An investing guide for a better financial life and investment returns

“Data!data!data!” he cried impatiently. “I can’t make bricks without clay.” ― Arthur Conan Doyle, The Adventure of the Copper Beeches

“It amazes me how people are often more willing to act based on little or no data than to use data that is a challenge to assemble.” ― Robert J. Shiller

We need to bear in mind only 6 simple main investing ideas for a better financial life and improved returns.

These can be showed in 6 charts: 1) Cash is a bad investment due to inflation; 2) Compounding works great in investments and hurts badly in debt; 3) Stocks are for the long and medium run and bonds for shortest terms; 4) Efficient Diversification is a must; 5) Investments in index and low cost funds are better; 6) Goal based investing is key.

In this blog we will go through each one of these issues. Step by step. More in-depth.

We will cover all of them in an investment series of 20 plus structured posts that we will publish within the next year.

Alongside we will be posting other articles that provide more colour to those subjects.

Now let´s have a quick look at each one of the 6 major investing ideas.

Inflation decreases the value of money over time.

Whenever promised or expected returns on any investment are below inflation, it is a bad investment.

That makes cash and some minimal return investments, bad investments.

Money must be put to work somewhere else. Its effect can be huge.

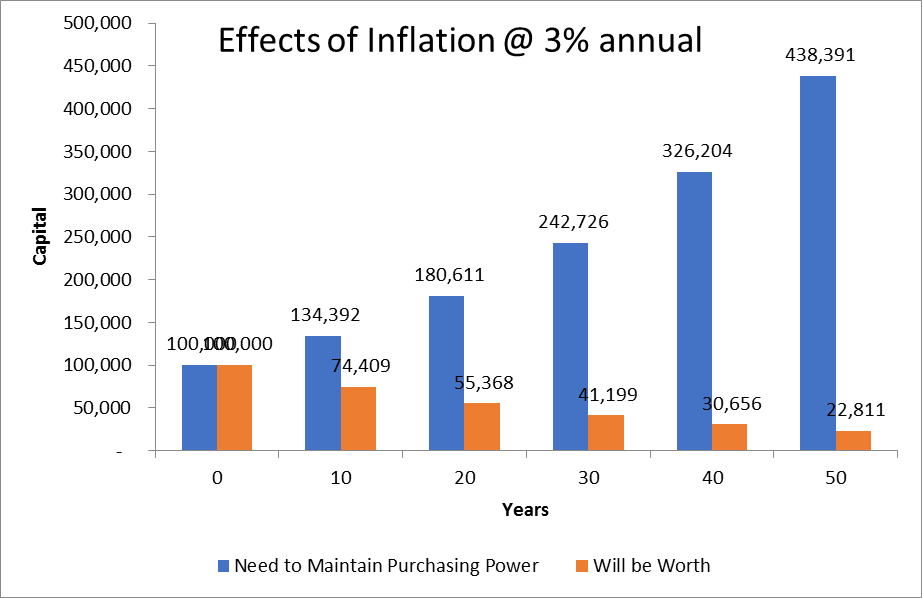

At a 3% per annual normal (i.e. average) inflation rate, a $100,000 capital today will be worth only $55,000 20 years from now and you’ll need to have $181,000 just to keep your purchasing power.

The following graph evidences the corresponding values to other timeframes.

What matters is the money one gets after inflation and … by the way, also taxes!

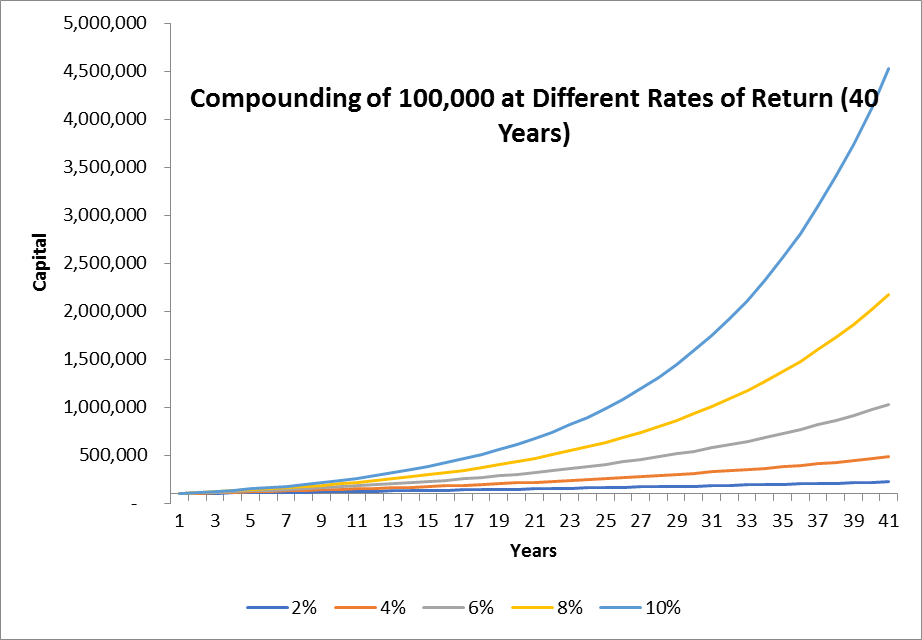

Compounding.

Compounding is financial income on income, be it interest, capital gains or both.

Compounding works on both assets and liabilities.

While compounding boosts the value of an asset more rapidly, it can also increase the amount of money owed on a loan, as interest accumulates on the unpaid principal and previous interest charges.

A capital of $10,000 compounded at a rate of 6% per annum will translate in $40,000 in 24 years.

In compounding there is an easy way to know how long it will take for your money to double, called the rule of 72.

The rule simply states that if you divide 72 by the interest rate, it will tell you how long it takes for your money to double.

For example, assume you earn a 6% rate of return on your money.

To find out how long it takes for your initial amount of money to double, just do the simple calculation: 72 / 6 percent = 12 years

Stocks are for the long and medium run and bonds shortest terms.

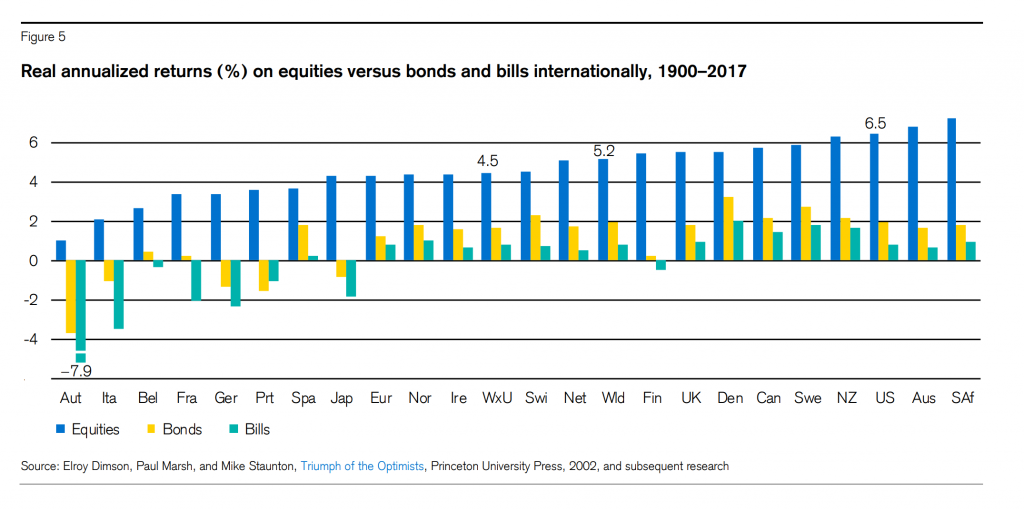

We must learn from the financial markets history.

It matters because financial history repeats itself.

We must look out for returns and risks/losses.

Since 1900 to date, real (or after inflation) annualized returns were around 5,2 % in stocks, 2% in treasury bonds and less than 0.5% in treasury bills in every major country in the world.

Stocks are clearly more productive than treasury bonds.

But there is a flip side, which is risk. Risk is the chance of making a loss.

Stocks fluctuate much more than treasury bonds.

And we must also bear in mind that we only make a loss when we need to liquidate or sell something that has had a negative fluctuation since the moment we bought it.

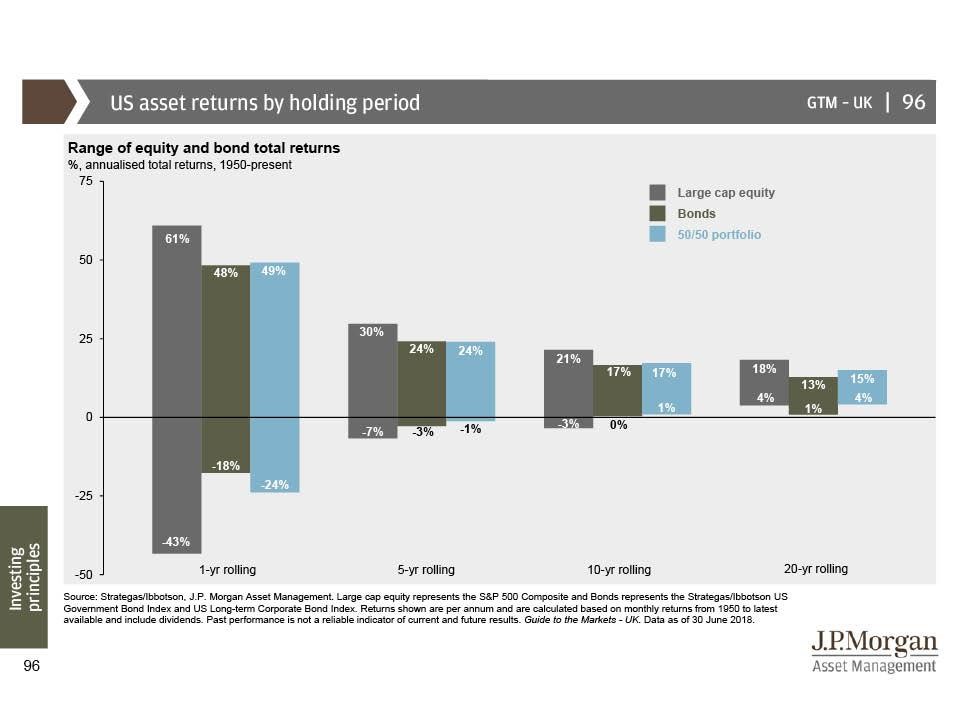

The right way to perceive risk and loss is to see the intervals of returns along some specific time periods.

Using data for the US since 1950 to date we see that in one-year periods annual returns from stocks vary from -43% to +61% and treasury bonds from -18% to +48%.

In 5-year periods, annual returns from stocks vary from -7% to 30% and treasury bonds from -3% to 24%.

And in 20-year periods, annual returns from stocks vary from +4% to +18% and treasury bonds from +1% to +13%.

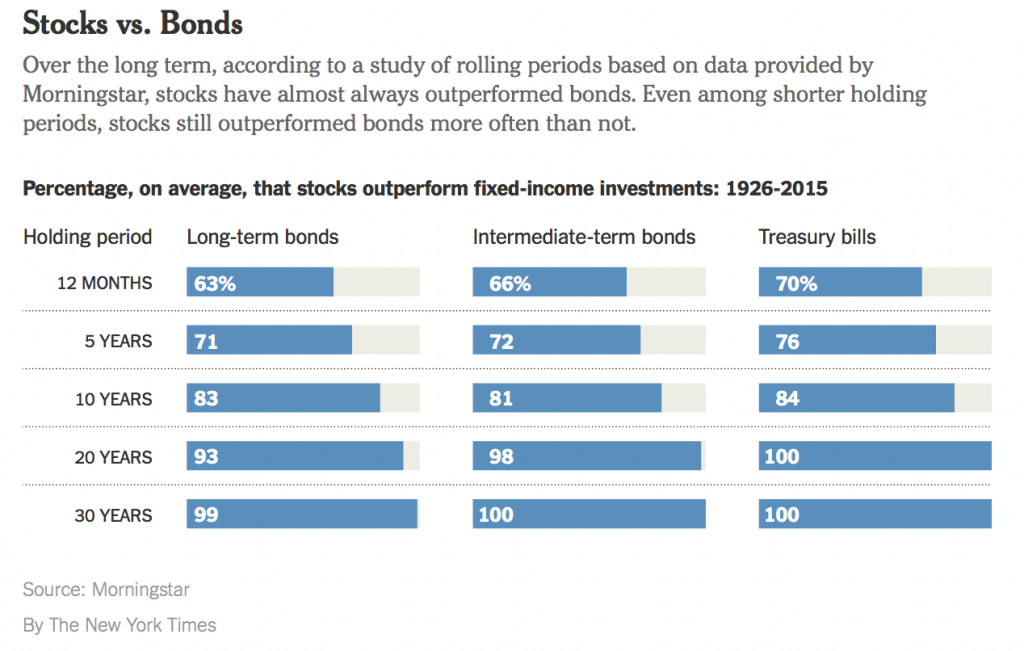

It is also important to know what the frequency of the returns is. In the US for the period between 1926 and 2015, stocks have had higher returns in 63% of the years, 71% in every 5-year period, 83% for 10-year intervals, 93% for 20s and 99% for 30-year cycles.

.

In conclusion:

Stocks are more volatile than treasury bonds but less so as the investment period is longer.

Stocks are highly volatile in the short term but lesser so in longer terms.

Stocks are the best investment for the medium and long run and bonds for the shortest terms.

Stocks provide your portfolio with the opportunity for long-term growth.

Bonds are an important part of a balanced portfolio because they help lessen your overall portfolio risk and provide an opportunity for income.

Again, cash is a bad investment.

Similar data can be found for Europe and Asia and the conclusion will be the same.

Efficient Diversification.

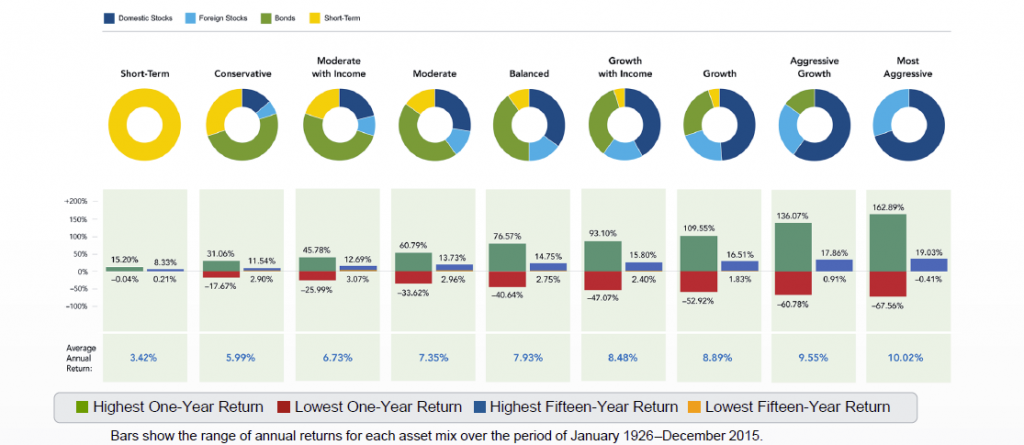

So, how to balance risk and return? We do it through diversification.

Diversification is a means of managing risk, and it is accomplished by mixing a variety of financial instruments within a single portfolio. It’s a kind of don’t put all your eggs in the same basket.

As financial markets are unpredictable and individual investors cannot tolerate its short term fluctuations they must diversify.

By combining stocks and bonds in different mixes/proportions investors can achieve an assets allocation that is more adequate to their personal financial situation and risk profile, i.e. risk capacity and risk tolerance.

Best investments.

Investments selection and choice should be driven by their features in terms of diversification, representation of required asset class and low costs.

We want to invest in the more diversified and profitable adjusted by risk, consistent and cheaper investments of each asset class. Fees and commissions are very important in this decision.

Financial markets are uncertain and no one can guess or predict the investment returns but fees are certain, and a cost that can be very expensive in the long run.

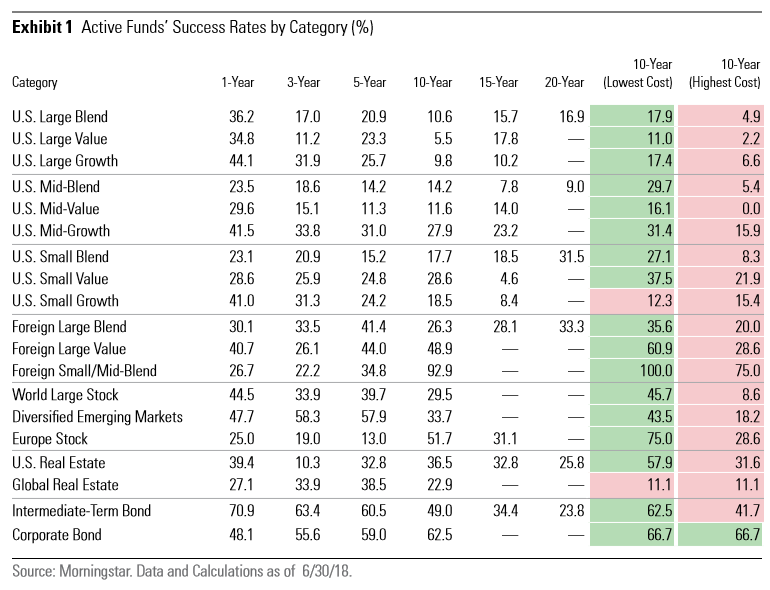

The active funds success rates, i.e., the percentage of actively managed funds that beat the respective markets/asset class or benchmarks, is very low in every funds category and across time periods from 1-year to 20-year.

This is more true for higher cost funds.

The index or passive funds are cheaper, more diversified and provide a better replication of the asset class.

So, we normally gain by choosing indexed mutual funds to main market asset classes and have low fees.

Goal based investing

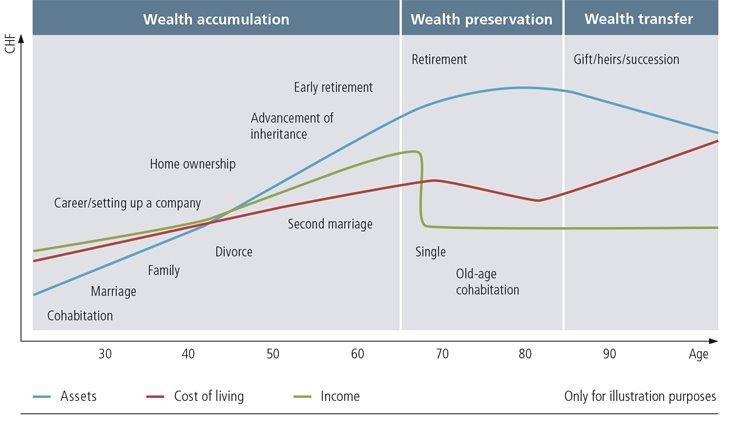

Goal based investing is a relatively new approach to wealth management that emphasizes investing with the objective of attaining specific life goals.

Goal-based investing aims to get around the drawback of the traditional investment approach, which generally focuses on outperforming the market while staying within the investor’s threshold for risk.

Instead, it uses individual asset pools with an investment strategy that is tailored to the client’s specific goals.

Thus, if a client’s main goals are to save for an emergency fund or a planned retirement, the investment strategy would be more conservative for the former and relatively aggressive for the latter.

Source: UBS Wealth Management Business

As we said at the beginning, we aim to provide you a better financial live.

We hope you can get you there. And enjoy the ride.

Podcast: Play in new window | Download

Investing is not as difficult as most people think it is.

Some people try to make it hard only to hide their flaws and shortcomings.

In fact, it can be simple, easy, and accessible to everyone.

This is our mantra and master guideline.

We must avoid the financial jargon and purposely hard language.

And doubt of those who use and abuse of it.

Remember what Warren Buffett said: Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.

We strongly believe in what Albert Einstein once said: If you can’t explain it to a six-year-old, you don’t understand it yourself.

6 simple well-anchored ideas are all we need to achieve better investment returns.