What are simple investment portfolios

The advantages and disadvantages of simple portfolios

Concrete investments suitable for the composition of simple portfolios

The various simple or lazy portfolios with only 2 investments, one of stocks and one of bonds

In this article we start a series of very simple and DIY portfolios (“do-it-yourself” or “self-service”) and that can be easily used by any investor.

They are so simple that we also call them lazy portfolios.

In our day and more and more we have no time for anything. We’re always running and we don’t stop.

Which often leads us to stop doing what is necessary, such as investing to improve our lives.

We think we need a lot of time. Because we want to do it right. After all, it’s about money that was very hard to earn.

These lazy portfolios are the answer to many of these questions.

As we shall see, simplifying does not mean losing rigour, but rather making it more easy. Its great advantage is to break down the barriers of inertia, of not to make investments.

They’re so simple and good that no one has excuses not to invest.

In fact, these portfolios count among their main defenders and promoters some of the greatest wealth managers of all time.

What are simple investment portfolios

As we’ve seen before, building appropriate portfolios looks at the following steps:

- Know the returns and risks of the main asset classes;

2. Understand appropriate diversification as the combination of asset classes that improves risk/return binomial, which fits the objective, in particular the respective term, and which is aligned with the financial situation and capacity and individual risk tolerance profile (asset allocation strategy);

3. Make the investments by selecting the most suitable vehicles, namely indexed investments, better representative of the asset classes we want, whether funds, ETFs or others, and low cost; and from here monitor, review and adjust.

However, we often do not have the time, capacity or competence to make this construction of portfolios that takes place in a wider and thinner diversification of investments, investing in a set of 6 to 12 indexed funds representative of the desired asset allocation.

In these situations, simple portfolios, also called lazy, in some cases composed exclusively of only 2 to 4 indexed mutual funds, are a good option.

Simpler portfolios are not necessarily worse than more complex ones. In many situations, on the contrary.

Simplicity is not to be simplistic or to lack rigor, let alone to result in a loss of suitability or value.

On the contrary, there are many complex portfolios much worse than the simpler ones.

Simple portfolios are composed exclusively of the two main financial assets – stocks and bonds.

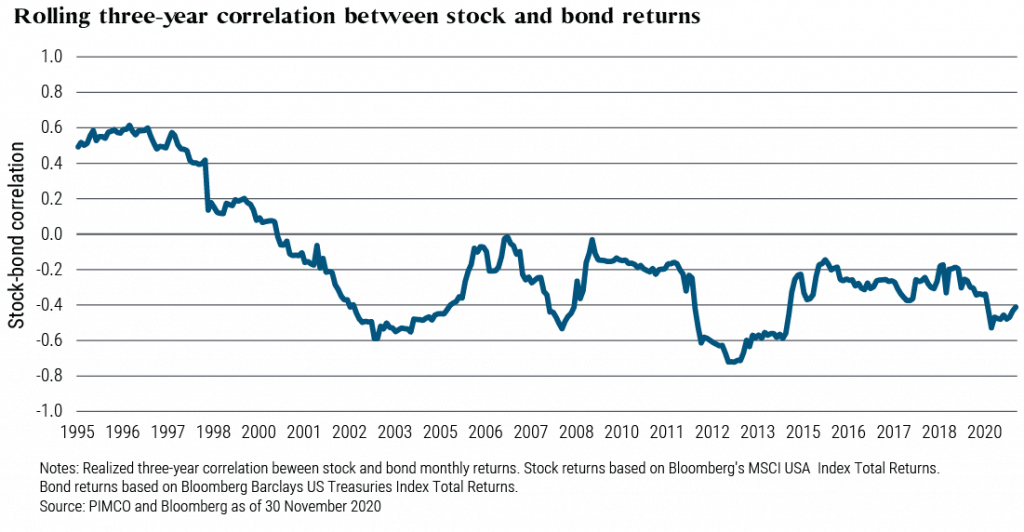

The basic idea of the simplicity of these portfolios is to take advantage of the diversification resulting from the negative correlation between stocks and bonds.

As we can see in the chart above the correlation has been negative since 1997.

What we want with these portfolios is to combine the appreciation and growth of the capital provided by stocks with the stability of income, the preservation and protection of the capital associated with bonds.

The differences between the various portfolios that we will see focus only on the allocation weights to each of these assets, adjusting that diversification to the profile of each investor.

In addition, they are realized through the investments that best represent these assets, with a good level of diversification and low costs.

And ensuring in any case that the rebalancing of the portfolio is done periodically.

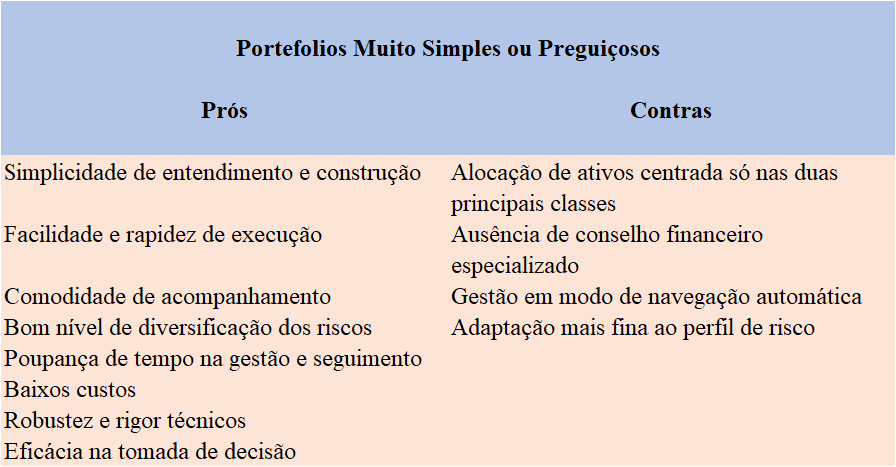

The advantages and disadvantages of simple portfolios

More importantly, these simpler portfolios can deliver returns higher than those typically obtained by individual investors and even those of many professional investors.

If we choose well, they already guarantee a good level of diversification.

And simplicity brings with it the advantage of being easy-to-use, make, track and adjust portfolios when needed.

Simplifying is an advantage. Which is easy, you can tell and you do it right away. You don’t take it off. What is more complex and not perceived, does not be done or can lead to error.

The great can be the enemy of the good. What we fail to earn for more tuning is more than offset by the faster action associated with the simplicity of the process.

These portfolios are intended and are very useful in the following situations:

• When we have no investment experience in the financial markets

• When we do not understand the financial investments that are proposed to us

• When we have little time to execute and manage our investments

• When we want to ensure easy monitoring

• When we want ease, convenience, speed and flexibility

• When we want low costs

• Always, because it is always useful to have a global or a broad portfolio, general and non-specific, that follows us throughout life

In addition, simple portfolios help us understand some aspects of the most complex, such as their elements or components.

To use these portfolios, the investor only needs to make three decisions:

- Choose the portfolio that best suits you (selection of asset allocation);

- Choose the investments that best materialize this portfolio composition (selection of investments)

- Rebalance periodically to ensure that asset allocation weights do not deviate too far from the intended one.

This simple reality has been consistently defended by many of the largest investors, including Jack Bogle, the founder of Vanguard, the world’s largest investment fund manager, who said:

“The most fundamental decision to invest is the allocation of your assets: How much should you have in stocks? How much should you detain in bonds? How much should you keep as cash?

and

“The biggest enemies of the investor are the costs and emotions”

In this series we will show simple portfolios for various asset allocations, which can be used by people with different objectives, financial situations and investor profiles.

Before we start to see these portfolios it is worth addressing the issue of the materialization of investments.

Concrete investments suitable for the composition of these simple portfolios

These portfolios are composed exclusively of adequately diversified baskets of stocks and bonds, and are distinguished exclusively by the different weights allocated to each of these asset classes.

In order to ensure the best diversification and low costs, the choice of concrete investments representing each asset class should be as follows:

The stock component should be represented through diversified mutual funds representing the global stock market or the main U.S. stock market (the S&P 500 index) in dollars (as it is the currency of most companies under investment).

In the stock component, the share of more profitability and risk in the portfolio, investors must replicate the world markets.

The bond component should be implemented via diversified mutual funds representing the investor currency bond market for investors in developed countries.

In the bond component, the lower profitability and risk portion of the portfolio, investors should minimize foreign exchange risk.

The most suitable investments to materialize the composition of these portfolios are mutual funds or ETFs on indices or indexed to the main stock and bond markets.

Also included are the very diversified and representative mutual funds of these two large asset classes, with the main global capital markets, by geographies and securities.

These funds provide the desired diversification, replicate the desired allocation and have low costs.

In the articles in the Series on Mutual Funds we explain and develop the main characteristics of these funds, in order to help investors better select the funds to invest in.

In addition, in the Best of Investment Funds series we present some of the concrete investment funds, stocks and bonds, suitable for each type of investor – be it the United States, the European Union, the United Kingdom, emerging markets, etc. – of the largest management and lower cost companies, with a very useful and practical information content.

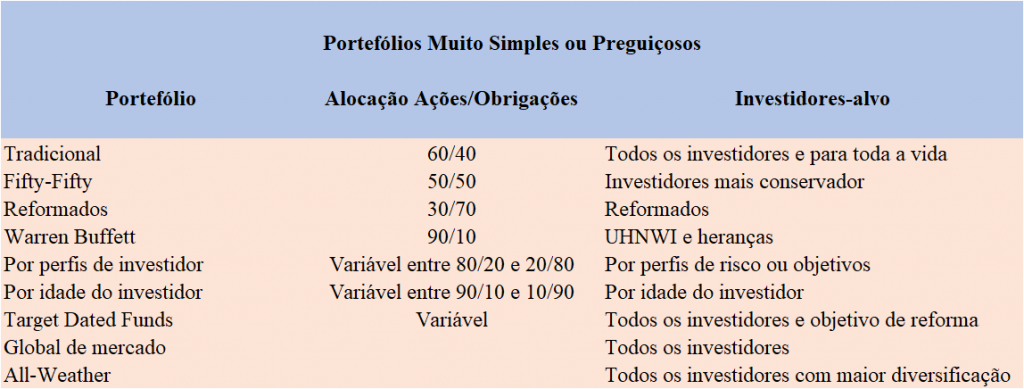

Very simple or lazy portfolios are composed exclusively of two classes and subclasses of assets, stocks and bonds with different weights, and comprise the following:

The traditional portfolio of 60/40 (60% stocks and 40% bonds) or balanced for life

The 50/50 or “fifty-fifty” portfolio (half stocks and half bonds), also for life and more defensive

The 30/70 portfolio (30% stocks and 70% bonds) for retirees

Warren Buffett’s 90/10 portfolio for great fortunes and inheritances

Portfolios by investor profiles

The portfolios by investor ages

Dynamic, “lifecycle” or “target-dated” portfolios for retirement

The global market portfolio

The “all-weather” portfolio

In the next articles, we will develop each of these portfolios.

And in this link we can see some types of lazy portfolios recommended by financial industry professionals: