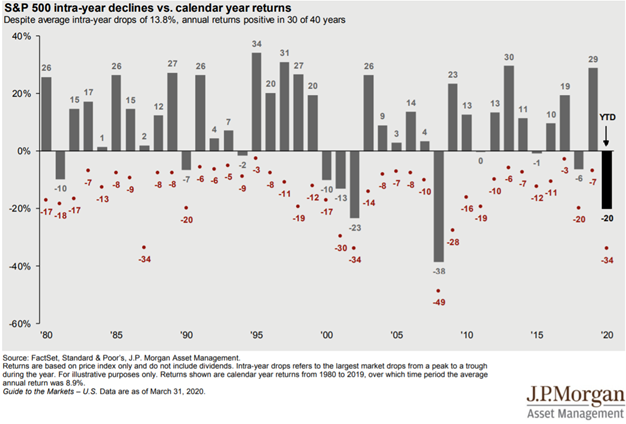

The following graph shows that even in years with positive returns there have been enough corrections greater than 10% and almost 20%, enough to put us in cautious mode:

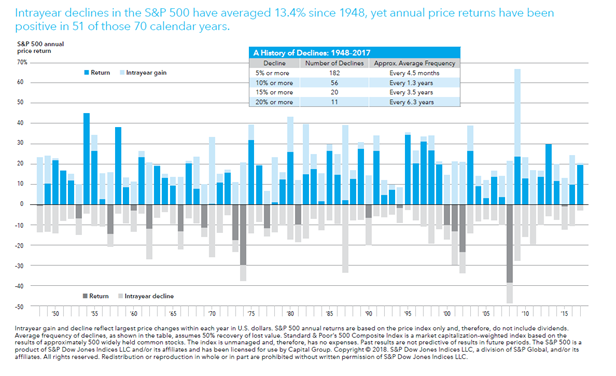

The following chart shows that despite the positive returns of the S&P 500 in 51 of the last 70 years, in each year there has been average devaluations of 13.4% that could have caused many investors to give up these investments out of excess concern or anxiety. If this were to happen, the average annual return would have disappeared.

Even in a shortest term, such as a daily basis, it is difficult and expensive to make market timing

Getting it right on daily basis is very difficult.

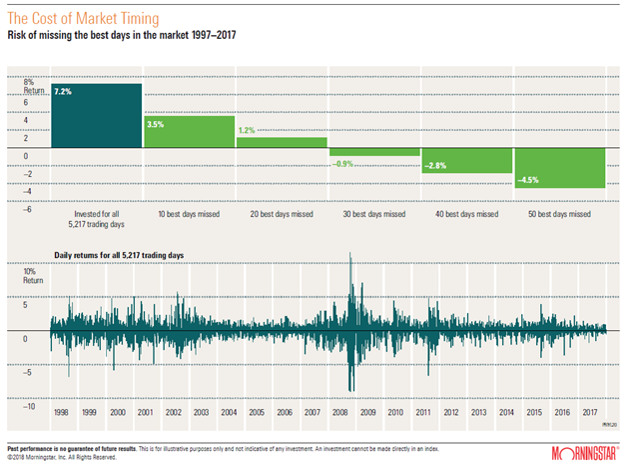

The following chart shows the average annual profitability from 1997 to 2017 that we would get if we were always invested versus if we lost some of the best profitability days in the market.

That is more than 5,217 days spread over 21 years. It also shows that if we lose the best 10 days, we lose almost half of the profitability, and if we lose 30 days the profitability becomes negative. And it is easy to lose them if we’re not always on the market. We know that in this period, 10 of the best days occurred in the two-week interval of the 10 worst days

The best time to invest is as early as possible and for as long as possible

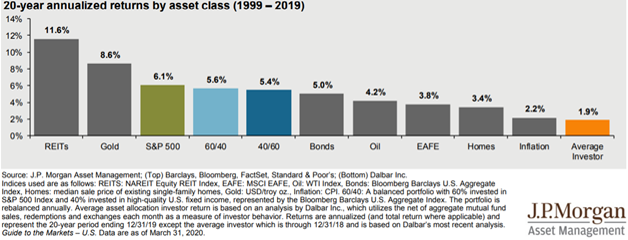

In the following chart we see the average annual return of the last 20 years provided by several investments and the ones obtained by the average investor:

In this 20-year period, the investor did not even manage to beat inflation. In a medium and long-term investment, the investor loses about half of the annual returns of the investment in stocks and almost all the return on bonds investments. They were between 6,1% and 5% per year in each case, respectively.

On the other hand, the returns provided by investing in the markets of each asset class in general are remarkably interesting and rewarding.

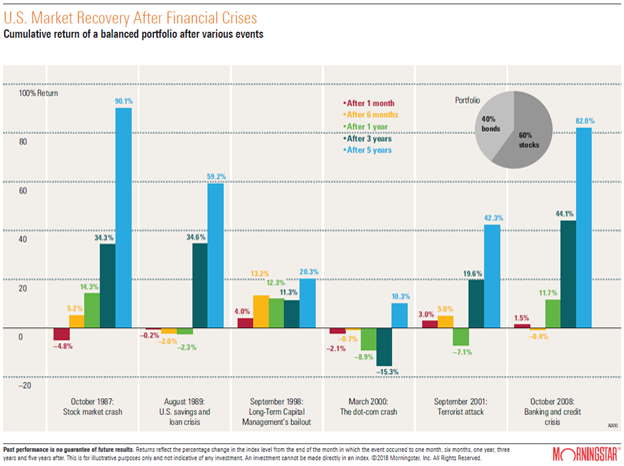

Moreover, even in times of crisis and sharp decline of the riskiest markets, such as stocks, there was always good recoveries in the following years, reinforcing the gains of investments in the medium term.

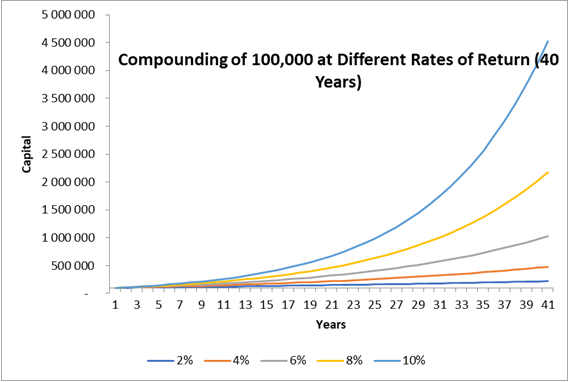

The rest is to let work the compounding of income for a long time, investing as early as possible.

The following graph shows the evolution of the investment of a capital of 100,000 monetary units over a period of 40 years (usually a duration of an active life or our retirement savings period):

We must also do the annual rebalancing so that we do not deviate from the objective and risk profile

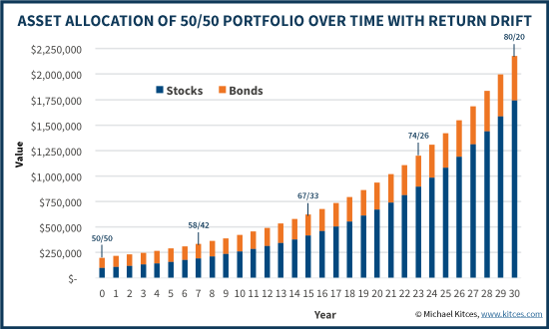

Rebalancing consists of periodically adjusting the allocation of investments between asset, stock and bond classes, and even their subclasses of those assets, to the level initially set, to prevent market movements from distorting it significantly.

We have seen that asset allocation plays a major role in the investment’s portfolio performance. We also know that with the passage of time the initial allocation percentages change with the so-called drift.

There are mainly two ways of rebalancing. In defined periods or depending on the deviation percentage.

The majority considers it more appropriate to do periodic rebalancing, particularly once a year. It is not possible to prove that the alternative is better and has the advantage of being easier to implement.