The importance and interest of bond investing

#1 (Investment grade bonds) Provide preservation of invested capital

#2 Ensure income stability

#3 Stock diversification element

We’ve written a lot about bonds. However, in view of recent developments, we consider it appropriate to return to the subject.

In fact, recently there has been a lot of discussion about investing in bonds, with differing opinions on its attractiveness.

During the long bond bull market between 1980 and 2020 of gradual and prolonged decline in long-term interest rates, and consequent good bond valuations, few discussed their interest.

In the years leading up to the end of this long cycle, in which interest rates reached near-zero and even negative values, bonds performed poorly, but investors kept investing.

Then there was the precipitous rise in interest rates to fight inflation, which definitively caused the end of this cycle, and resulted in devaluations of 20% in 2021, deep and unprecedented, in investments in bonds, leading many analysts to predict the end of the attractiveness of bonds and the traditional 60/40 portfolio.

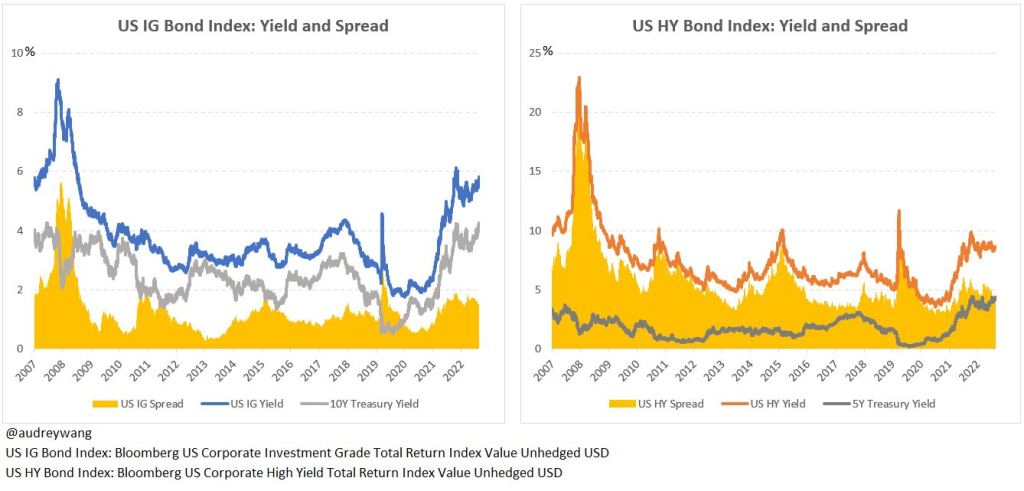

Finally, at present, with long-term interest rates at the highest levels of the last decade (since 2007 and 2011 for US 10- and 30-year government debt, respectively), above 4% per year, some analysts argue that investment in bonds over stocks should be preferred.

The question then arises of what we should do. Is it worth keeping the allocation to obligations, or reducing, or strengthening it?

In this article we will revisit the importance of investing in bonds in the framework of a correct and adequate asset allocation of our financial assets, and simultaneously analyze the conditions of the current context for such an investment.

As we have said, this context has changed significantly in the recent past, to such an extent that many experts and professional investors wonder about the expected returns of bond investments in the future and their contribution to the diversification of financial assets.

We anticipate that our opinion is that not only It is worthwhile to maintain our allocation of investment to bonds, for the diversification they provide, as well as that the current market conditions with interest rates at all-time highs over the past 15 years further reinforce this opportunity, at least for U.S. investors.

When discussing the financial markets, we talk much more about stocks than bonds.

It is implied that investing in bonds is less important, or less interesting.

This is not true for several reasons.

First, the world bond market is considerably larger than the world stock market.

Second, the agents involved in the bond markets are very professional. They are fundamentally institutional investors, such as banks, insurance companies, pension funds, investment funds, among others.

Third, and as a result, the bond market is very efficient. In fact, it is considered that the bond market goes further, anticipates and influences the movements of the stock market. This is due to the importance of the behaviour of interest rates and credit spreads for shareholder investment as predictors of the evolution of economic growth.

Fourth, perhaps most importantly, though often overlooked, obligations play a key role in the asset allocation of our wealth and financial wealth.

Essentially, they are the element of financial security, providing stability and predictability of incomes.

It is for this reason that on this site we have already addressed the subject of obligations several times and we revisit this matter with due frequency.

In previous articles, we started by describing and characterizing bond investing, we saw the comparative returns and risks of bonds and stocks, the importance of bonds for diversification, the reasons for investing in bonds, and the role of bonds and stocks in an investment portfolio.

Then we saw how you evaluate the investment and how you invest in bonds.

More recently we have looked at the behaviour of bonds (and stocks) in the various business cycles and in the The context of rising interest rates and inflation, the long “bull market ” of bonds with “Quantitative Easing”, the shift to “Quantitative Tigthnening” and the unprecedented loss of bond investment in 2022 caused by the end of that cycle.

In the interim, we looked at what we could do when we had long-term interest rates close to zero and even negative.

In the Tools folder we present some of the largest investment funds in investment grade bonds in the US and the Eurozone.

We will then recall the reasons for the importance and interest of investing in bonds and how we should make allocations and adjustments according to market conditions.

The importance and interest of bond investing

Bonds are shown to provide three benefits to investment portfolios, that of preserving invested capital, income stability and an element of equity risk diversification or mitigation.

#1 (Investment grade bonds) Provide preservation of invested capital

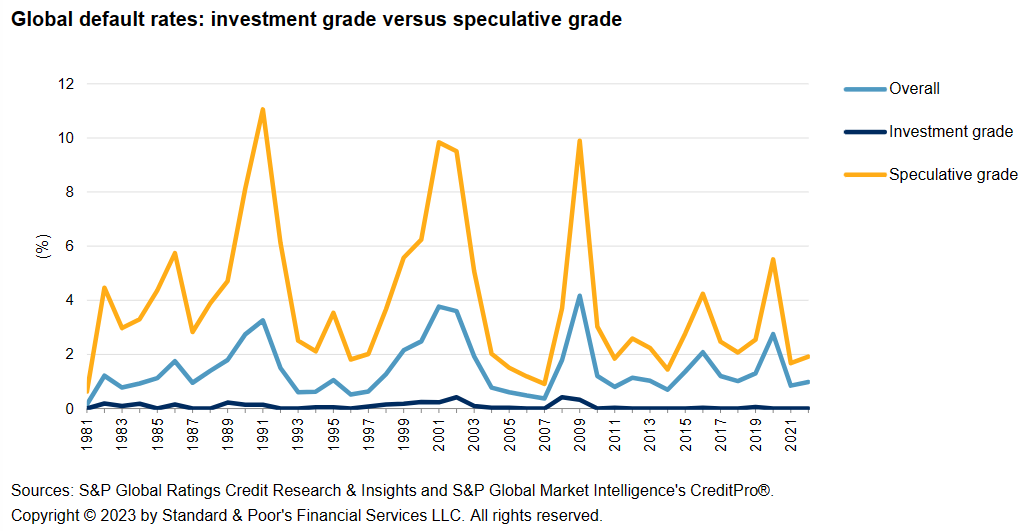

The following chart shows the default rates on capital repayment for global investment-grade and speculative rating obligations from 1981 to the present:

The default rate on the repayment of investment-grade bonds is very low, below 0.4%, while that of speculative-grade bonds already reaches almost 10% in some years, bringing the overall default rate to between minus 1% and a maximum of 4%.

Investment grade bonds are the recommended obligations for all individual investors.

#2 Ensure income stability

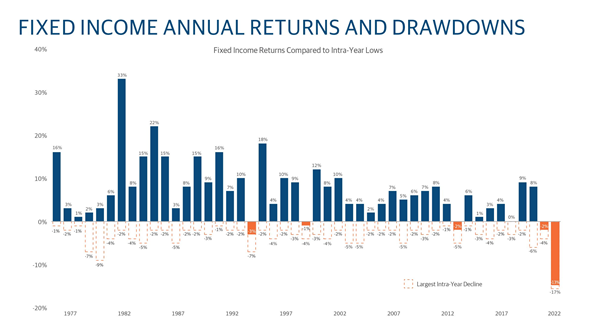

The following chart shows the annual yields and drawdowns of U.S. bonds from 1997 to 2022:

Bonds provide yield for all scenarios.

In this period, annual profitability rates were only sharply negative in 2022 (and in the previous 3 times they have been negative, since 1976, the loss was about 2%).

In fact, since 1926, only 6 times, drawdowns have been more than 5%, and with an average duration of just over 1 year.

The average annual rate of return on bonds has been about 5% since 1926.

Historically, almost 90% of bond profitability comes from coupon payments, with the remaining 10% of capital gains.

#3 Stock diversification element

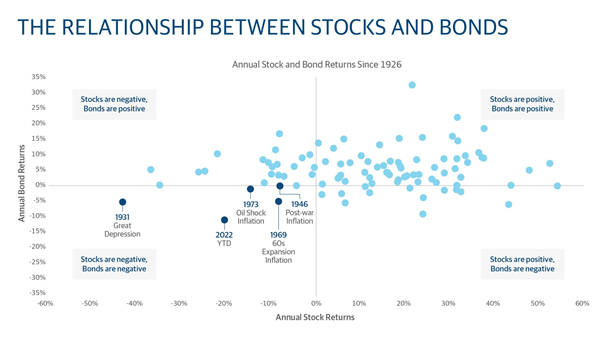

The contribution to the diversification or risk mitigation of bonds is clearly visible when the rates of return on bonds and stocks are positioned each year in parallel:

In most years, bonds and stocks had positive returns (1st quadrant).

In some years, bonds showed positive returns and negative shares, or vice versa, functioning as elements of diversification (2nd and 4th quadrants).

In just 4 years, we had negative returns for stocks and bonds, coinciding with periods of high inflation, above 5% (and 2022 was one of the cases).

In years when stocks had negative yields of 13% on average, bonds had positive average returns of 5%.

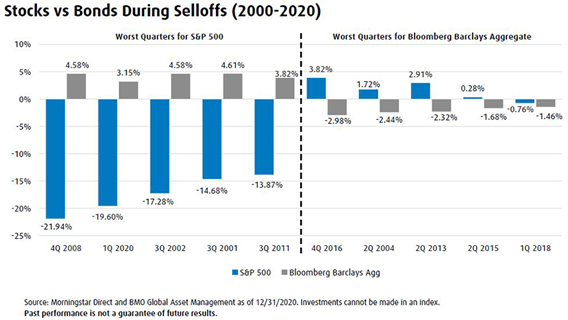

This diversification factor is even more important in times of market crisis:

In periods when stocks have steep declines, bonds pay off, and vice versa.

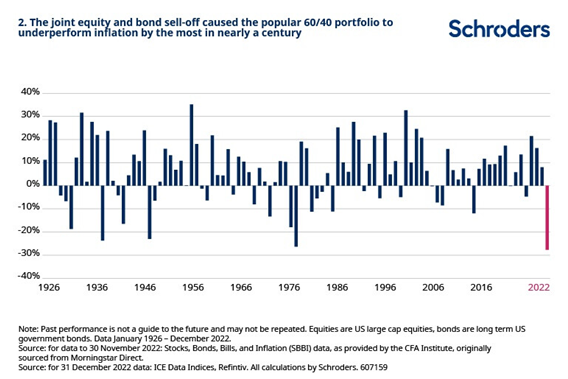

That’s why the traditional 60/40 portfolio has worked well almost every year:

Only 4 times – in 1937, 1947, 1978 and 2022 – the 60/40 portfolio had annual devaluations of more than 20%.

Holding a core portfolio of bonds composed of investment credit rating issuers, with maturities between 5 and 15 years, offers security and stability to long-term investors, to function well in environments of rising and falling interest rates.

Specifically, we refer to investment grade bonds, which are those that should be part of the portfolios of individual investors.

In our opinion, speculative-grade bonds should only be part of the portfolios of investors with specialist knowledge and experience, and within the satellite component of a core and satellite investment strategy.