One of the most important decisions of our investments is the choice of mutual funds of the asset class in which we intend to invest.

This decision is critical because mutual funds are considered the best investment vehicle for individual investors.

They provide the best diversification, in terms of risk management.

And they are easy to apply in choosing the most appropriate asset allocation to our investment profile, which largely determines their performance.

However, the difficulty is that there is a huge variety of mutual funds of various types and categories.

This Series is dedicated precisely to the choice of mutual funds by individual investors.

In the first article of this series we saw the main characteristics and advantages of mutual funds, showing why they should be the privileged investment of individual investors.

In the second article we develop the various types or categories of funds, as the investor’s asset allocation determines the category in which to invest.

Next, we presented the aspects of the returns of the funds, bearing in mind their relevance in the choice by investors.

Fund returns are diverse and not consistent, varying over time.

We then looked at the costs of the funds and their relationship to profitability, realising that, in general, the highest cost funds are those with the lowest net return.

We also looked at the importance of access, availability and investment currency in the investor’s country, to the extent that each fund is approved and subject to distribution in a given jurisdiction (region, country or set of countries), and the currency of denomination is a risk factor that should be considered in the investment.

More recently we have developed the theme of how we can choose between indexed investment funds and active funds.

Finally, we have addressed one more very useful issue in deciding the selection of investment funds in each category, that of the main rating agencies of the funds, which provide us with detailed information and evaluations of many funds.

In this article we will get to know the largest mutual fund management companies in the world.

This information is useful, assuming that investors in general choose the most successful funds.

All these issues should be considered in the process of choosing mutual funds.

In the Best of Investment Funds Series integrated in the Tools folder, we present some of the world’s largest mutual funds of various types and categories, which are available in various countries or regions.

We cover passive or indexed equity funds for U.S. and European investors and active equity funds of large companies also for U.S. and European investors, among others.

We have also developed passively managed bond funds for North American and European investors, as well as actively managed funds for US and European investors.

The evolution and concentration of the volume of assets under management worldwide

The distribution of mutual funds worldwide is as follows:

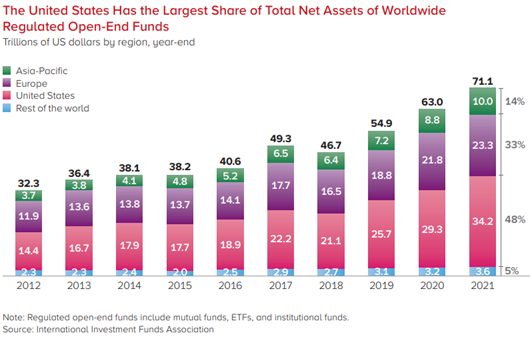

The U.S. owns nearly half the value of open-end fund investment, followed by Europe at 33 percent and Asia-Pacific at 14 percent.

There is a high concentration of mutual funds in terms of management companies in the world:

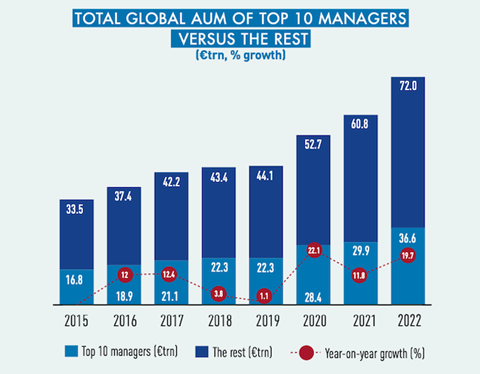

The volume of asset management through mutual funds has been growing at a good pace, reaching around 108.8 trillion in 2022.

The 10 largest management companies had 36.6 trillion assets under management, about a third of the total value.

The largest global asset management companies

The following table presents the 50 largest global asset management companies, which roughly correspond to the largest investment fund management companies:

In the group of the 10 largest there are 9 American and one European.

The top 5 consists of Blackrock, Vanguard, Fidelity, State Street and JP Morgan.

But this information is insufficient for our decision.

As we saw in a previous article in this series, in the choice of investment funds it is important to analyze their access and availability in our country.

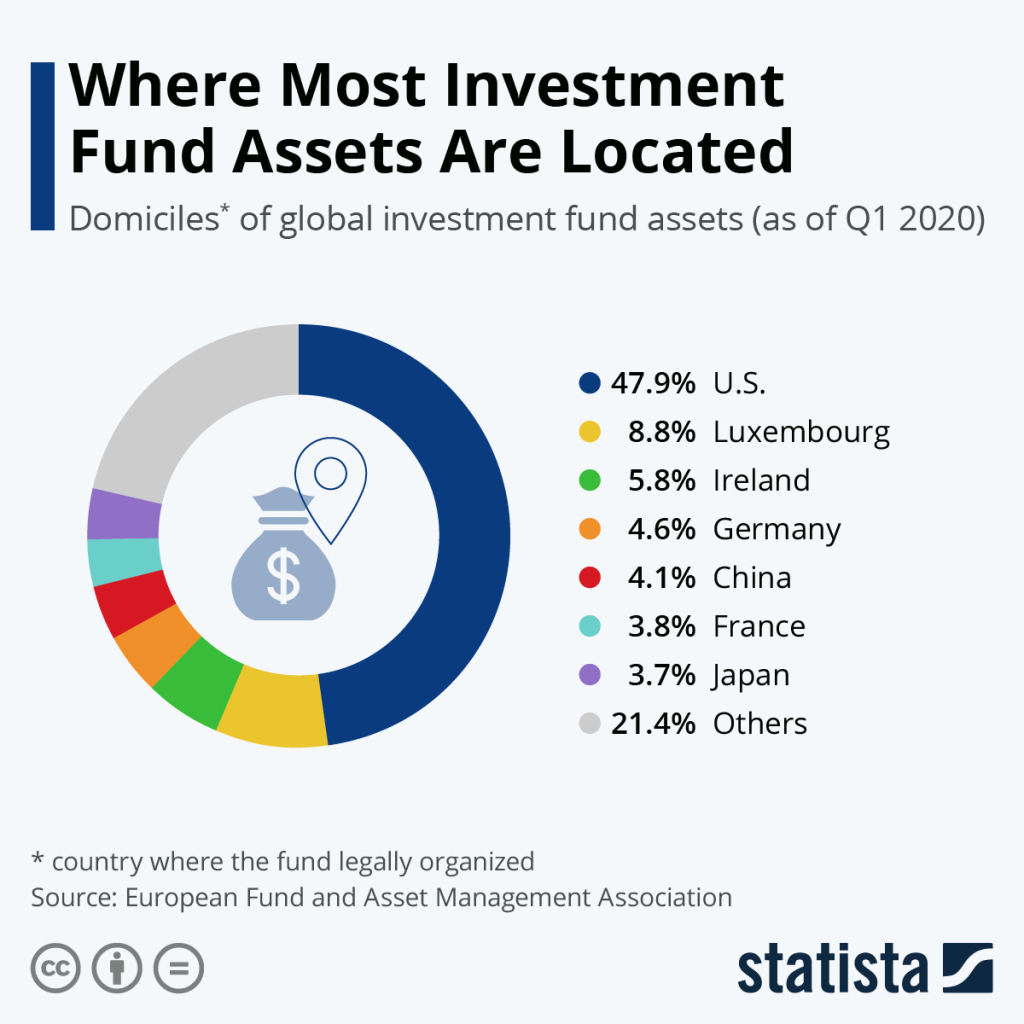

Management companies domicile their funds in the main world financial markets such as New York, London, Frankfurt, Paris, Dublin, Luxembourg, Zurich, Amsterdam, Milan, Tokyo, Shanghai, Hong Kong, etc.

And they determine the availability of funds by regions and countries by approving the distribution and marketing offering documents on the exchanges of these financial markets, in accordance with the laws and rules applicable in the respective jurisdictions.

U.S. management companies have their entire fund offering approved for distribution in the U.S., but only a portion in the other regions.

For example, its offer is not as wide in Europe, although it is considerable and has been growing in recent years.

On the contrary, European management companies have the entire offering of funds approved for distribution in Europe, and only a part in the USA.

Thus, to analyze and have a complete view of the availability of the offering of funds in our country it is also important to know who are the largest managers of the various regions.

The largest regional asset management companies

The largest European institutional asset management companies are:

Of course, most societies are European-rooted, although the leadership remains at Blackrock.

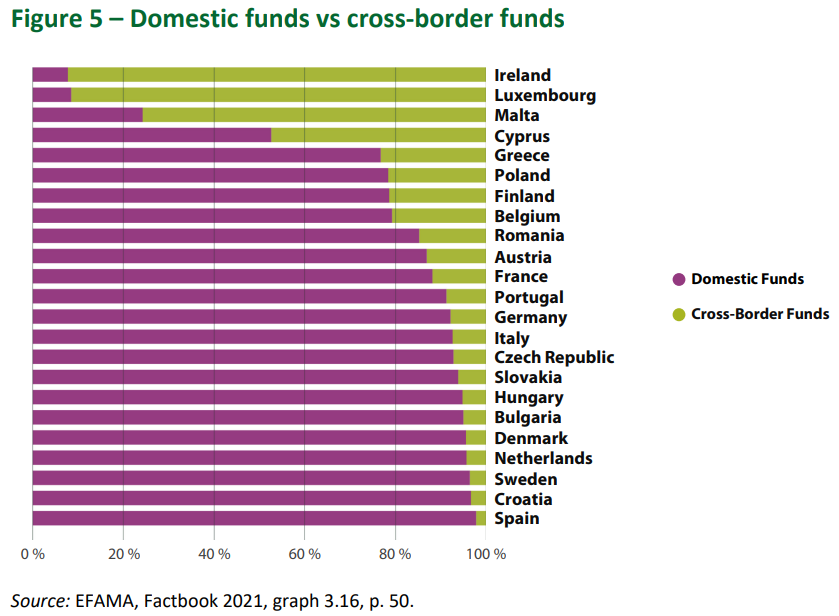

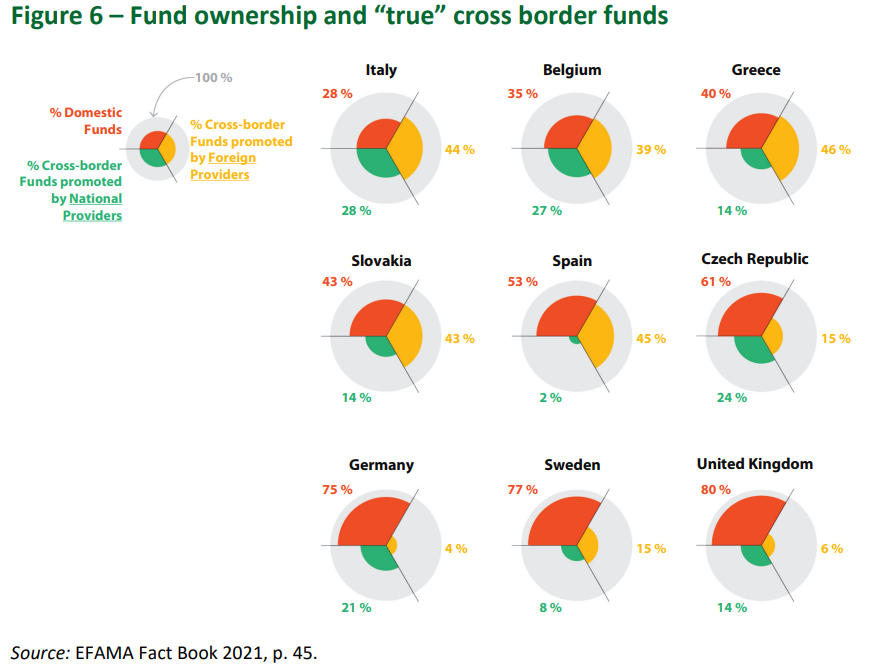

Despite the various regulatory initiatives developed in the recent past, the European fund market remains fragmented and most funds are domiciled in a few countries.

In most Member States, funds are mainly distributed in their internal market.

On the contrary, funds domiciled in some countries such as Ireland, Luxembourg and Malta are predominantly sold abroad.

According to the European Fund and Asset Management Association (EFAMA), local funds account for 67% of funds held in Europe, compared to 73% ten years ago.

In several Member States of the European Union, most cross-border funds are sold by domestic asset managers rather than by foreign asset managers.

The following chart shows the ownership and distribution of mutual funds held in Europe:

The conclusion is that most of the funds held by European investors are managed by European management companies.

Banks, which are generally the largest distributors of mutual funds, mainly market funds managed by companies owned by them or with which they have a strong business relationship.

Foreign funds, particularly those managed by US companies, are not widely marketed by European distributors.

Similarly, the marketing of European management companies’ mutual funds in the USA is very limited.

In other words, the global market for the distribution of investment funds has many barriers to entry and is very fragmented.

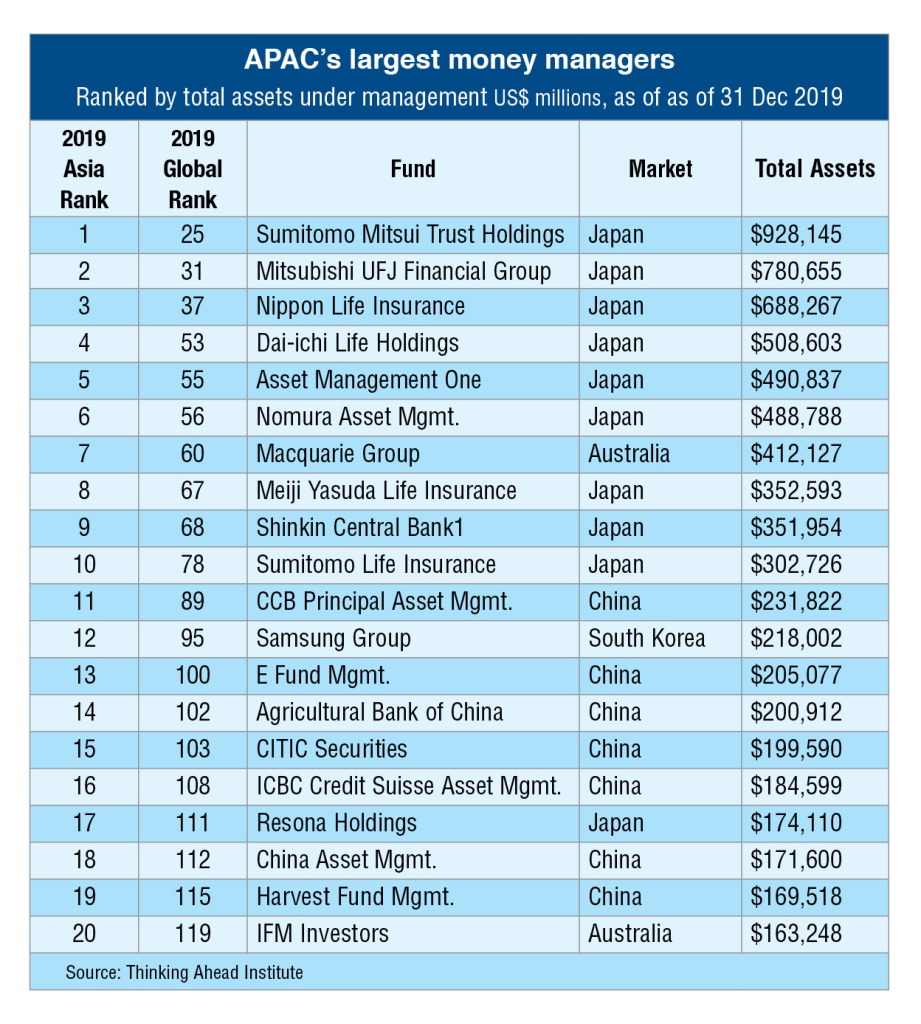

The largest asset management companies in Asia Pacific are as follows:

The top 10 is dominated by Japanese companies, with 9 entities, almost all associated with banks, with the exception of Australian Macquarie.

However, China appears with many societies between the 11th and twentieth positions, and it is conceivable that many of these societies will move to the first tier, considering its strong pace of growth.

In the following link we can know the 500 largest global asset management companies and their values under management:

https://www.thinkingaheadinstitute.org/research-papers/the-worlds-largest-asset-managers-2022/

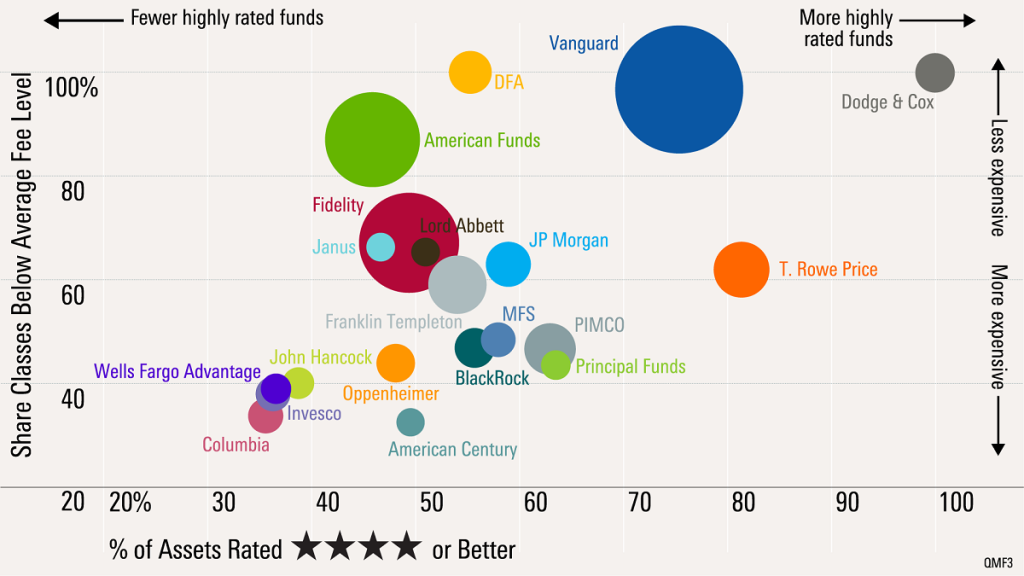

The distribution of the rating of funds among the main management companies

Thus, the best positioned societies are those in the upper right quadrant (high rating and low cost), while the worst are in the lower left quadrant (low rating and high cost).

Thus , the top-ranked company is Dodge & Co., which has a medium size.

Vanguard is the highest-ranked of the largest fund management companies.

In the Best of Investment Funds series we present some of the largest investment funds.

We organize the funds by the origin of the investor, namely from the USA and Europe, and by asset, of shares and bonds.

We also classify investment funds by type of management, active and passive management, and by style or strategy, including value and growth strategies, small, medium and large caps, dividend stocks, etc.