The main regulatory advances of corporate governance: Cadbury Report (UK), Principles of Corporate Governance (OECD) and Sarbanes-Oxley (US)

The 2 main approaches to corporate governance in the world: Rules (US) or Principles (UK)

The 6 fundamental principles of corporate governance according to the OECD

The 6 fundamental principles of corporate governance in the UK

The corporate governance system in the U.S.

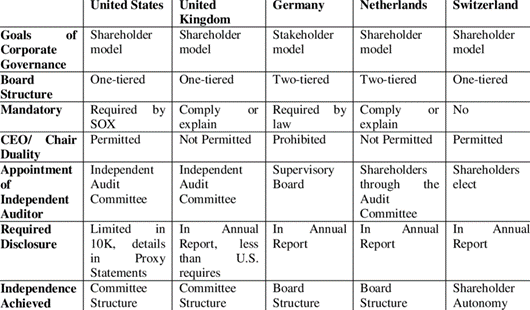

Comparison of corporate governance models in major countries

This article is part of the ESG Investing series that seeks to focus on the various aspects of sustainable investment.

The first article of the series gave an overview of the theme, addressing the scope, development history and main strategies of sustainable investment.

In the second article we presented the growth and trends of this investment.

The following articles focused on the various aspects of sustainable investment and how investors view sustainable investment.

Two other articles on corporate governance have also been published.

The first makes the general introduction to the theme.

In this article we will see the main bases of the regulatory systems of corporate governance and the two main alternative models.

The main regulatory advances of corporate governance: Cadbury Report (UK), Principles of Corporate Governance (OECD) and Sarbanes-Oxley (US)

There is no single universal system of effective corporate governance.

Each country has a unique framework consisting of a combination of hard and soft regulation, which reflects its own economic, cultural and legal history.

Therefore, the desirable combination of legislation, self-regulation and voluntary standards can vary significantly from country to country.

Around the world, jurisdictions seek to influence the private sector through their own international corporate governance frameworks.

These are typically composed of a regulatory combination of company and securities law, as well as stock exchange listing rules and corporate governance codes.

The Organization for Economic Cooperation and Development (OECD) and the International Corporate Governance Network (ICGN) have published international principles that can be applied as a supplement to local corporate governance codes.

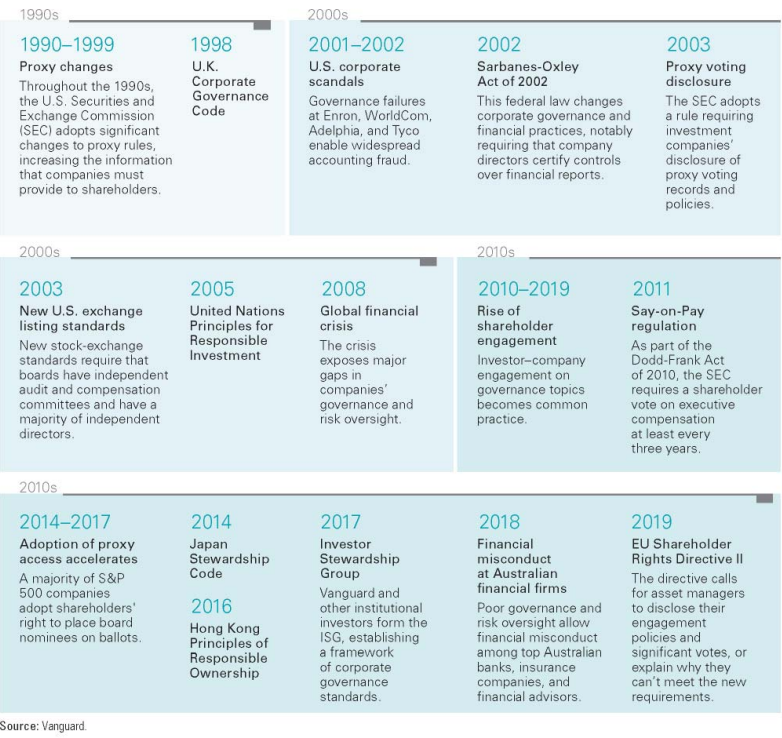

Contemporary discussions on corporate governance tend to refer to the principles established in three documents published since 1990:

- The Cadbury Report (United Kingdom, 1992);

- The Principles of Corporate Governance (OECD, 1999, 2004 and 2015);

- The Sarbanes-Oxley Act of 2002 (USA, 2002).

The reports by Cadbury and the Organisation for Economic Co-operation and Development (OECD) present general principles around which companies are expected to work to ensure adequate governance.

The Sarbanes-Oxley Act, informally referred to as Sarbox or SOX, is an attempt by the United States federal government to legislate several of the principles recommended in the Cadbury and OECD reports.

The 2 main approaches to corporate governance in the world: Rules (US) or Principles (UK)

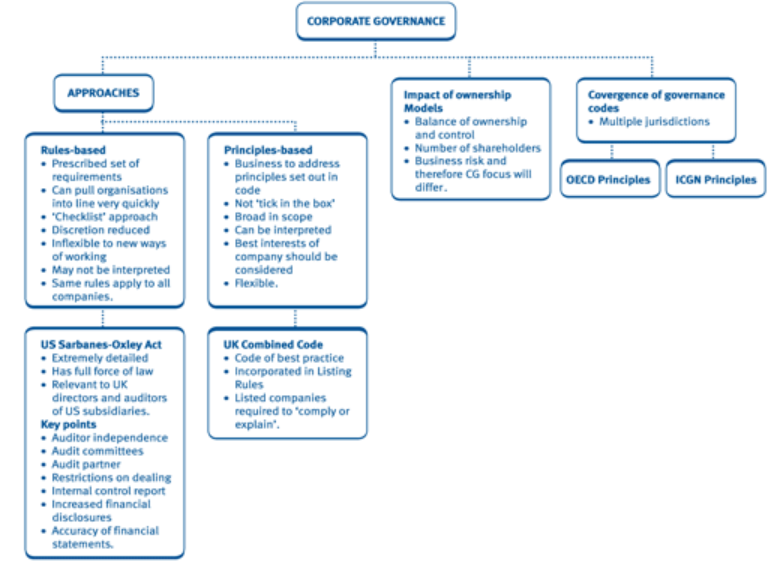

There are two types of approaches or perspectives for the communication, management and monitoring of corporate governance codes, one based on compliance with the rules and the other on compliance with principles:

The rules-based approach associates the code with the law, with appropriate sanctions for transgression.

The principled approach requires companies to comply with the spirit, not the letter of the code.

Companies must comply with the code or explain why they do not do so by reporting to the competent body and its shareholders.

The UK model is based on principles.

The American model is based on rules, being enshrined in law by virtue of Sarbanes-Oxley.

Most OECD countries have adopted a principles approach. Its established principles of good corporate governance act as a reference for companies to join.

Almost all jurisdictions that have adopted a corporate governance code or corporate governance principles have implemented a “comply or explain” approach, where compliance is not statutory, but a company’s deviations from the code should be explained in their report.

The 6 fundamental principles of corporate governance according to the OECD

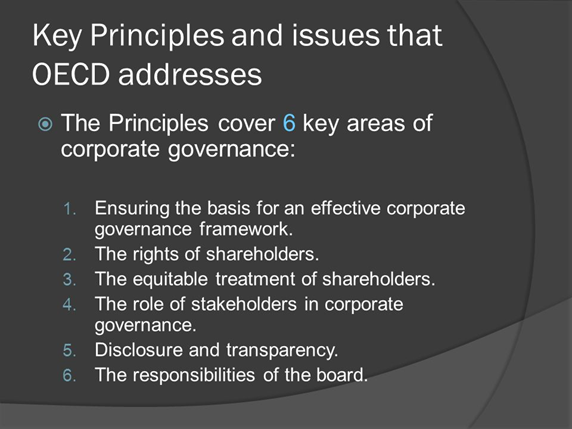

In synthetic terms, the OECD establishes the following 6 fundamental principles of corporate governance:

- Ensuring the basis for an effective corporate governance framework

The corporate governance framework should promote transparent and efficient markets, be consistent with the rule of law, and clearly articulate the division of responsibilities between the different supervisory, regulatory and enforcement authorities.

In other words, it must ensure that everyone involved is aware of their individual responsibilities, so no party has any doubts about the scope or object to which it is responsible.

- Rights and equitable treatment of shareholders

Organizations must respect the rights of shareholders and help shareholders exercise those rights.

They can help shareholders exercise their rights by communicating information openly and effectively, and encouraging shareholders to participate in general meetings.

- Interests of other stakeholders

Organizations should recognise that they have legal, contractual, social and market-oriented obligations to non-shareholder stakeholders, including employees, investors, creditors, suppliers, local communities, customers and policy makers.

- Role and responsibilities of the Board of Directors

The board needs sufficient relevant skills and capabilities to review and challenge management performance.

It also needs an adequate dimension and adequate levels of independence and commitment.

- Integrity and ethical behavior

Integrity should be a fundamental requirement in the choice of corporate elements and board members.

Organizations should develop a code of conduct for their directors and executives that promote ethical and responsible decision-making.

- Disclosure and transparency

Organisations should clarify and publicly disclose the roles and responsibilities of the board of directors and other governing bodies to provide a level and framework of responsibility to stakeholders.

They shall also implement procedures to independently verify and safeguard the integrity of the company’s financial report.

The disclosure of material matters relating to the organisation should be timely and balanced to ensure that all investors have access to clear and factual information.

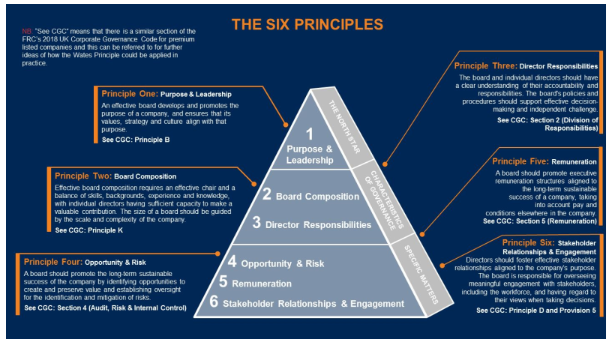

The 6 fundamental principles of corporate governance in the UK

The UK corporate governance code also establishes 6 basic, similar but slightly different principles from those of the OECD:

The 6 principles of this code are the object and leadership, composition of the board of directors, the responsibilities of the directors, the opportunity and risk, the remuneration, and the relationship and mobilization of the shareholders.

The corporate governance system in the U.S.

The U.S. has not adopted a corporate governance code for US companies.

Corporate governance matters are regulated in state and federal laws, regulations and stock exchange listing rules.

There is also an influential body of good practice literature around corporate governance.

The main key aspects of the Sarbanes-Oxley law are as follows:

Three aspects have to do with the audit (without surprise, recalling the scandals of previous audits that the case of Arthur Andersen was the most media).

The mandatory replacement of auditors after 5 years, the independence of auditors and the existence of an audit committee.

The remaining three are the signing of financial reports by the CEOs and CFO, the reporting of internal control systems in the annual report and the prohibition of trading of shares by directors in sensitive periods.

There are also two important corporate bodies that establish corporate governance principles for American companies.

They are the Business Roundtable CEO, whose members are the CEO of the largest U.S. companies, and the Investor Stewardship Group (ISG), made up of the largest institutional investors.

Comparison of corporate governance models in major countries

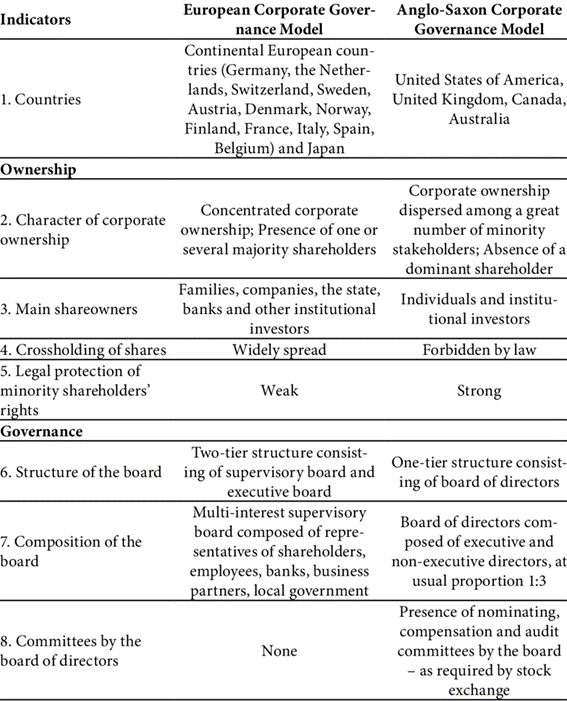

There are two main alternative models of corporate governance – the shareholder model and the stakeholder model:

.

The Anglo-American corporate governance system is based on the shareholder model, while the European corporate govero model is based on the German stakeholder model.

The so-called Anglo-American model of corporate governance emphasizes the interests of shareholders.

It is based on a single board of directors that is typically has a majority of non-executive directors elected by shareholders. Therefore, it is also known as “the unitary system”.

The European model emphasizes stakeholders and not (exclusively) shareholders, and has a prevalence by two-level boards, structured with a supervisory board (total or partially non-executive) and a board of directors (executive), which prohibits the duality of CEO and Chairman.

These two models apply to forms of ownership with some distinctions and that are reflected in the governance model:

In continental European countries where the stakeholder model predominates, companies typically have families, companies or the state as their main shareholders, while in the US and UK the main shareholders are institutional and individual investors.

Thus, the decision on which approach to be used in each country is governed by many factors.

The most important are the dominant ownership structure (bank, family or multiple shareholder), legal system and its power or capacity, structure and government policies, state of the economy, culture and history, levels of capital or investment entering the country, global economic and political climate.