The strategies of top investors are different: value vs. growth, security selection vs. diversification, trend followers vs. contrarians, macro vs. micro, fundamental vs. technical/quantitative, etc.

But they have in common, above all, the patience to see the investment in the long term.

Unlike the average investor who has a shorter investment perspective and which is expensive to him.

Knowing the stories and investment strategies of large investors is very useful.

We always learn anything that can make us better investors.

These top investors are a separate category.

They are investors who manage to systematically outperform the financial market in a consistent way and for a very prolonged period, which extends over a few decades.

It is very difficult to imitate them.

They have innate characteristics that distinguish them and have achieved and join teams of strong professionals to develop a winning investment model.

However, we can copy some of their ways of acting.

A common characteristic is to realize that money only yields if it is invested.

They are people who know that liquidity is an asset that generates an insufficient income, lower than inflation, and is, to that extent, unproductive.

They are long-term investors, and in a previous article we saw that investing is a medium and long-term process, comparing it to running a long marathon.

They know that the long run has the advantage of enhancing the capitalization of incomes, and in this way, the accumulation of wealth.

These investors invest in the main securities in the market, large companies, in which we can also invest.

They don’t invest in trendy titles.

They prefer stocks of solid, well-known companies with prospects for future growth. The actions that are at the center or that turn the economies around.

In another article, we also saw the importance of investing in the investments we perceive and master.

The difference is that they do it with large amounts and in a more concentrated way.

The ability to do an in-depth analysis of securities allows them less diversification of investments than is recommended for individual investors.

This analysis and valuation of individual securities gives them an advantage that most individual investors do not possess.

We regularly have information about the main movements of the portfolios of investors of this group that are still in the asset, being able to follow their investments and their rationale.

In a previous article we looked at how Warren Buffett has managed Berkshire Hathaway’s investments.

In future articles we will address the strategies used by other of these large investors.

The strategies of top investors are different: value vs. growth, bond selection vs. diversification, trend followers vs. opponents, macro vs. micro, fundamental vs. technical/quantitative, etc.

The world has had and still has great investors.

We can and should learn a lot from them.

It’s a shame if we don’t.

The investment strategies used by each are diverse, in terms of models and styles, which means there is no single path to succeed.

Although they reserve for you some of the secrets of the business, your story, experience or your conversations end up revealing many ideas that we can use as individual investors.

Next we will get to know a little more about the investors we are talking about.

Warren Buffett (with Charlie Munger) has had an average annualized return of 19% from 1965 to date in Berkshire Hathaway’s investment vehicle. This is one of the best records in the history of investing.

Buffett is a pure stock picker who built his fortune following the value investing principles of his mentor Benjamin Graham.

Benjamin Graham has as its essence the investment of value, in which every investment must be worth substantially more than an investor has to pay for it.

He believed in fundamental analysis and looked for companies with strong balance sheets, or, those with little debt, above-average profit margins, and ample cash flows.

George Soros is the most famous and successful hedge fund manager of all time, providing an average annualized return of about 30% while running the Quantum Fund.

Soros made his wealth by betting on global macroeconomic trends, including a $10 billion one-day profit on a bet against the British pound in 1992.

Carl Icahn has the best result in the history of investments. It has an average annualized yield of more than 30% since 1968 (including surpassing Buffett).

Icahn is an activist investor who invests large positions in very undervalued value stocks, pushes for change, and then leaves, often, with huge profits.

Ray Dalio managed for many years the world’s largest hedge fund, Bridgewater, with more than $150 billion in assets under management. He is an expert in asset allocation, and the pioneer of what he invented as “risk parity investing.”

In very simple terms, it acts on the assumption that, over time, the main asset classes increase in value and generate better returns than money.

He shares with Buffet the belief that, over time, the world will improve, will grow, and will be a better and more efficient place to live than it was before.

Dalio evaluates asset classes based on volatility, which has provided gradual and consistent annual returns.

James Simons is the king of quantitative investing, and founder of one of the best-performing hedge funds of his career, the Renaissance Medallion fund. This fund has had average annualized returns of more than 30% after tax since its inception.

Simons is an MIT graduate with a PhD from the University of California at Berkley. Your fund uses computer models to profit from short-term market inefficiencies.

David Tepper may be the best-performing investor over his 23-year career, with an average annualized return of 30%. It manages the hedge fund Appaloosa Management, with assets under management of $18 billion.

Tepper is unique in that it combines investments in companies in a difficult financial situation with global macroeconomic investments.

John (Jack) Bogle founded the hedge fund firm Vanguard Group in 1974 and has become one of the largest and most respected sponsors of investment funds in the world.

Bogle pioneered investment funds without distribution expenses and promoted investment in low-cost index funds to millions of investors. He created and introduced the first index fund, Vanguard 500, in 1976.

Jack Bogle’s investment philosophy advocates capturing market profitability by investing in broad-based index funds that are characterized by having no distribution costs, being low-cost, low-turning, and passively managed.

John Templeton was the creator of the modern investment fund.

He came up with this idea from his own experience: in 1939, he bought 100 shares of each company he traded on the New York Stock Exchange under $1. It purchased a total of 104 companies, for a total investment of $10,400. Over the next four years, 34 of these companies went bankrupt, but he was able to sell the entire remaining portfolio for $40,000.

This gave him insight into the value of diversification and investment in the market as a whole – some companies will fail, while others will win.

He was described as the best bargain hunter, looking globally for companies ignored by everyone else because he believed that the highest-value stocks were those completely neglected.

Peter Lynch managed to grow the Fidelity Magellan Fund’s investment portfolio from $20 million to $14 billion in just 20 years.

Often described as a “chameleon,” Peter Lynch adapted to whatever style of investing worked at the time. But when it came to choosing specific stocks, I only invested in those that I knew and/or could easily understand.

William (Bill) H. Gross is considered the world’s largest bond fund manager. As founder and executive manager of PIMCO’s bond fund family, he managed more than $600 billion of fixed income assets.

In 1996, Gross was the first portfolio manager inducted into the Fixed-Income Analyst Society Inc. Hall of Fame for his contributions to advances in bond and portfolio analysis.

But they have in common, above all, the patience to see the investment in the long term.

Despite using different strategies, in many cases radically different, these large investors have a common basis: above all, the patience to have a long-term investment perspective.

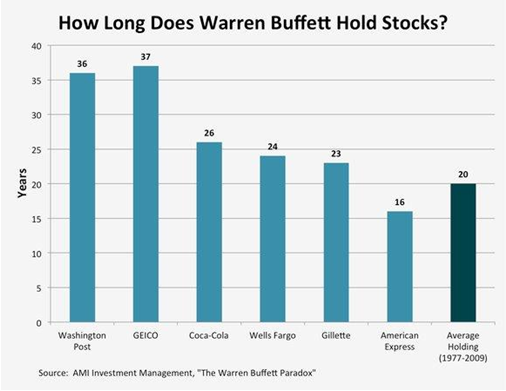

The following chart shows Warren Buffett’s stock holding periods:

Buffett holds stakes for more than 20 years, on average, and some have been accumulated over more than 30 years, such as the Washington Post and GEICO, almost all are more than a decade old.

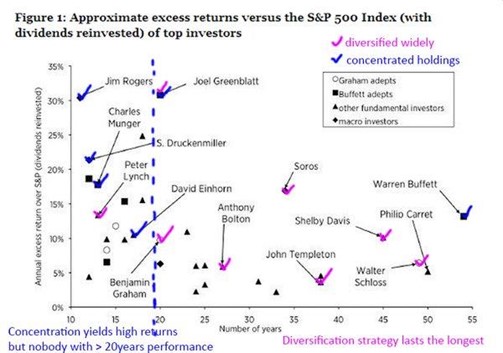

The following chart shows the excess annualized average return relative to the S&P 500 index and the average holding period of the investments of the world’s largest investors:

These top investors have holdings that are more than 10 years old, on average, and some are over 50.

It is curious to note that the investors with the greatest diversification are those who have the longest term, especially the cases of Warren Buffett, Benjamin Graham, George Soros and John Templeton.

This patience allows them to combat the emotions that destroy the results for many investors, such as impatience, greed and fear. This firm determination immunizes them from the investment mistakes associated with frustration, anger, or regret.

Unlike the average investor who has a shorter investment perspective and who is expensive to him.

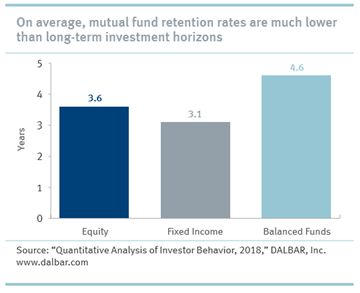

Dalbar conducts an annual study on the behaviors of U.S. private investors, and in the 2018 edition concluded once again in the following:

Private investors have investment fund holding times between 3.1 and 4.6 years on average, depending on the nature of the fund.

As we have seen, this deadline is much shorter than that of the world’s best investors.

In fact, it has been proven that one of the main reasons for the much lower performance of the market obtained by private investors for short or very long periods (from 1 to 20 years), is precisely due to their shorter investment time in stocks.