The Developmental Stage Change Syndrome: Labour Is No Longer Cheap

The Domestic Challenge of Productivity Growth

Setbacks in globalization, world hegemony (bipolarization versus multipolarization), and trade wars. Too many challenges for a developing economy?

This article is part of a series dedicated to investing in Chinese stocks.

In the first article, a general introduction to the topic was made,including a synthesis of the remarkable performance of economic growth and development in the last 4 decades, as well as the challenges it has faced especially since mid-2015.

In the second article, aspects of China’s strong economic growth over the past 4 decades were developed.

The third article was divided into two parts, the first addressing the performance of the Chinese stock market in the last 4 decades, while the second provided a framework for the prospects of foreign investors’ understanding of the economic reality and the markets.

In the fourth article, also divided into two parts, we began to develop the main challenges of the Chinese economy.

In this article we analysed how it all started, the problem of the construction sector, explaining its direct and also indirect effects.

It was thought that this would be the central problem, combined with the draconian Covid response policy.

But appearances are often deceiving.

In the most recent articles we have shown that China’s problem is deeper and more structural, and focuses on the lack of change in the economic development model, from an economy based on public investment to an economy driven by private consumption.

Chinese government authorities intend to stimulate and boost consumption to grow the economy, but have been unable to achieve this goal.

We have already touched on two of the reasons, the response to insecurity and the problem of demography.

In this article we continue to give an explanation for this fact, now focusing on the themes of the political, economic and social model, as well as geopolitical problems.

In previous articles we have already developed the size and weight of the Chinese economy in global terms, its enrichment in recent years, as well as its convergence with the most developed countries.

Also in previous articles we have addressed the growth of investment in emerging equity markets, as well as their attractiveness, with emphasis on the Chinese market.

In another article, we also delved into the specifics of the structure, functioning and activity of the Chinese stock market.

The Developmental Stage Change Syndrome: Labour Is No Longer Cheap

For years, China has capitalized on cheap labor to become an economic powerhouse and be the factory of the entire world.

Rising labour costs could change this:

As in Japan, manufacturers may slowly start to exit the country, resulting in a vicious circle of falling domestic demand and less domestic investment.

Fewer jobs and a further fall in private consumption and business investment could follow.

The country will need to shift from low-value manufacturing and up the value chain to more skilled workers.

Investment in areas such as science and technology can boost growth opportunities.

The Domestic Challenge of Productivity Growth

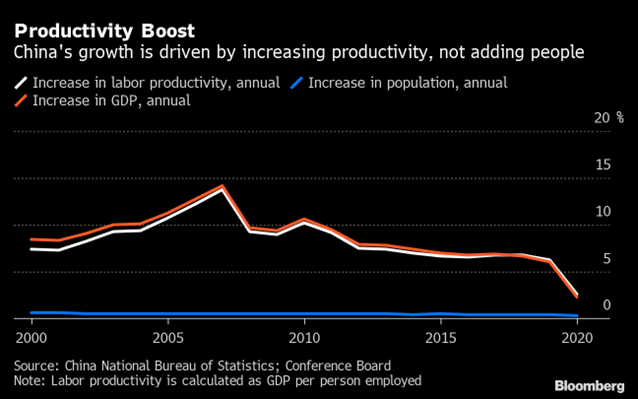

Productivity growth should be a driver of economic expansion at the middle-income stage in which China finds itself.

But productivity increases are no longer as they used to be:

The economic reform agenda has stalled, or even reversed in some areas.

Government authorities continue to push through expensive industrial policy programs that contribute little to productivity growth, or self-sufficiency.

The private sector and foreign companies are increasingly wary of regulatory guidance and ideological signals.

The contradictions and conflicts inherent in the model of a socialist, planned and dirigiste market economy cause constant deviations from reformist initiatives to solve immediate economic and financial problems

#1 O modelo de economia socialista de mercado sobrepõe o controlo estatal à agenda reformista

The Chinese Communist Party (CCP) officially refers to China’s economic system as the socialist market economy.

To guide economic development, the Chinese central government adopts five-year plans that detail its key economic and political priorities.

The fourteenth five-year plan (2021-2025), places an emphasis on consumption-driven growth and technological self-sufficiency as China transitions from an upper-middle-income economy to a high-income economy:

Driven by the twin goals of quality growth and “national rejuvenation” rather than high growth or economic efficiency, the planned and public allocation of resources appears to be a priority for the Chinese Communist Party (CCP).

The public sector plays a central role in China’s economy.

China retains state control over the dominant structures of the economy in key sectors such as infrastructure, telecommunications and finance, despite the significant commodification of the economy since reform and opening-up began in 1985.

Specific mechanisms implementing China’s control over the dominant structures of the economy include public property rights, widespread administrative involvement, and the Communist Party’s supervision of top managers.

#2 O papel preponderante das empresas estatais e as suas ineficiências

Chinese state-owned enterprises perform important functions that benefit the state.

These companies contribute to central and local government revenues through dividends and taxes, support urban employment, keep key prices of essential goods low, channel capital into specific industries and technologies, support subnational redistribution to poorer provinces in the interior and west, and help the state’s response to natural disasters. financial crises and social instability.

China has more SOEs than any other country, and the highest number of SOEs among large domestic companies.

State-owned enterprises accounted for more than 60% of China’s market capitalization in 2019 and generated 40% of China’s GDP of US$16 trillion (101 trillion yuan) in 2020, with private, domestic and foreign companies accounting for the remaining 60%:

State-owned enterprises are over-indebted and structurally less efficient than their private counterparts:

For its part, China’s private sector, which has been accelerating since the global financial crisis, is now serving as the main driver of China’s economic growth.

The combination of the numbers 60/70/80/90 is often used to describe the contribution of the private sector to the Chinese economy: they contribute 60% of China’s GDP and are responsible for 70% of innovation, 80% of urban employment and provide 90% of new jobs.

Setbacks in globalization, world hegemony (bipolarization versus multipolarization), and trade wars. Too many challenges for a developing economy?

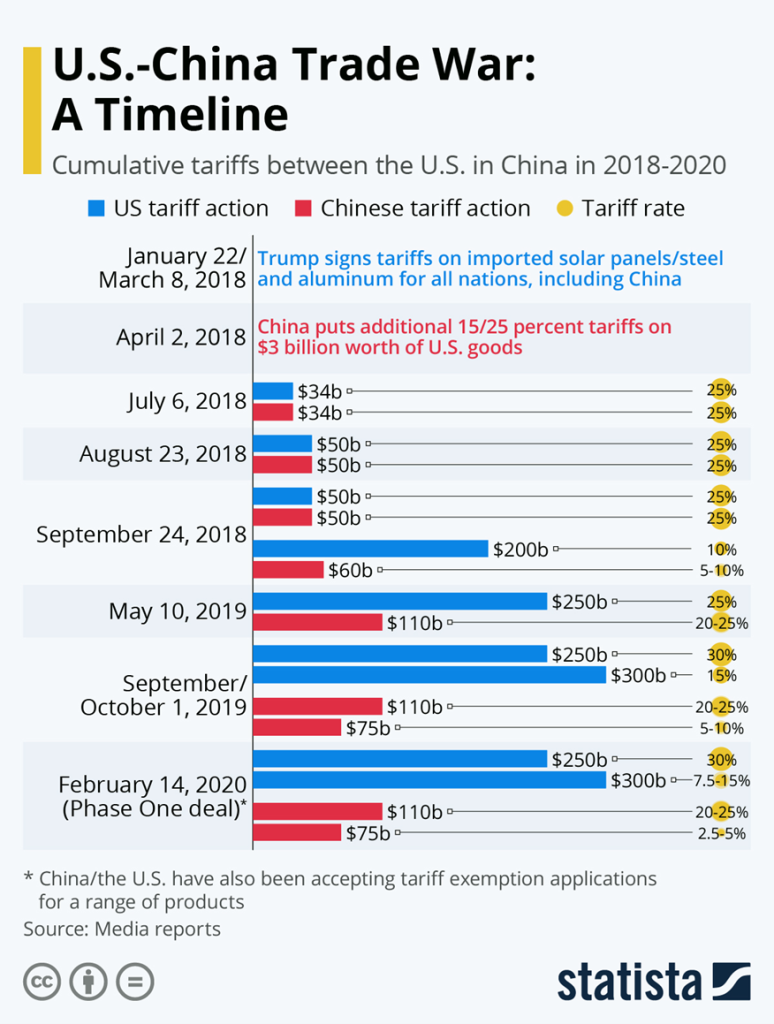

As China’s leaders consistently point out, external conditions are also becoming increasingly challenging since the start of the trade war with the US:

This war began with Trump’s imposition of trade tariffs in 2018, with the argument of combating “dumping” trade practices, correcting growing external imbalances and protecting the domestic economy.

Later, it extended to geopolitical issues of national security, with the import ban on 5G technology from Huwaei, other telecommunications and technology equipment companies, and more recently, the export ban on smart chips.

These actions were also accompanied by other European partner countries of the US.

Geopolitical headwinds are restricting China’s access to foreign capital, markets, technology and talent.

In the past, easy access to foreign consumers has enabled China to achieve economies of scale and scope.

That is changing, especially in important sectors.

Rather than boosting China’s growth, the external dimension may increasingly act as an obstacle.

In 2024, we have a year marked by crucial elections in Taiwan, the European Union, and the United States.

These elections will significantly influence the global geopolitical landscape and shape the European Union’s outlook and policies towards China.

Persistent tension between the United States and China will continue to shape Chinese foreign policy.

However, deteriorating economic conditions will intensify domestic challenges in Chinese society.

At the same time, the ongoing conflicts in regions such as Ukraine and the Middle East will undoubtedly have an impact on Europeans’ views of China.

The “securitization of everything” (turning regular political or economic issues into national security issues) and the choice of ideology over pragmatism under President Xi Jinping will characterize the course of Chinese leadership in 2024.

Following the trend of securitization, China’s economic development policies are expected to be primarily geared towards addressing economic security concerns and geo-economic competition.

Domestic issues of concern that scored high include economic crises (such as financial or real estate) and economic pressure on society, while innovation policies or market liberalization lag far behind.

In the following articles, we will continue to delve into each of these aspects and the consequences regarding the interest of the Chinese stock market for foreign investors.

This central question of the attractiveness of the Chinese market is very pertinent because, as we know, investing well means diversifying risks, doing so, above all, in the world’s largest economies and companies, and privileging those that are world leaders and consumer goods, in order to put the economy to work for us.